This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC243 Schedule A

for the current year.

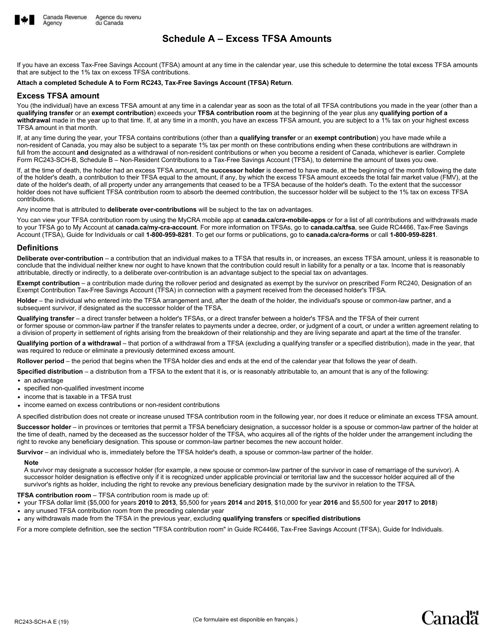

Form RC243 Schedule A Excess Tfsa Amounts - Canada

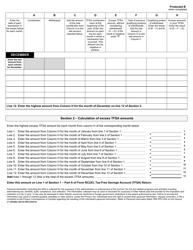

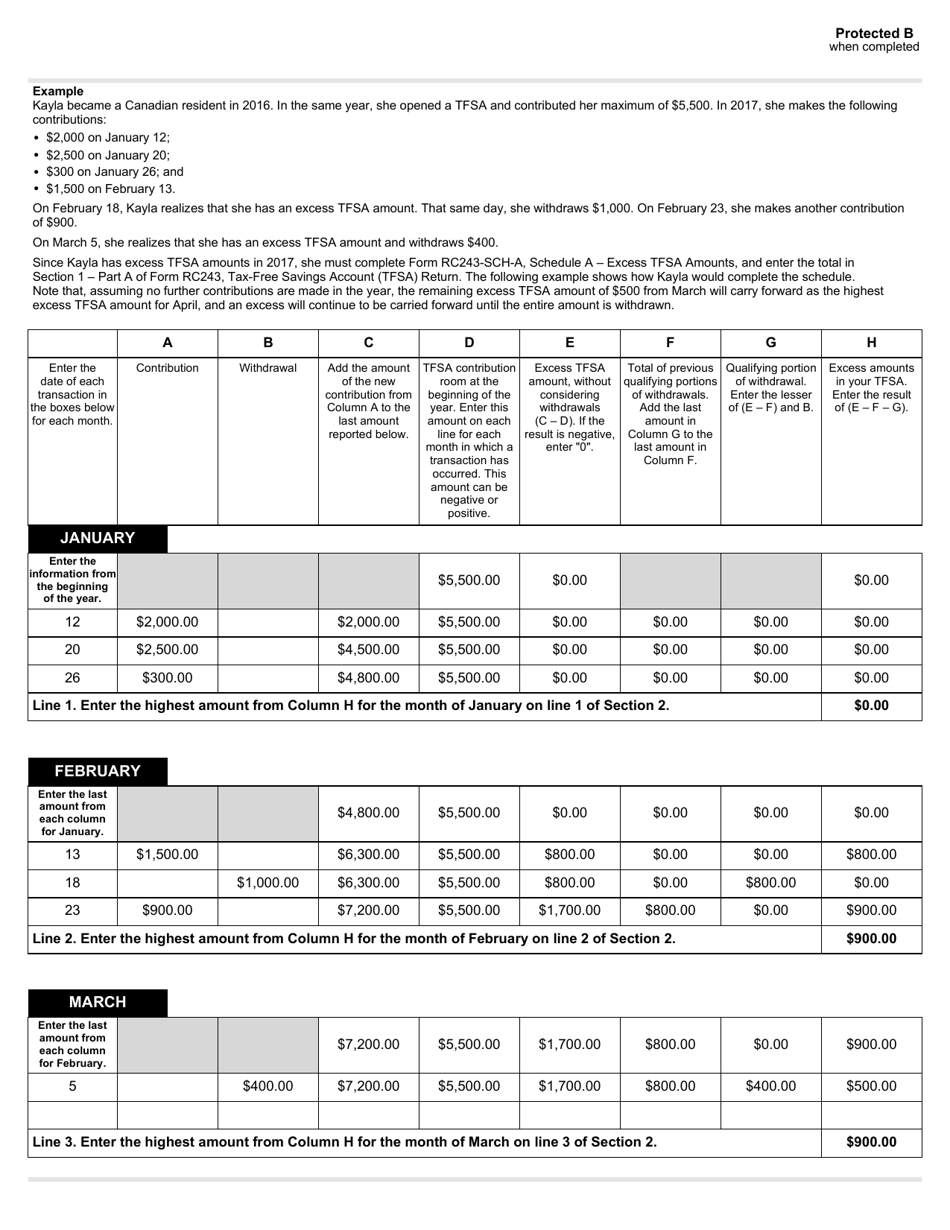

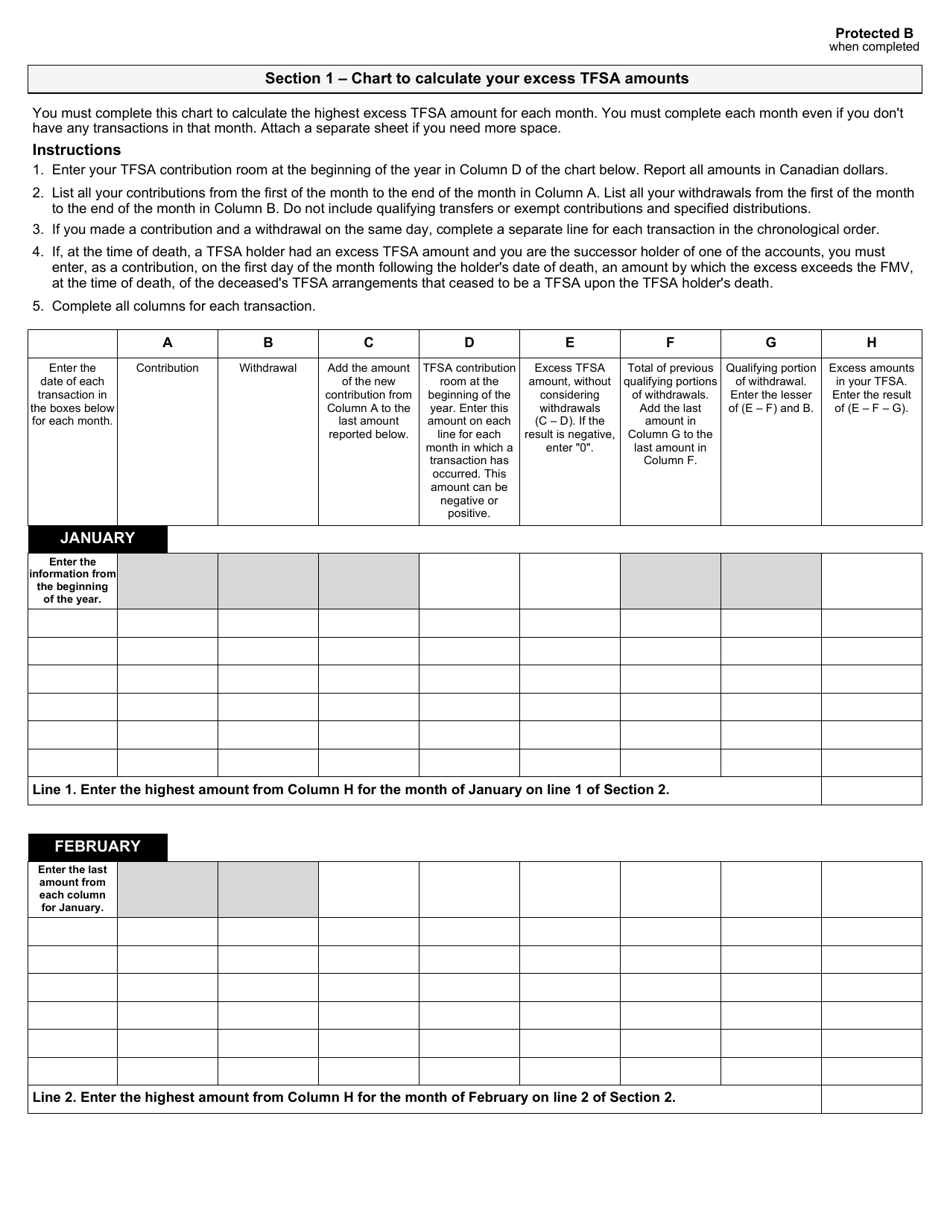

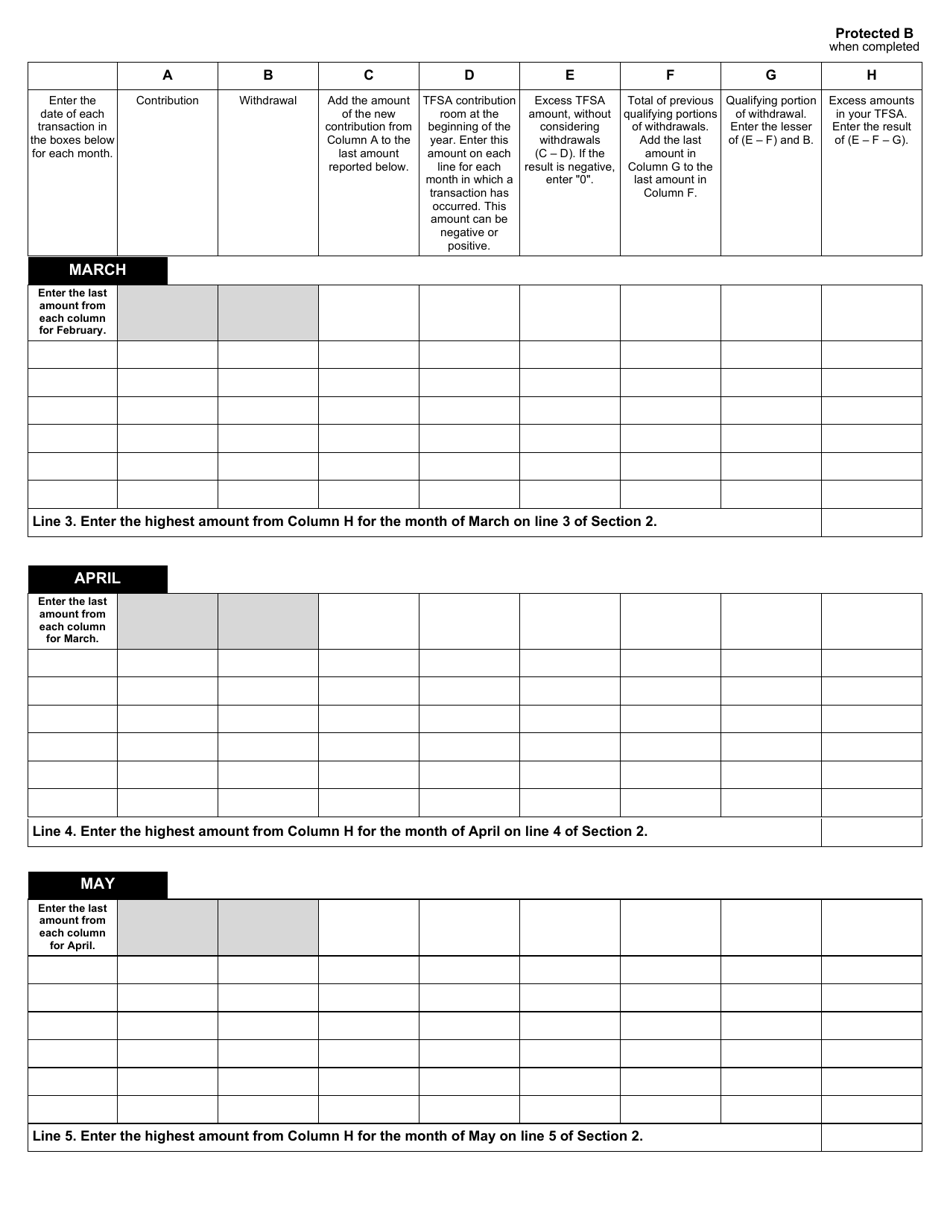

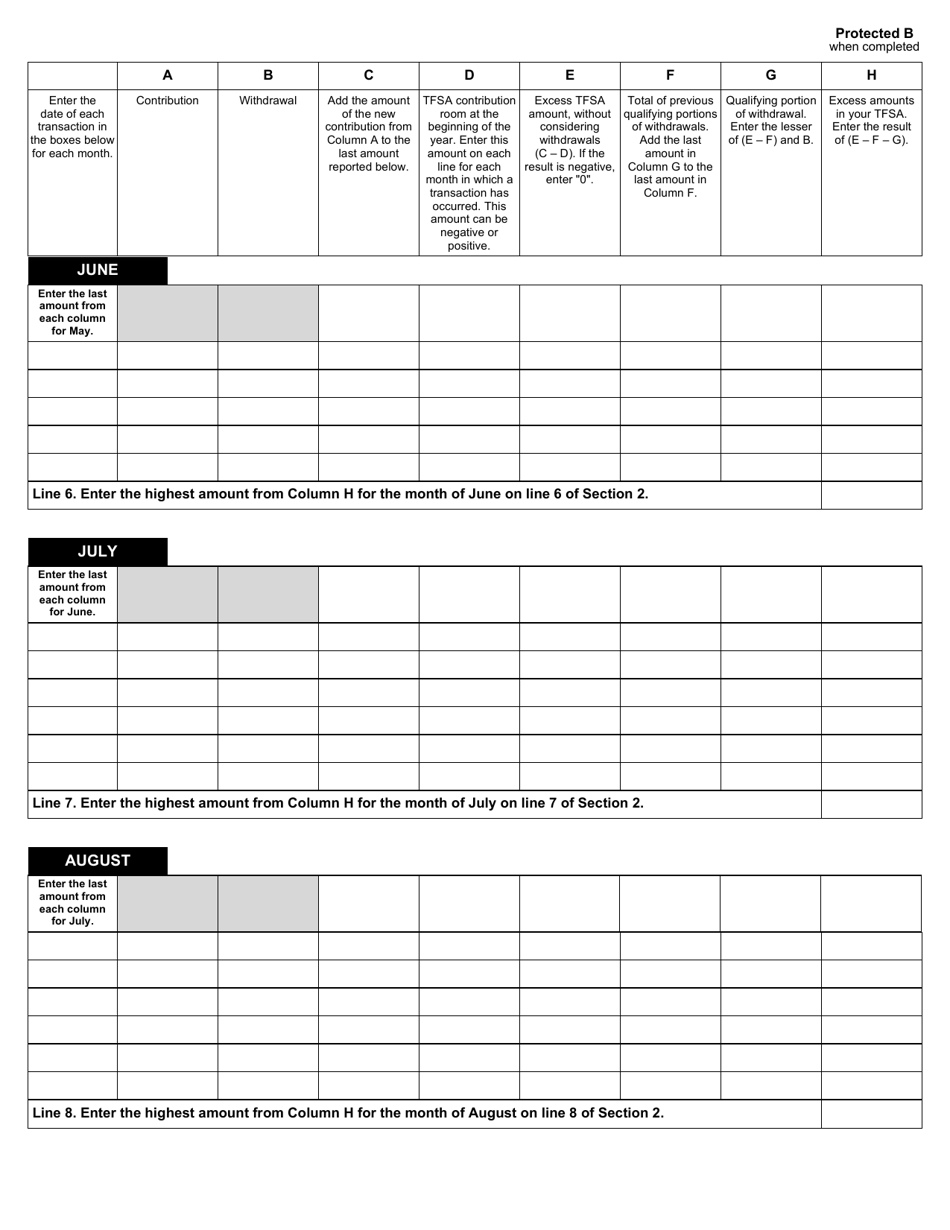

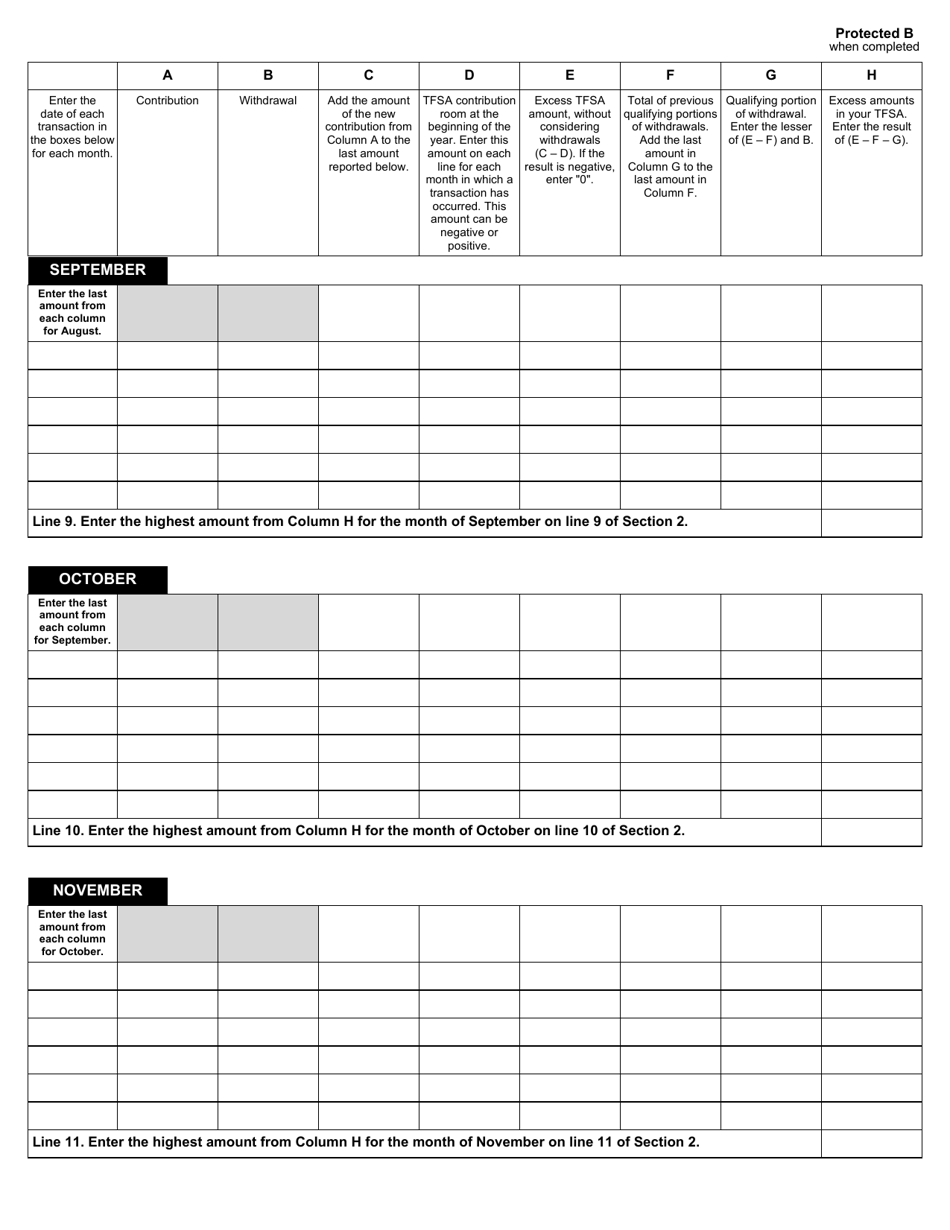

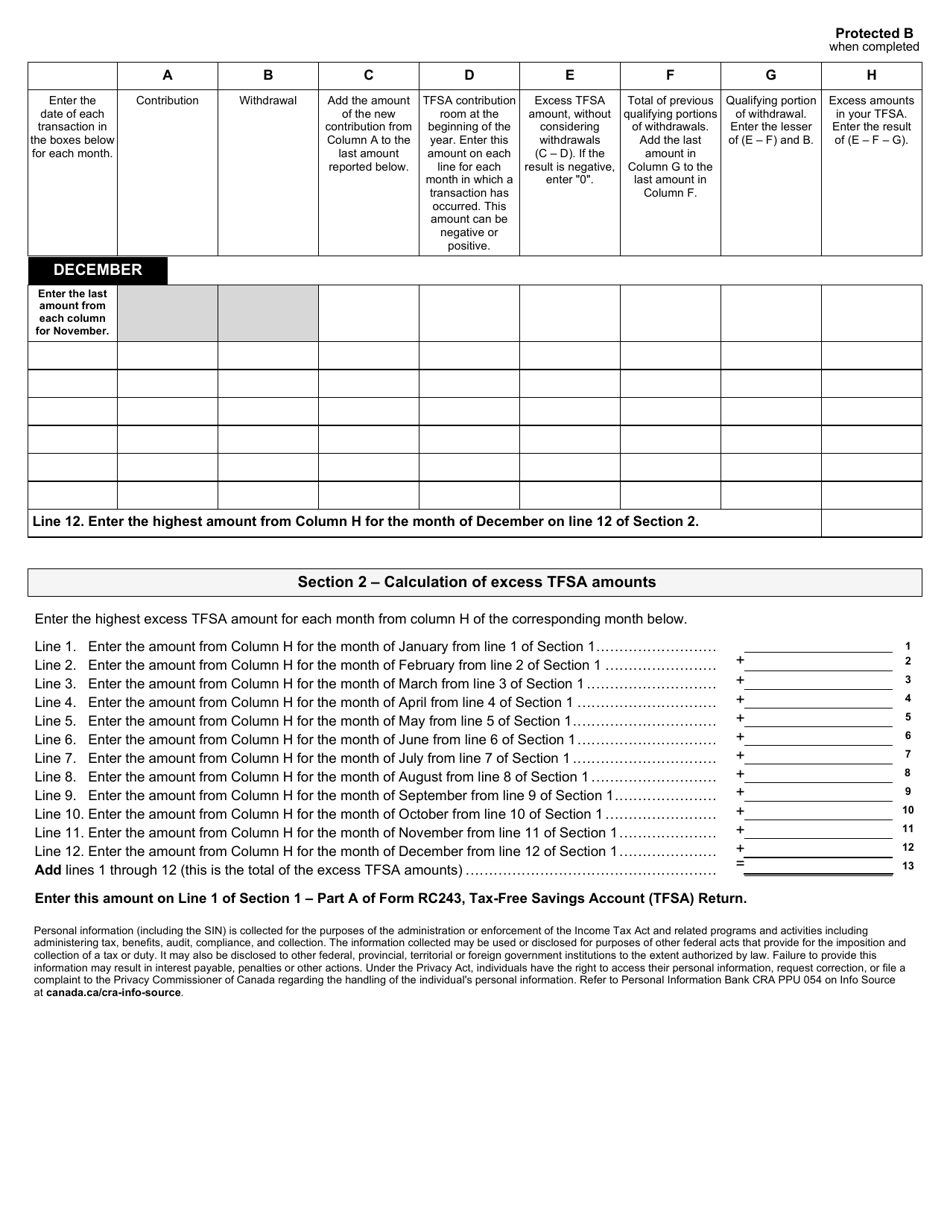

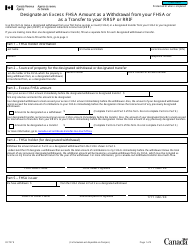

Form RC243 Schedule A Excess TFSA Amounts in Canada is used to report any excess contributions made to a Tax-Free Savings Account (TFSA). This form is required to calculate and report the amount of the excess contributions to the Canada Revenue Agency (CRA). By filing this form, individuals can determine any tax implications and potential penalties associated with the excess TFSA contributions.

The Form RC243 Schedule A Excess TFSA Amounts in Canada is filed by individuals who have contributed more than their allowable limit to their Tax-Free Savings Account (TFSA). This form is used to calculate the excess TFSA amount and to determine any applicable taxes or penalties that may be owed. The form is typically filed by the individual taxpayer and submitted to the Canada Revenue Agency (CRA).

FAQ

Q: What is Form RC243 Schedule A?

A: Form RC243 Schedule A is a form specifically used by Canadian taxpayers to report excess Tax-Free Savings Account (TFSA) amounts.

Q: What are excess TFSA amounts?

A: Excess TFSA amounts refer to any contributions made to a Tax-Free Savings Account that exceed the annual contribution limit set by the Canadian government.

Q: Why do I need to report excess TFSA amounts?

A: Reporting excess TFSA amounts is required by the Canada Revenue Agency (CRA) to ensure compliance with the contribution limits and to calculate any applicable taxes or penalties.

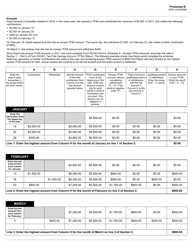

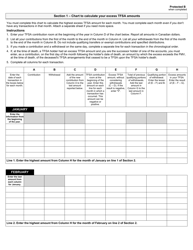

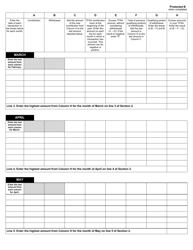

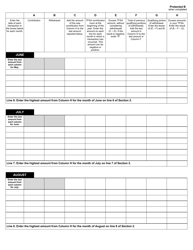

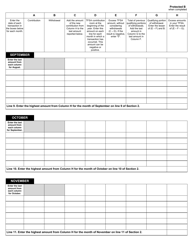

Q: How do I complete Form RC243 Schedule A?

A: To complete Form RC243 Schedule A, you will need to provide your personal information, including your name, social insurance number, and contact information. You will also need to indicate the tax year for which you are reporting, and provide details of the excess TFSA amounts, including the amount contributed and any withdrawals made.

Q: What should I do if I have excess TFSA amounts?

A: If you have excess TFSA amounts, you should report them on Form RC243 Schedule A and file it along with your personal income tax return. The CRA will assess any taxes or penalties owed based on the excess contributions.

Q: What happens if I don't report excess TFSA amounts?

A: Failing to report excess TFSA amounts can result in penalties and interest charged by the CRA. It is important to accurately report and pay any taxes or penalties owed to avoid potential consequences.

Q: Can I avoid paying taxes on excess TFSA amounts?

A: No, taxes are generally owed on excess TFSA amounts. However, it is recommended to consult with a tax professional or the CRA for specific advice based on your individual circumstances.