This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC249

for the current year.

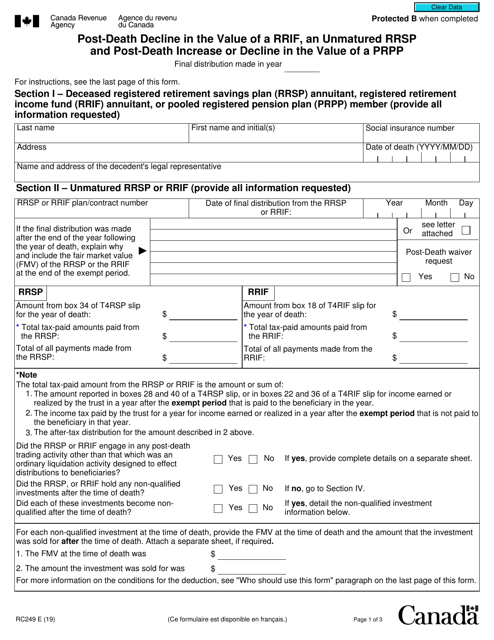

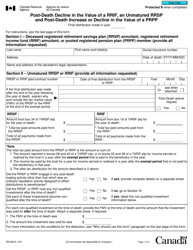

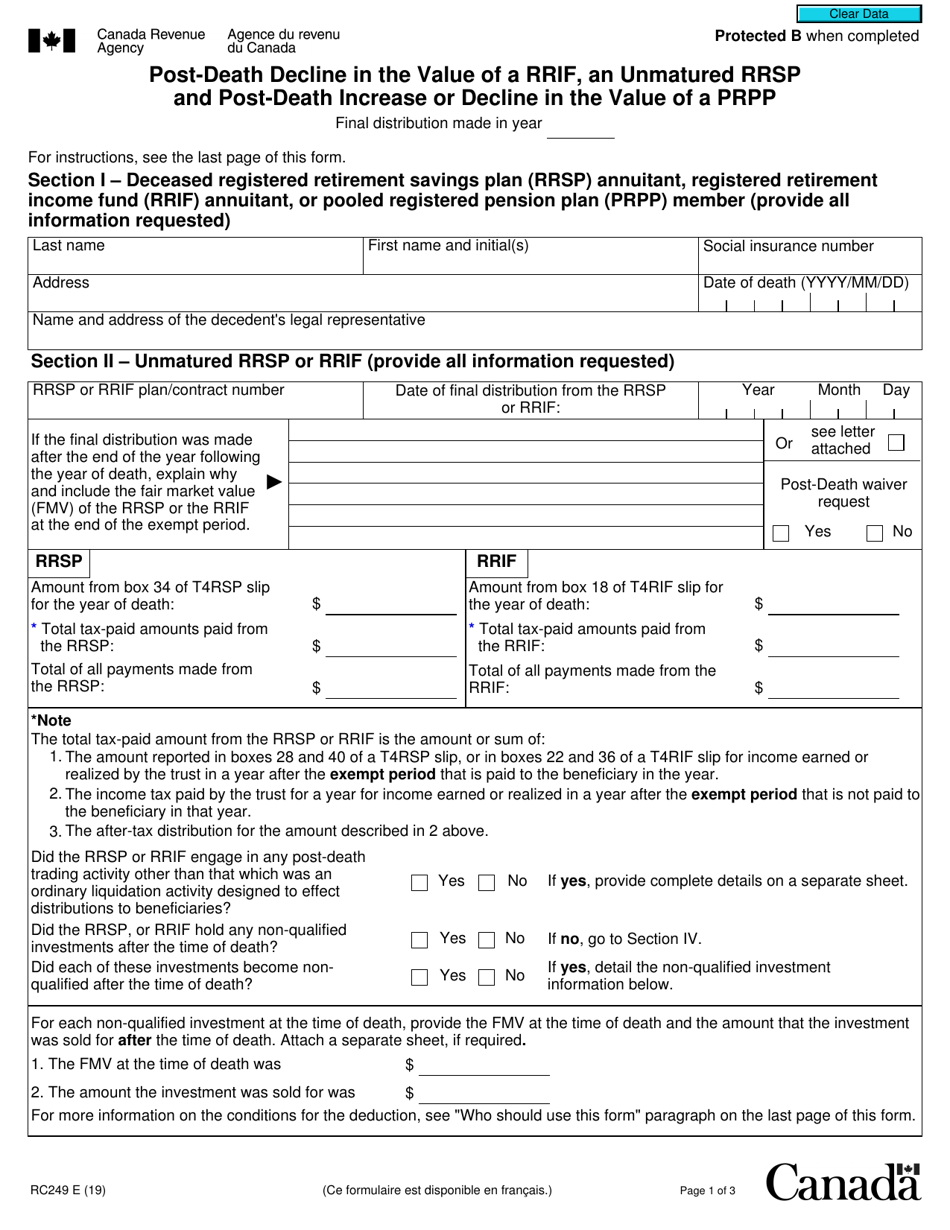

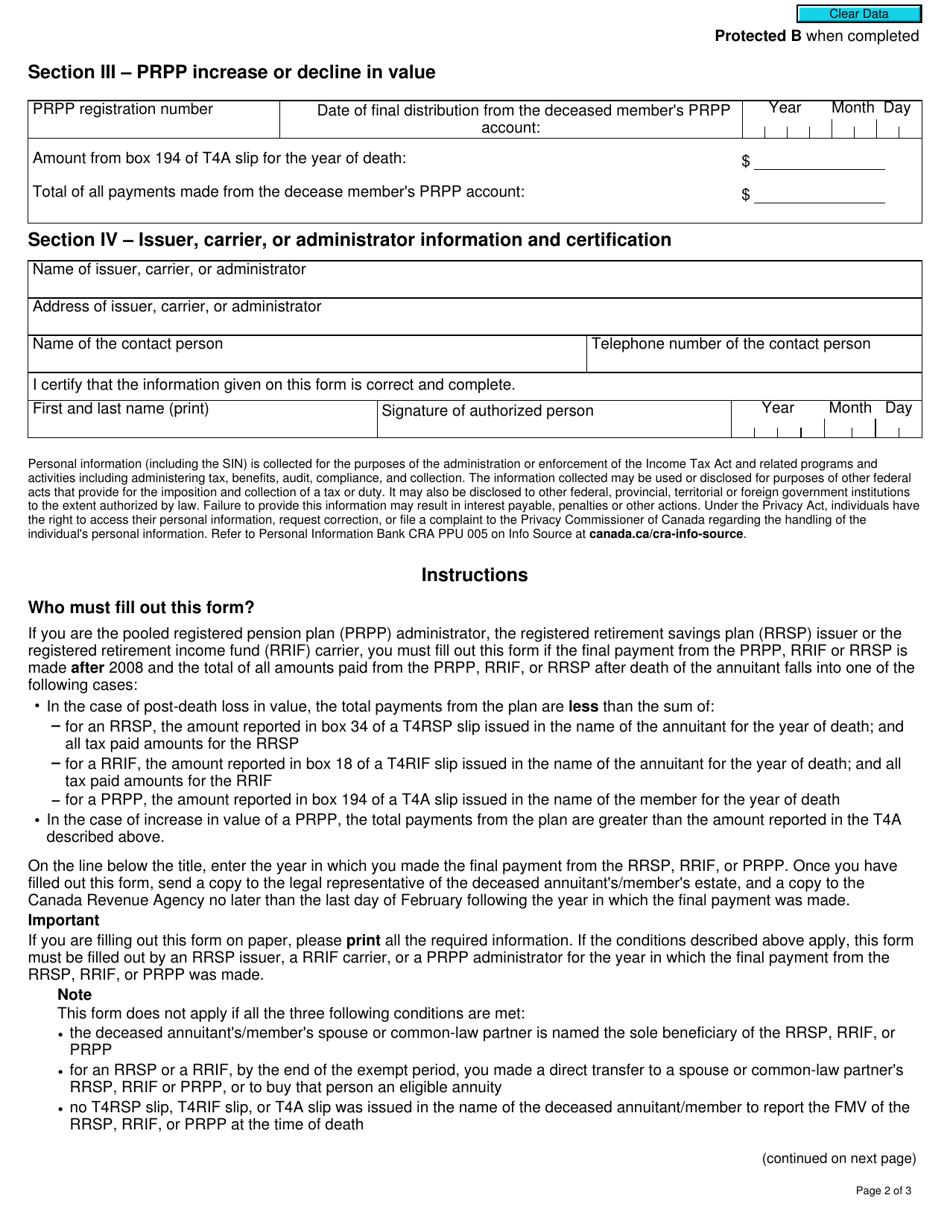

Form RC249 Post-death Decline in the Value of a Rrif, an Unmatured Rrsp and Post-death Increase or Decline in the Value of a Prpp - Canada

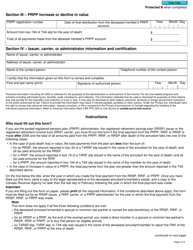

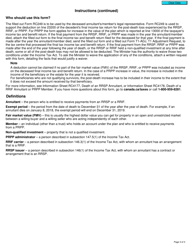

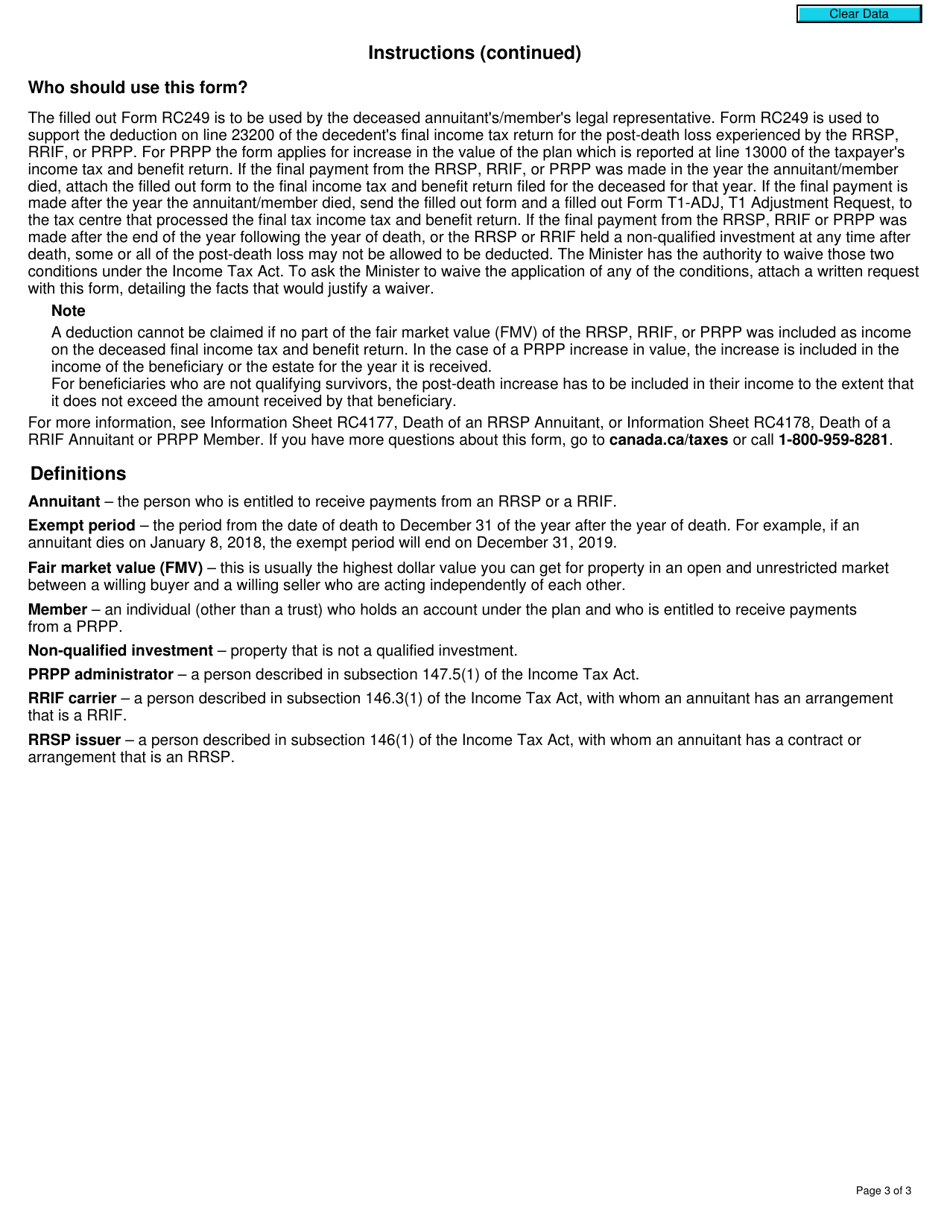

Form RC249 is used in Canada to report any post-death decline in the value of an unmatured RRIF (Registered Retirement Income Fund), RRSP (Registered Retirement Savings Plan), or a PRPP (Pooled Registered Pension Plan).

The beneficiary or legal representative of the deceased individual files the Form RC249 for post-death decline in the value of a RRIF, an unmatured RRSP, and post-death increase or decline in the value of a PRPP in Canada.

FAQ

Q: What is Form RC249?

A: Form RC249 is used in Canada for reporting the post-death decline in the value of a RRIF, an unmatured RRSP, and post-death increase or decline in the value of a PRPP.

Q: What does RRIF stand for?

A: RRIF stands for Registered Retirement Income Fund.

Q: What does RRSP stand for?

A: RRSP stands for Registered Retirement Savings Plan.

Q: What does PRPP stand for?

A: PRPP stands for Pooled Registered Pension Plan.

Q: Who uses Form RC249?

A: Individuals in Canada who need to report post-death changes in the value of their RRIF, RRSP, or PRPP use Form RC249.

Q: When should Form RC249 be filed?

A: Form RC249 should be filed with the Canada Revenue Agency (CRA) within 90 days after the end of the year in which the post-death change in value occurred.

Q: What happens if Form RC249 is not filed on time?

A: Penalties may apply if Form RC249 is not filed on time.

Q: Is there a fee to file Form RC249?

A: No, there is no fee to file Form RC249.

Q: What information is required to complete Form RC249?

A: The form requires information about the deceased individual, the investment plan (RRIF, RRSP, or PRPP), and the post-death change in value.

Q: Can Form RC249 be filed electronically?

A: Yes, Form RC249 can be filed electronically using the CRA's My Account service or through authorized tax software.

Q: Can I get help with completing Form RC249?

A: Yes, the Canada Revenue Agency (CRA) provides resources and assistance for completing Form RC249. You can also seek help from a tax professional or advisor.