This version of the form is not currently in use and is provided for reference only. Download this version of

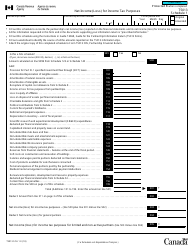

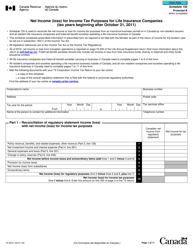

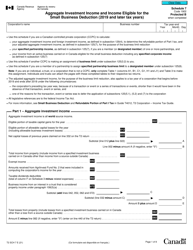

Form T1139

for the current year.

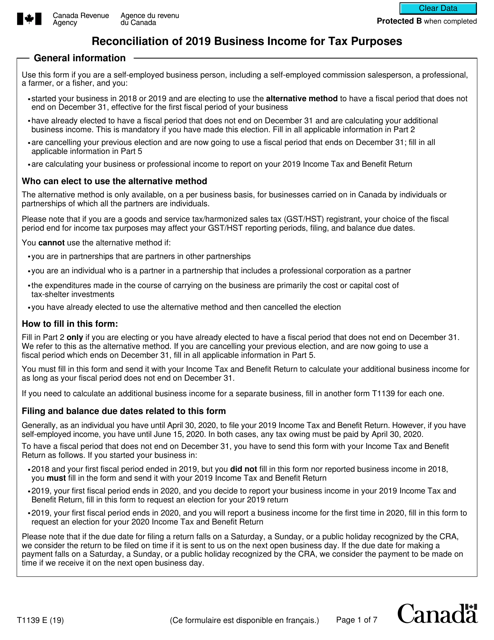

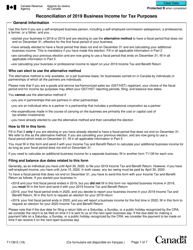

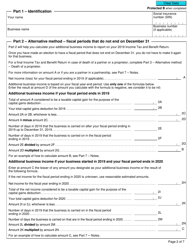

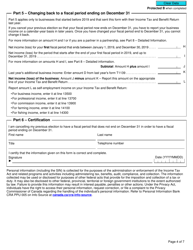

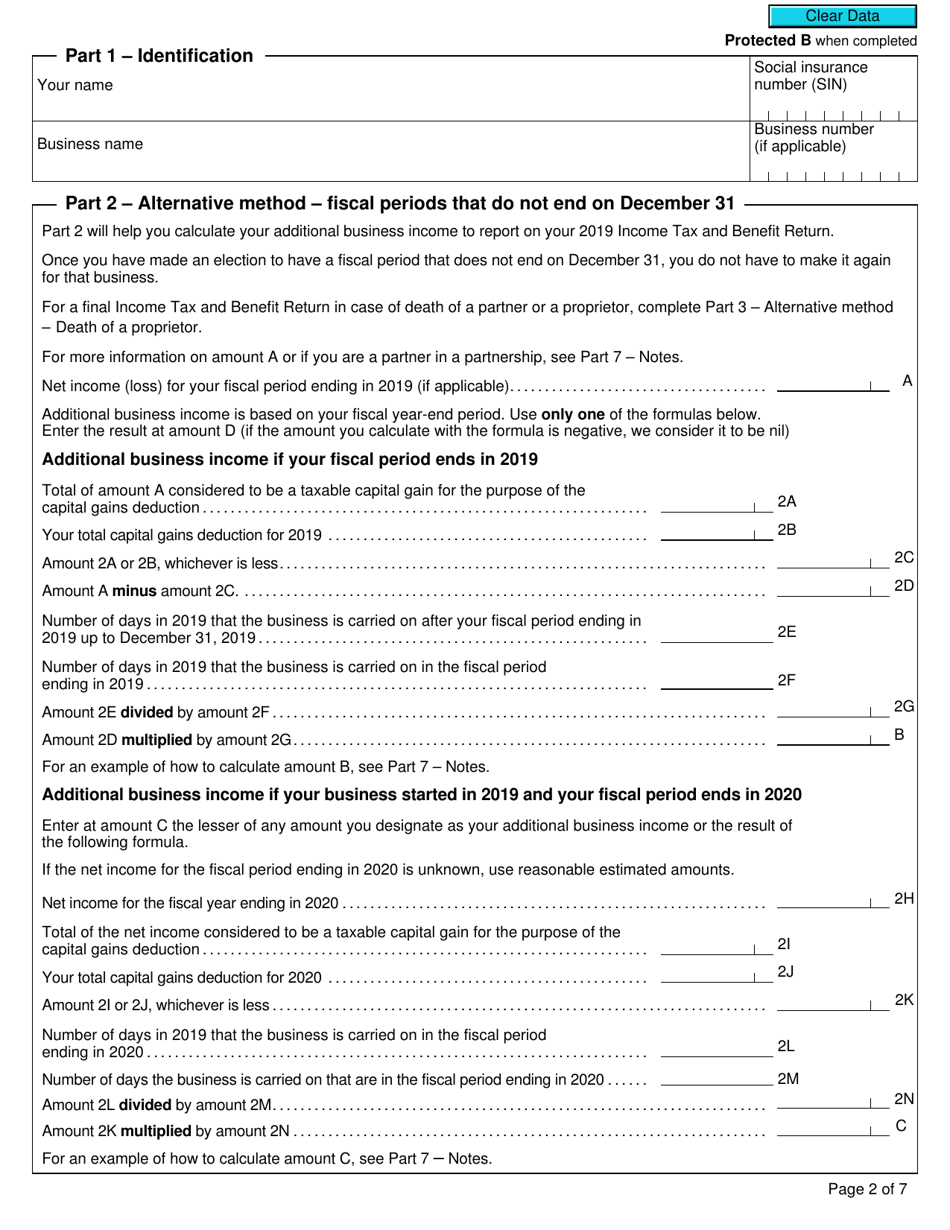

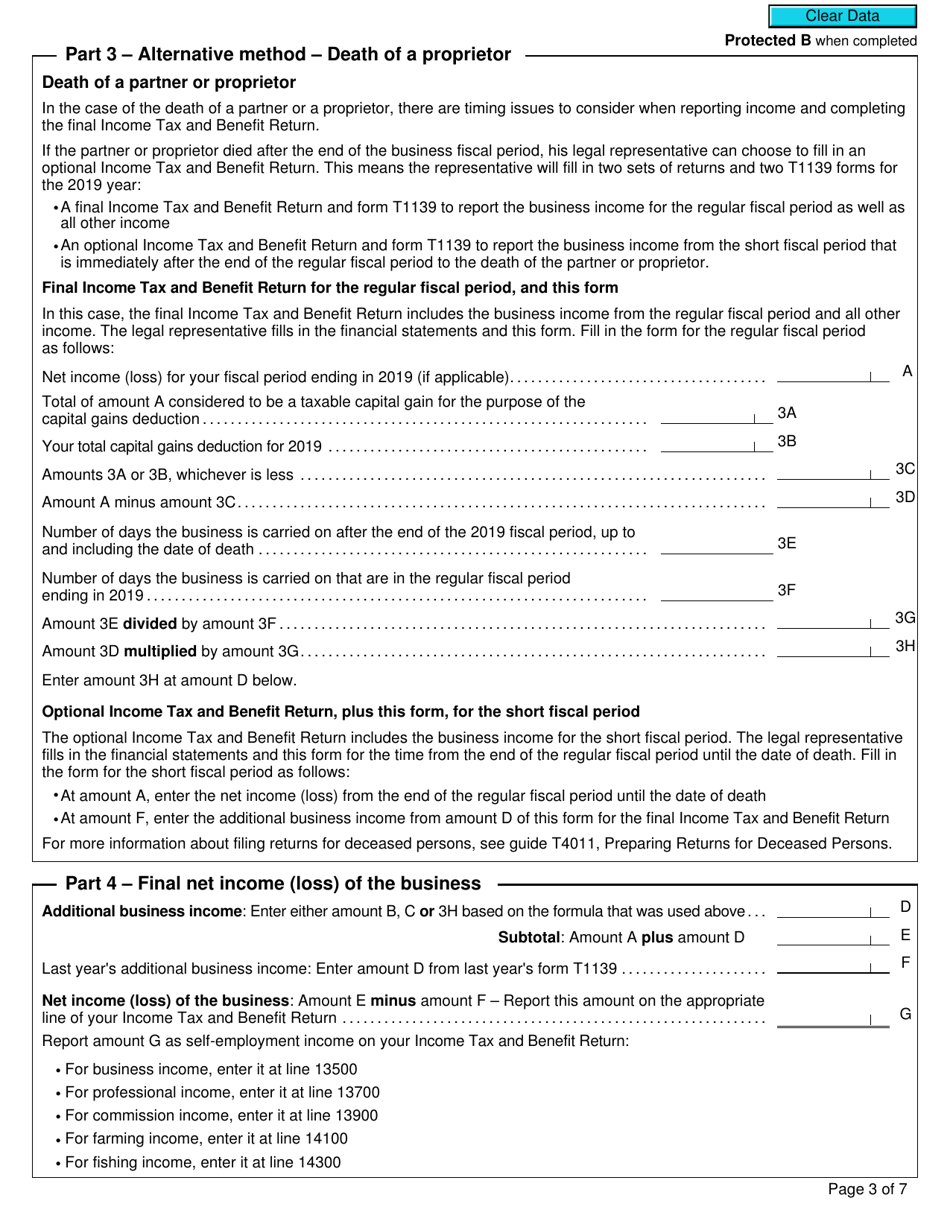

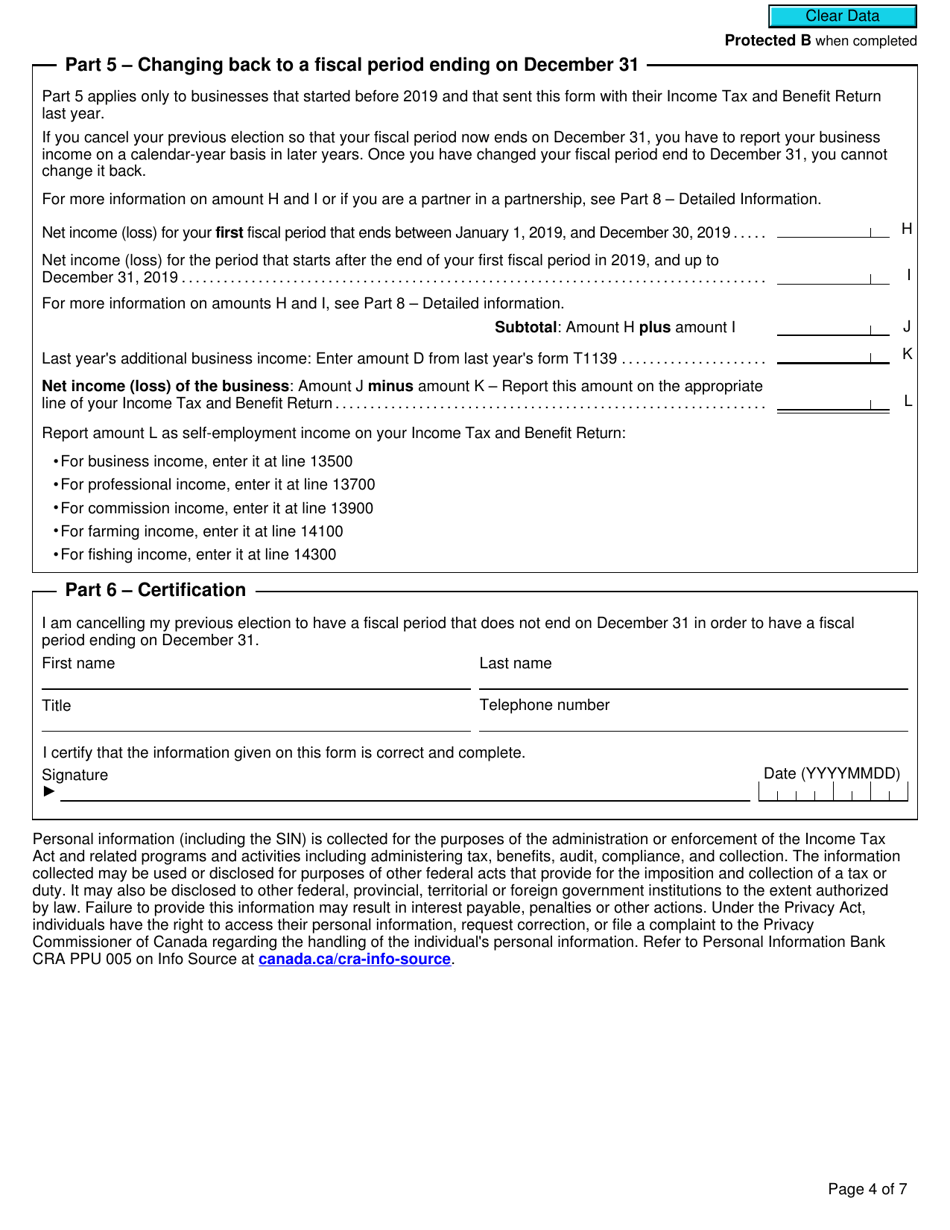

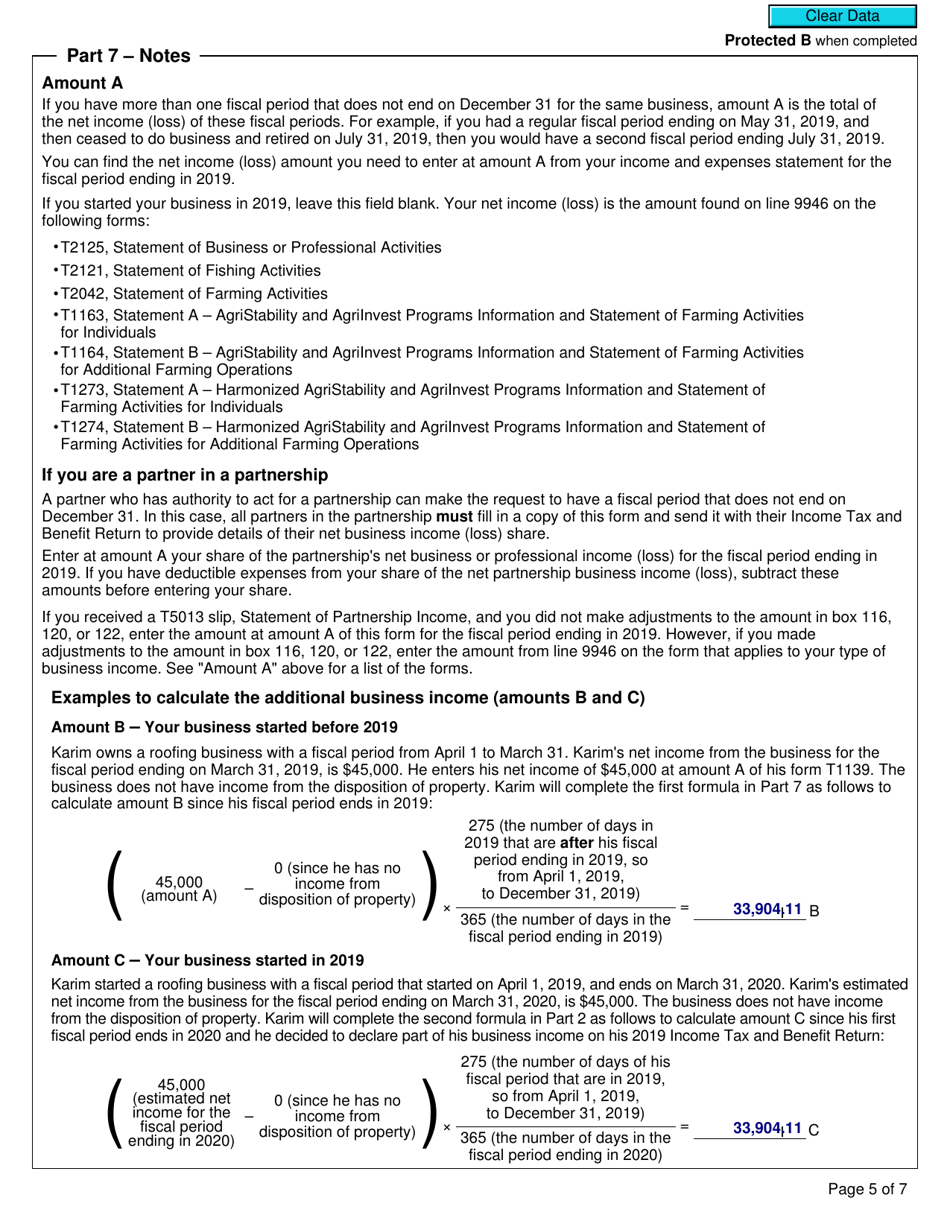

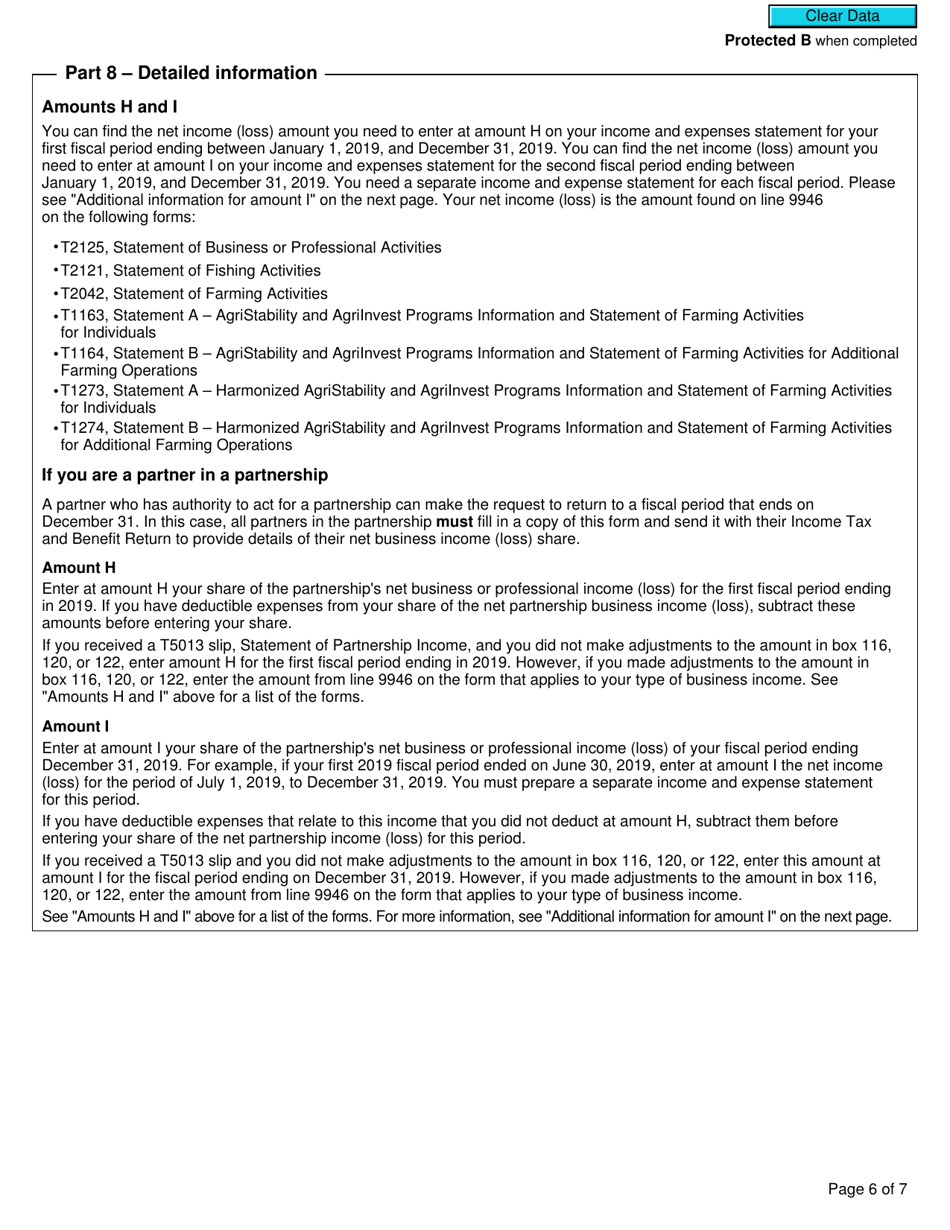

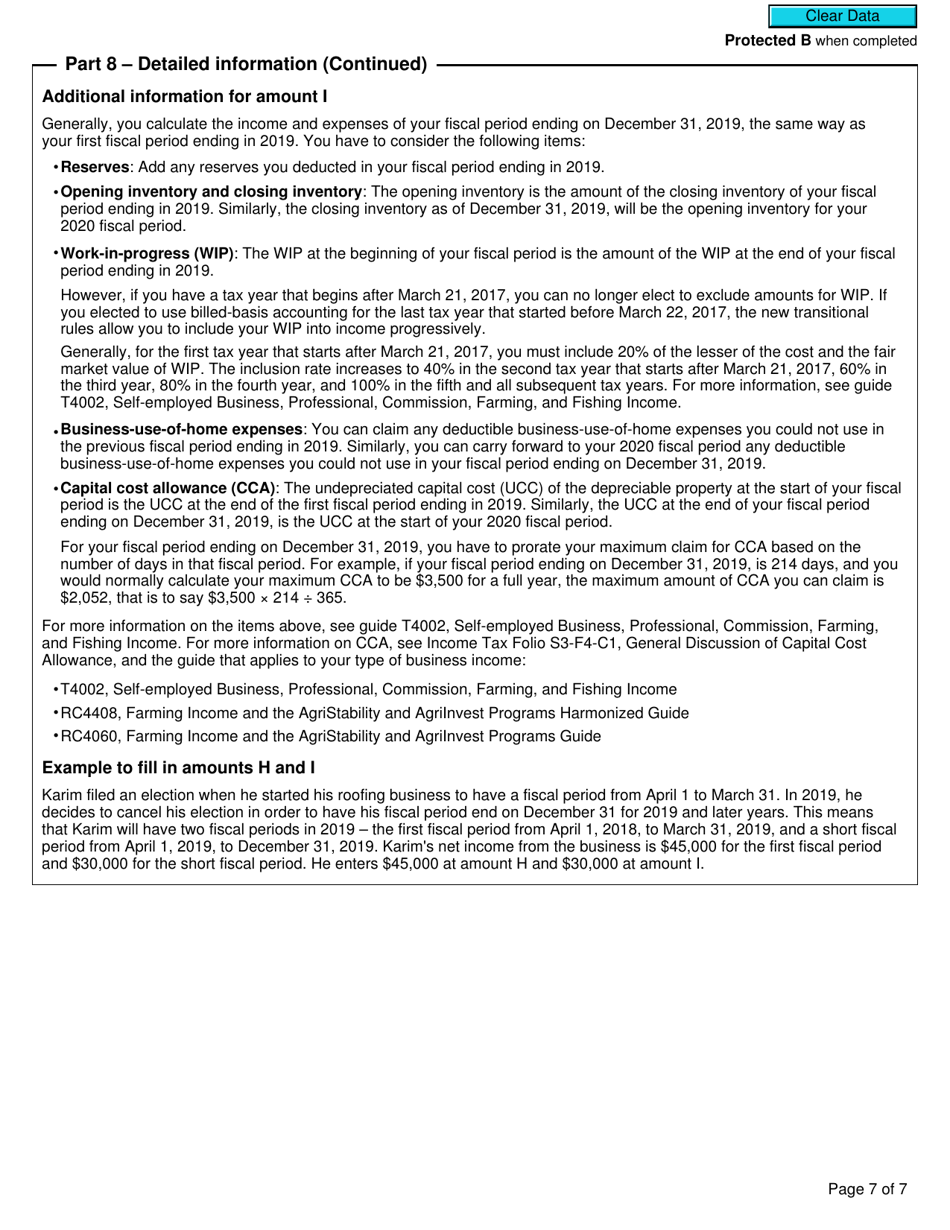

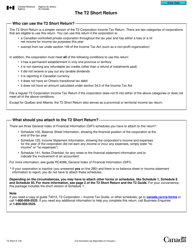

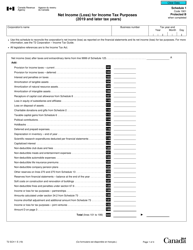

Form T1139 Reconciliation of 2019 Business Income for Tax Purposes - Canada

Form T1139, Reconciliation of 2019 Business Income for Tax Purposes, is used in Canada to reconcile the business income reported on the taxpayer's T2 Corporation Income Tax Return with the income reported on the taxpayer's financial statements. It helps identify and explain any differences between the two amounts.

The individual or business who needs to reconcile their 2019 business income for tax purposes in Canada would file the Form T1139.

FAQ

Q: What is Form T1139?

A: Form T1139 is a form used in Canada to reconcile business income for tax purposes.

Q: What year does Form T1139 relate to?

A: Form T1139 relates to the year 2019.

Q: What is the purpose of Form T1139?

A: The purpose of Form T1139 is to reconcile business income for tax purposes.

Q: Who needs to fill out Form T1139?

A: Individuals or businesses in Canada who need to reconcile their business income for tax purposes may need to fill out Form T1139.