This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1-OVP-S

for the current year.

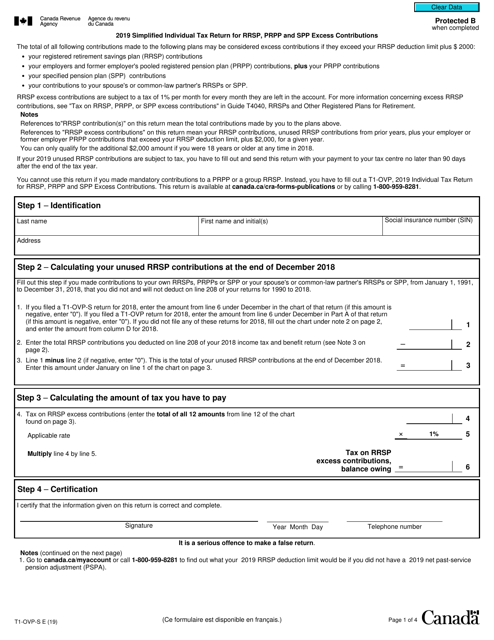

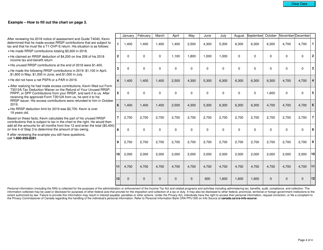

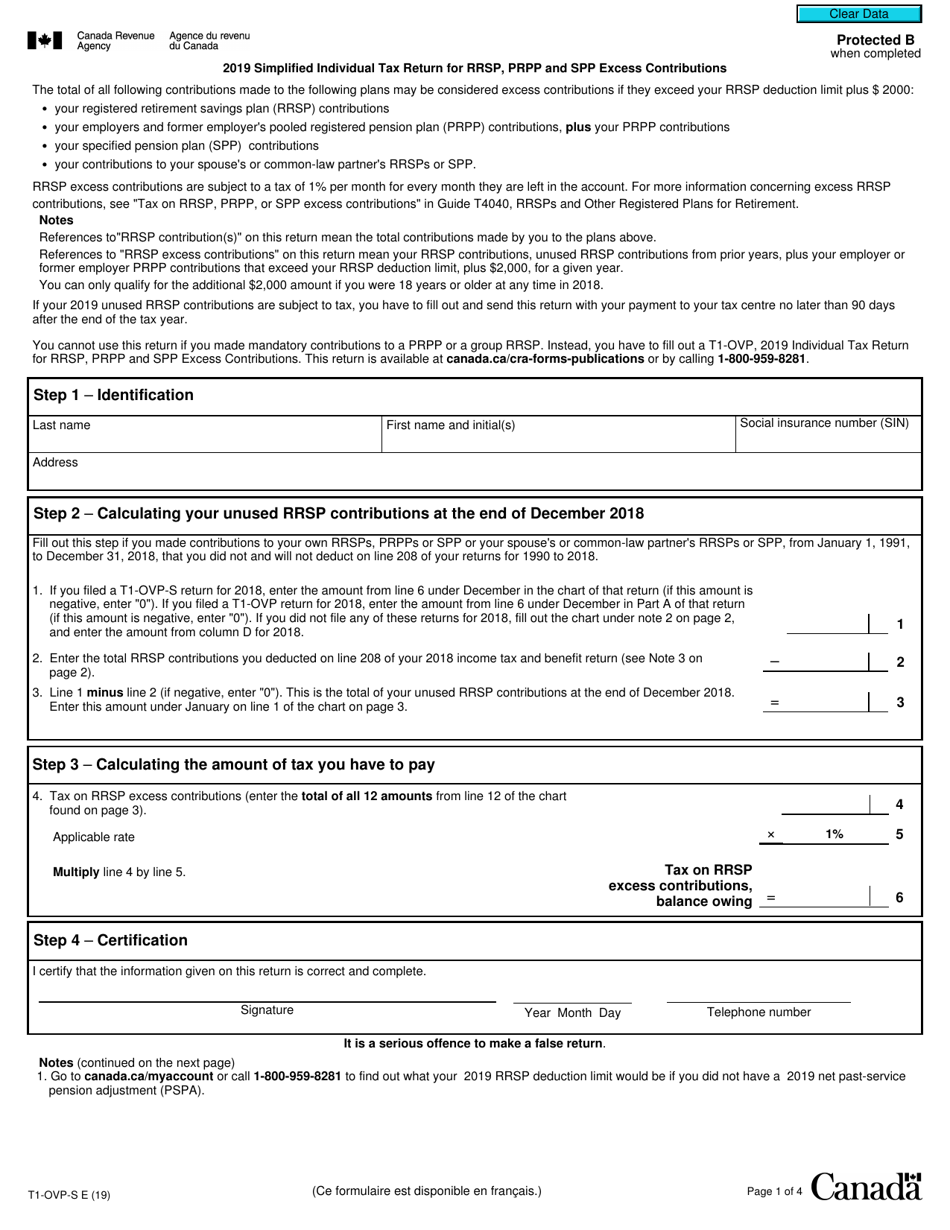

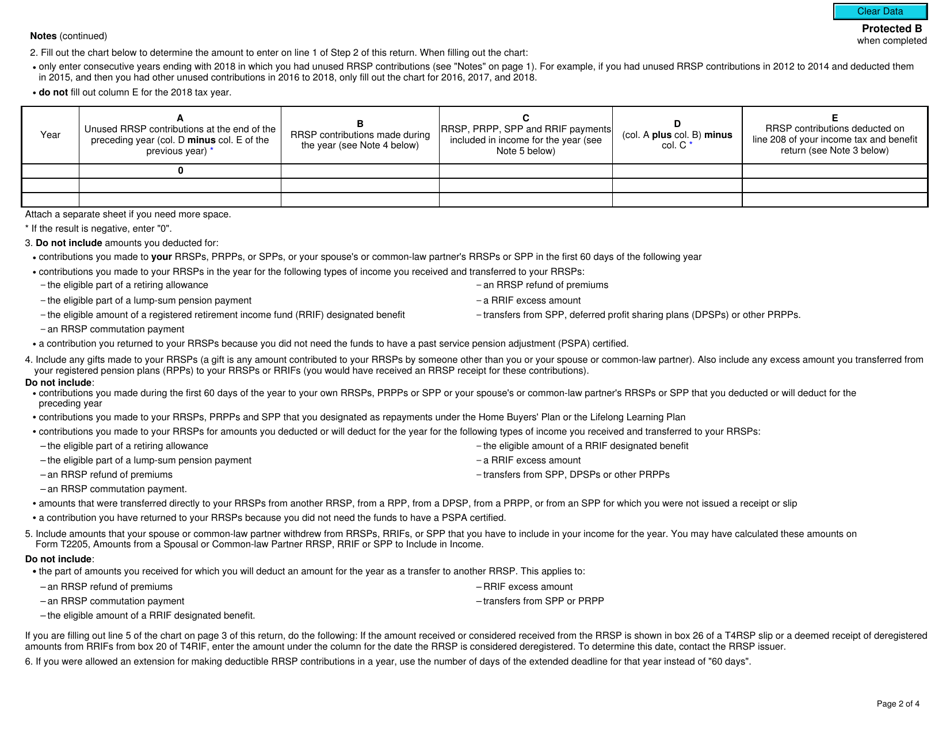

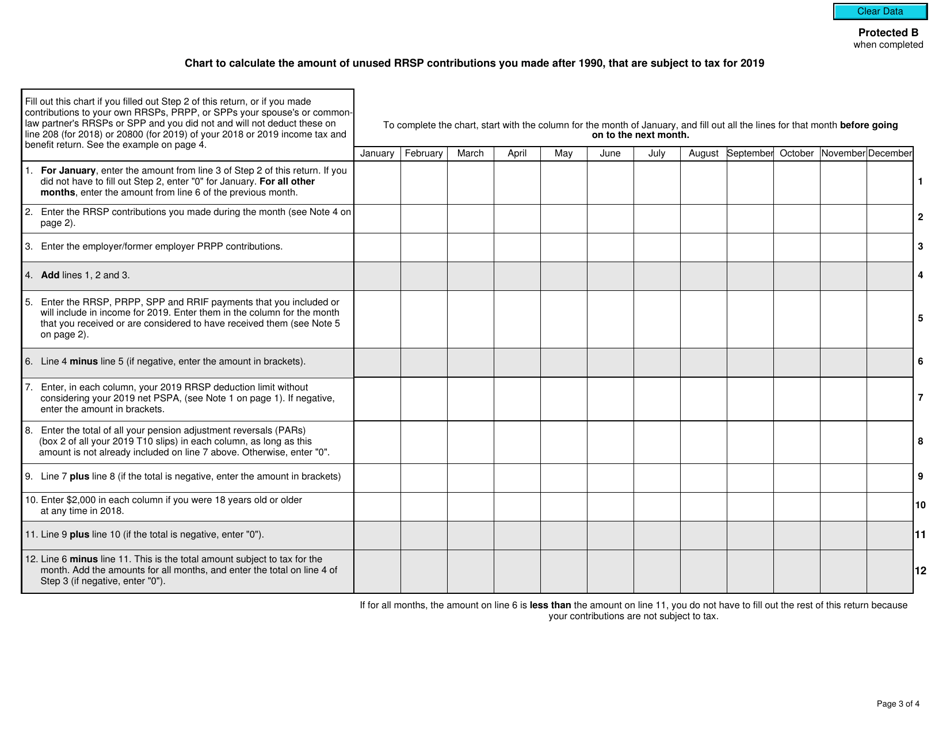

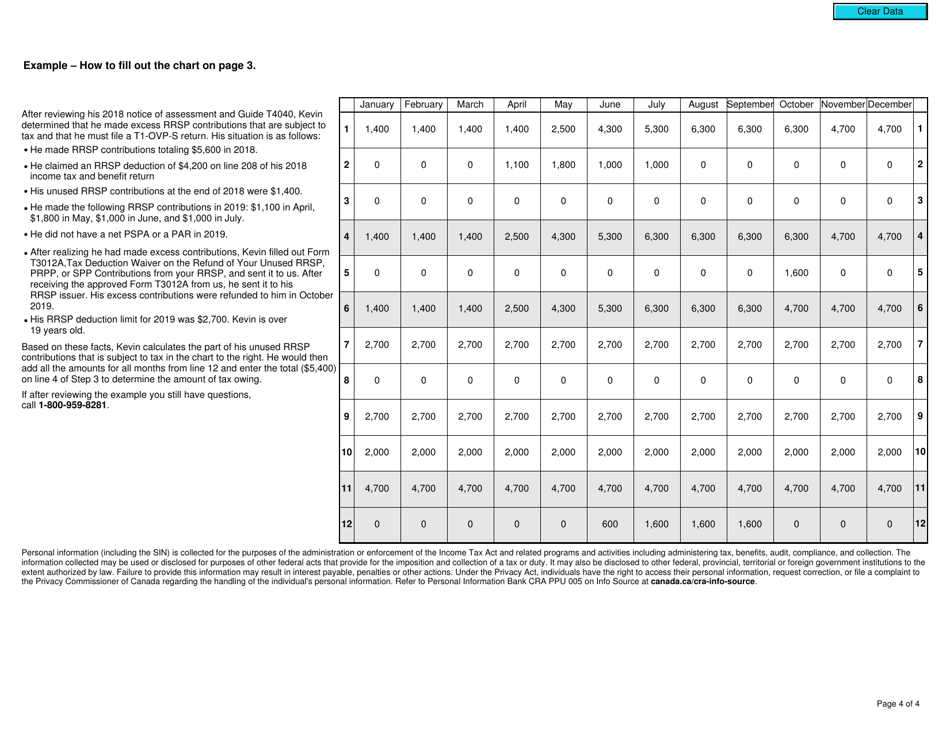

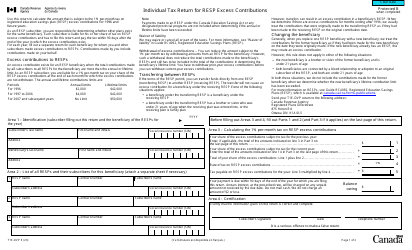

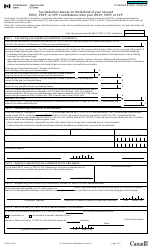

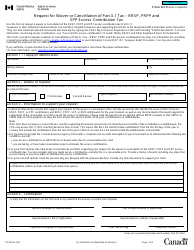

Form T1-OVP-S Simplified Individual Tax Return for Rrsp, Prpp and Spp Excess Contributions - Canada

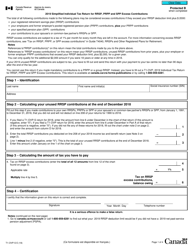

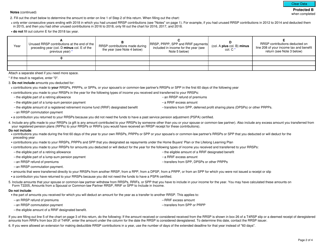

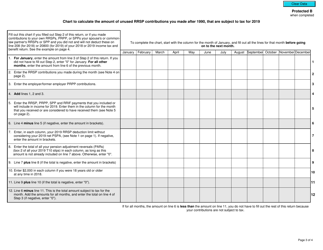

Form T1-OVP-S, Simplified Individual Tax Return for RRSP, PRPP and SPP Excess Contributions, is used by Canadian taxpayers to report and pay taxes on any excess contributions made to their Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP). It helps ensure compliance with the Canadian tax laws regarding these retirement savings vehicles.

The person who files the Form T1-OVP-S Simplified Individual Tax Return for RRSP, PRPP, and SPP excess contributions in Canada is the individual who made the excess contributions.

FAQ

Q: What is Form T1-OVP-S?

A: Form T1-OVP-S is a simplified individual tax return for RRSP, PRPP, and SPP excess contributions in Canada.

Q: Who should file Form T1-OVP-S?

A: Individuals who have made excess contributions to their RRSP, PRPP, or SPP in Canada should file Form T1-OVP-S.

Q: What are RRSP, PRPP, and SPP?

A: RRSP stands for Registered Retirement Savings Plan, PRPP stands for Pooled Registered Pension Plan, and SPP stands for Spousal Retirement Savings Plan.

Q: What are excess contributions?

A: Excess contributions are contributions made to RRSP, PRPP, or SPP that exceed the allowable limits set by the Canada Revenue Agency.

Q: Why do I need to file Form T1-OVP-S?

A: Filing Form T1-OVP-S allows you to rectify the excess contributions and avoid penalties or taxes on the excess amount.

Q: What should I include when filing Form T1-OVP-S?

A: When filing Form T1-OVP-S, you should include information about the excess contributions, the year of the contributions, and any applicable penalties.

Q: When is the deadline for filing Form T1-OVP-S?

A: The deadline for filing Form T1-OVP-S is usually the same as the deadline for filing your income tax return, which is April 30th of each year, or June 15th if you or your spouse is self-employed.