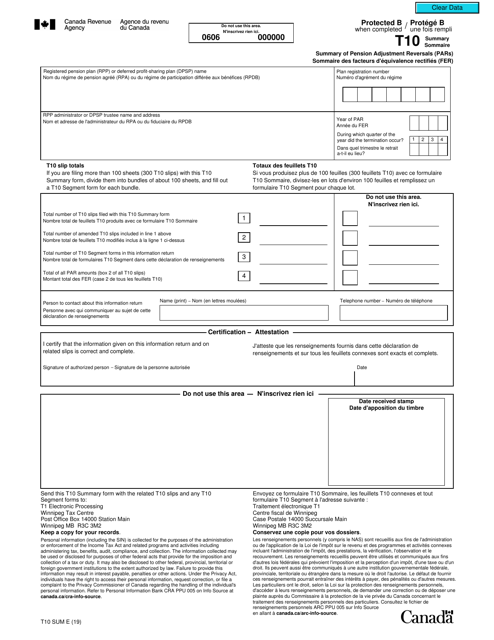

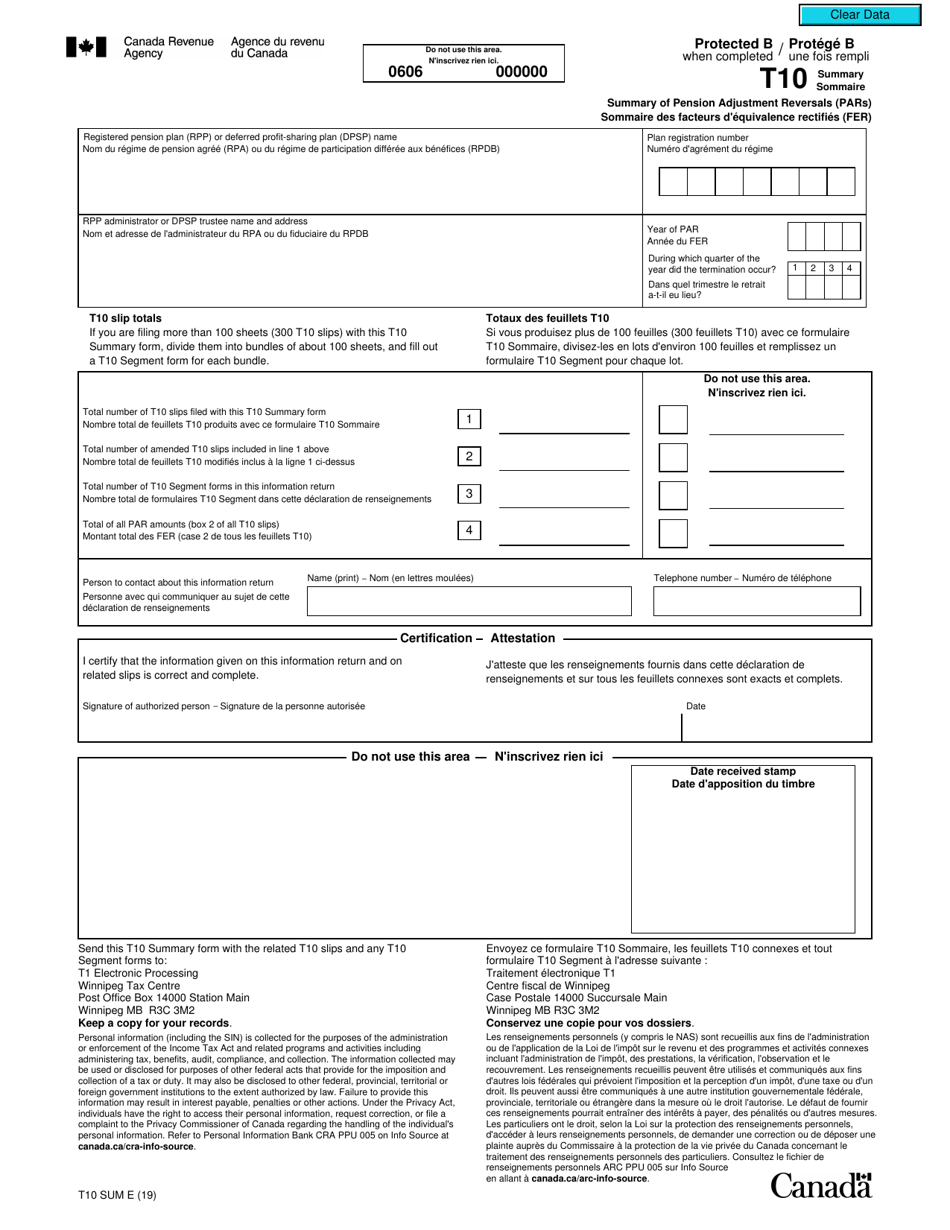

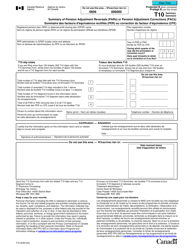

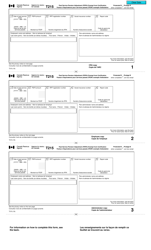

Form T10SUM Summary of Pension Adjustment Reversals (Pars) - Canada (English / French)

Form T10SUM Summary of Pension Adjustment Reversals (PARs) in Canada is used to report the total amount of pension adjustment reversals made during the tax year. This form is required for individuals who have pension adjustments reversed or reduced due to certain circumstances. It provides a summary of these reversals and is used for tax filing purposes.

The Form T10SUM Summary of Pension Adjustment Reversals (PARs) in Canada is typically filed by the employer or pension plan administrator.

FAQ

Q: What is Form T10SUM?

A: Form T10SUM is a summary of Pension Adjustment Reversals (PARs) in Canada.

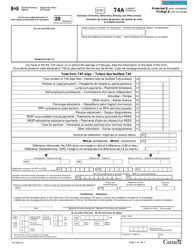

Q: What does Form T10SUM show?

A: Form T10SUM shows the total amounts of PARs for a specific tax year.

Q: Why is Form T10SUM important?

A: Form T10SUM is important for individuals who have PARs as it helps them calculate their allowable pension adjustment for tax purposes.

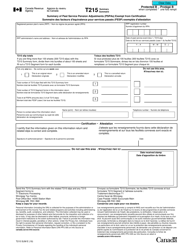

Q: Who needs to file Form T10SUM?

A: Individuals who have PARs for a specific tax year need to file Form T10SUM.

Q: Is Form T10SUM available in both English and French?

A: Yes, Form T10SUM is available in both English and French.

Q: What information do I need to complete Form T10SUM?

A: To complete Form T10SUM, you will need the total amounts of PARs for a specific tax year.

Q: When is the deadline to file Form T10SUM?

A: The deadline to file Form T10SUM is usually April 30th of the following year.

Q: What happens if I don't file Form T10SUM?

A: If you don't file Form T10SUM and you have PARs, you may not be able to claim the allowable pension adjustment for tax purposes.

Q: Do I need to keep a copy of Form T10SUM for my records?

A: Yes, it is recommended to keep a copy of Form T10SUM for your records in case of future reference or audits.