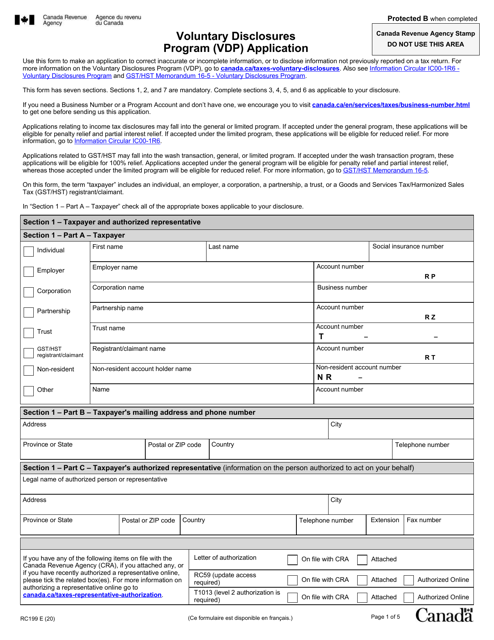

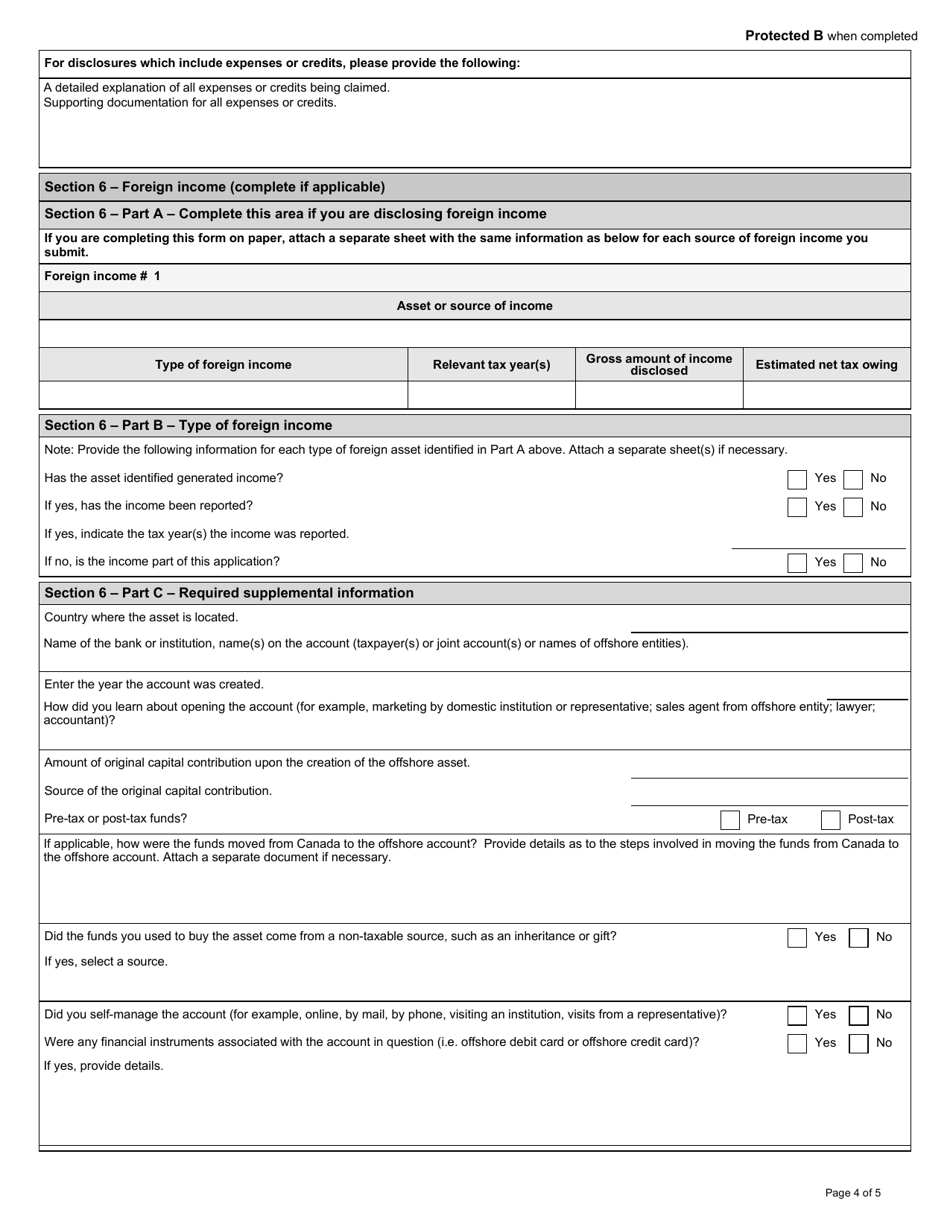

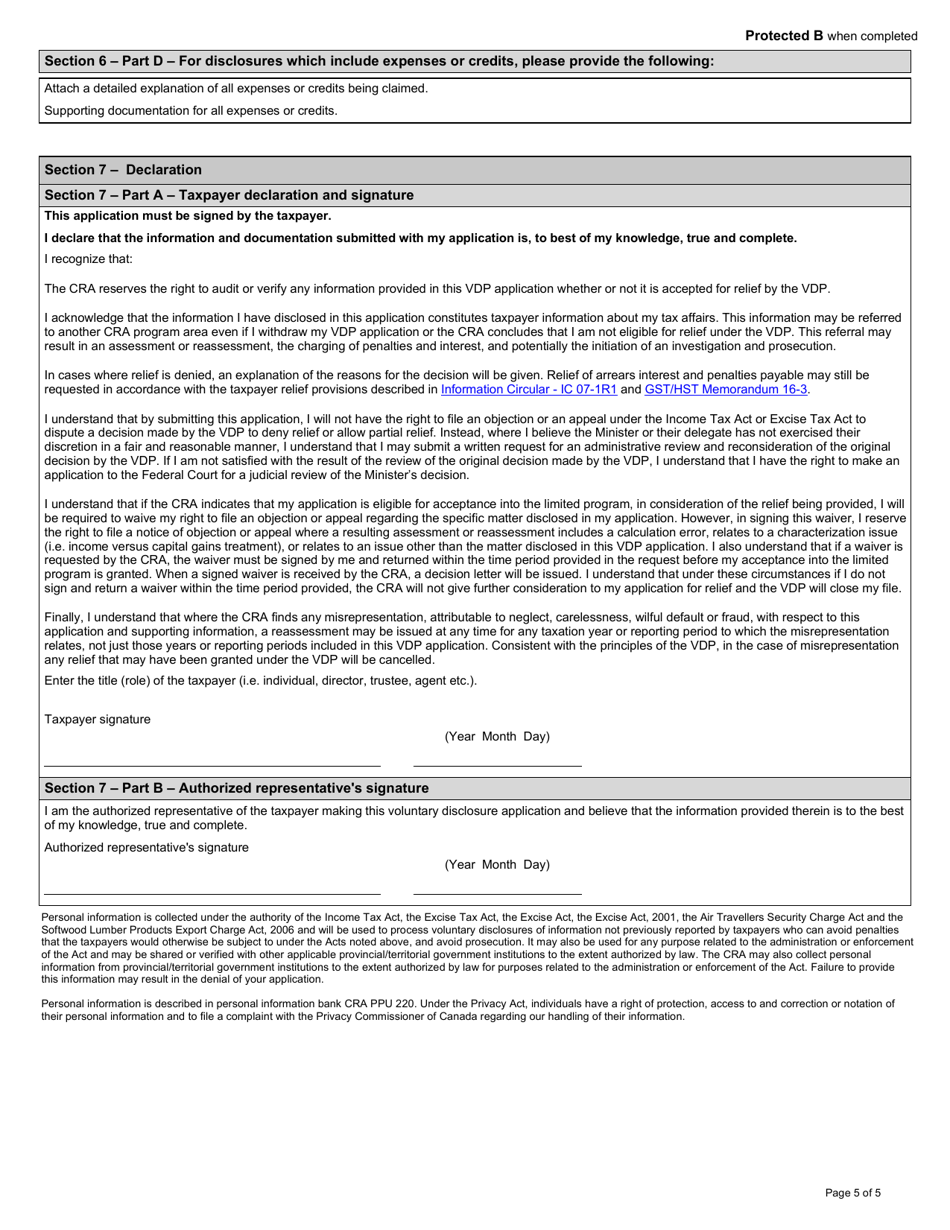

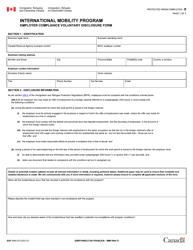

Form RC199 Voluntary Disclosures Program (Vdp) Application - Canada

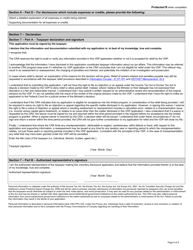

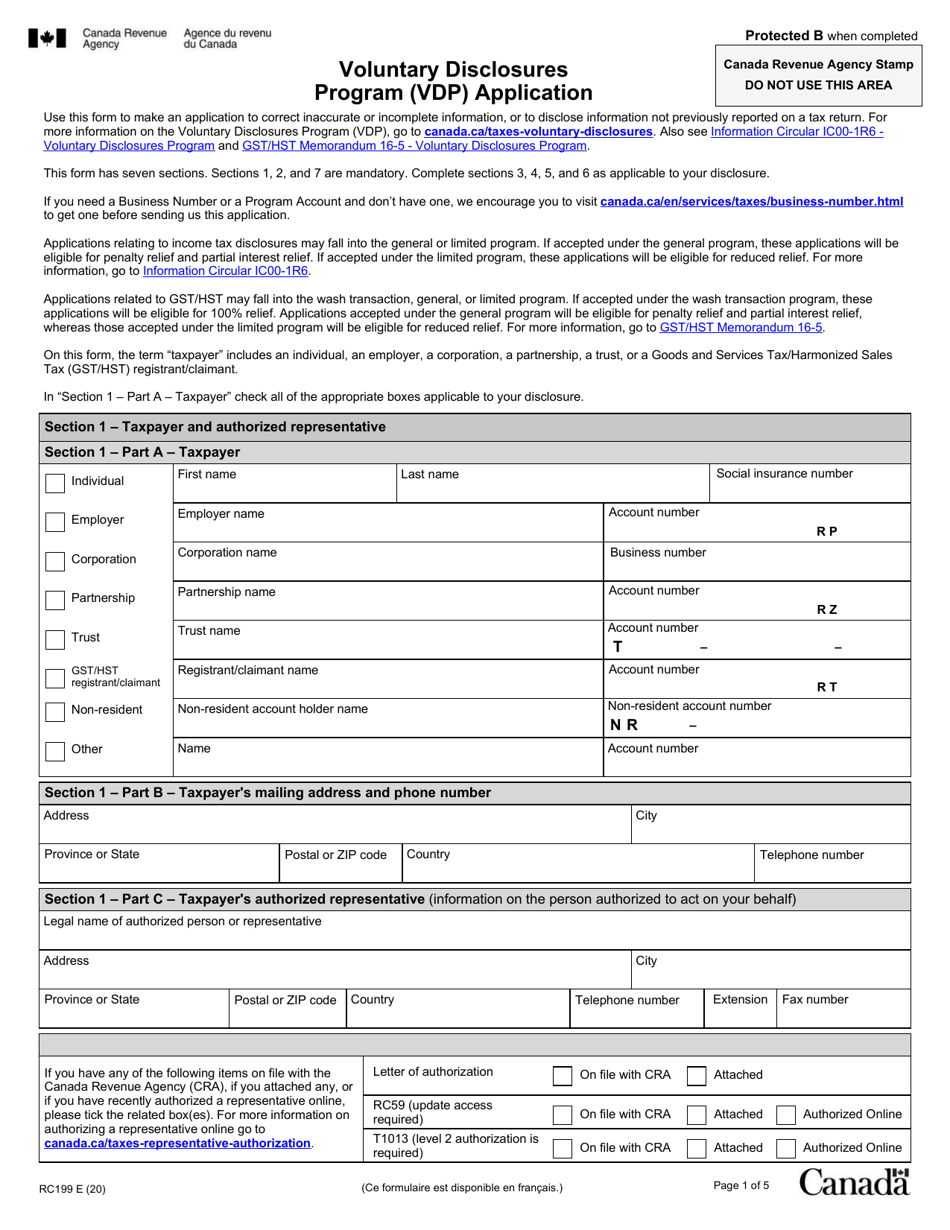

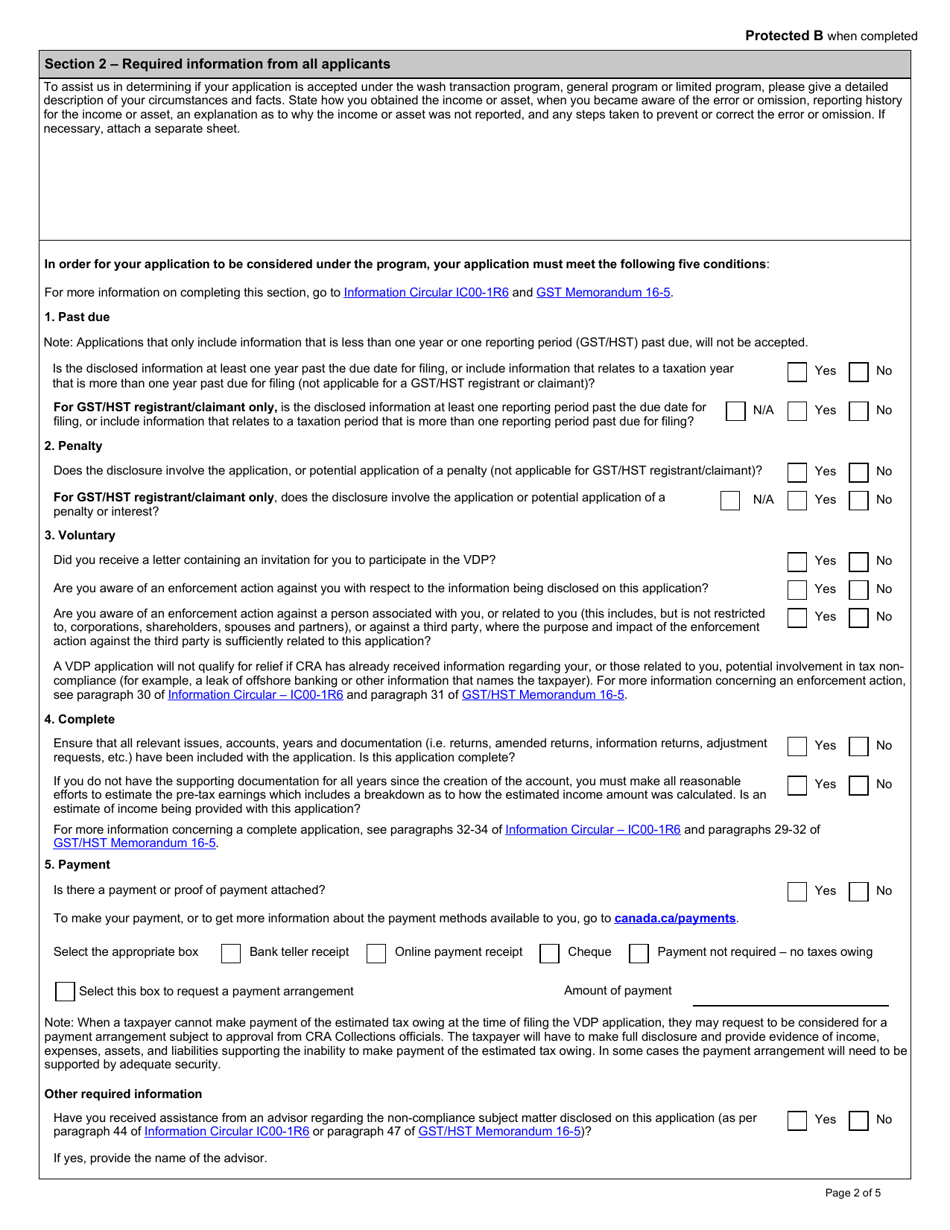

Form RC199 Voluntary Disclosures Program (Vdp) Application is used in Canada to apply for the Voluntary Disclosures Program (VDP). This program allows taxpayers to come forward and correct inaccurate or incomplete information previously reported to the Canada Revenue Agency (CRA), or to disclose information that was not reported at all. It provides taxpayers with the opportunity to voluntarily correct their tax affairs and potentially avoid penalties or prosecution.

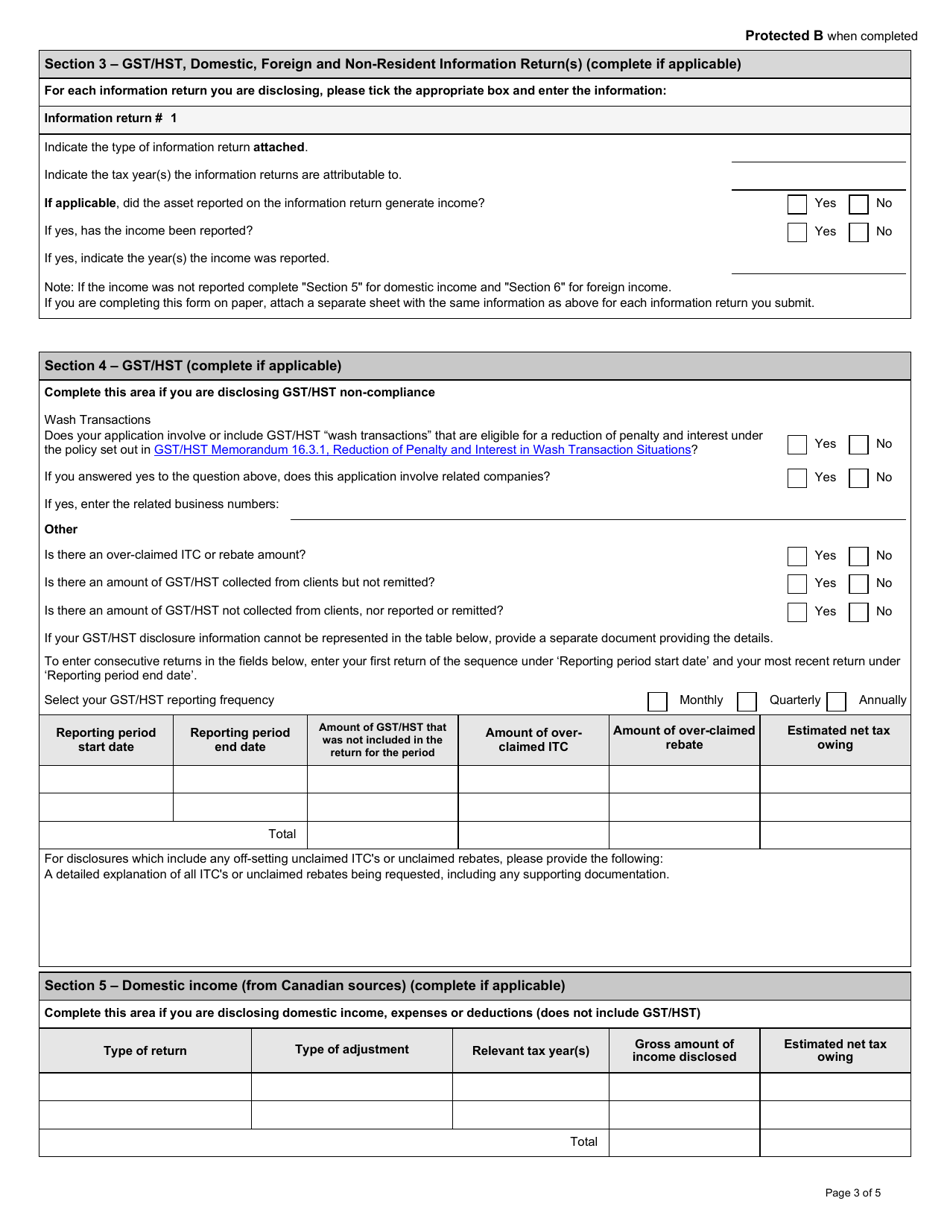

The taxpayer or their authorized representative files the Form RC199 Voluntary Disclosures Program (VDP) application in Canada.

FAQ

Q: What is Form RC199?

A: Form RC199 is the Voluntary Disclosures Program (VDP) application form in Canada.

Q: What is the Voluntary Disclosures Program (VDP) in Canada?

A: The Voluntary Disclosures Program (VDP) in Canada allows taxpayers to come forward and correct any inaccurate or incomplete information related to their taxes voluntarily.

Q: Who can use Form RC199?

A: Any taxpayer who wants to disclose inaccurate or incomplete information regarding their taxes can use Form RC199.

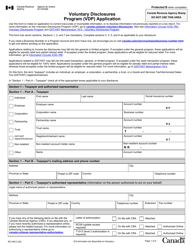

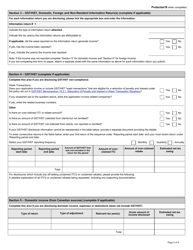

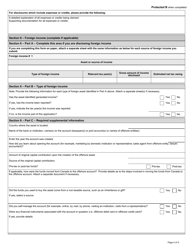

Q: What information is required in Form RC199?

A: Form RC199 requires information such as the taxpayer's personal information, taxation years in question, details of the inaccurate or incomplete information, and any supporting documentation.

Q: Is there a deadline for submitting Form RC199?

A: There is no specific deadline for submitting Form RC199, but it is recommended to submit it as soon as possible to avoid penalties and interest charges.

Q: What are the benefits of using the Voluntary Disclosures Program (VDP) in Canada?

A: The benefits of using the VDP include avoiding penalties, potential reductions in interest charges, and immunity from prosecution for the disclosed inaccuracies or omissions.

Q: Can the Voluntary Disclosures Program (VDP) be used for all types of tax matters?

A: Yes, the VDP can be used for all types of tax matters, including income tax, GST/HST, payroll deductions, and more.

Q: Can I make a voluntary disclosure if I am already under investigation?

A: No, if you are already under investigation by the CRA, you are not eligible for the Voluntary Disclosures Program.

Q: What happens after I submit Form RC199?

A: Once you submit Form RC199, the CRA will review your voluntary disclosure and may contact you for additional information. If your disclosure is accepted, you will be required to pay any taxes owing and any interest charges. You will also receive the benefits of penalty relief and immunity from prosecution for the disclosed inaccuracies or omissions.