This version of the form is not currently in use and is provided for reference only. Download this version of

Form NR602

for the current year.

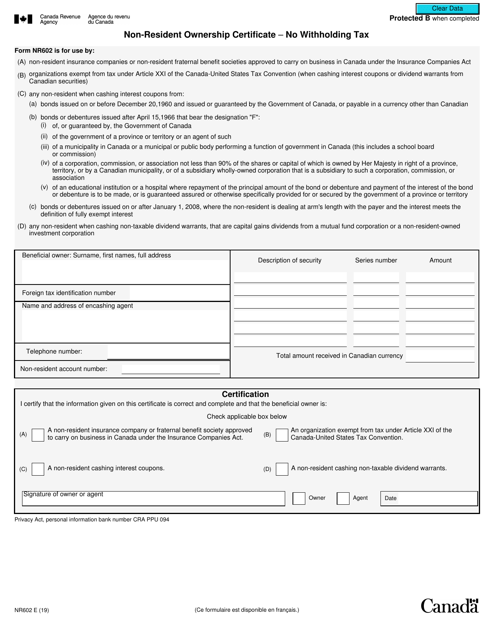

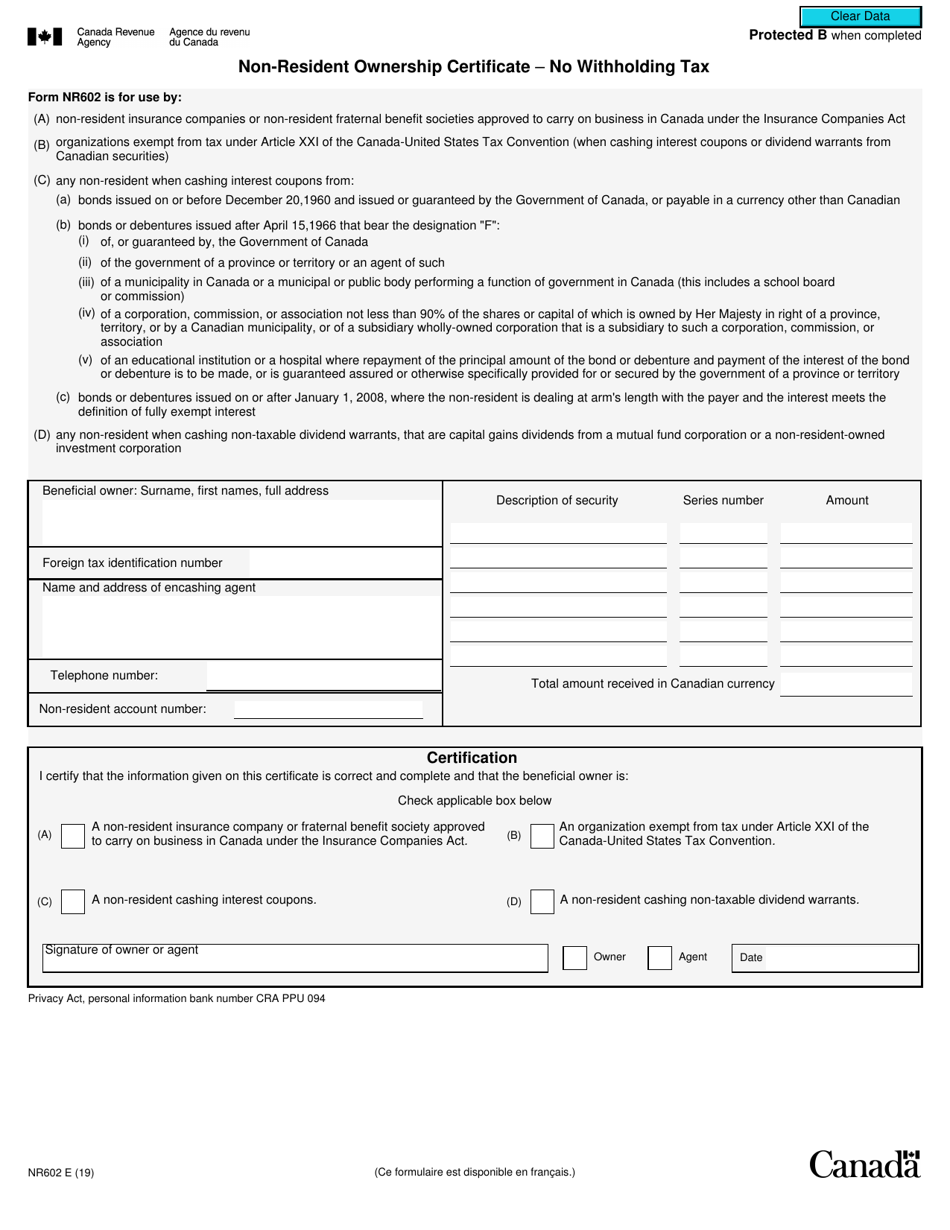

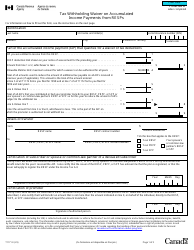

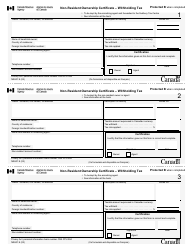

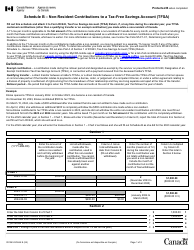

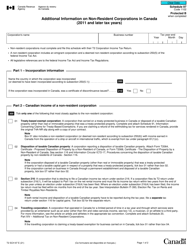

Form NR602 Non-resident Ownership Certificate - No Withholding Tax - Canada

Form NR602 Non-resident Ownership Certificate - No Withholding Tax is used by non-residents of Canada to certify that they are not subject to withholding tax on various types of income, such as rental income from Canadian property or royalties.

The Form NR602 Non-resident Ownership Certificate - No Withholding Tax in Canada is filed by the non-resident owner of the property.

FAQ

Q: What is Form NR602?

A: Form NR602 is the Non-resident Ownership Certificate.

Q: Who needs to use Form NR602?

A: Non-resident individuals or corporations who own property in Canada and are eligible for an exemption from withholding tax.

Q: What is the purpose of Form NR602?

A: The purpose of Form NR602 is to apply for a waiver of withholding tax on rental income or property sale proceeds generated in Canada.

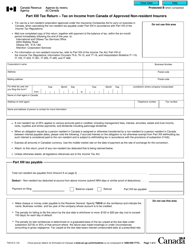

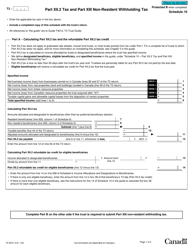

Q: What is withholding tax?

A: Withholding tax is a tax deducted by the payer of income at the source. In this case, it refers to the tax withheld on rental income or property sale proceeds by the tenant or purchaser.

Q: Why would someone be eligible for an exemption from withholding tax?

A: Certain circumstances, such as tax treaties between Canada and another country or the Immovable Property Tax Act, may exempt non-residents from withholding tax.

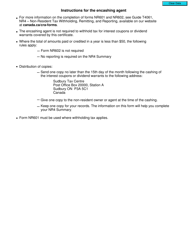

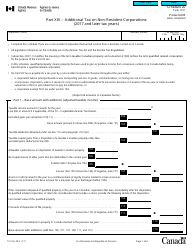

Q: How do I fill out Form NR602?

A: You will need to provide information about yourself, the property you own, and the reasons for the exemption. The form also requires supporting documentation.

Q: Do I need to file Form NR602 every year?

A: No, you only need to file Form NR602 when you meet the conditions for an exemption from withholding tax.

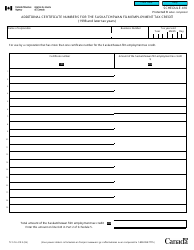

Q: What happens after I submit Form NR602?

A: The CRA will review your application and, if approved, provide you with a certificate of exemption. This certificate can be provided to the tenant or purchaser to avoid withholding tax.