This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4625

for the current year.

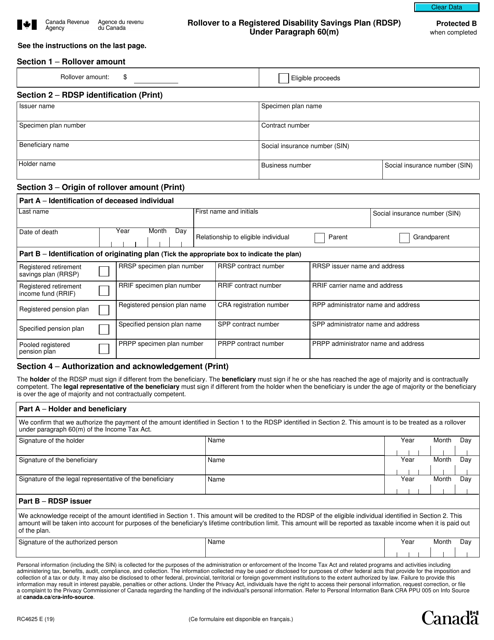

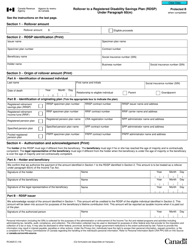

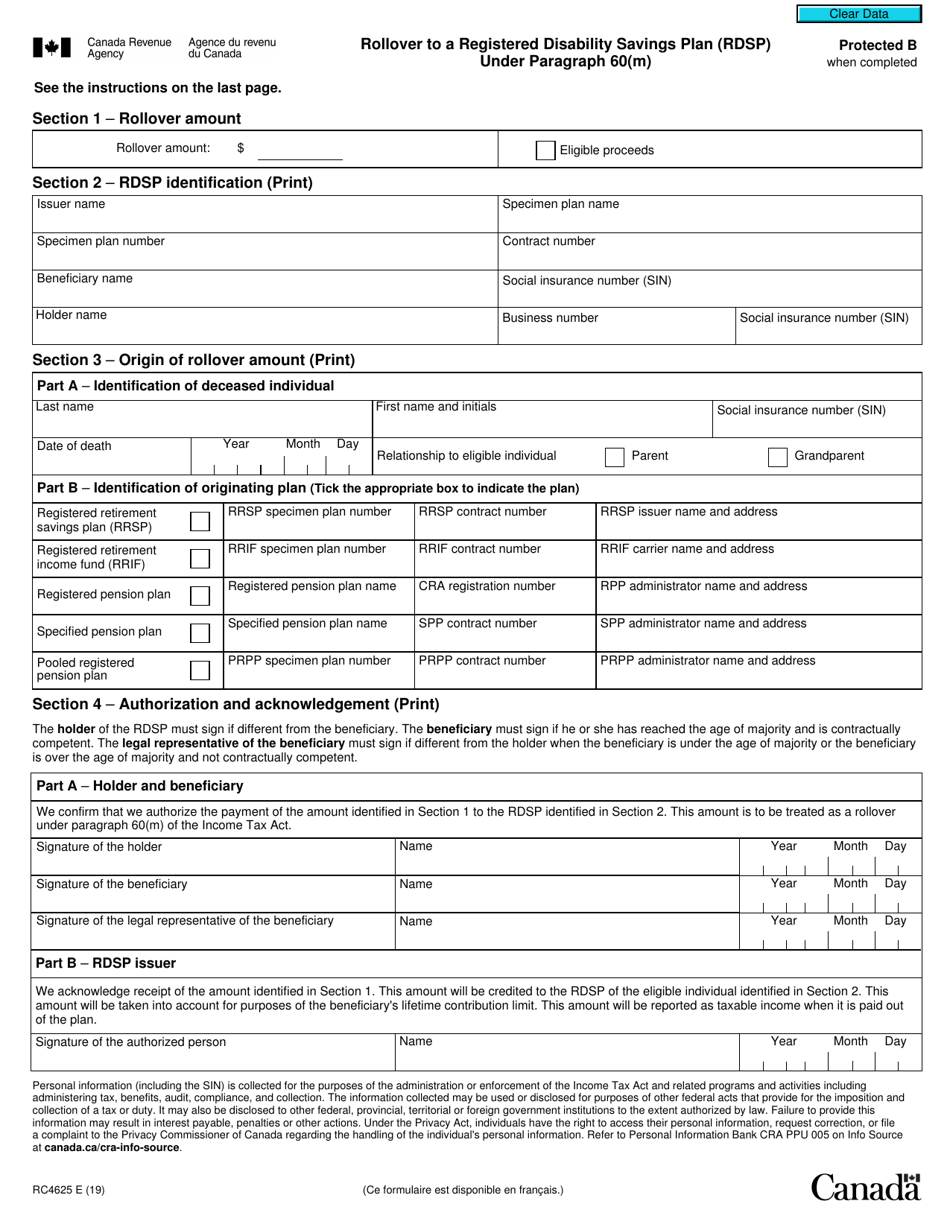

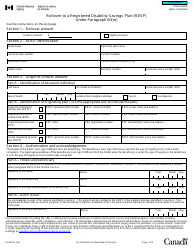

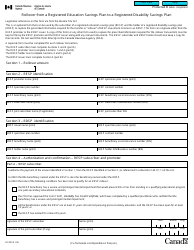

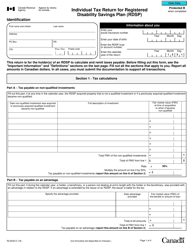

Form RC4625 Rollover to a Registered Disability Savings Plan (Rdsp) Under Paragraph 60(M) - Canada

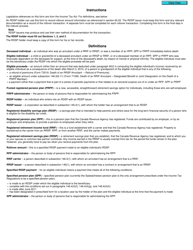

Form RC4625 Rollover to a Registered Disability Savings Plan (RDSP) under Paragraph 60(M) in Canada is used for transferring funds from a Registered Retirement Savings Plan (RRSP), Registered Pension Plan (RPP), or Registered Retirement Income Fund (RRIF) to an RDSP for the benefit of an individual with a disability. This form allows for the tax-free rollover of funds, providing financial support for individuals with disabilities.

The taxpayer or their legal representative files Form RC4625 in Canada for the rollover to a Registered Disability Savings Plan (RDSP) under paragraph 60(m).

FAQ

Q: What is Form RC4625?

A: Form RC4625 is a government form used in Canada to rollover funds to a Registered Disability Savings Plan (RDSP) under paragraph 60(m).

Q: What is a Registered Disability Savings Plan (RDSP)?

A: A Registered Disability Savings Plan (RDSP) is a savings plan that helps individuals with disabilities and their families save for the future.

Q: Who can use Form RC4625?

A: Form RC4625 is used by individuals who want to rollover their funds to a Registered Disability Savings Plan (RDSP) in Canada.

Q: What is the purpose of the rollover?

A: The purpose of the rollover is to transfer funds from another savings plan or investment to a Registered Disability Savings Plan (RDSP) to provide future financial security for individuals with disabilities.

Q: How do I fill out Form RC4625?

A: To fill out Form RC4625, you will need to provide personal information, details about the transferring plan or investment, and information about the RDSP to which you want to transfer the funds.

Q: Are there any eligibility requirements for using Form RC4625?

A: Yes, there are eligibility requirements for using Form RC4625, such as being a resident of Canada, having a disability, and having a valid RDSP.

Q: Can I rollover funds to an RDSP from any type of savings plan?

A: No, you can only rollover funds from certain types of savings plans or investments, as specified by the Canada Revenue Agency (CRA).

Q: Is there a deadline for using Form RC4625 to rollover funds to an RDSP?

A: No, there is no specific deadline for using Form RC4625 to rollover funds to an RDSP in Canada.

Q: Can I make contributions to an RDSP after completing the rollover?

A: Yes, after completing the rollover, you can continue to make contributions to the RDSP to further save for the future.