This version of the form is not currently in use and is provided for reference only. Download this version of

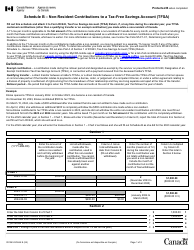

Form RC240

for the current year.

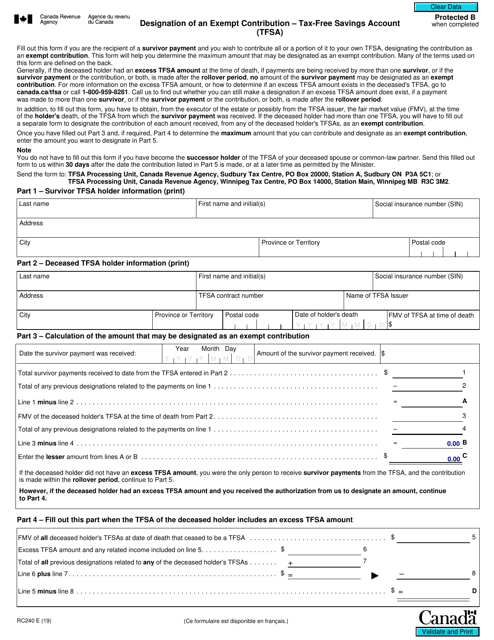

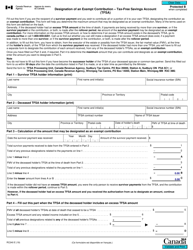

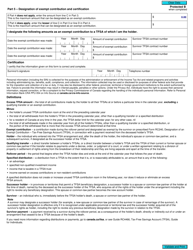

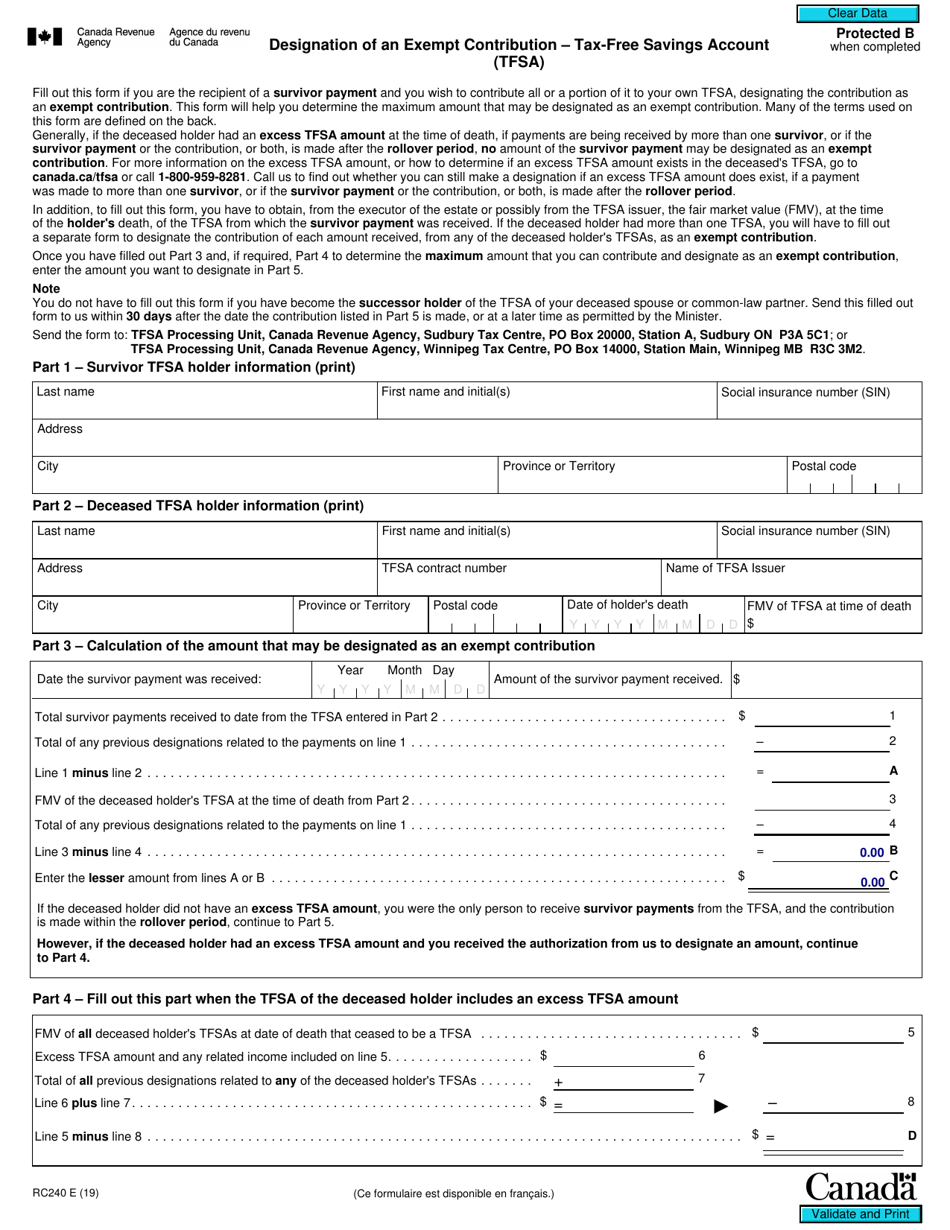

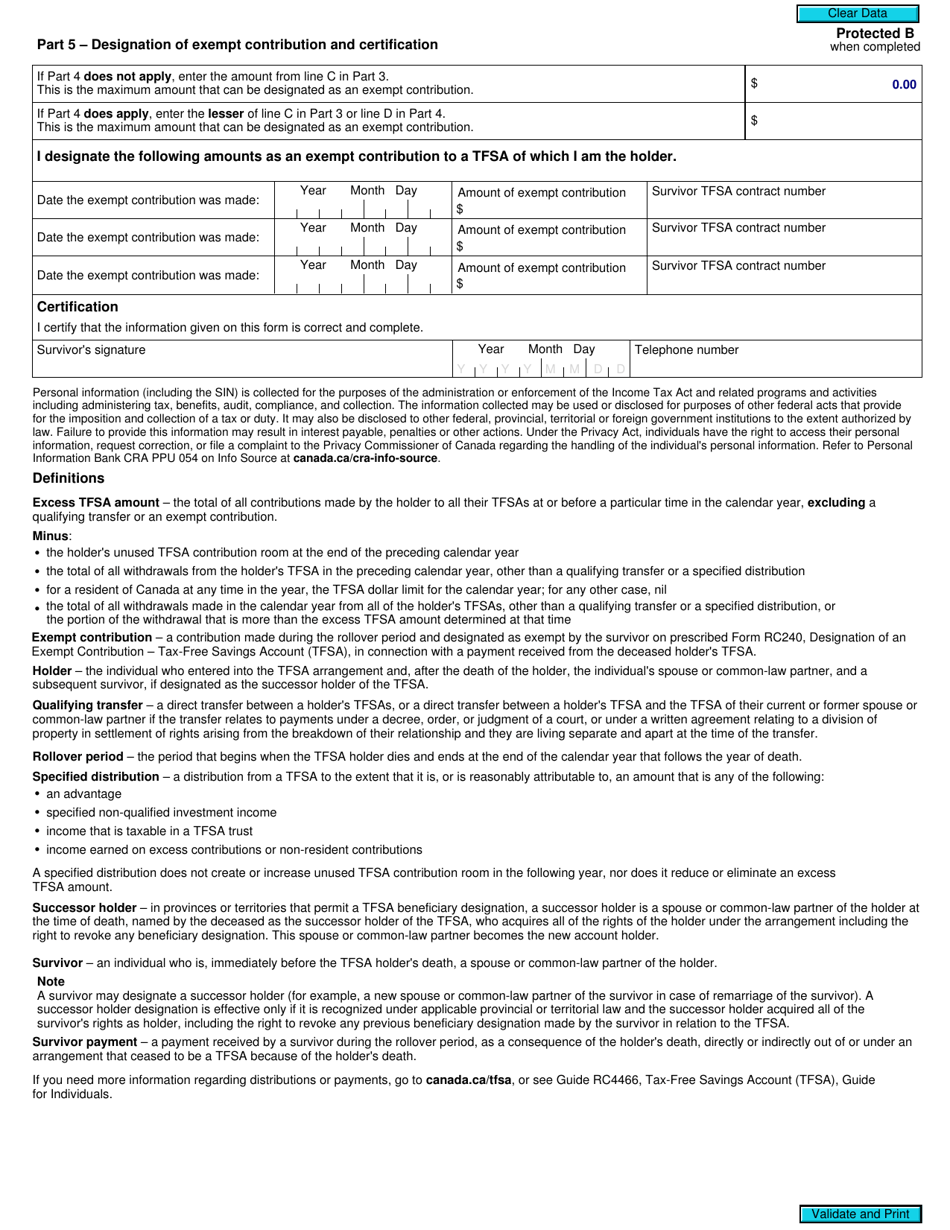

Form RC240 Designation of an Exempt Contribution - Tax-Free Savings Account (Tfsa) - Canada

Form RC240 in Canada is used for designating an exempt contribution to a Tax-Free Savings Account (TFSA). It is used to specify that the contribution being made to a TFSA is exempt from taxation.

The individual who makes the tax-free contribution to their Tax-Free Savings Account (TFSA) in Canada would file Form RC240, Designation of an Exempt Contribution.

FAQ

Q: What is Form RC240?

A: Form RC240 is the Designation of an Exempt Contribution for a Tax-Free Savings Account (TFSA) in Canada.

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a type of investment account in Canada that allows individuals to earn tax-free income and savings.

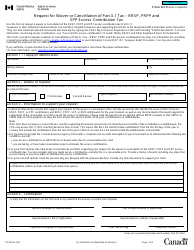

Q: What is the purpose of Form RC240?

A: Form RC240 is used to designate a contribution made to a TFSA as an exempt contribution, meaning it is not subject to tax.

Q: Who needs to fill out Form RC240?

A: Individuals who want to designate a contribution made to their TFSA as an exempt contribution need to fill out Form RC240.

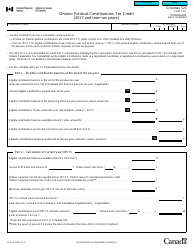

Q: What information is required on Form RC240?

A: Form RC240 requires information such as your name, TFSA account number, financial institution information, and details of the contribution being designated as exempt.

Q: What are the consequences of not filling out Form RC240?

A: If you do not fill out Form RC240 to designate a contribution as exempt, it may be subject to tax.

Q: Are there any fees associated with filing Form RC240?

A: No, there are no fees associated with filing Form RC240.