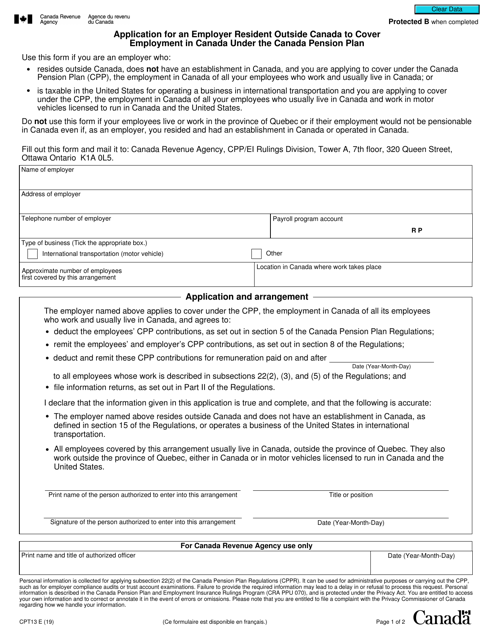

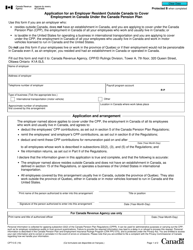

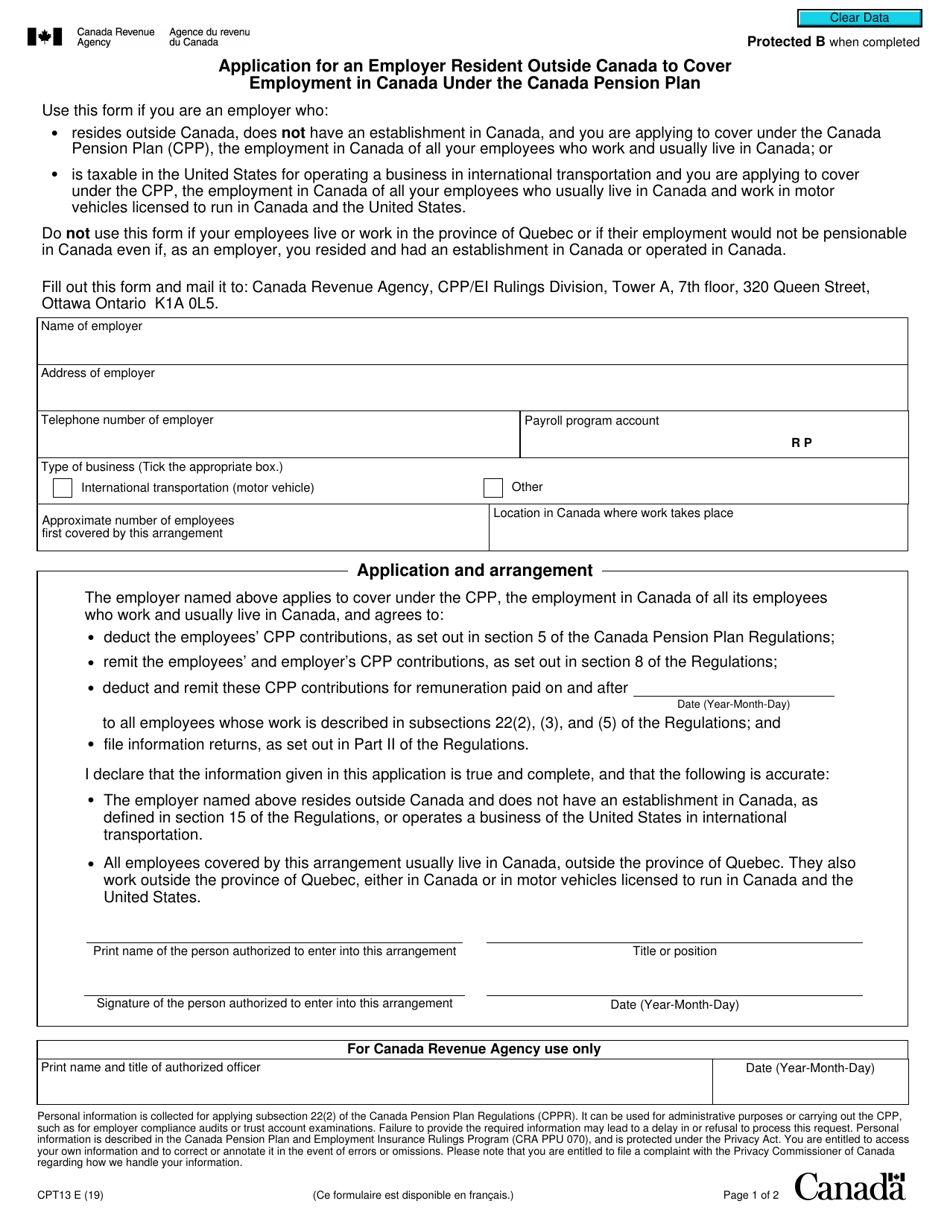

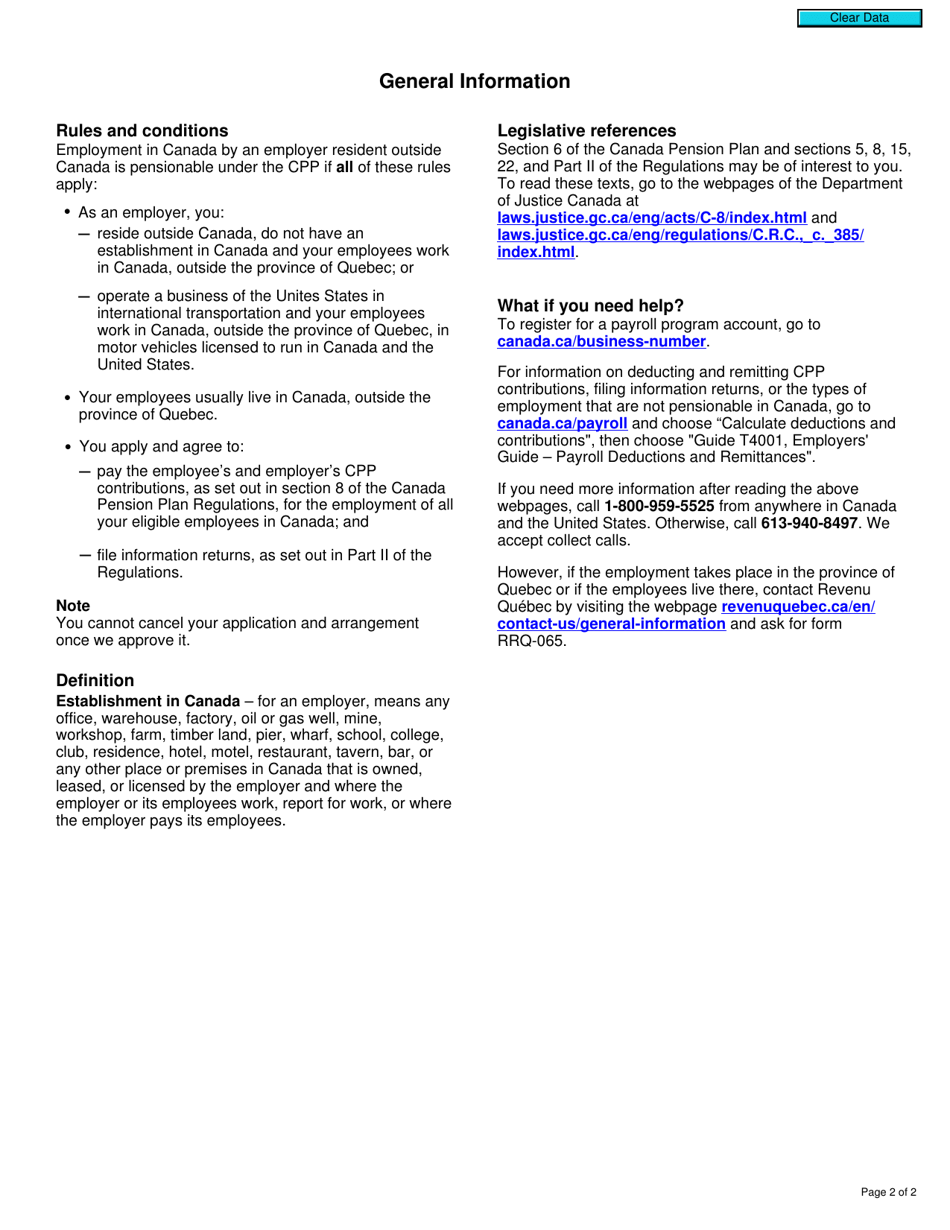

Form CPT13 Application for an Employer Resident Outside Canada to Cover Employment in Canada Under the Canada Pension Plan - Canada

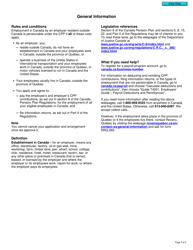

Form CPT13 is used by employers who are residents outside of Canada to apply for coverage of their employees under the Canada Pension Plan (CPP). This form allows the employer to report and remit CPP contributions for their employees who are working in Canada.

The employer resident outside Canada files the Form CPT13 application for covering employment in Canada under the Canada Pension Plan.

FAQ

Q: What is Form CPT13?

A: Form CPT13 is an application for an employer resident outside Canada to cover employment in Canada under the Canada Pension Plan.

Q: Who can use Form CPT13?

A: Form CPT13 can be used by employers who are residents outside Canada to cover employment in Canada under the Canada Pension Plan.

Q: What is the purpose of Form CPT13?

A: The purpose of Form CPT13 is to apply for coverage under the Canada Pension Plan for employment in Canada.

Q: Who needs to complete Form CPT13?

A: Employers who are residents outside Canada and want to cover employment in Canada under the Canada Pension Plan need to complete Form CPT13.

Q: What information is required on Form CPT13?

A: Form CPT13 requires information such as the employer's name, address, and contact information, as well as details about the employees they want to cover under the Canada Pension Plan.

Q: Are there any fees for submitting Form CPT13?

A: No, there are no fees for submitting Form CPT13.

Q: How can I submit Form CPT13?

A: Form CPT13 can be submitted by mail to the Canada Revenue Agency or by fax.

Q: Can I apply for coverage under the Canada Pension Plan without using Form CPT13?

A: No, employers who are residents outside Canada must use Form CPT13 to apply for coverage under the Canada Pension Plan for employment in Canada.