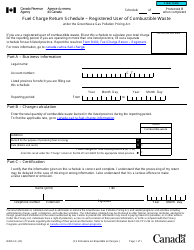

This version of the form is not currently in use and is provided for reference only. Download this version of

Form B400-4

for the current year.

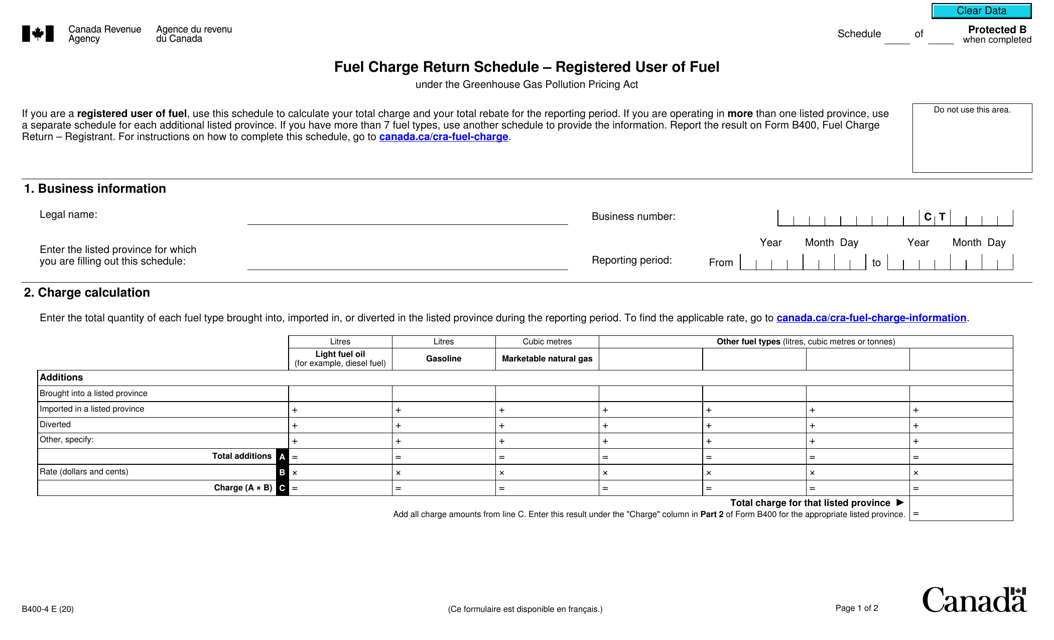

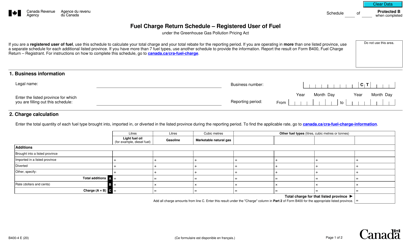

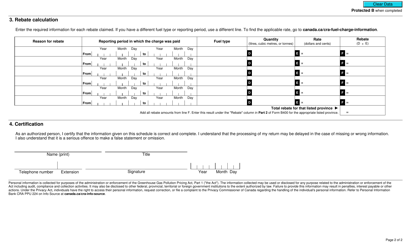

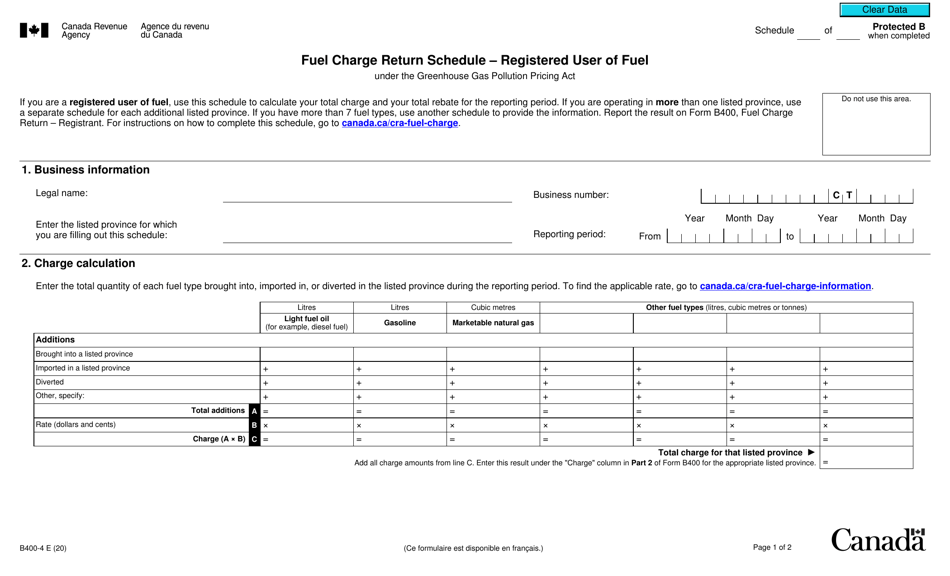

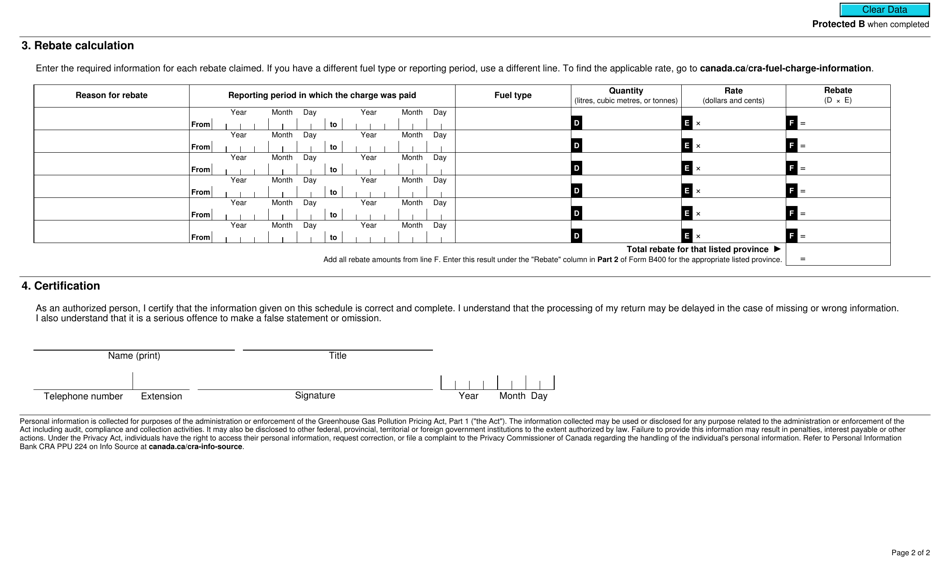

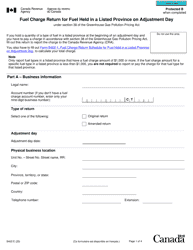

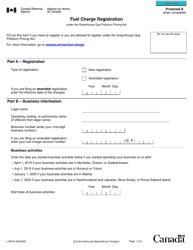

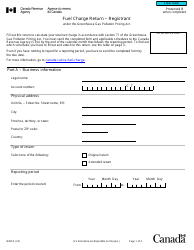

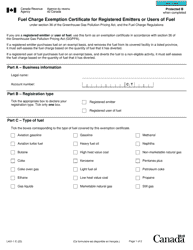

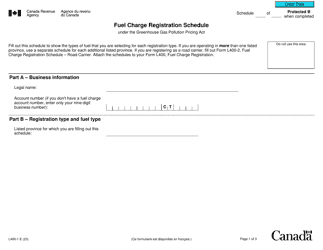

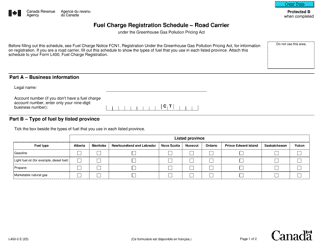

Form B400-4 Fuel Charge Return Schedule - Registered User of Fuel Under the Greenhouse Gas Pollution Pricing Act - Canada

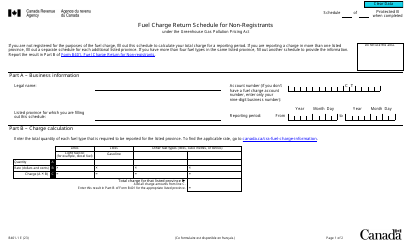

Form B400-4 Fuel ChargeReturn Schedule is used by registered users of fuel under the Greenhouse Gas Pollution Pricing Act in Canada to report and remit the fuel charge payable on specified fuels. The form helps users comply with the requirements of the Act and accurately calculate the amount of fuel charge owed to the Government of Canada.

The registered user of fuel is responsible for filing the Form B400-4 Fuel Charge Return Schedule under the Greenhouse Gas Pollution Pricing Act in Canada.

FAQ

Q: What is Form B400-4?

A: Form B400-4 is a Fuel Charge Return Schedule.

Q: Who is required to file Form B400-4?

A: Registered users of fuel under the Greenhouse Gas Pollution Pricing Act in Canada are required to file Form B400-4.

Q: What is the purpose of Form B400-4?

A: The purpose of Form B400-4 is to report and calculate the amount of fuel charge owed under the Greenhouse Gas Pollution Pricing Act.

Q: What is the Greenhouse Gas Pollution Pricing Act?

A: The Greenhouse Gas Pollution Pricing Act is a Canadian federal legislation aimed at reducing greenhouse gas emissions and addressing climate change.

Q: Is filing Form B400-4 mandatory?

A: Yes, filing Form B400-4 is mandatory for registered users of fuel under the Greenhouse Gas Pollution Pricing Act.

Q: When is the deadline to file Form B400-4?

A: The deadline to file Form B400-4 is generally within 12 months following the end of the reporting period.

Q: What happens if I don't file Form B400-4?

A: Failure to file Form B400-4 may result in penalties and interest charges imposed by the Canada Revenue Agency.

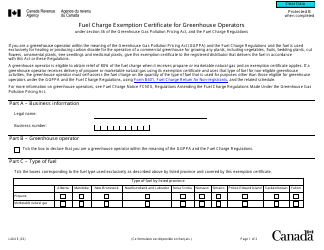

Q: Are there any exemptions to filing Form B400-4?

A: There may be exemptions or special rules available for certain types of fuel or specific circumstances. It's best to consult the Canada Revenue Agency or a tax professional for specific guidance.

Q: Can I file Form B400-4 electronically?

A: Yes, the Canada Revenue Agency provides an electronic filing option for Form B400-4.