This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4604-2

for the current year.

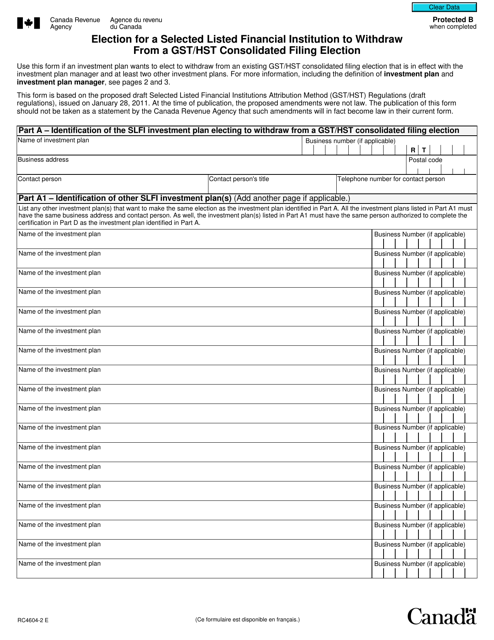

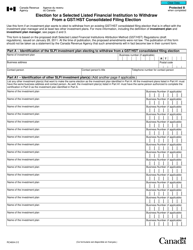

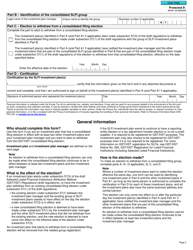

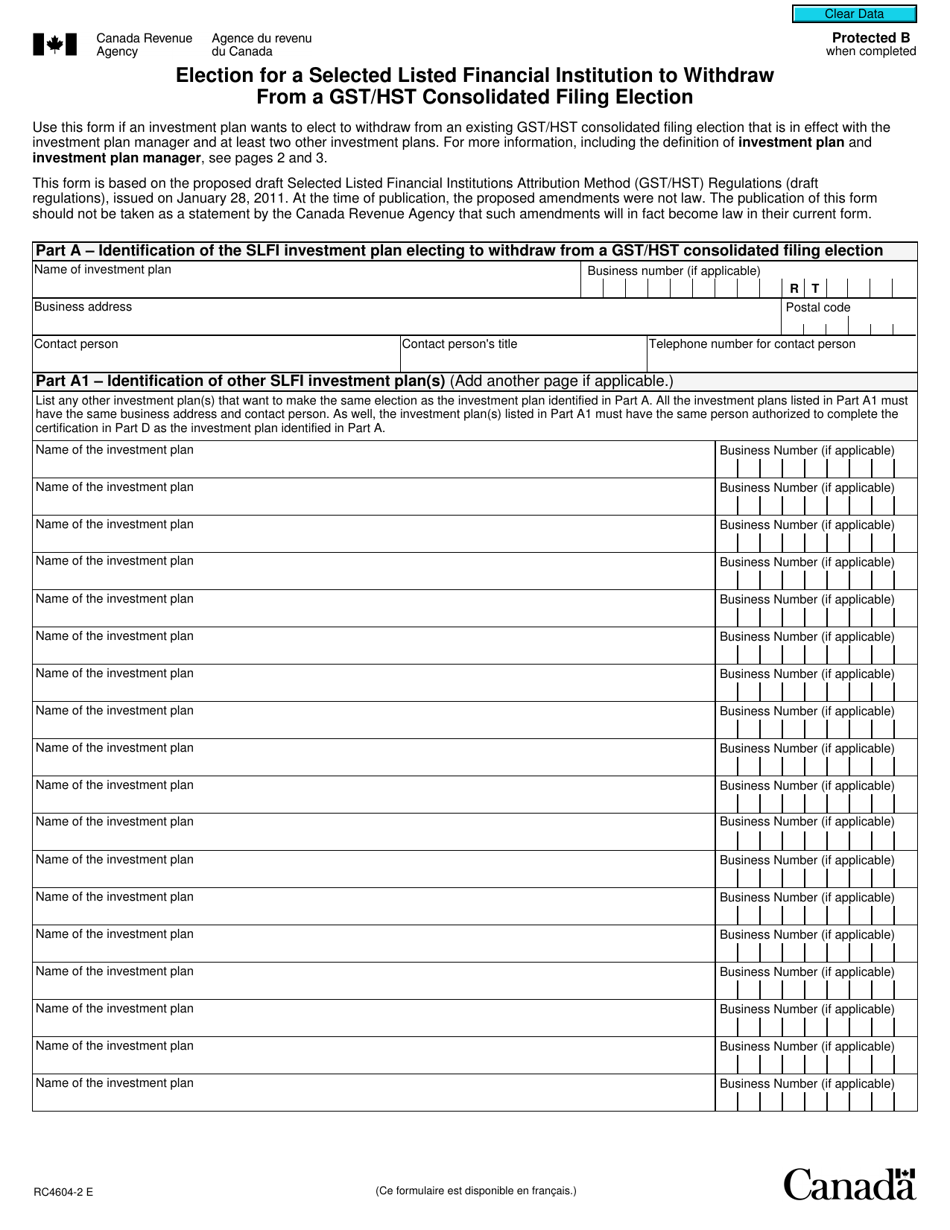

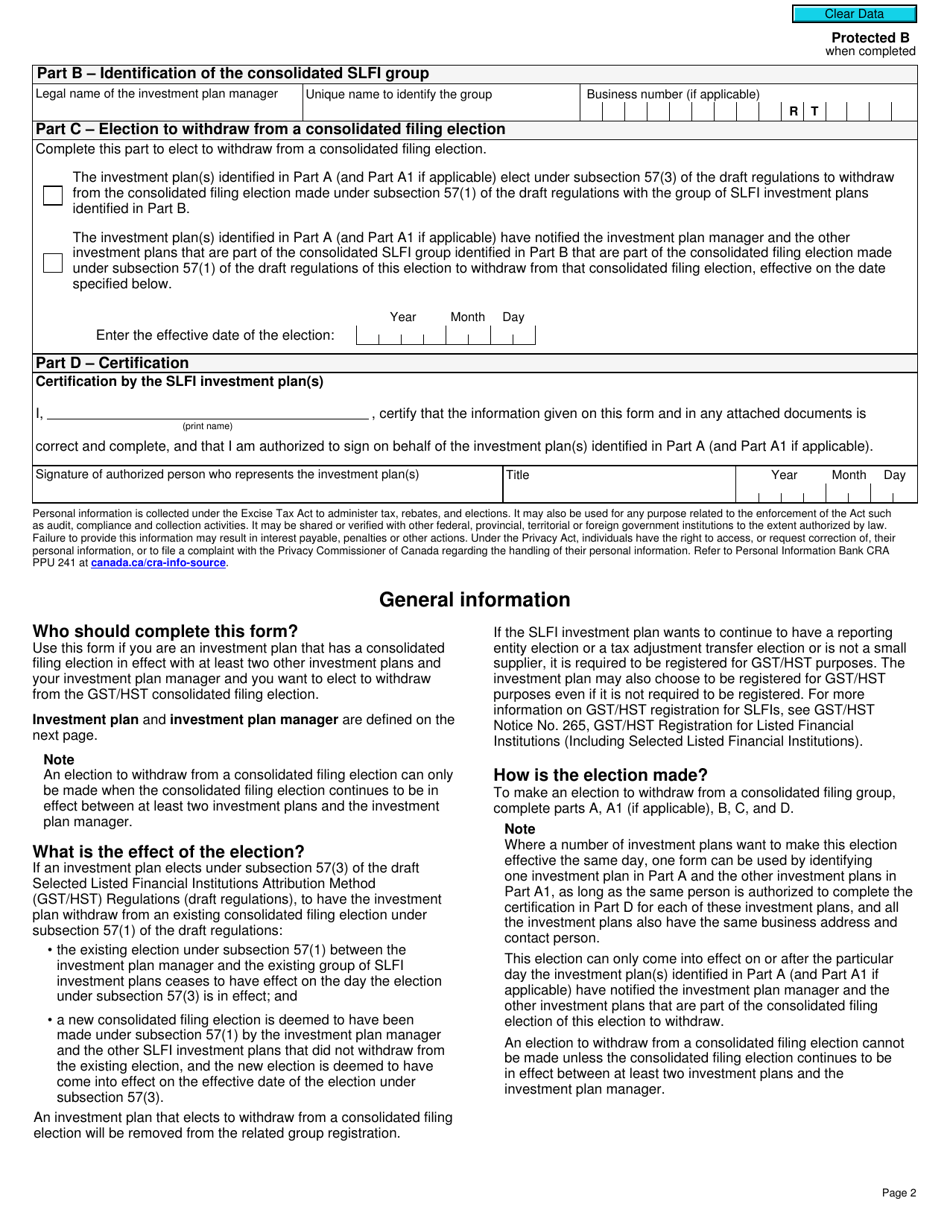

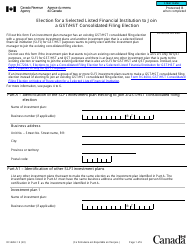

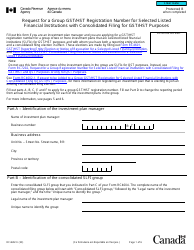

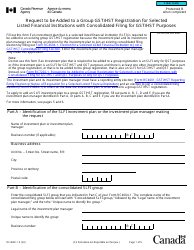

Form RC4604-2 Election for a Selected Listed Financial Institution to Withdraw From a Gst / Hst Consolidated Filing Election - Canada

Form RC4604-2 in Canada is used by a selected listed financial institution to withdraw their election to file Goods and Services Tax/Harmonized Sales Tax (GST/HST) consolidated returns.

The form RC4604-2 "Election for a Selected Listed Financial Institution to Withdraw From a GST/HST Consolidated Filing Election" is filed by a selected listed financial institution in Canada that wants to withdraw from a GST/HST consolidated filing election.

FAQ

Q: What is form RC4604-2?

A: Form RC4604-2 is a document used in Canada for the election of selected listed financial institutions to withdraw from a GST/HST consolidated filing election.

Q: What is the purpose of form RC4604-2?

A: The purpose of form RC4604-2 is to allow selected listed financial institutions to withdraw from a GST/HST consolidated filing election.

Q: Who needs to use form RC4604-2?

A: Selected listed financial institutions who want to withdraw from a GST/HST consolidated filing election need to use form RC4604-2.

Q: What is a GST/HST consolidated filing election?

A: A GST/HST consolidated filing election allows certain financial institutions to file a single GST/HST return for multiple branches or divisions.