This version of the form is not currently in use and is provided for reference only. Download this version of

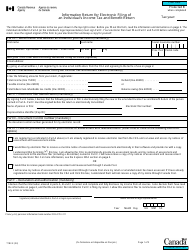

Form RC66SCH

for the current year.

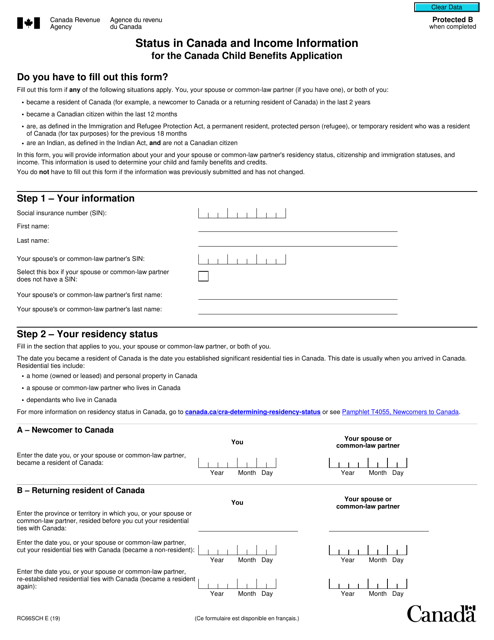

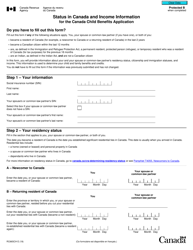

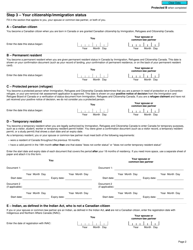

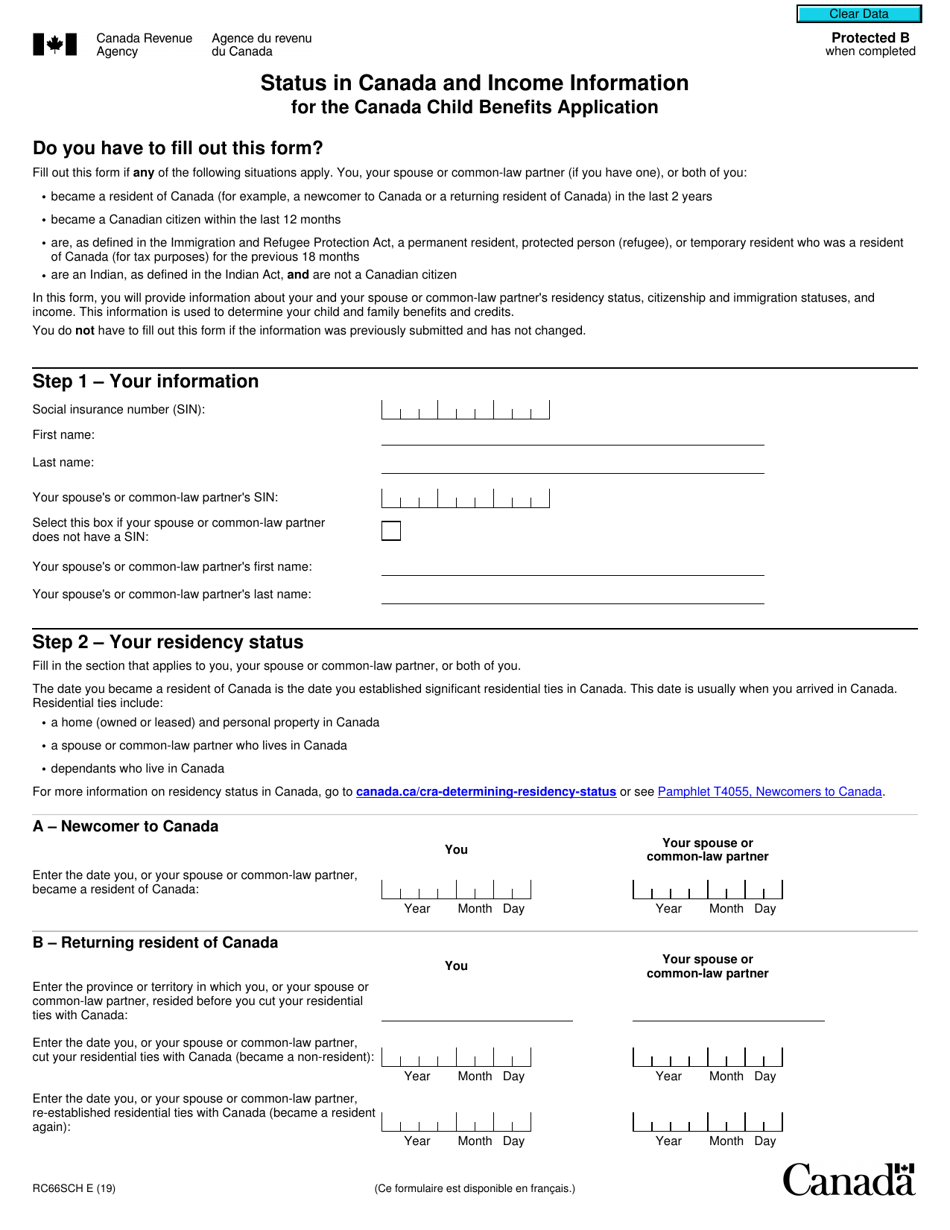

Form RC66SCH Status in Canada and Income Information for the Canada Child Benefits Application - Canada

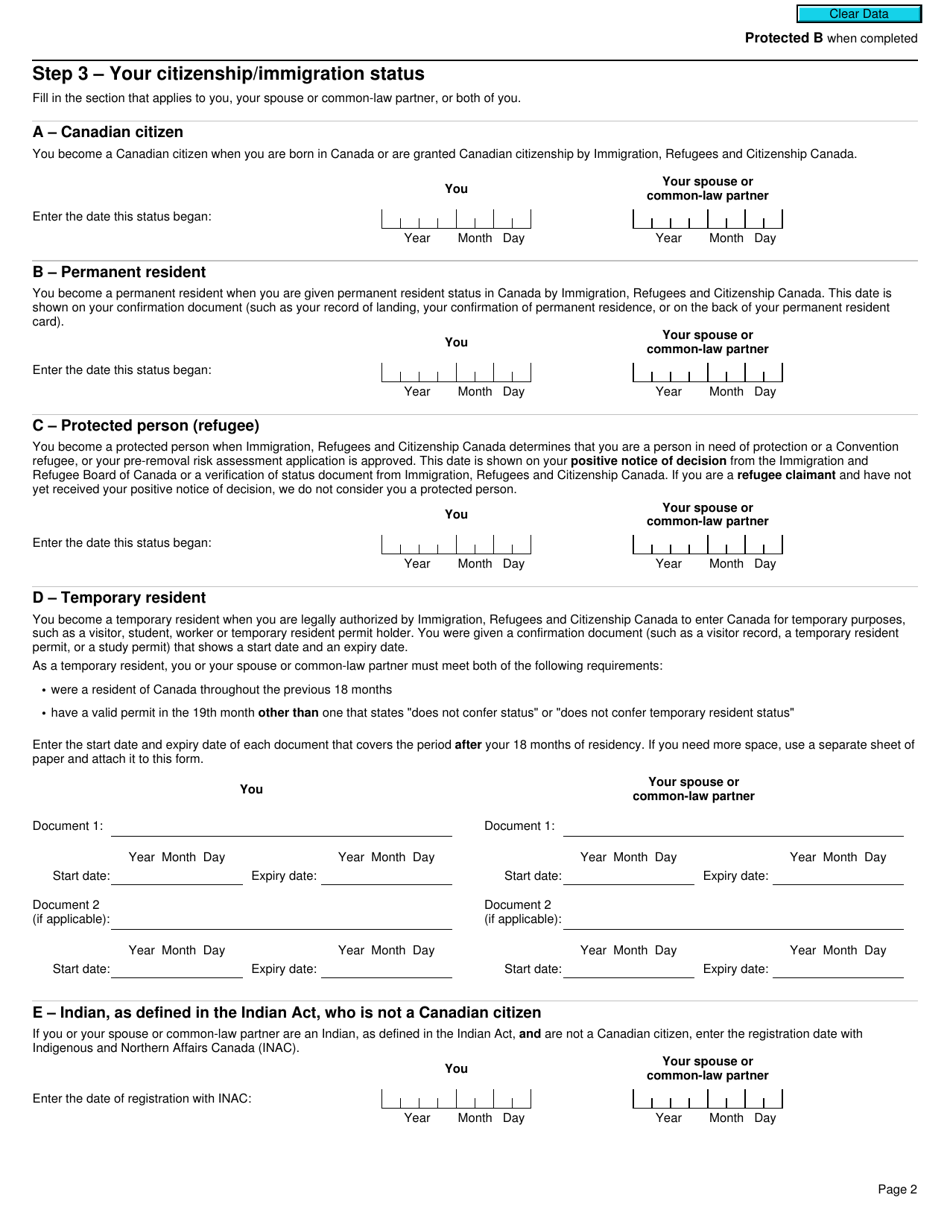

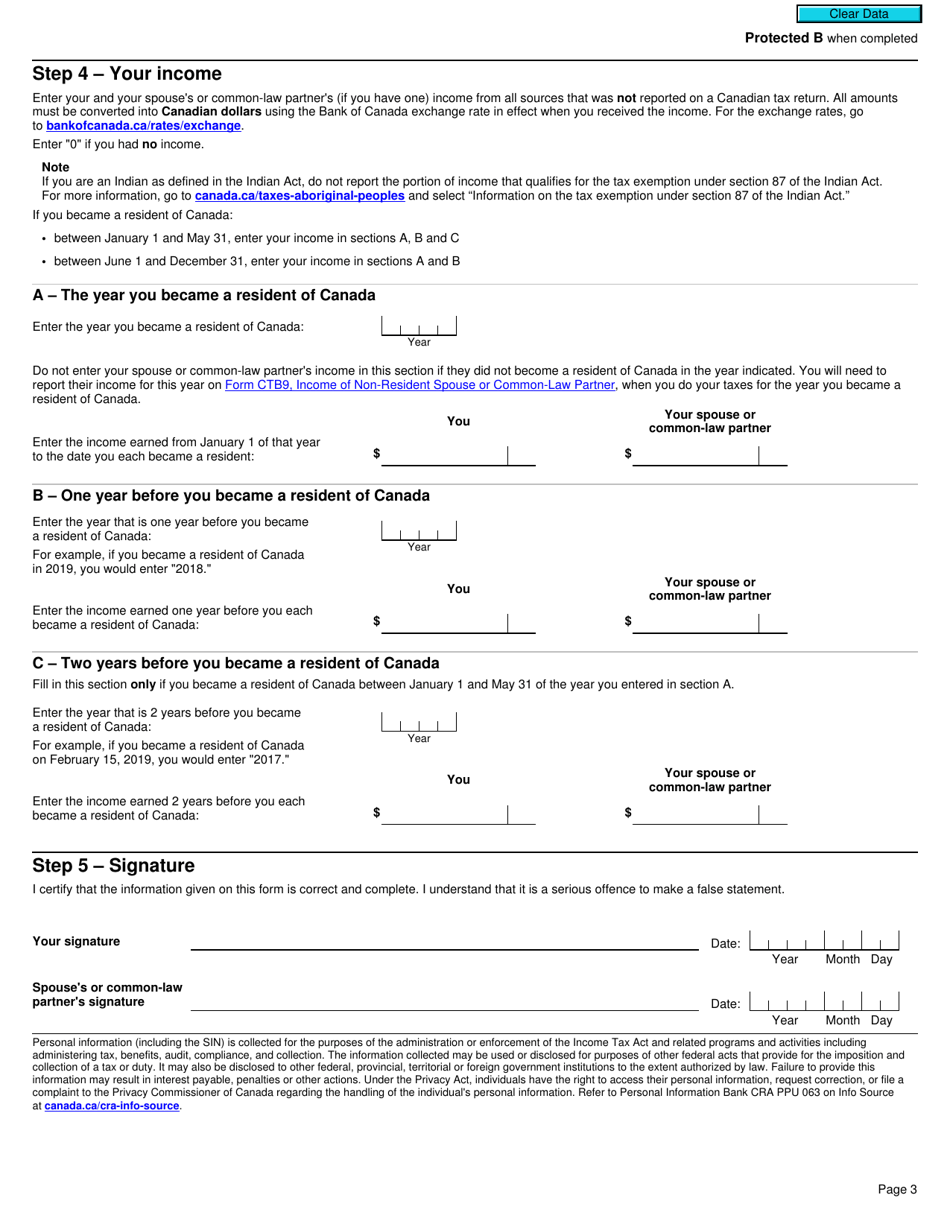

Form RC66SCH Status in Canada is a Schedule that is used to provide income information for the Canada Child Benefits Application. This form helps the Canadian government determine if you are eligible for child benefits based on your income.

The Form RC66SCH Status and Income Information for the Canada Child Benefits Application is filed by the individual or family applying for the Canada Child Benefit.

FAQ

Q: What is the Form RC66SCH?

A: The Form RC66SCH is a document used to provide status in Canada and income information for the Canada Child Benefits Application.

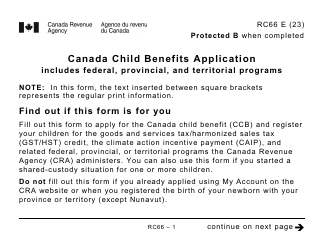

Q: What is the Canada Child Benefits Application?

A: The Canada Child Benefits Application is a program that provides monthly payments to eligible families to help with the cost of raising children.

Q: What does the Form RC66SCH require?

A: The Form RC66SCH requires you to provide information about your status in Canada and your income, which is used to determine your eligibility and the amount of benefits you may receive.

Q: Who is eligible for the Canada Child Benefits?

A: Eligibility for the Canada Child Benefits is based on factors such as your income, the number of children you have, and whether you are a resident of Canada.

Q: How often are the Canada Child Benefits paid?

A: The Canada Child Benefits are paid monthly.

Q: Is there a deadline for submitting the Canada Child Benefits Application?

A: There is no specific deadline for submitting the Canada Child Benefits Application, but it is recommended to apply as soon as possible to start receiving benefits.

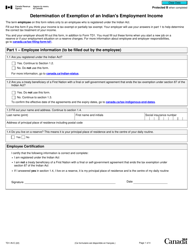

Q: What if my income or status changes after I submit the Form RC66SCH?

A: If your income or status changes after you submit the Form RC66SCH, you must notify the Canada Revenue Agency (CRA) so that they can reassess your eligibility and adjust your benefits accordingly.