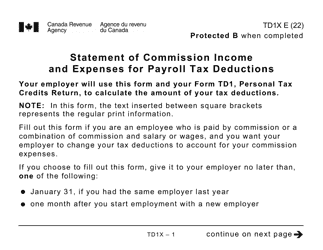

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1X

for the current year.

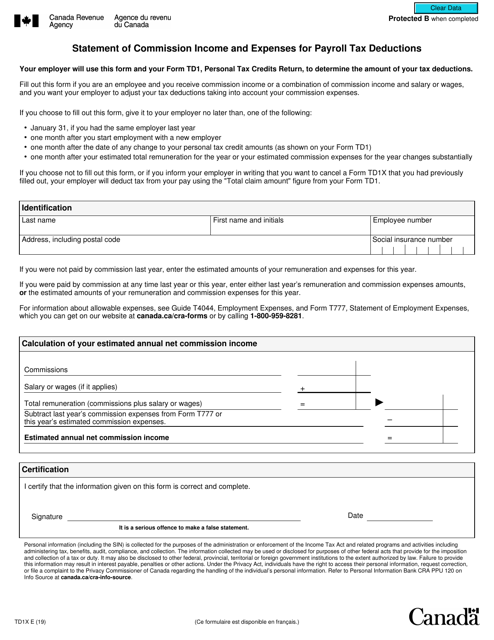

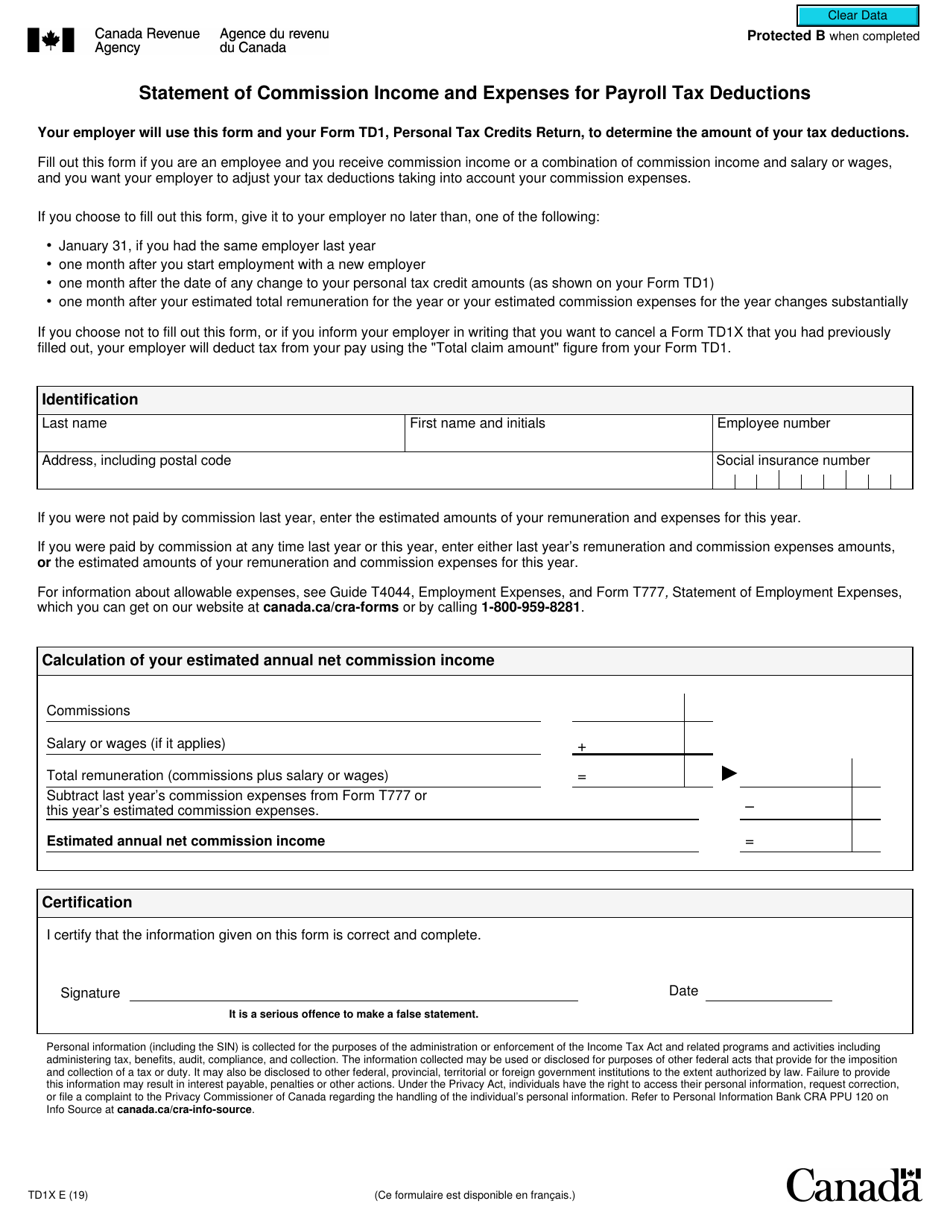

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions - Canada

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions in Canada is used by individuals who earn commission income to report their commission income and related expenses to their employers. This form helps determine the appropriate amount of income tax to be deducted from their pay.

The Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions in Canada is typically filed by individuals who earn commission income and want to ensure that the correct amount of tax is deducted from their payroll.

FAQ

Q: What is Form TD1X?

A: Form TD1X is a statement used in Canada to declare commission income and expenses for payroll tax deductions.

Q: Who needs to fill out Form TD1X?

A: Individuals who receive commission income and want to claim related expenses for tax deductions need to fill out Form TD1X.

Q: What is the purpose of Form TD1X?

A: The purpose of Form TD1X is to calculate the proper amount of payroll taxes to be deducted based on commission income and related expenses.

Q: What information do I need to fill out Form TD1X?

A: You will need to provide details about your commission income, expenses related to earning that income, and any other relevant information requested on the form.

Q: Why is it important to accurately fill out Form TD1X?

A: Accurately filling out Form TD1X ensures that the correct amount of payroll taxes is deducted and helps avoid any issues or penalties with the CRA.

Q: When should I submit Form TD1X?

A: You should submit Form TD1X to your employer as soon as possible, preferably before you start receiving commission income.

Q: Can I make changes to Form TD1X throughout the year?

A: Yes, if there are any changes to your commission income or related expenses during the year, you should update and submit a new Form TD1X to your employer.

Q: Do I need to keep a copy of Form TD1X for my records?

A: Yes, it is recommended to keep a copy of Form TD1X for your records, as it serves as documentation of your declared commission income and expenses.