This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1043

for the current year.

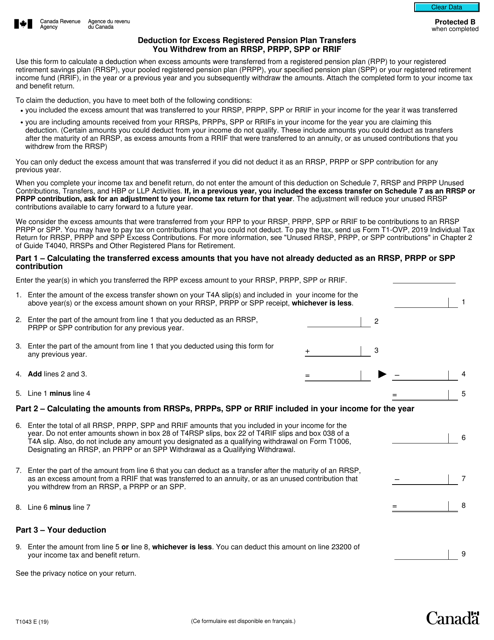

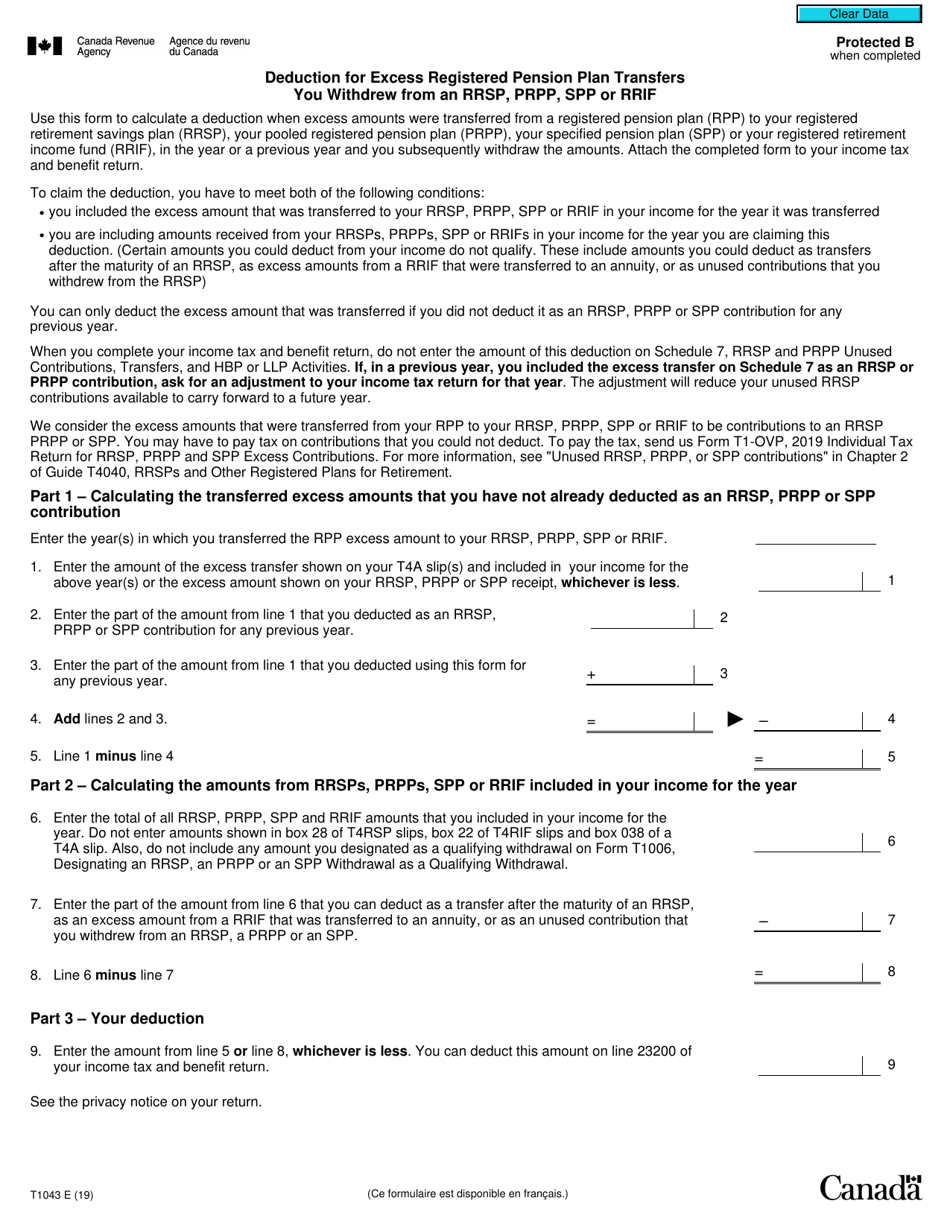

Form T1043 Deduction for Excess Registered Pension Plan Transfers You Withdrew From an Rrsp, or Rrif - Canada

Form T1043 is used in Canada to claim a deduction for excess registered pension plan transfers that you withdrew from an RRSP (Registered Retirement Savings Plan) or a RRIF (Registered Retirement Income Fund). This form allows you to report and claim the tax deduction for any excess transfers you made from your pension plan.

In Canada, the individual who withdrew the excess registered pension plan transfers from an RRSP or RRIF would be responsible for filing the Form T1043 Deduction.

FAQ

Q: What is Form T1043?

A: Form T1043 is a tax form used in Canada.

Q: What is the purpose of Form T1043?

A: The purpose of Form T1043 is to claim a deduction for excess Registered Pension Plan transfers you withdrew from an RRSP or RRIF.

Q: What is an RRSP?

A: An RRSP stands for Registered Retirement Savings Plan and is a type of savings account designed to help Canadians save for retirement.

Q: What is an RRIF?

A: An RRIF stands for Registered Retirement Income Fund and is a type of retirement income plan that is converted from an RRSP.

Q: What is the deduction for excess Registered Pension Plan transfers?

A: It is a deduction that allows you to avoid paying taxes on excess transfers from your RRSP or RRIF.

Q: Who is eligible to claim the deduction?

A: Individuals who have made excess transfers from their RRSP or RRIF and meet certain criteria are eligible to claim the deduction.

Q: How do you claim the deduction?

A: To claim the deduction, you need to complete and submit Form T1043 to the Canada Revenue Agency (CRA).

Q: Are there any limitations or restrictions on the deduction?

A: Yes, there are certain limitations and restrictions on the deduction, such as the maximum deduction amount and eligibility criteria.

Q: Is there a deadline for submitting Form T1043?

A: Yes, there is a deadline for submitting Form T1043, which is usually the same as the deadline for filing your income tax return in Canada.