This version of the form is not currently in use and is provided for reference only. Download this version of

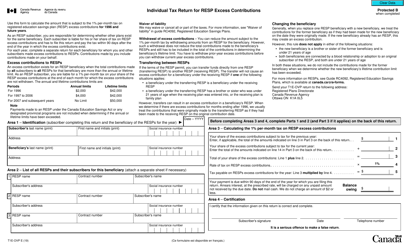

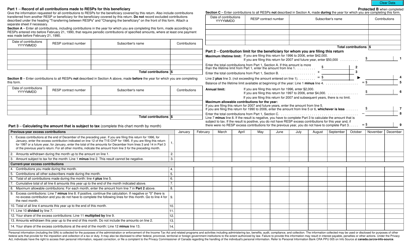

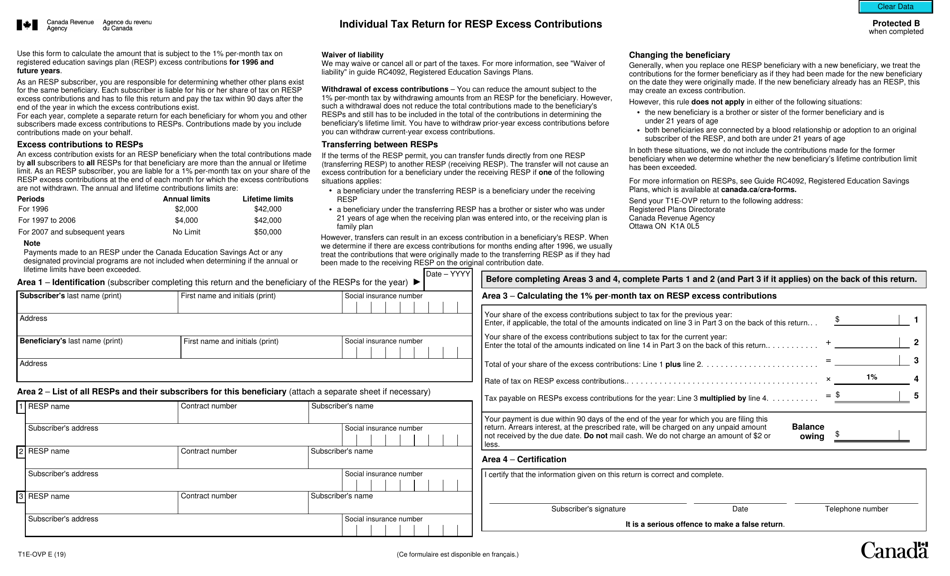

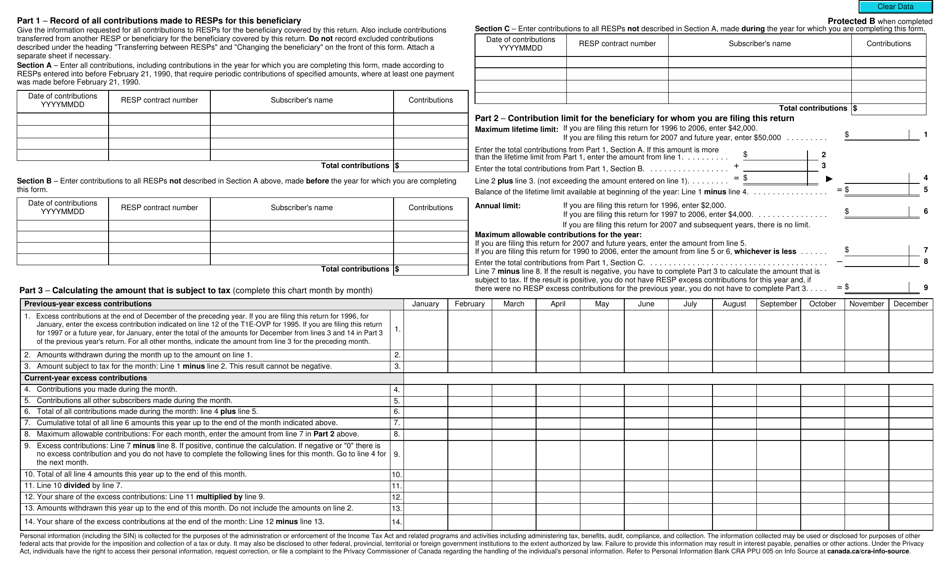

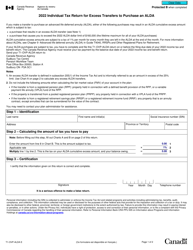

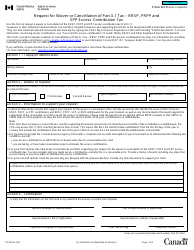

Form T1E-OVP

for the current year.

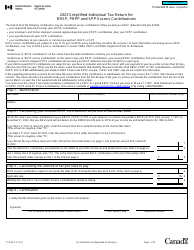

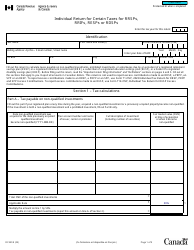

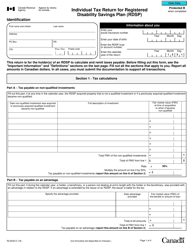

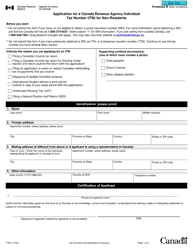

Form T1E-OVP Individual Tax Return for Resp Excess Contributions - Canada

Form T1E-OVP is used in Canada to report excess contributions to a Registered Education Savings Plan (RESP). This form helps individuals rectify any contributions made to an RESP that exceed the allowable limits set by the Canadian government.

The individual taxpayer files the Form T1E-OVP for RESP excess contributions in Canada.

FAQ

Q: What is a T1E-OVP form?

A: The T1E-OVP form is used for reporting excess contributions to a Registered Education Savings Plan (RESP) in Canada.

Q: Who needs to file a T1E-OVP form?

A: You need to file a T1E-OVP form if you have made excess contributions to your RESP.

Q: What are excess contributions?

A: Excess contributions are amounts that exceed the RESP limits set by the government.

Q: How do I know if I have excess contributions?

A: You can calculate your excess contributions by subtracting the accumulated income from the total value of your RESP.

Q: What happens if I don't file a T1E-OVP form?

A: If you don't file the T1E-OVP form for excess contributions, you may be subject to penalties and additional taxes.