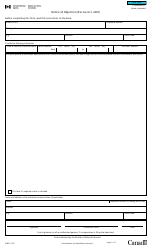

This version of the form is not currently in use and is provided for reference only. Download this version of

Form N10

for the current year.

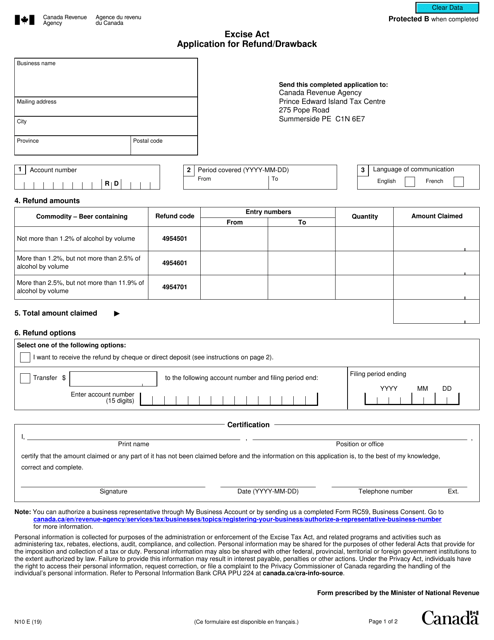

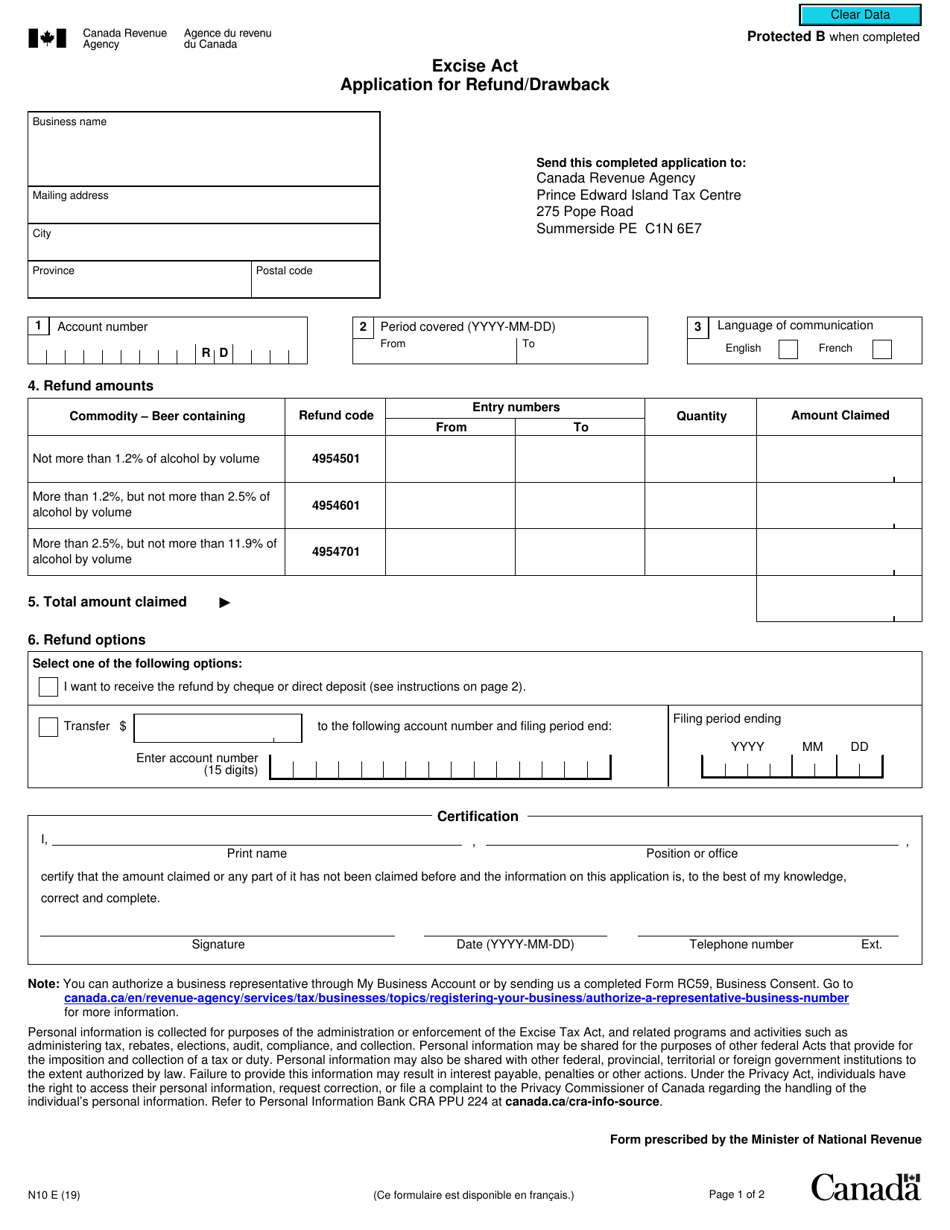

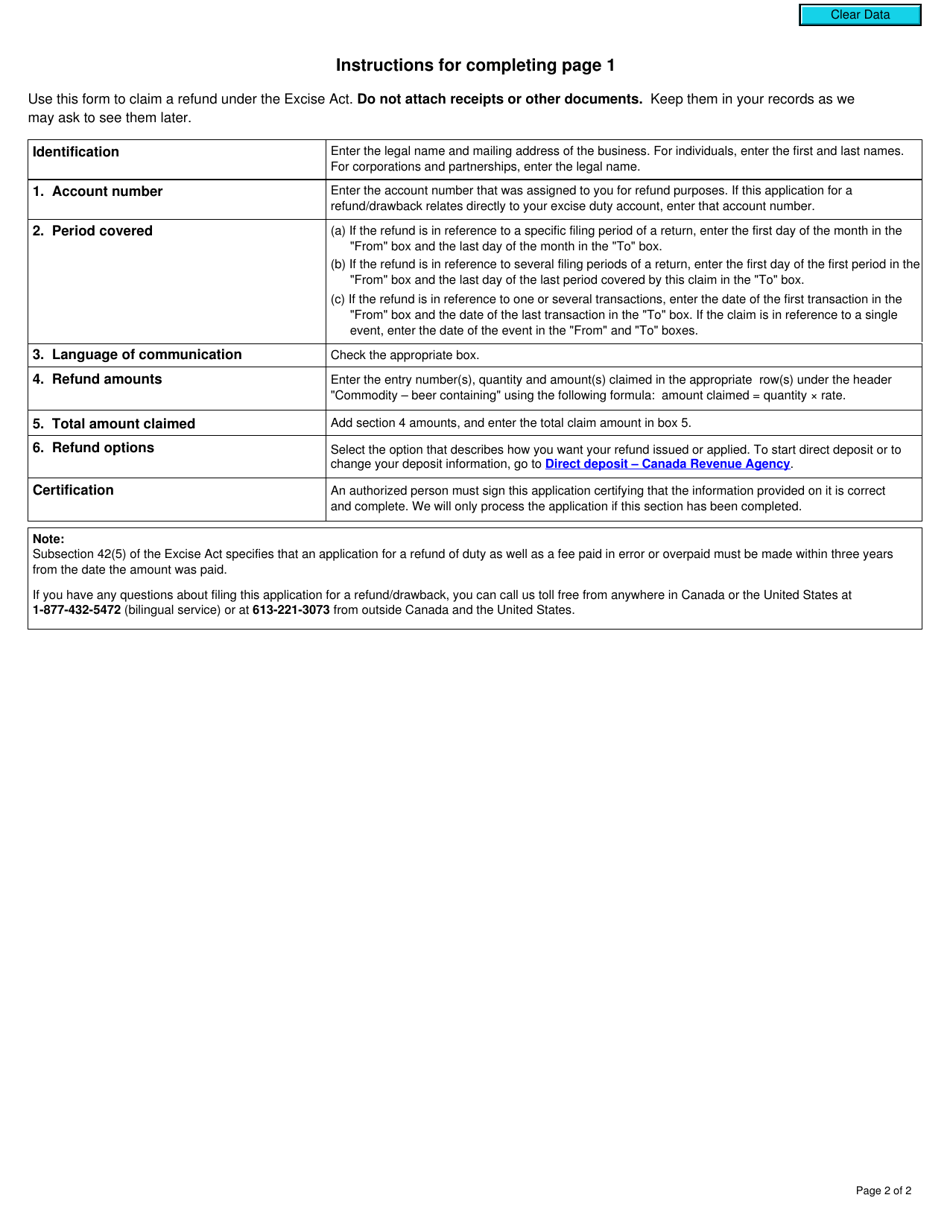

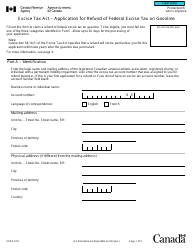

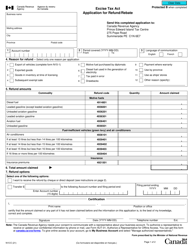

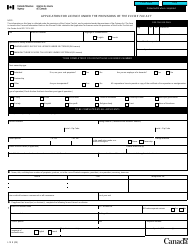

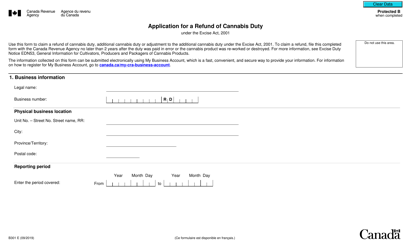

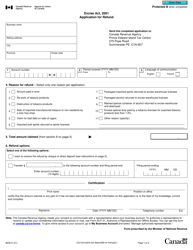

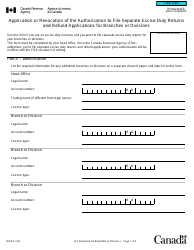

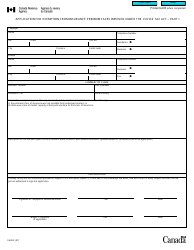

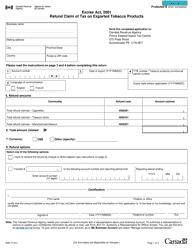

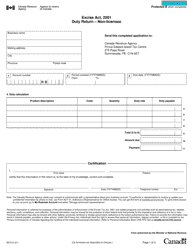

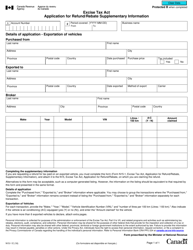

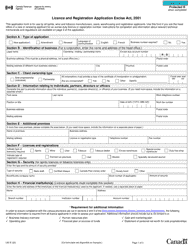

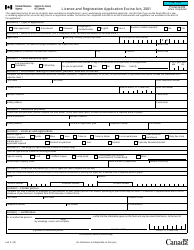

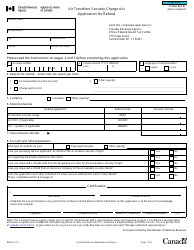

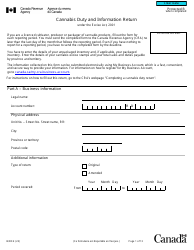

Form N10 Excise Act - Application for Refund / Drawback - Canada

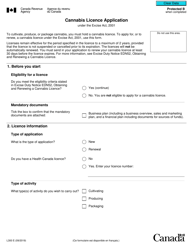

Form N10, Excise Act - Application for Refund/Drawback, is used in Canada for the purpose of claiming a refund or drawback of excise taxes that have been paid. Excise taxes are specific taxes imposed on certain goods, such as alcohol, tobacco, and fuel. Individuals or businesses that have paid excise taxes and are eligible for a refund or drawback can use this form to apply for the return of those taxes.

The Form N10 Excise Act - Application for Refund/Drawback is filed by individuals or businesses in Canada who are seeking a refund or drawback of excise taxes paid.

FAQ

Q: What is Form N10?

A: Form N10 is an Application for Refund/Drawback under the Excise Act in Canada.

Q: What is the Excise Act?

A: The Excise Act is a Canadian law that governs the taxation of certain goods, such as alcohol and tobacco.

Q: Who can use Form N10?

A: Form N10 can be used by individuals or businesses who are eligible for a refund or drawback under the Excise Act.

Q: What is a refund?

A: A refund is a repayment of taxes previously paid, typically due to an overpayment or an exemption.

Q: What is a drawback?

A: A drawback is a refund of duties or taxes paid on imported goods that are subsequently exported or used in the production of exported goods.

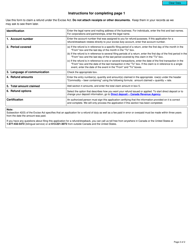

Q: How do I submit Form N10?

A: Form N10 can be submitted by mail or electronically, depending on the requirements of the Canada Revenue Agency.

Q: What documentation is required for Form N10?

A: Documentation such as invoices, receipts, and supporting evidence may be required to support your refund or drawback claim.

Q: How long does it take to process a Form N10?

A: Processing times can vary, but it typically takes several weeks to receive a decision on a refund or drawback claim.

Q: What if my Form N10 is denied?

A: If your Form N10 is denied, you may have the option to appeal the decision or seek further clarification from the Canada Revenue Agency.