This version of the form is not currently in use and is provided for reference only. Download this version of

Form AGR-1 SUM

for the current year.

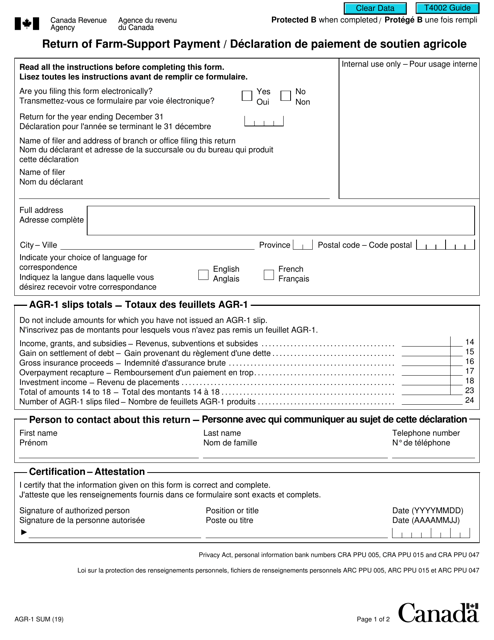

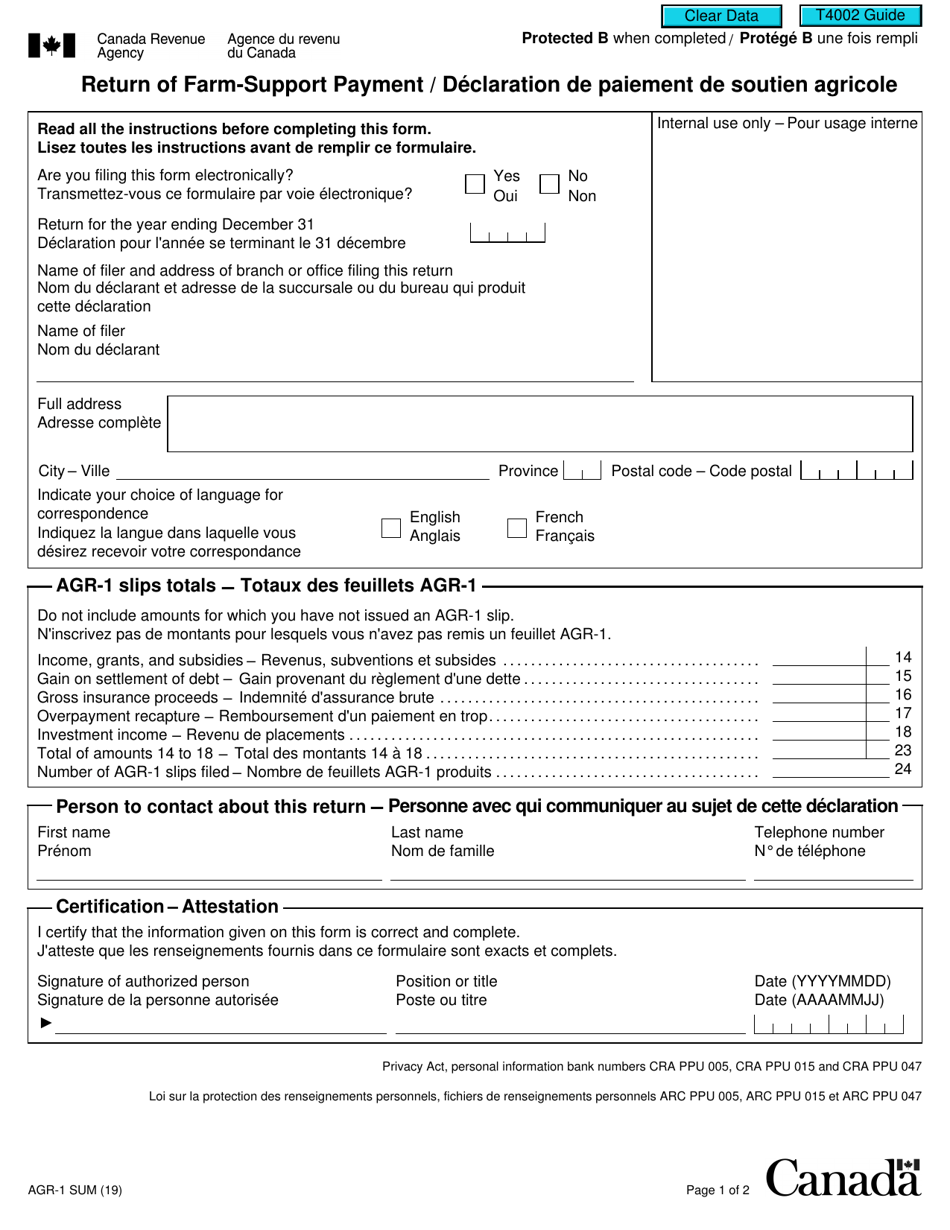

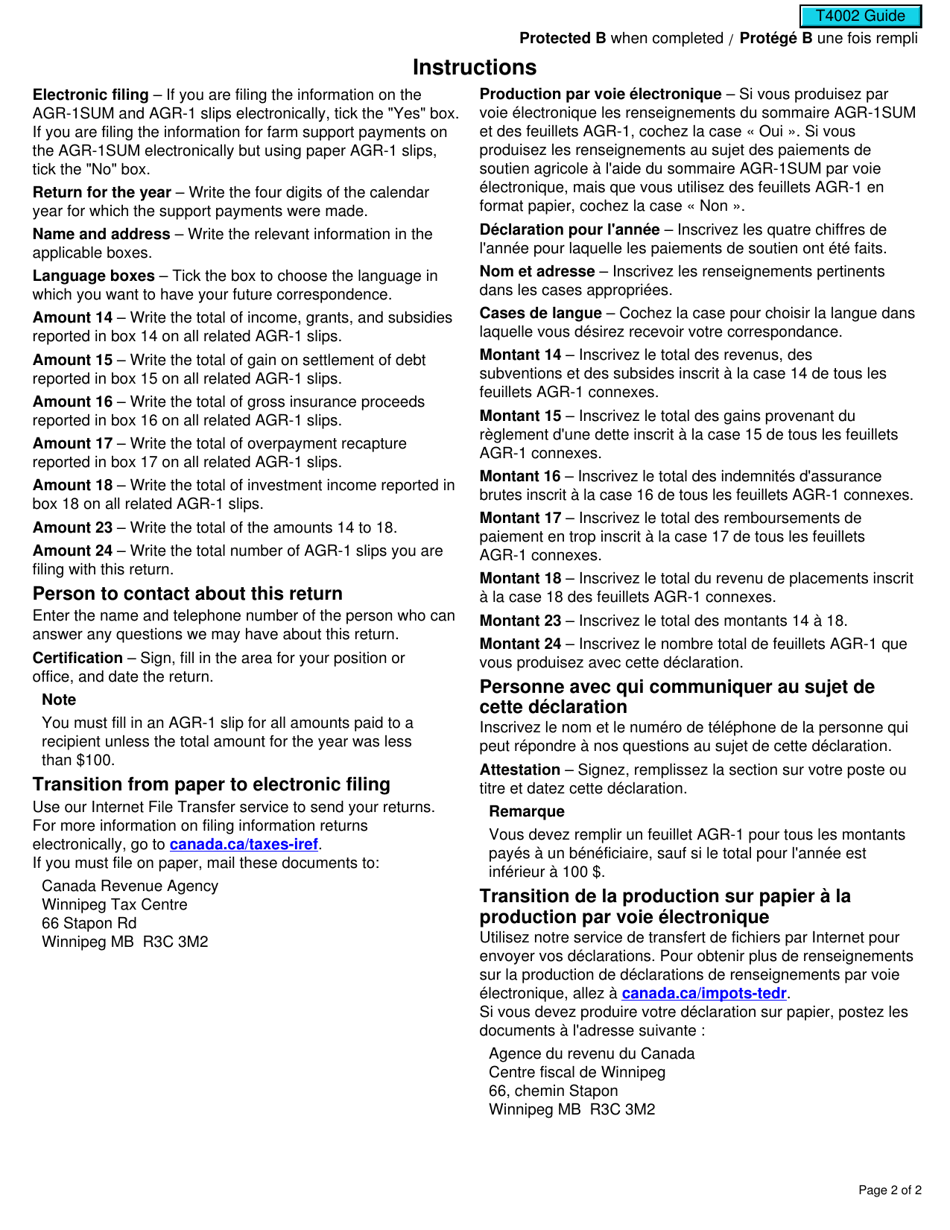

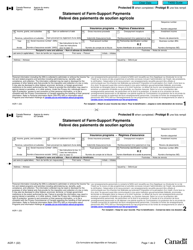

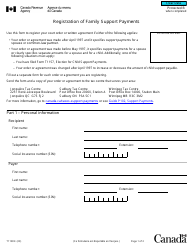

Form AGR-1 SUM Return of Farm-Support Payment - Canada (English / French)

Form AGR-1 SUM Return of Farm-Support Payment is used in Canada to report farm-support payments received by agricultural producers. It serves as a record of the financial assistance provided to farmers by the Canadian government.

The Form AGR-1 SUM Return of Farm-Support Payment in Canada can be filed by farmers who have received farm-support payments. The form is available in both English and French, so farmers can choose the language they prefer to file the return.

FAQ

Q: What is Form AGR-1 SUM?

A: Form AGR-1 SUM is the Return of Farm-Support Payment form used in Canada.

Q: What does AGR-1 SUM stand for?

A: AGR-1 SUM stands for Agricultural Support Payment Summary.

Q: Who needs to file Form AGR-1 SUM?

A: Farmers in Canada who have received farm-support payments need to file Form AGR-1 SUM.

Q: What is the purpose of Form AGR-1 SUM?

A: The purpose of Form AGR-1 SUM is to report the farm-support payments received by farmers in Canada.

Q: Is Form AGR-1 SUM available in both English and French?

A: Yes, Form AGR-1 SUM is available in both English and French versions for farmers in Canada.

Q: What information is required on Form AGR-1 SUM?

A: Form AGR-1 SUM requires information such as the farmer's name, address, payment details, and any applicable deductions.

Q: When is Form AGR-1 SUM due?

A: The deadline for filing Form AGR-1 SUM varies each year and is typically specified by the Canadian agricultural authority.

Q: Are there any penalties for late filing of Form AGR-1 SUM?

A: Yes, there may be penalties for late filing of Form AGR-1 SUM, so it is important to submit the form by the specified deadline.