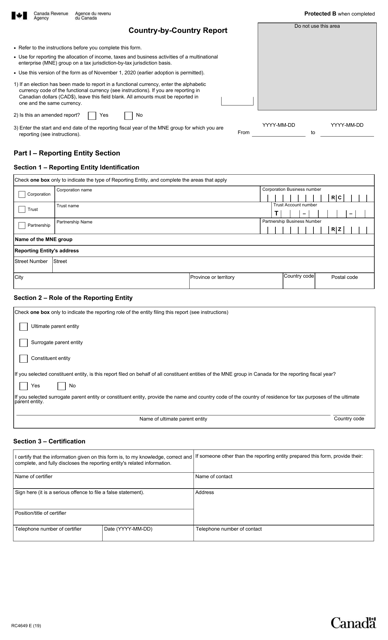

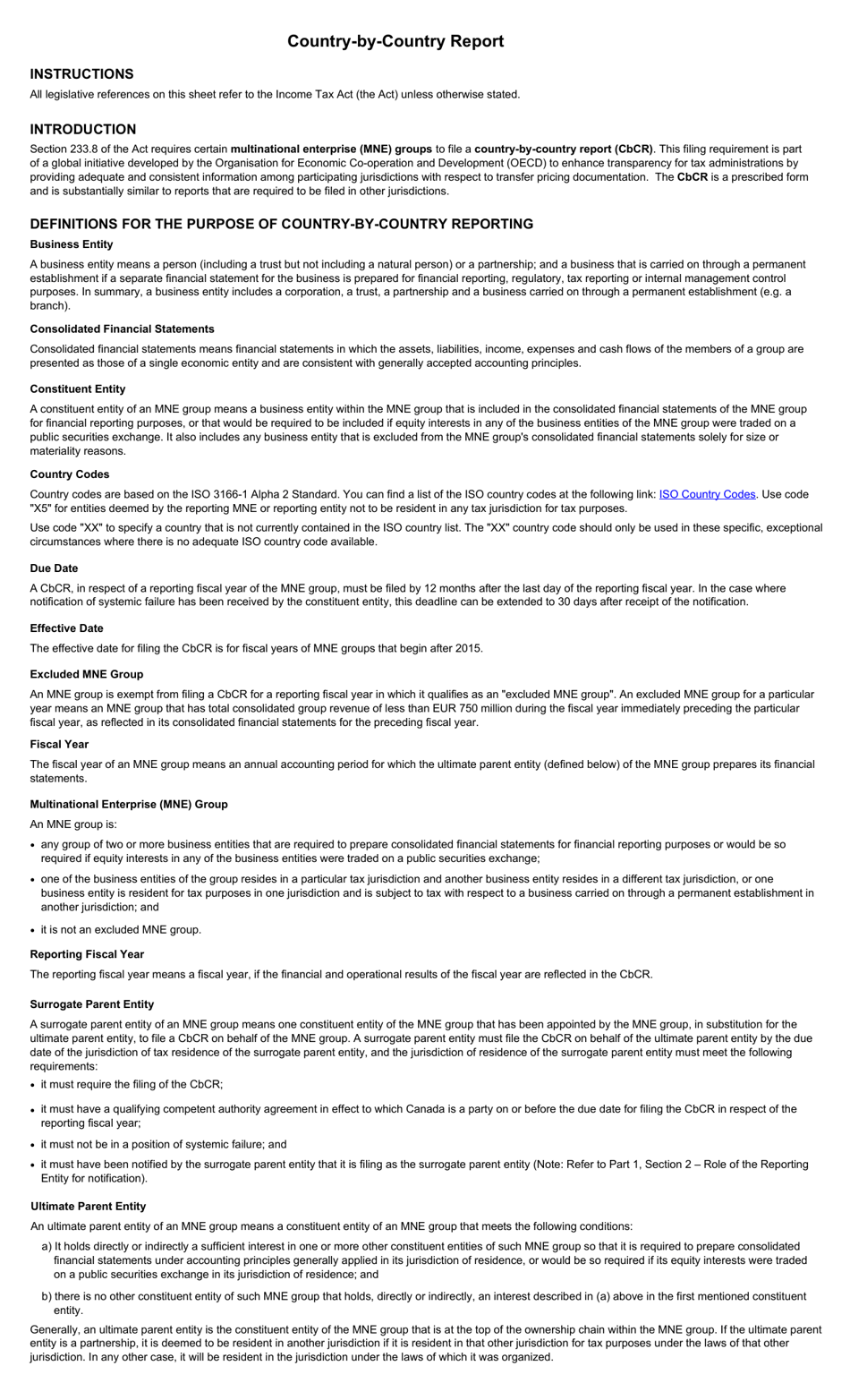

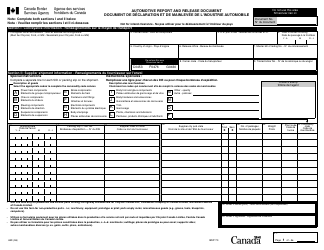

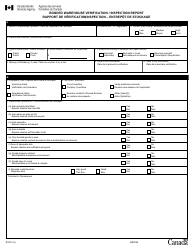

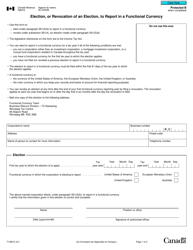

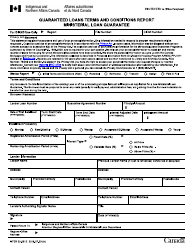

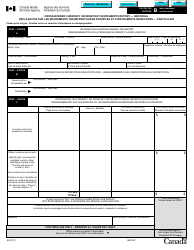

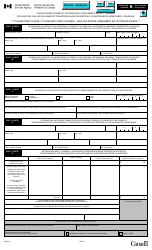

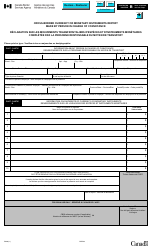

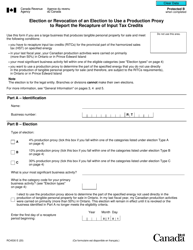

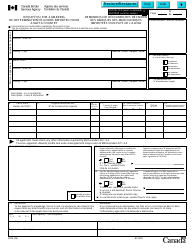

Form RC4649 Country-By-Country Report - Canada

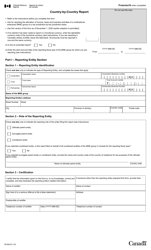

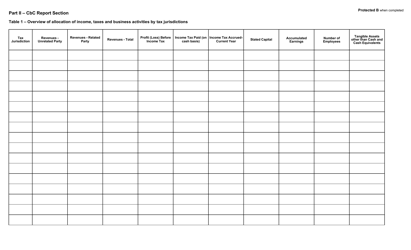

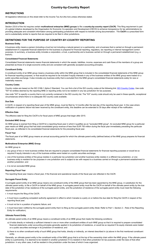

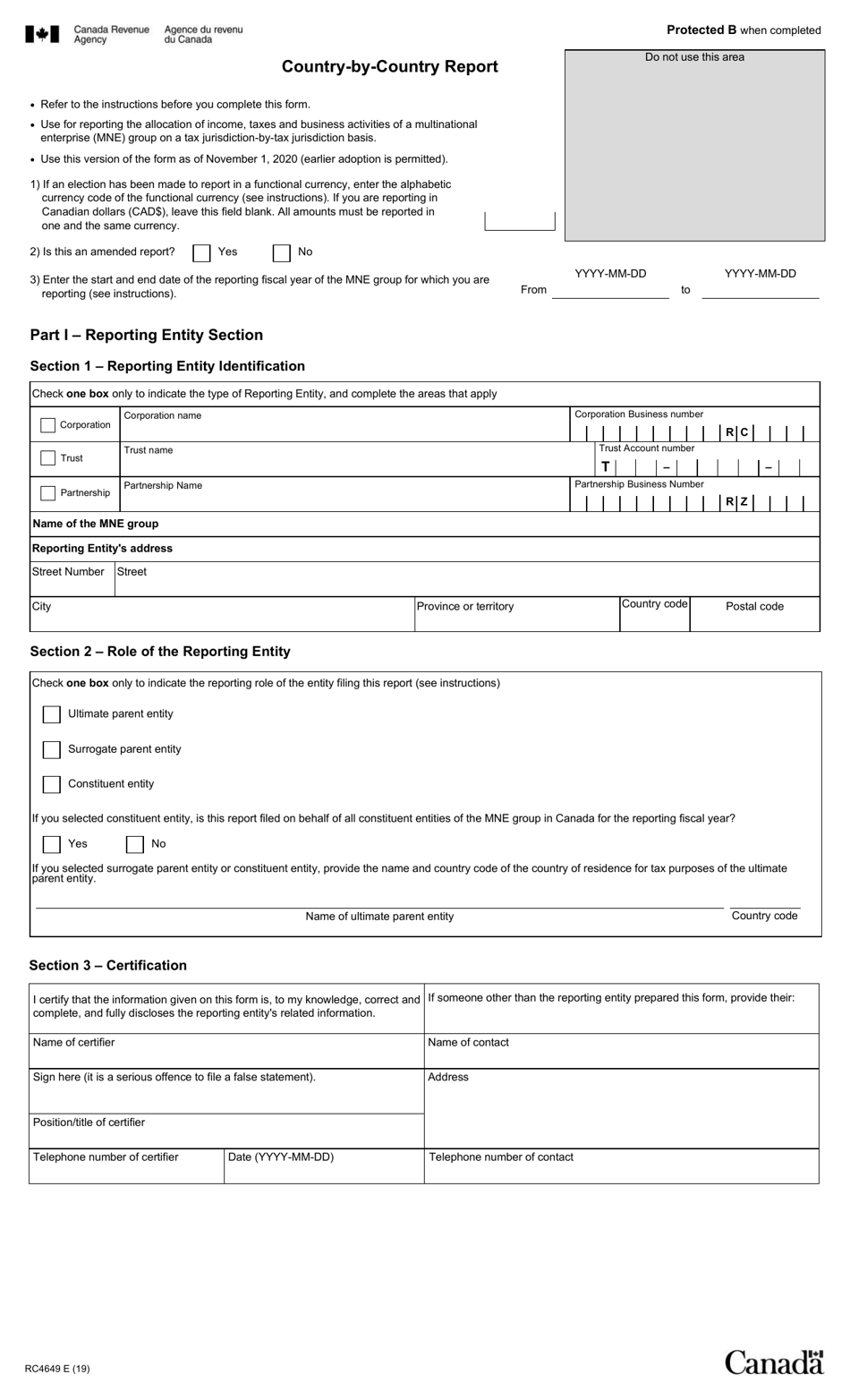

Form RC4649 Country-By-Country Report - Canada is used by multinational enterprises to provide information about their global allocation of income, taxes paid and economic activity for tax purposes.

In Canada, the Form RC4649 Country-By-Country Report is filed by multinational enterprises (MNEs) that meet certain criteria.

FAQ

Q: What is Form RC4649?

A: Form RC4649 is the Country-By-Country Report for Canada.

Q: What is the purpose of Form RC4649?

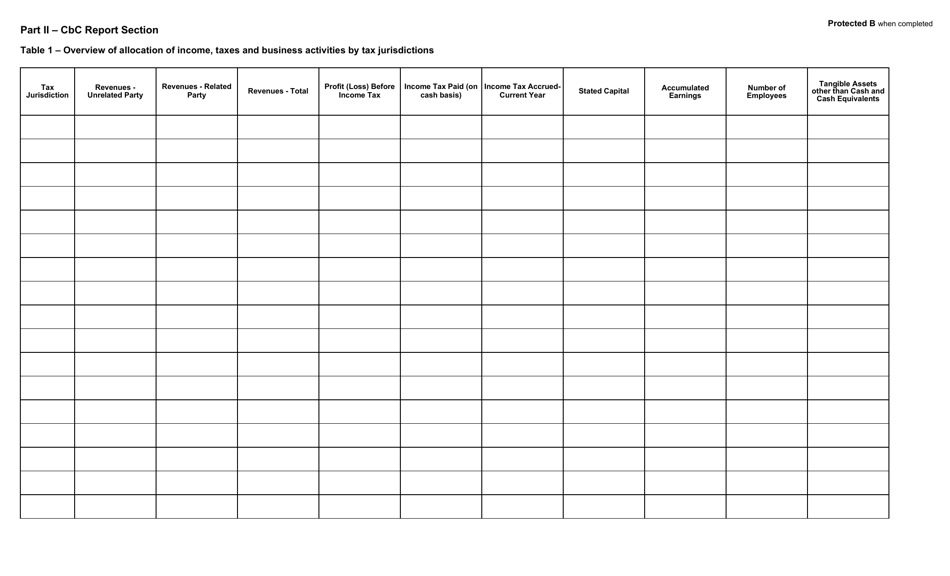

A: The purpose of Form RC4649 is to collect information about multinational enterprises' activities, including income, taxes paid, and more.

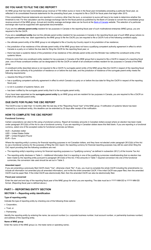

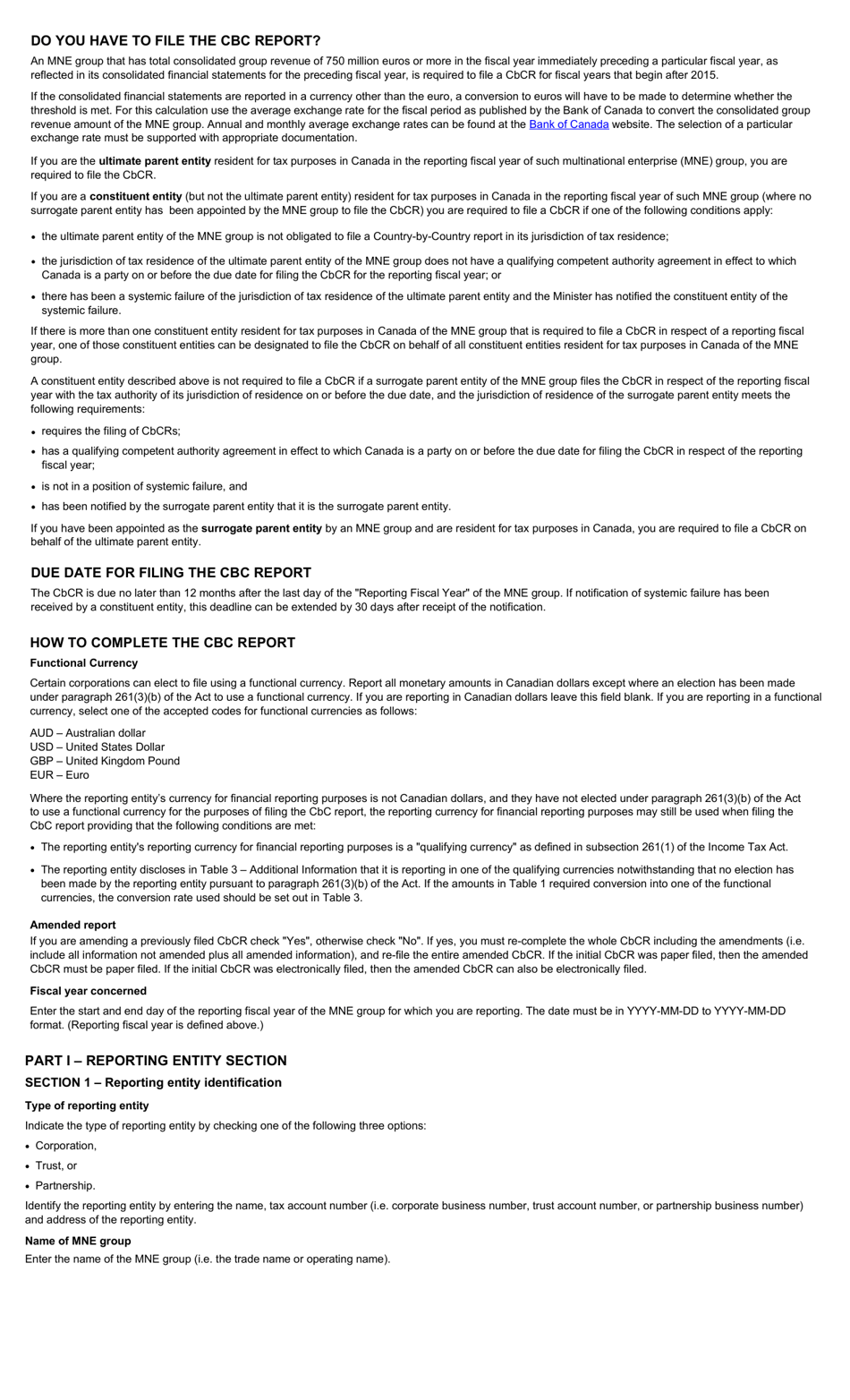

Q: Who needs to file Form RC4649?

A: Only multinational enterprises that meet specific size and criteria requirements need to file Form RC4649.

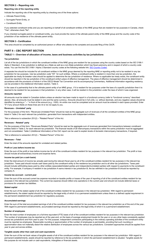

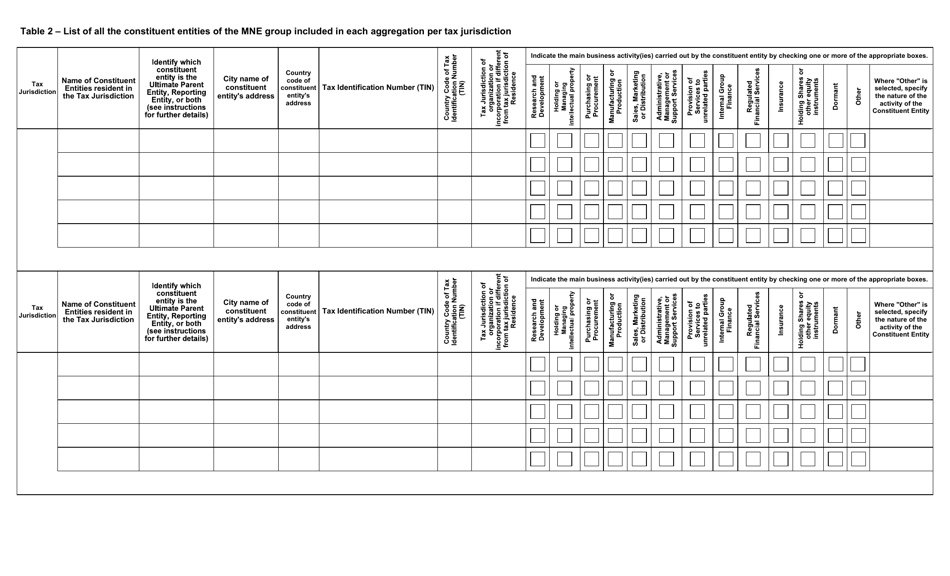

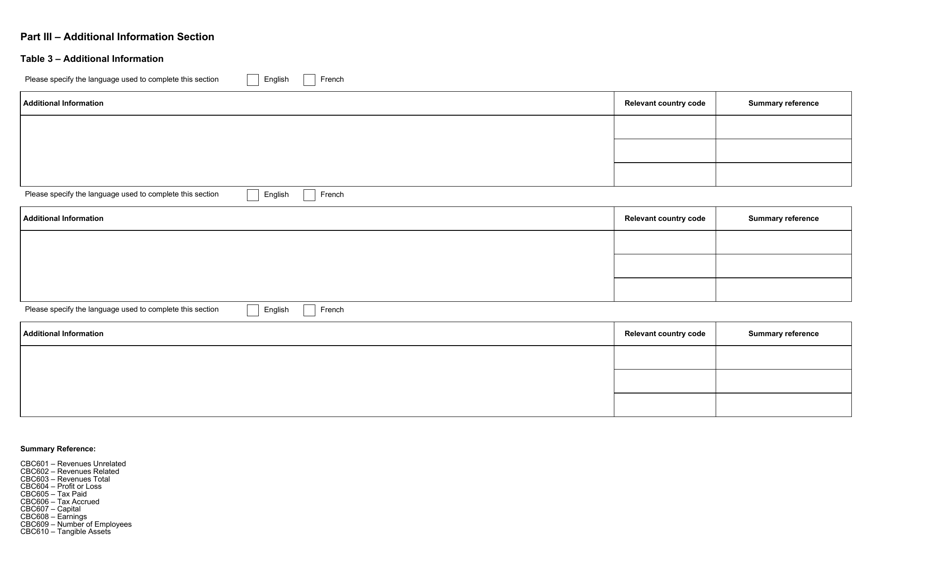

Q: What information is required to be reported on Form RC4649?

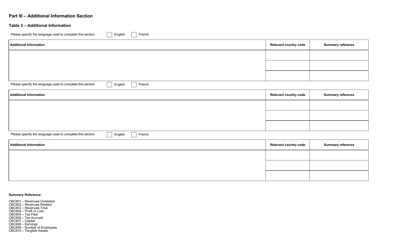

A: Form RC4649 requires the reporting of various financial and tax-related information, including the consolidated financial statements, essential entities' details, and more.

Q: When is Form RC4649 due?

A: Form RC4649 is generally due within 12 months of the last day of the multinational enterprise's fiscal year.

Q: Is Form RC4649 the same as the Country-by-Country Reporting (CBCR) requirement under Base Erosion and Profit Shifting (BEPS)?

A: Yes, Form RC4649 is Canada's implementation of the CBCR requirement under BEPS.

Q: Are there any penalties for non-compliance with Form RC4649?

A: Yes, there are penalties for non-compliance, which can include financial penalties and other consequences as determined by the CRA.

Q: Can I file Form RC4649 electronically?

A: Yes, the CRA allows for electronic filing of Form RC4649.

Q: Do I need to file Form RC4649 if I am a small business with no multinational activities?

A: No, Form RC4649 is only required for multinational enterprises that meet specific size and criteria requirements.