This version of the form is not currently in use and is provided for reference only. Download this version of

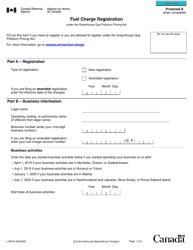

Form B400-1

for the current year.

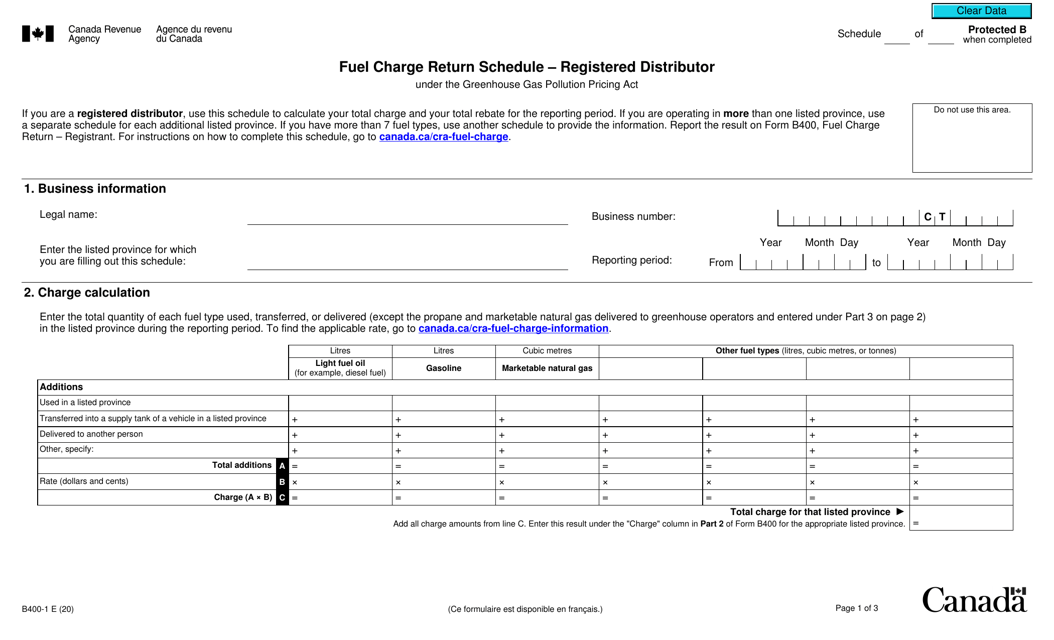

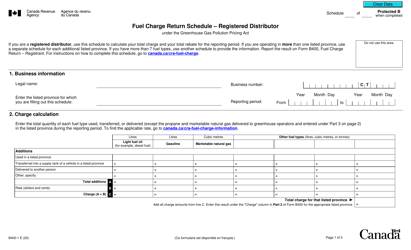

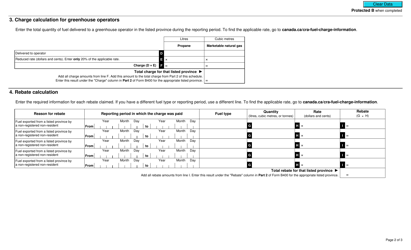

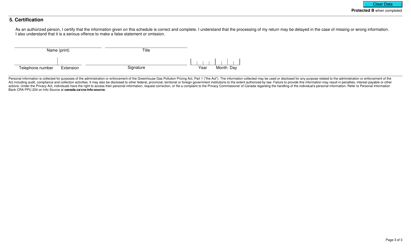

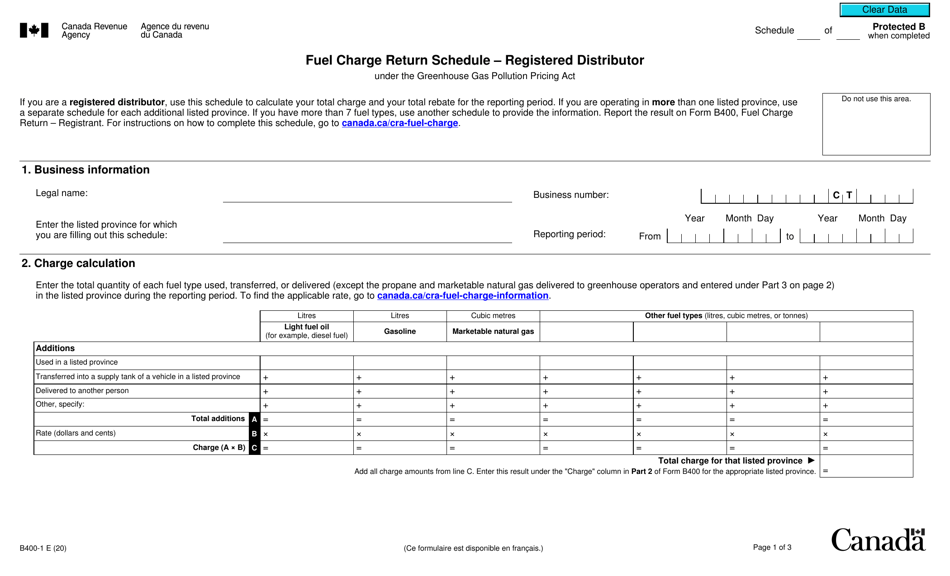

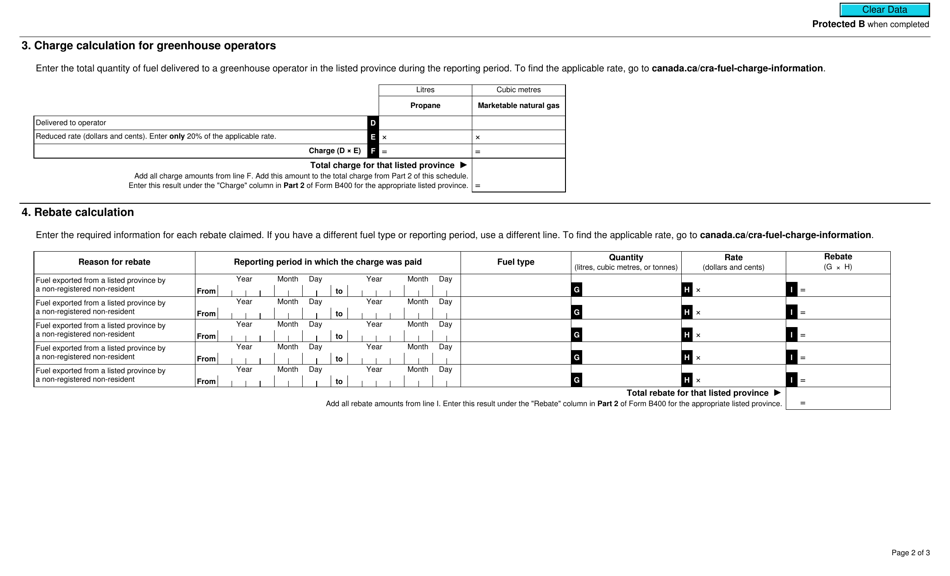

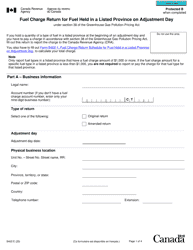

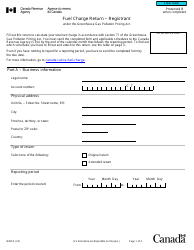

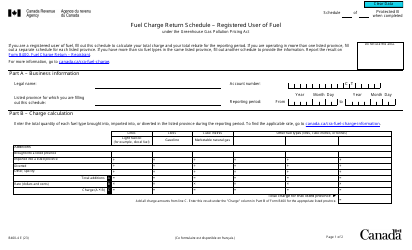

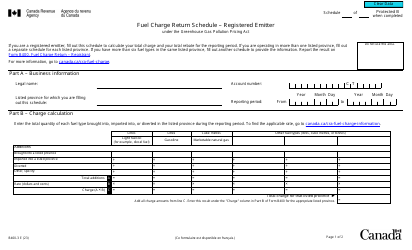

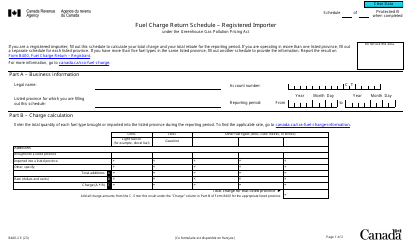

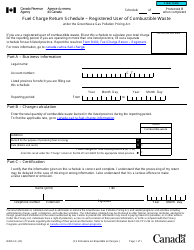

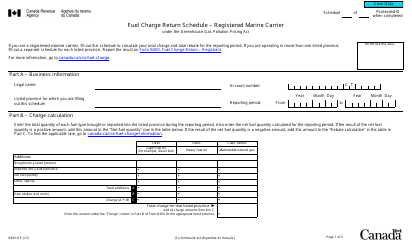

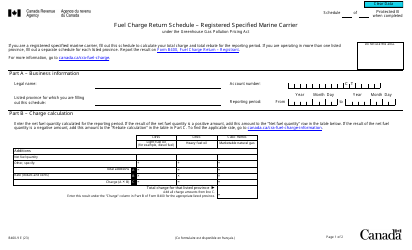

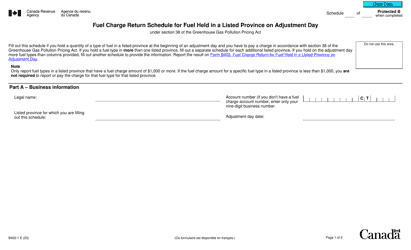

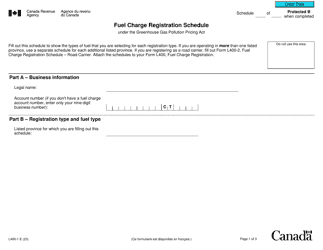

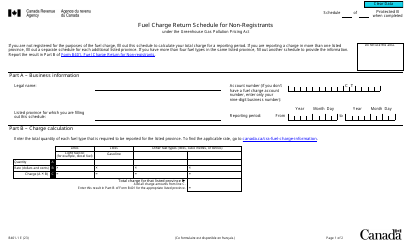

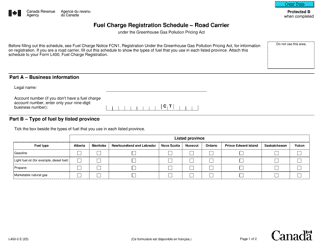

Form B400-1 Fuel Charge Return Schedule - Registered Distributor Under the Greenhouse Gas Pollution Pricing Act - Canada

Form B400-1 Fuel ChargeReturn Schedule - Registered Distributor Under the Greenhouse Gas Pollution Pricing Act - Canada is used by registered distributors in Canada to report and remit the fuel charge payable under the Greenhouse Gas Pollution Pricing Act. The form helps the government track and regulate carbon emissions and climate change impacts by taxing the use of certain fuels.

The Form B400-1 Fuel Charge Return Schedule is filed by registered distributors under the Greenhouse Gas Pollution Pricing Act in Canada.

FAQ

Q: What is Form B400-1?

A: Form B400-1 is the Fuel Charge Return Schedule for Registered Distributors under the Greenhouse Gas Pollution Pricing Act in Canada.

Q: Who is required to fill out Form B400-1?

A: Registered distributors under the Greenhouse Gas Pollution Pricing Act in Canada are required to fill out Form B400-1.

Q: What is the purpose of Form B400-1?

A: The purpose of Form B400-1 is to calculate and report the fuel charge payable by registered distributors under the Greenhouse Gas Pollution Pricing Act in Canada.

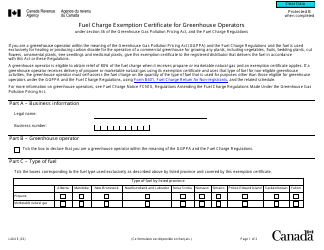

Q: What is the Greenhouse Gas Pollution Pricing Act?

A: The Greenhouse Gas Pollution Pricing Act is a Canadian federal legislation aimed at reducing greenhouse gas emissions by implementing a carbon pricing system.

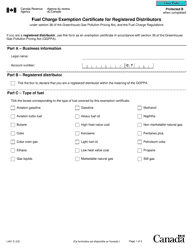

Q: What is a registered distributor?

A: A registered distributor is a business or individual that is registered under the Greenhouse Gas Pollution Pricing Act to distribute fuel in Canada.

Q: What is the fuel charge?

A: The fuel charge is a charge imposed on fossil fuels that produce greenhouse gas emissions, which is part of the carbon pricing system implemented under the Greenhouse Gas Pollution Pricing Act in Canada.

Q: How often is Form B400-1 filed?

A: Form B400-1 is filed on a monthly basis by registered distributors under the Greenhouse Gas Pollution Pricing Act in Canada.

Q: What are the consequences of not filing Form B400-1?

A: Not filing Form B400-1 or failing to pay the fuel charge as required can result in penalties and interest charges imposed by the Canada Revenue Agency.

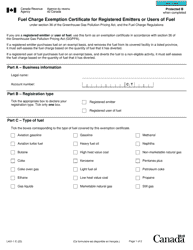

Q: Are there any exemptions or special rules for Form B400-1?

A: Yes, there are exemptions and special rules for certain types of fuel, specific industries, and designated provinces or territories. The details can be found in the guidelines provided by the Canada Revenue Agency.