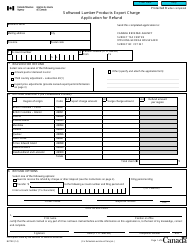

This version of the form is not currently in use and is provided for reference only. Download this version of

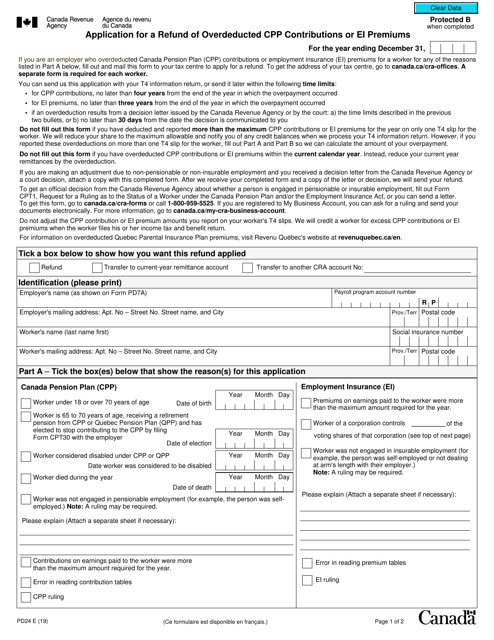

Form PD24

for the current year.

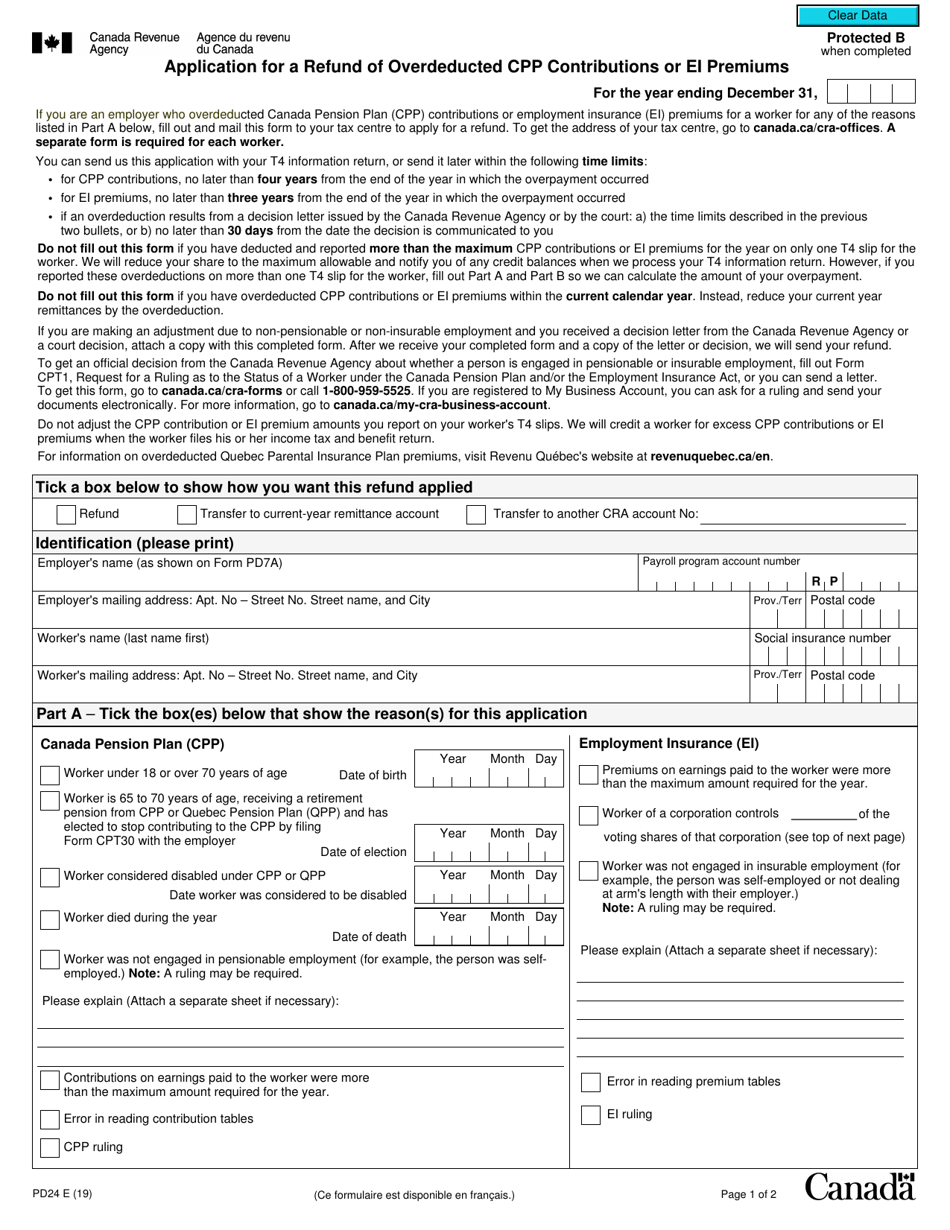

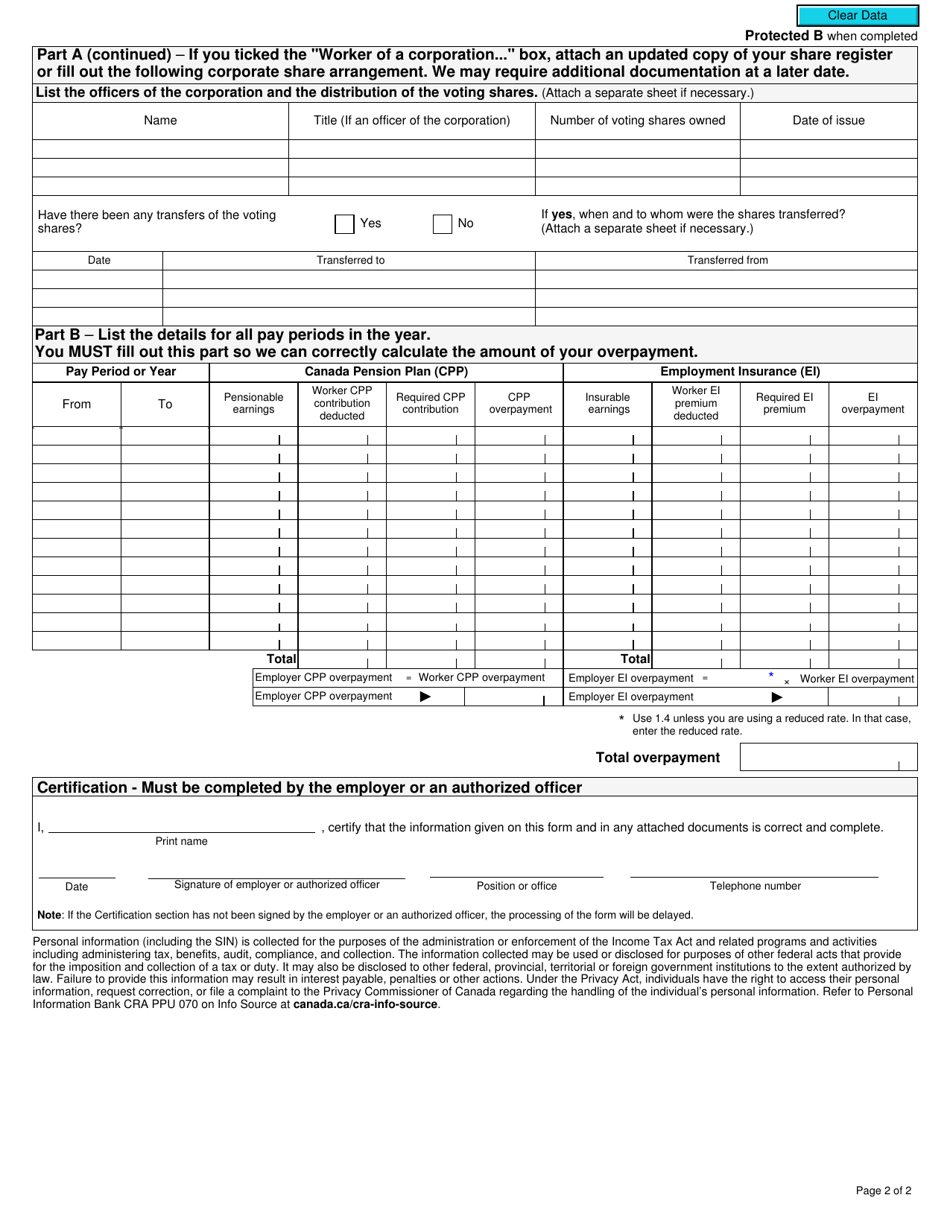

Form PD24 Application for a Refund of Overdeducted Cpp Contributions or Ei Premiums - Canada

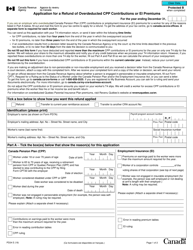

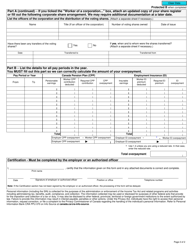

Form PD24 is an application for a refund of overdeducted Canada Pension Plan (CPP) contributions or Employment Insurance (EI) premiums. It is used by individuals who believe that an excess amount was deducted from their wages for CPP or EI and they want to request a refund.

The employer typically files the Form PD24 in Canada.

FAQ

Q: What is form PD24?

A: Form PD24 is the application used to request a refund of overdeducted CPP contributions or EI premiums in Canada.

Q: What can I use form PD24 for?

A: You can use form PD24 to apply for a refund of overdeducted CPP contributions or EI premiums that were deducted from your pay incorrectly.

Q: How do I fill out form PD24?

A: You will need to provide your personal information, details about the overdeducted amount, and any supporting documents when filling out form PD24.

Q: How long does it take to process form PD24?

A: Processing times for form PD24 may vary, but it typically takes several weeks to receive a refund after submitting your application.

Q: What should I do if I have other questions about form PD24?

A: If you have any further questions or need assistance with form PD24, you can contact the Canada Revenue Agency directly.