This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2033

for the current year.

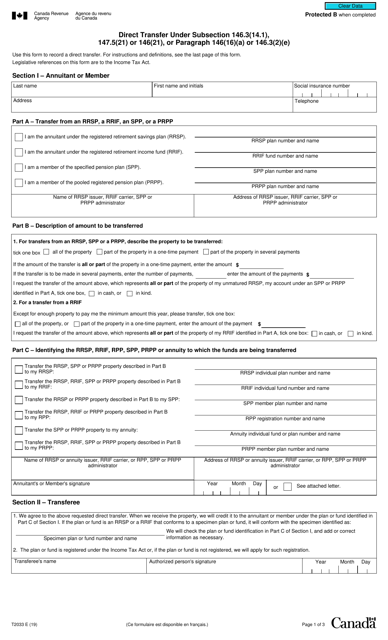

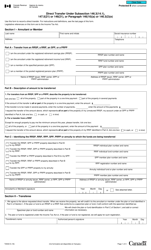

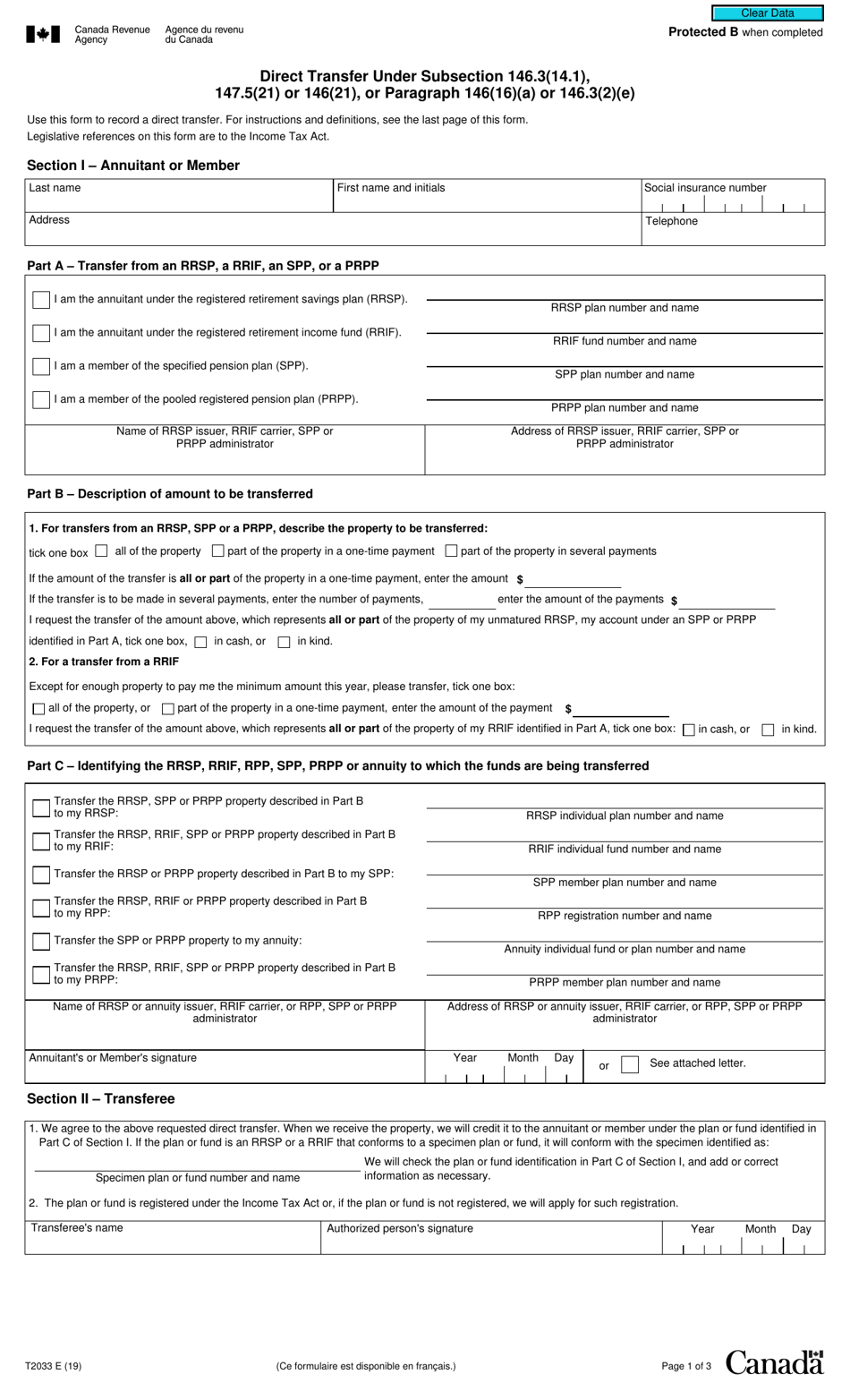

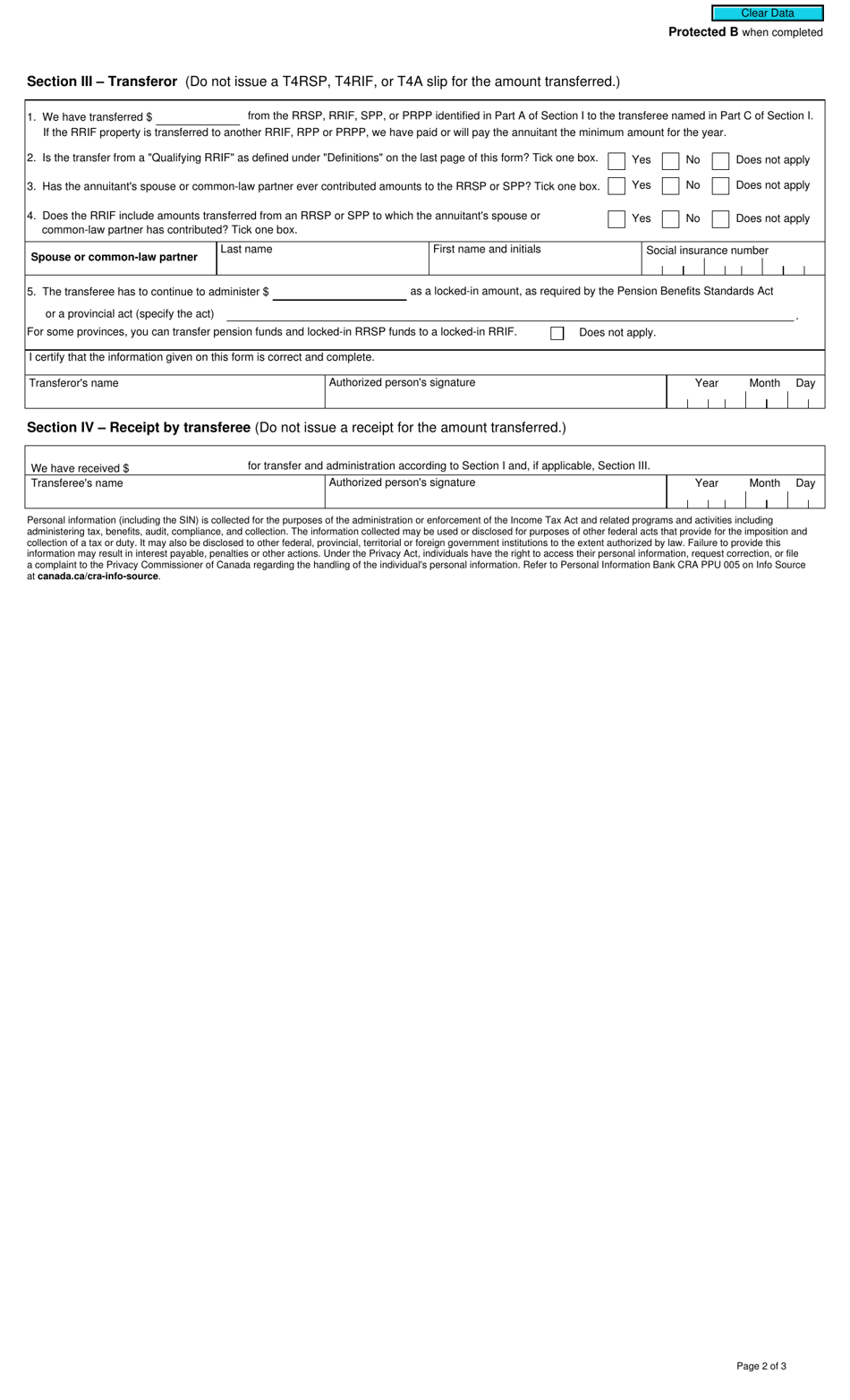

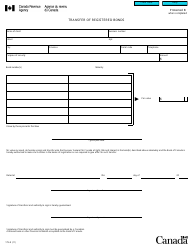

Form T2033 Direct Transfer Under Subsection 146.3(14.1), 147.5(21) or 146(21), or Paragraph 146(16)(A) or 146.3(2)(E) - Canada

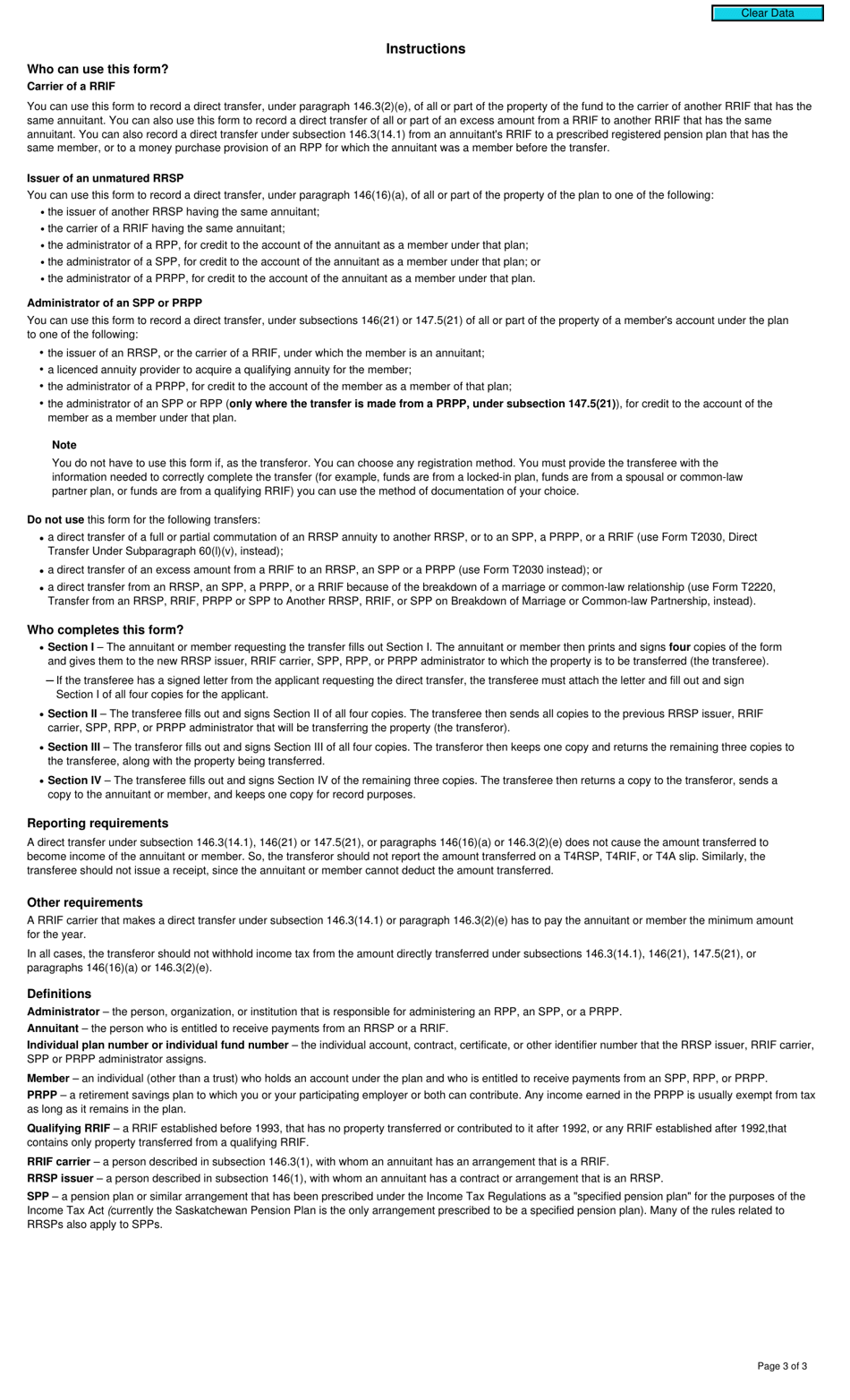

Form T2033, the Direct Transfer Under Subsection 146.3(14.1), 147.5(21) or 146(21), or Paragraph 146(16)(A) or 146.3(2)(E) in Canada, is used to transfer funds from one registered retirement savings plan (RRSP) or registered retirement income fund (RRIF) to another. It allows individuals to move their retirement savings without incurring tax consequences.

The individual or the registered pension plan (RPP) administrator files the Form T2033 for direct transfers under the designated provisions in Canada.

FAQ

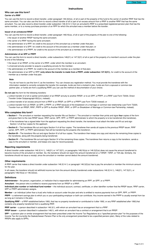

Q: What is Form T2033?

A: Form T2033 is a form used for direct transfer under specific subsections or paragraphs of the Canadian Income Tax Act.

Q: What is a direct transfer?

A: A direct transfer is the movement of funds or assets from one registered retirement savings plan (RRSP), registered retirement income fund (RRIF), or registered pension plan (RPP) to another without tax consequences.

Q: What subsections or paragraphs does Form T2033 cover?

A: Form T2033 covers subsections 146.3(14.1), 147.5(21) or 146(21), and paragraphs 146(16)(A) or 146.3(2)(E) of the Canadian Income Tax Act.

Q: What is the purpose of Form T2033?

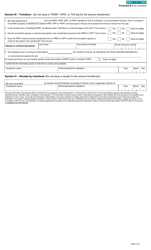

A: The purpose of Form T2033 is to provide a record of the transfer and ensure compliance with the tax regulations regarding direct transfers.

Q: Who needs to complete Form T2033?

A: Both the transferring and receiving financial institutions or administrators need to complete Form T2033 for a direct transfer.

Q: Are there any deadlines for submitting Form T2033?

A: Yes, Form T2033 must be submitted within 60 days after the end of the year in which the direct transfer occurred.

Q: What happens if Form T2033 is not completed correctly?

A: If Form T2033 is not completed correctly, it may result in tax consequences such as the transfer being treated as a withdrawal and subject to taxation.

Q: Can Form T2033 be used for all types of registered plans?

A: No, Form T2033 can only be used for direct transfers involving registered retirement savings plans (RRSPs), registered retirement income funds (RRIFs), or registered pension plans (RPPs).

Q: Is there a fee for submitting Form T2033?

A: There is no fee for submitting Form T2033 to the Canada Revenue Agency (CRA), but there may be fees charged by the financial institutions or administrators for processing the transfer.