This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1213(OAS)

for the current year.

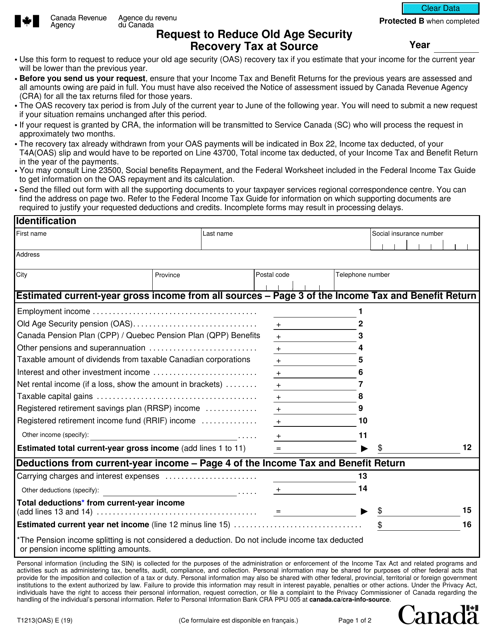

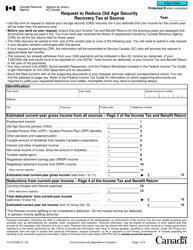

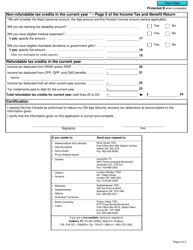

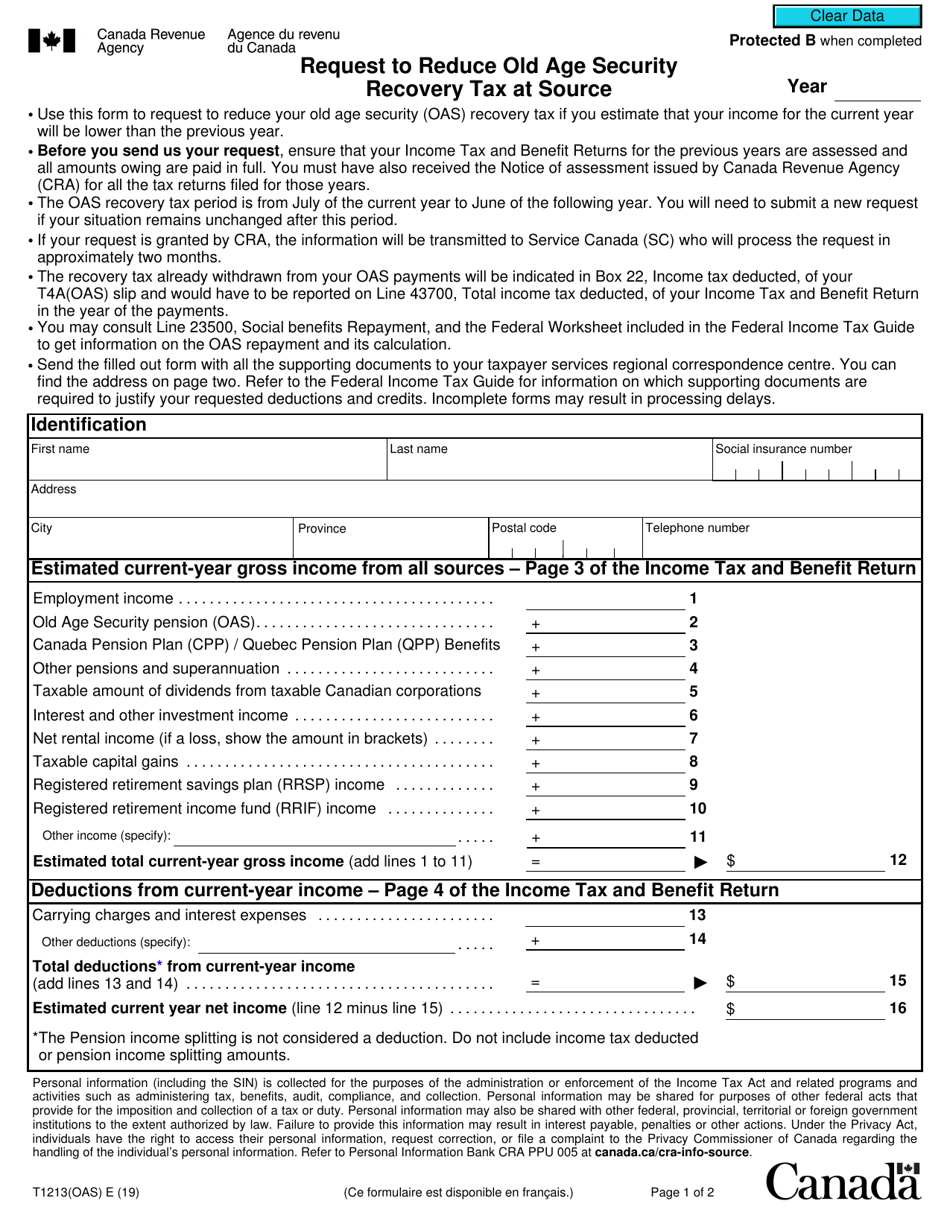

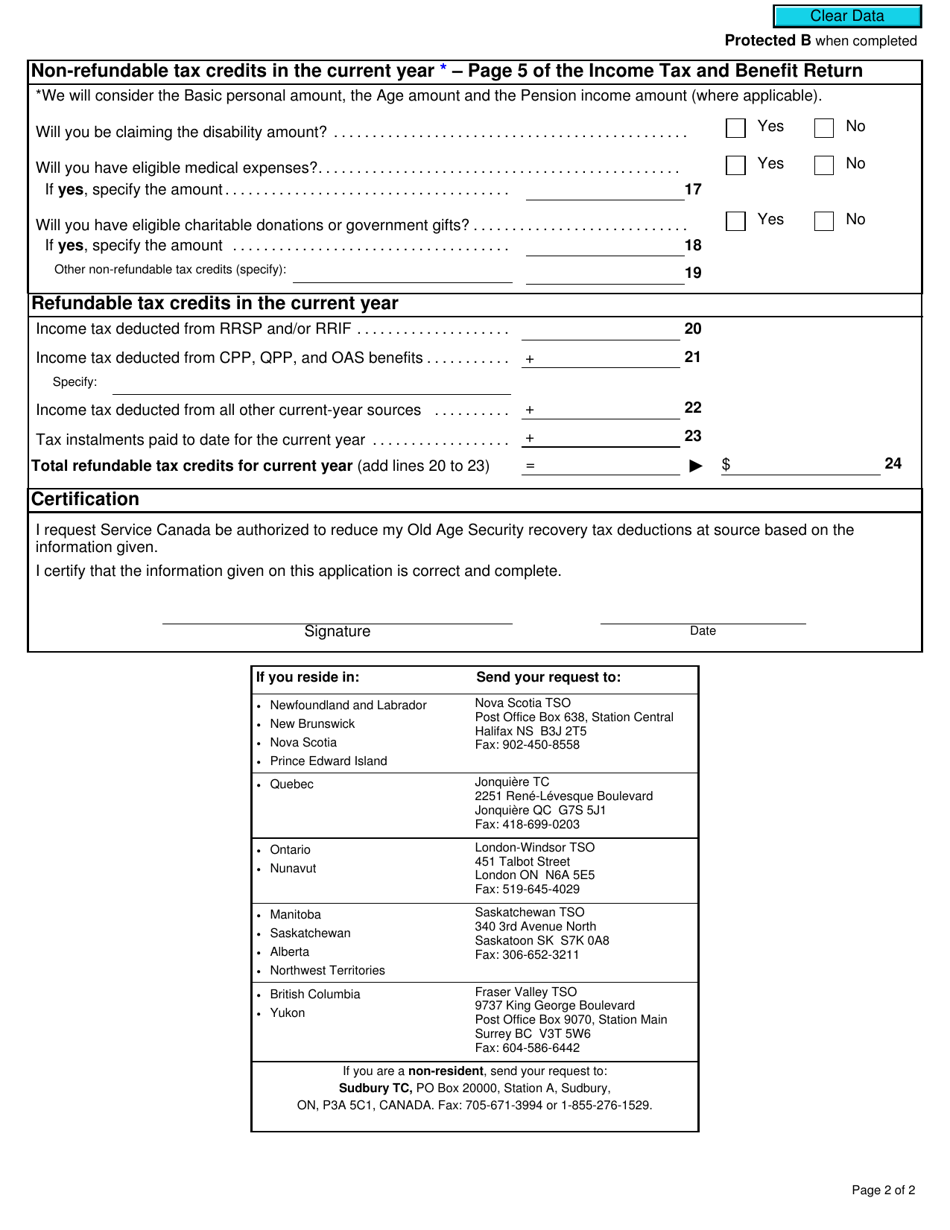

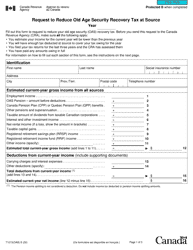

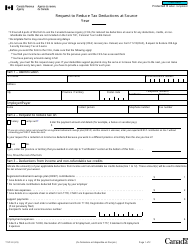

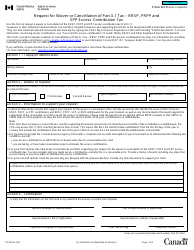

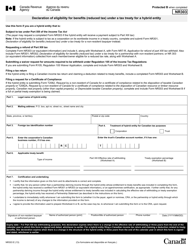

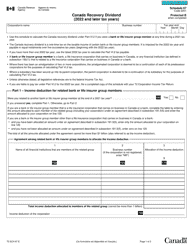

Form T1213(OAS) Request to Reduce Old Age Security Recovery Tax at Source - Canada

Form T1213(OAS) is utilized by individuals in Canada who receive Old Age Security (OAS) benefits and want to request a reduction in the amount of tax withheld from their OAS payments at source. By completing this form and submitting it to the Canada Revenue Agency (CRA), individuals can potentially lower the tax deduction at the source, resulting in more money in their pocket each month. This form is specifically designed for individuals who expect their deductions, credits, and benefits to be greater than their tax owing for the year.

The Form T1213(OAS) is filed by Canadian residents who want to request a reduction in the amount of Old Age Security Recovery Tax withheld at source.

FAQ

Q: What is Form T1213(OAS)?

A: Form T1213(OAS) is a request form in Canada to reduce the Old Age Security Recovery Tax at source.

Q: Who can use Form T1213(OAS)?

A: Form T1213(OAS) is for individuals who receive Old Age Security (OAS) and want to reduce the recovery tax deducted from their monthly payments.

Q: What information do I need to provide on Form T1213(OAS)?

A: You need to provide your personal information, your social insurance number, details of your OAS income, and the reasons why you are requesting a reduction in the recovery tax.

Q: Is there a deadline for filing Form T1213(OAS)?

A: There is no specific deadline for filing Form T1213(OAS), but it is recommended to submit it as soon as possible to ensure the reduction in tax is applied to your OAS payments.

Q: How long does it take for CRA to process Form T1213(OAS)?

A: The processing time for Form T1213(OAS) varies, but it generally takes a few weeks for the CRA to review and approve the request.

Q: Will the reduction in recovery tax be retroactive?

A: No, the reduction in recovery tax will only be applied to future OAS payments after the approval of your Form T1213(OAS) request.

Q: What should I do if there are changes to my income or circumstances?

A: If there are changes to your income or circumstances after submitting Form T1213(OAS), you should notify the CRA as soon as possible to make any necessary adjustments.