This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC616

for the current year.

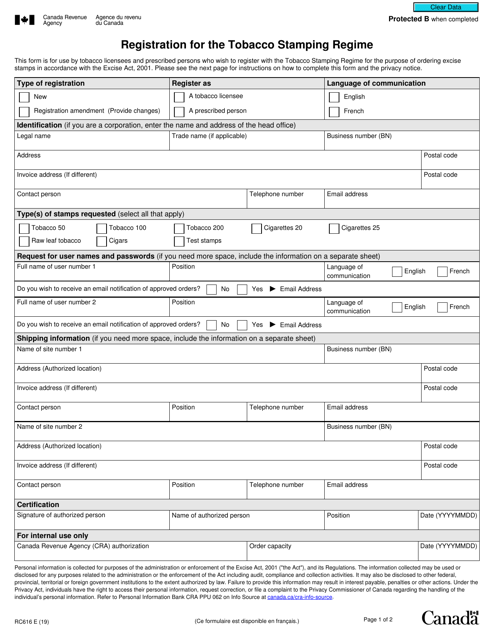

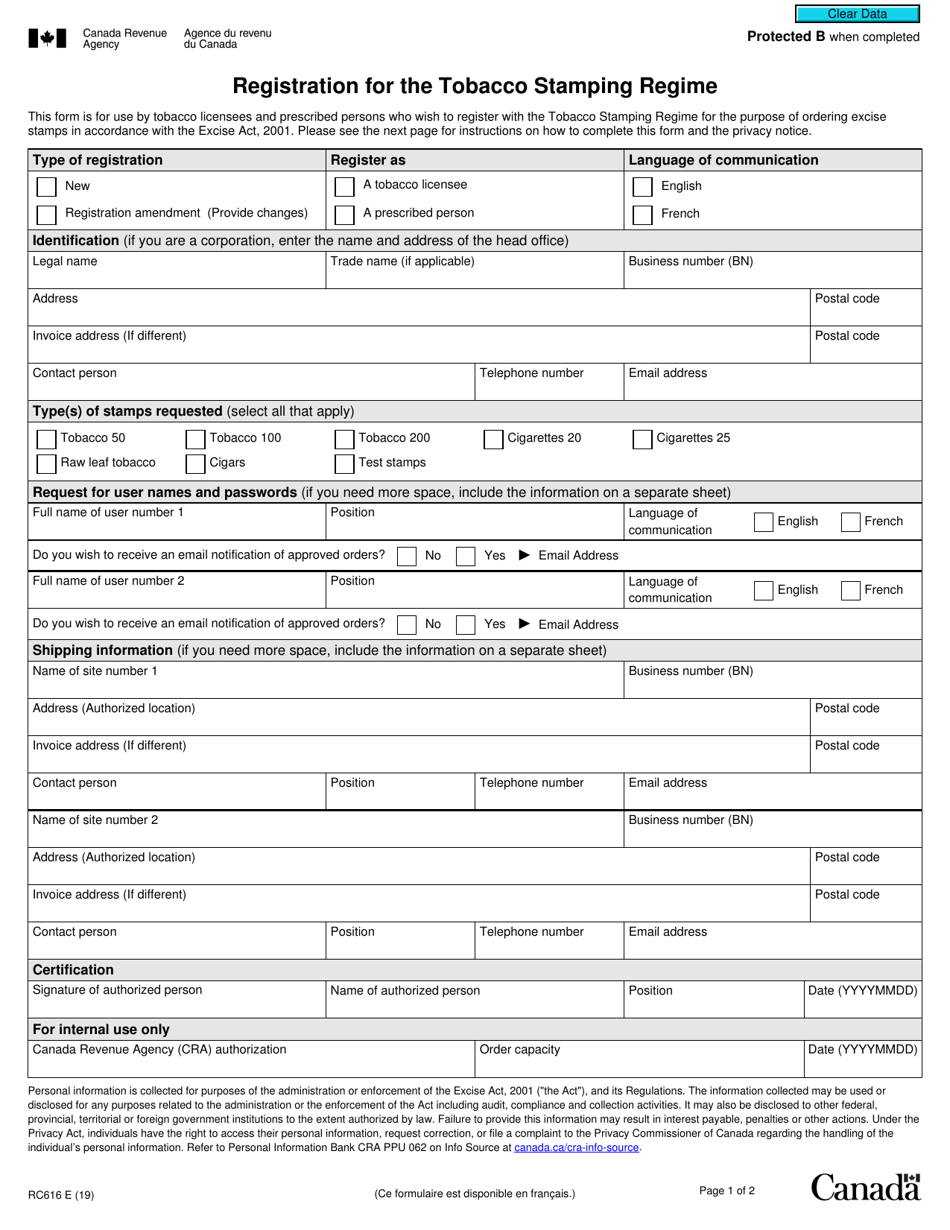

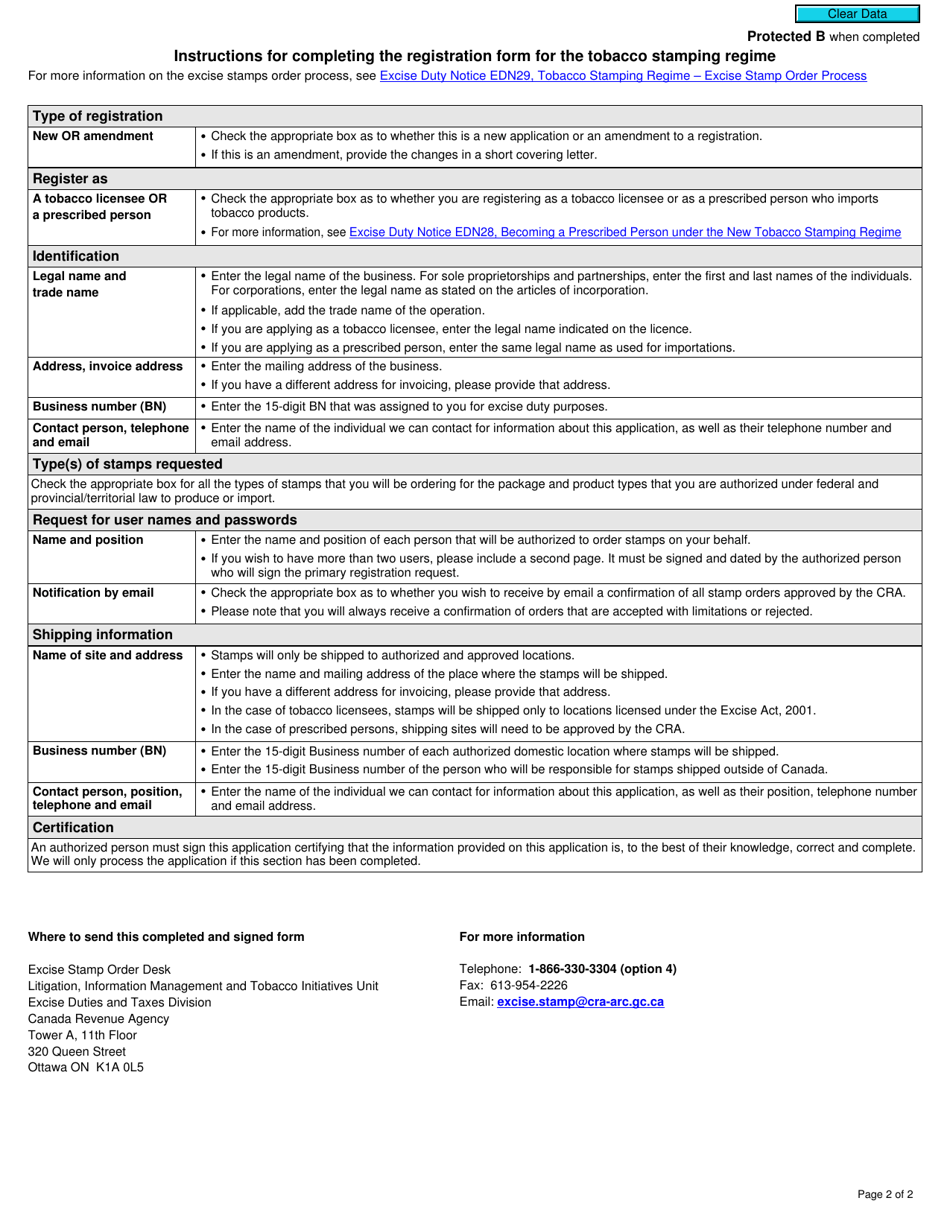

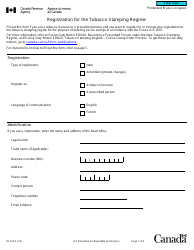

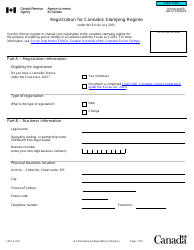

Form RC616 Registration for the Tobacco Stamping Regime - Canada

The Form RC616 is used for registration under the Tobacco Stamping Regime in Canada. This registration is required for anyone who manufactures or imports tobacco products for sale in Canada.

The Tobacco Stamping Regime in Canada requires tobacco manufacturers and importers to file the Form RC616 for registration.

FAQ

Q: What is form RC616?

A: Form RC616 is the Registration for the Tobacco Stamping Regime in Canada.

Q: Who needs to fill out form RC616?

A: Any person or business that intends to sell or distribute stamped tobacco products in Canada needs to fill out form RC616.

Q: What is the purpose of the Tobacco Stamping Regime?

A: The Tobacco Stamping Regime ensures that all tobacco products sold in Canada have the appropriate federal excise stamps.

Q: Are there any fees associated with form RC616?

A: No, there are no fees associated with form RC616.

Q: Is form RC616 mandatory?

A: Yes, form RC616 is mandatory for anyone selling or distributing stamped tobacco products in Canada.

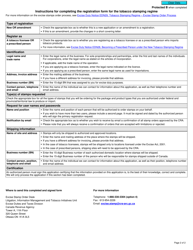

Q: What information is required on form RC616?

A: Form RC616 requires information such as the business name, address, contact information, and description of the tobacco products.

Q: Are there any penalties for not filling out form RC616?

A: Yes, there can be penalties for not filling out form RC616, including fines and potential legal consequences.

Q: What should I do after filling out form RC616?

A: After filling out form RC616, you should submit it to the Canada Revenue Agency along with any supporting documents or information.