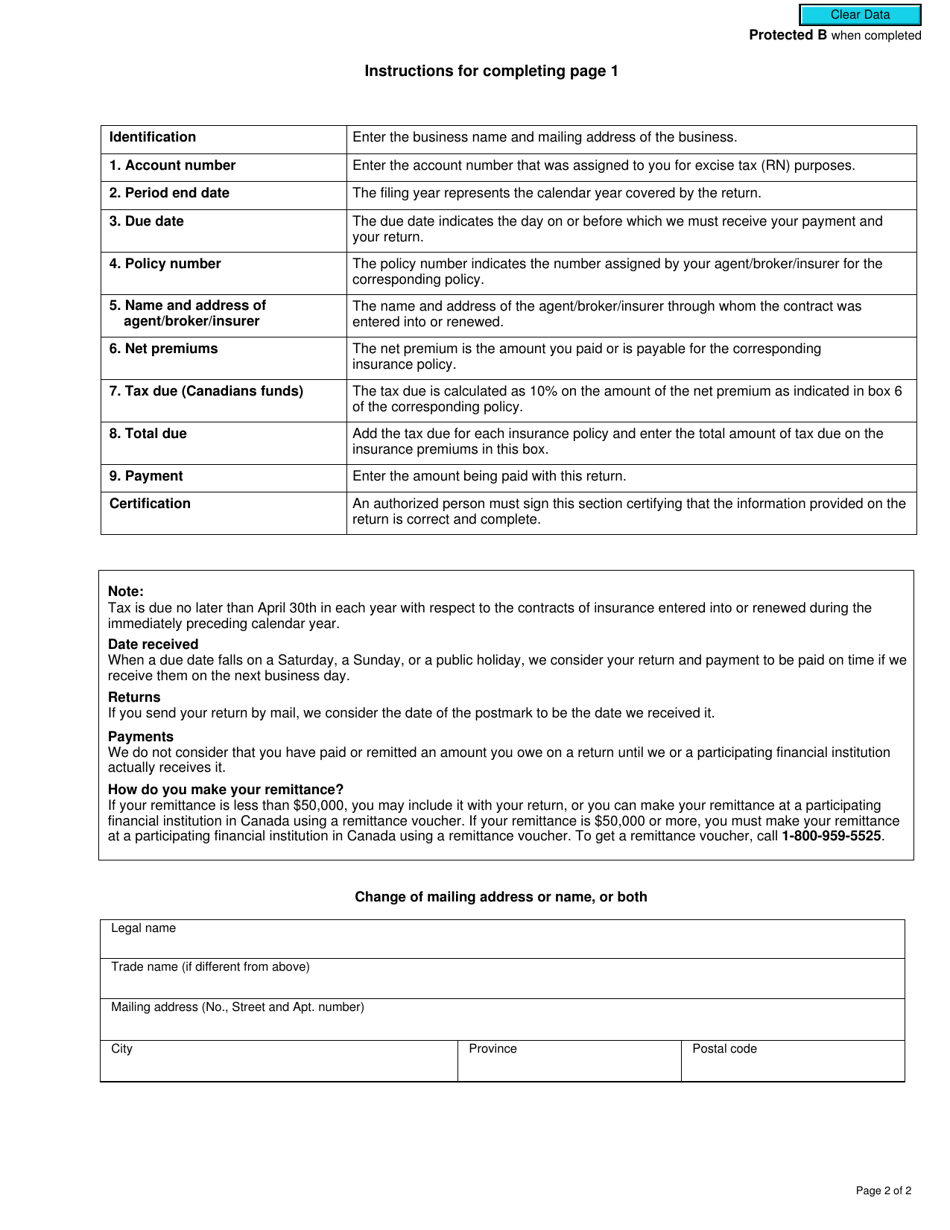

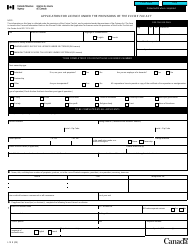

This version of the form is not currently in use and is provided for reference only. Download this version of

Form B243

for the current year.

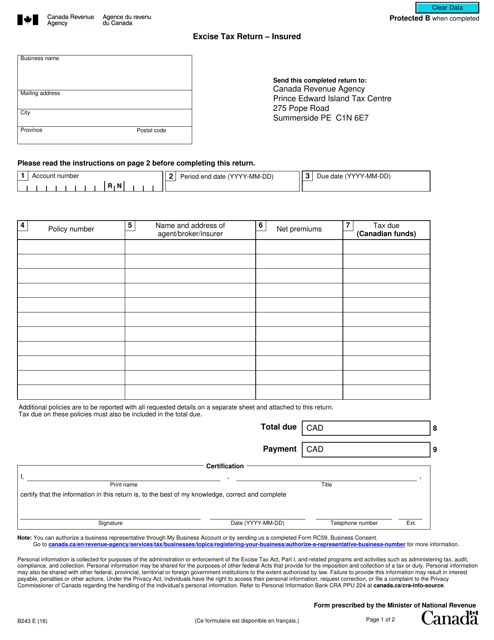

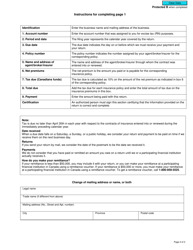

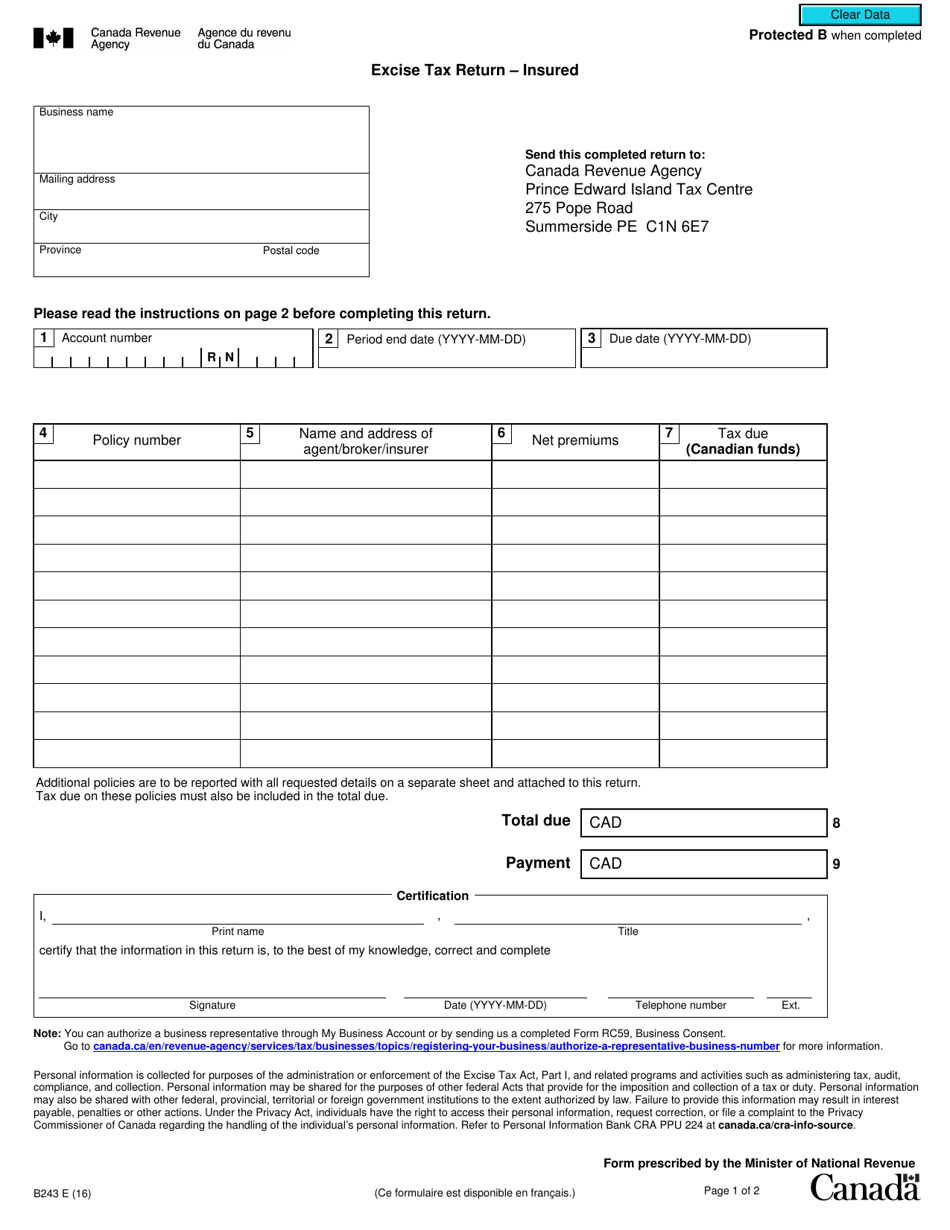

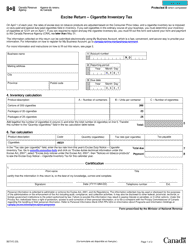

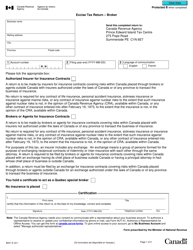

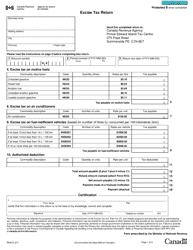

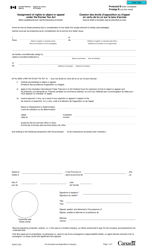

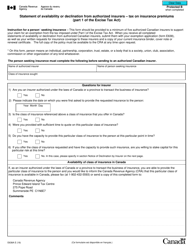

Form B243 Excise Tax Return - Insured - Canada

Form B243 Excise Tax Return - Insured - Canada is used for reporting and remitting excise taxes on insurance premiums collected in Canada.

FAQ

Q: What is Form B243?

A: Form B243 is an Excise Tax Return for Insured individuals in Canada.

Q: Who needs to file Form B243?

A: Insured individuals in Canada need to file Form B243.

Q: What is the purpose of Form B243?

A: The purpose of Form B243 is to report and pay excise tax.

Q: What is excise tax?

A: Excise tax is a tax on specific goods or services.

Q: What are some examples of goods or services that may be subject to excise tax?

A: Some examples include alcohol, tobacco, fuel, and air travel.

Q: How often do I need to file Form B243?

A: The frequency of filing depends on your specific situation. Consult the instructions or a tax professional.

Q: Is Form B243 only for residents of Canada?

A: Yes, Form B243 is specifically for individuals who are residents of Canada.

Q: What happens if I don't file Form B243?

A: Failure to file Form B243 or pay the excise tax may result in penalties and interest charges.