This version of the form is not currently in use and is provided for reference only. Download this version of

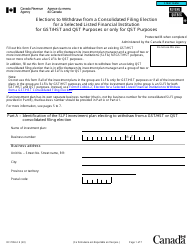

Form RC4602-1

for the current year.

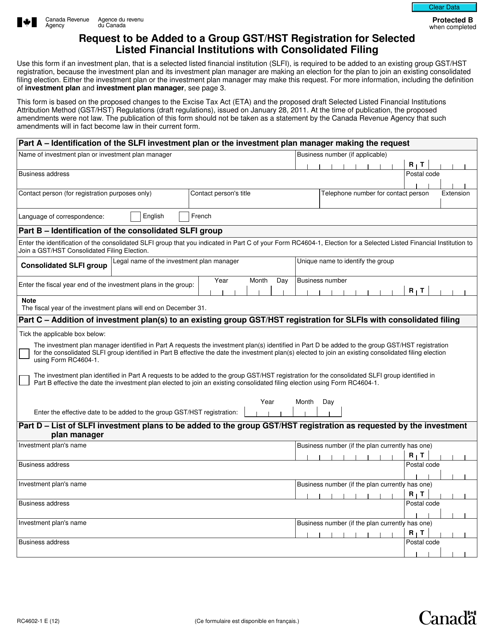

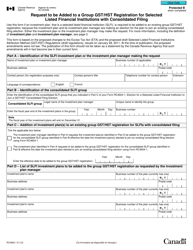

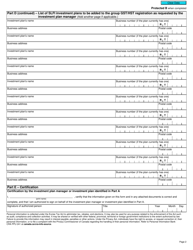

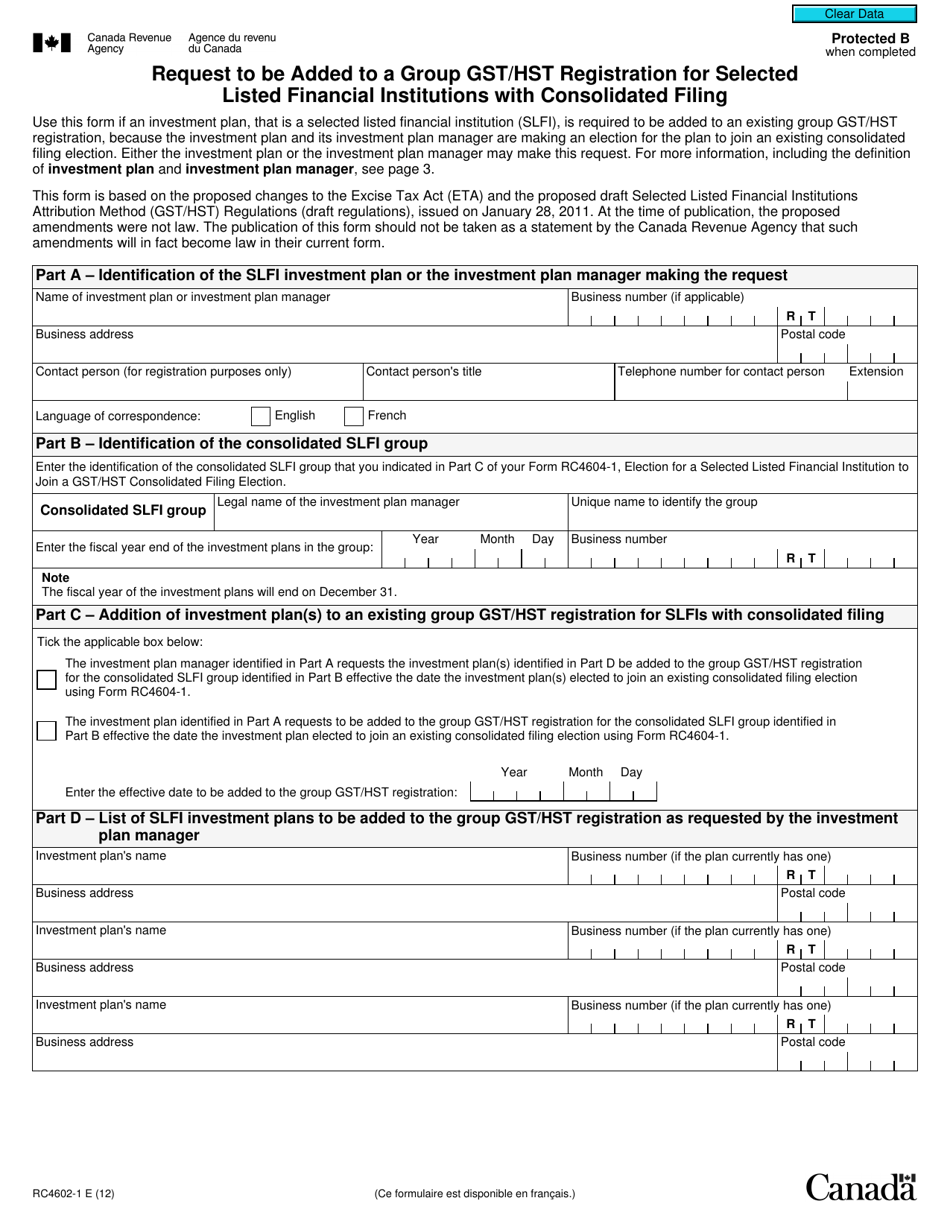

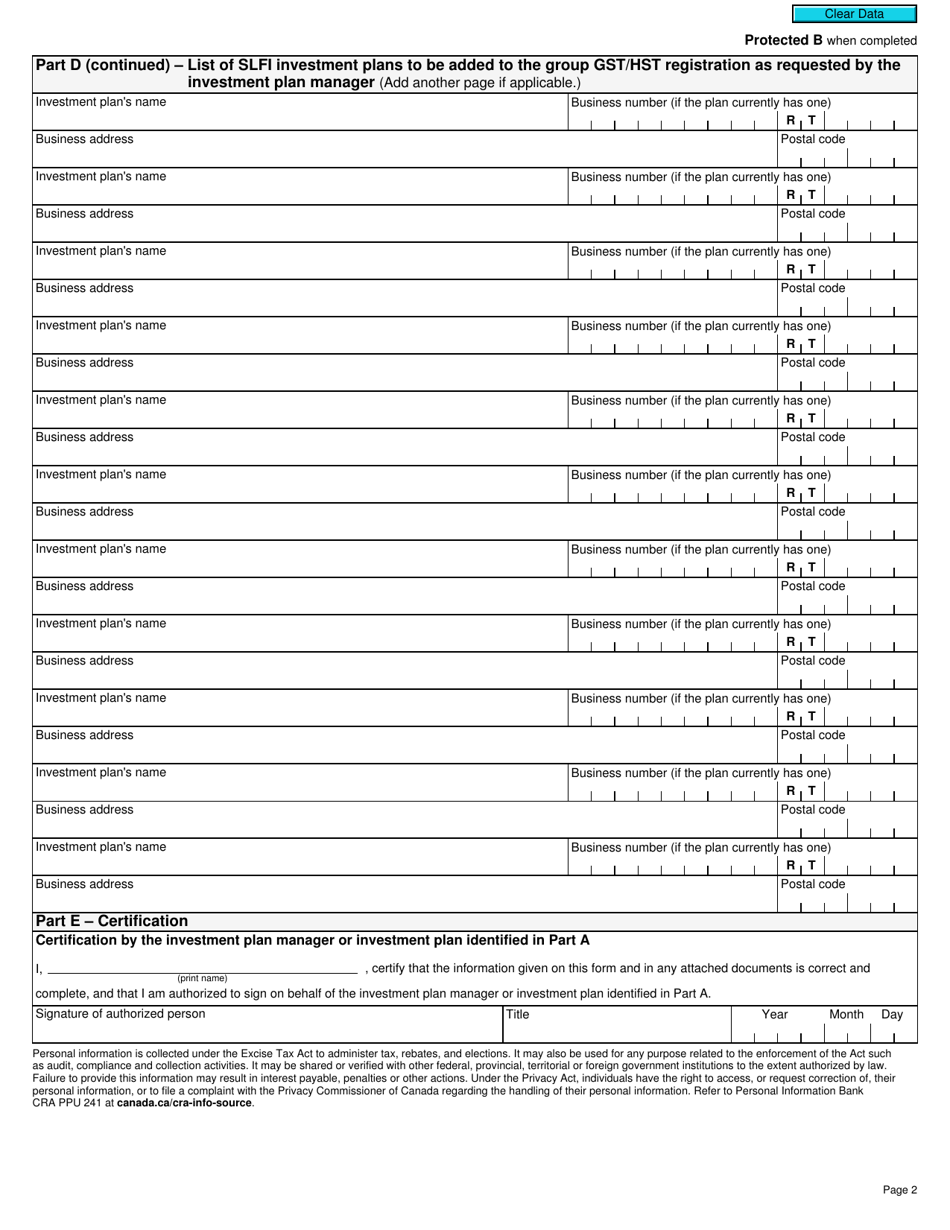

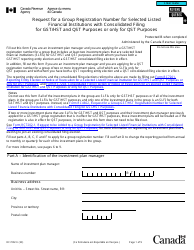

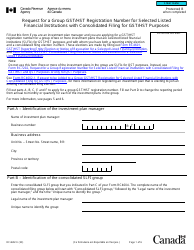

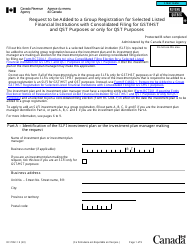

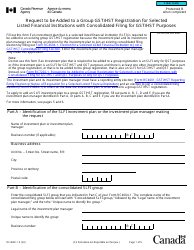

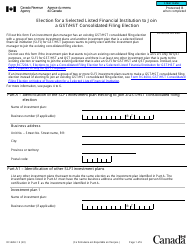

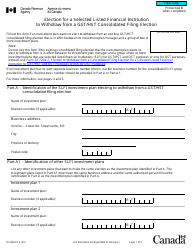

Form RC4602-1 Request to Be Added to a Group Gst / Hst Registration for Selected Listed Financial Institutions With Consolidated Filing - Canada

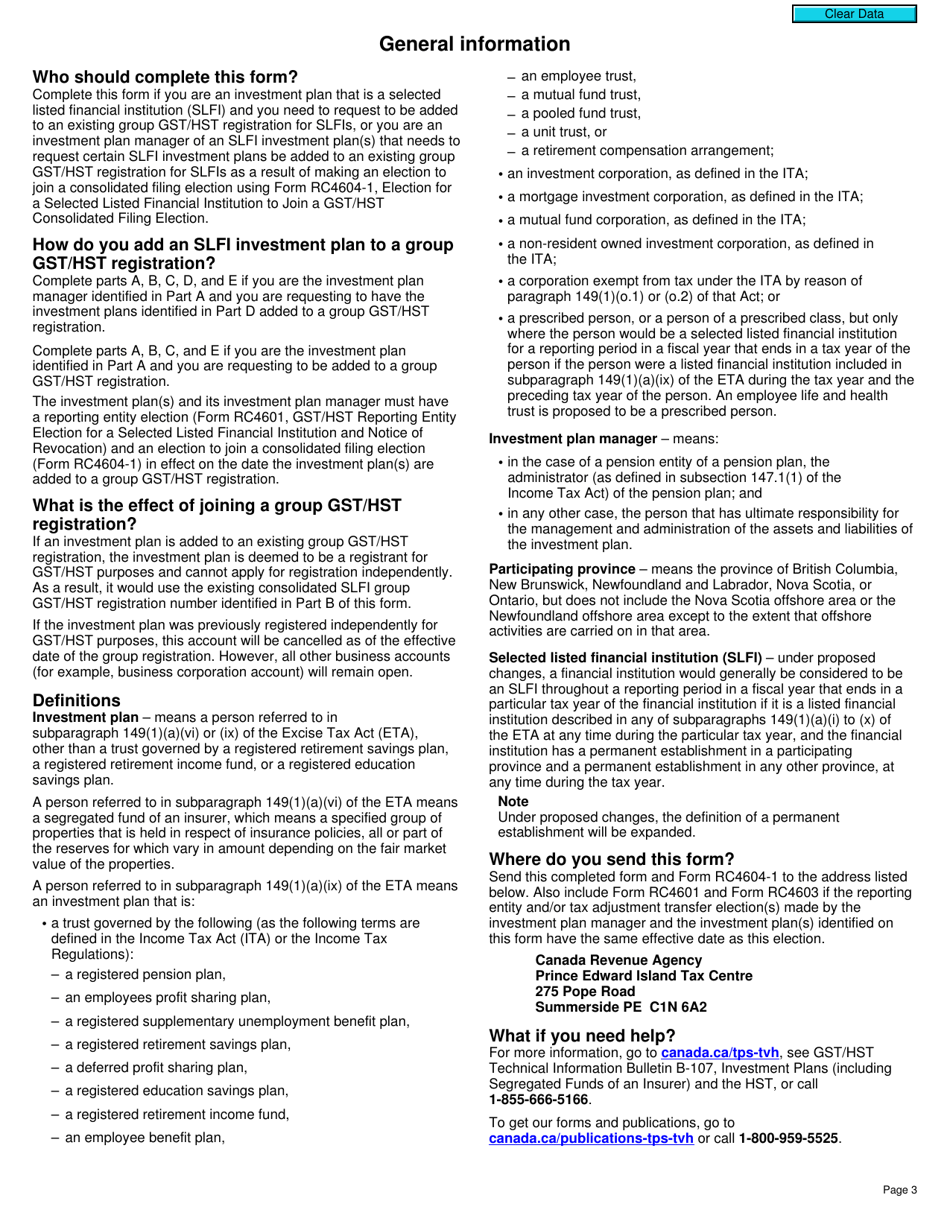

Form RC4602-1 "Request to Be Added to a Group GST/HST Registration for Selected Listed Financial Institutions with Consolidated Filing" in Canada is used by financial institutions to apply for a group GST/HST registration with consolidated filing. This allows the financial institutions to file a single GST/HST return on behalf of the group, rather than filing separate returns.

The financial institution itself would file the Form RC4602-1 to request to be added to a group GST/HST registration in Canada.

FAQ

Q: What is Form RC4602-1?

A: Form RC4602-1 is a request form to be added to a group GST/HST registration for selected listed financial institutions with consolidated filing in Canada.

Q: Who can use Form RC4602-1?

A: Form RC4602-1 can be used by selected listed financial institutions in Canada to request to be added to a group GST/HST registration.

Q: What is a group GST/HST registration?

A: A group GST/HST registration allows multiple eligible entities to be registered under a single GST/HST account.

Q: What are listed financial institutions?

A: Listed financial institutions are specific institutions, like a bank or a credit union, that are included in a list maintained by the Canada Revenue Agency.

Q: What is consolidated filing?

A: Consolidated filing is a method where multiple entities under a group registration file a single GST/HST return.