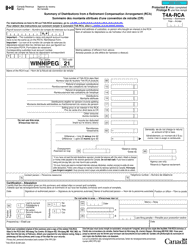

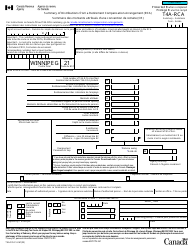

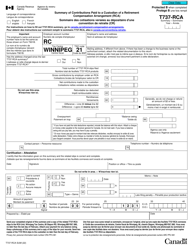

This version of the form is not currently in use and is provided for reference only. Download this version of

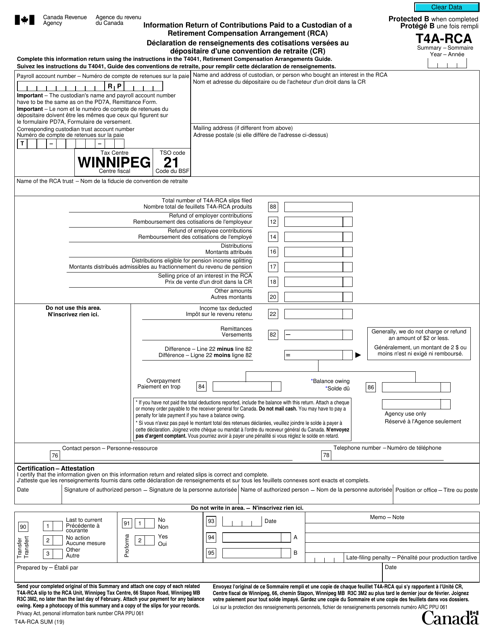

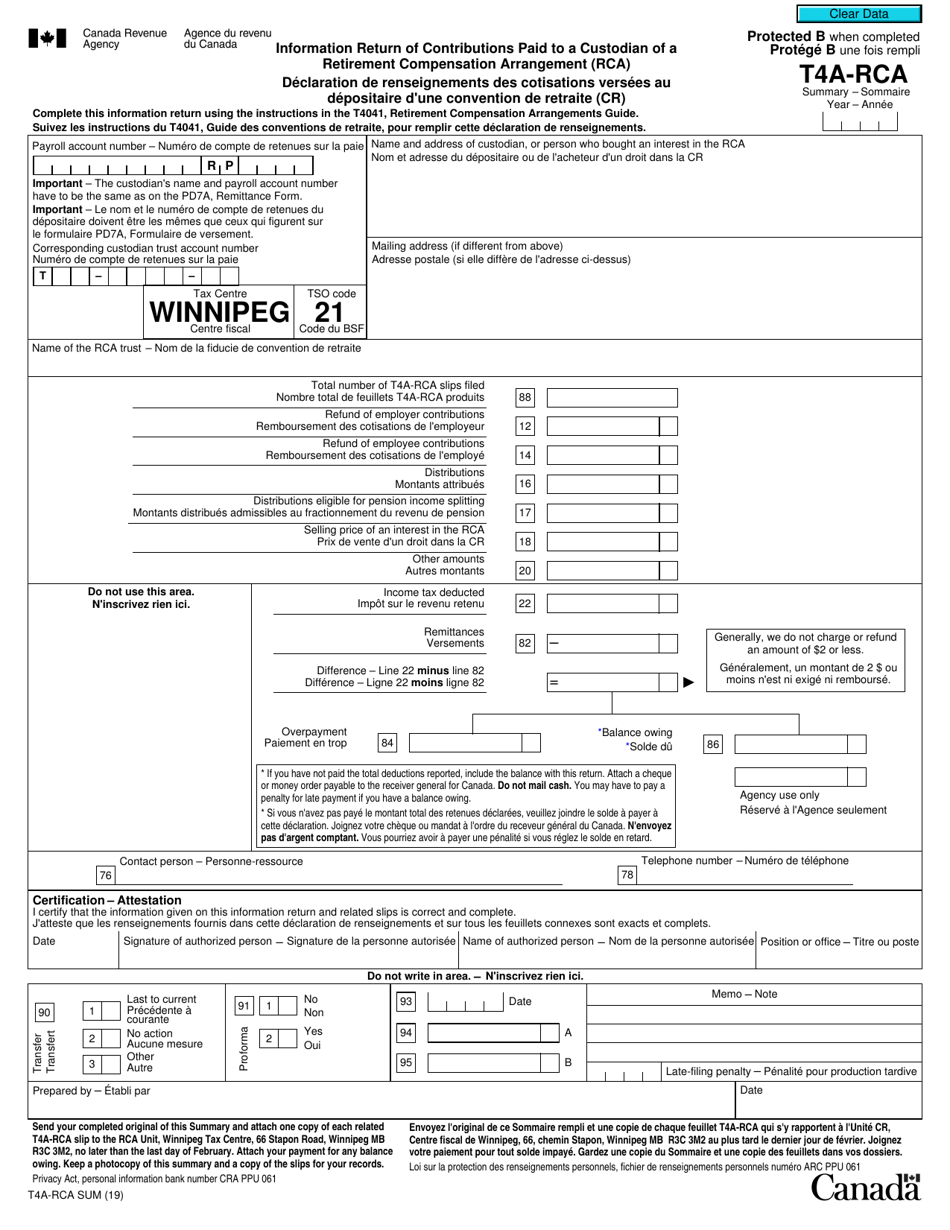

Form T4A-RCA SUM

for the current year.

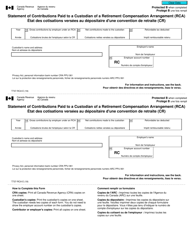

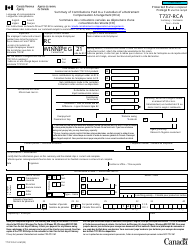

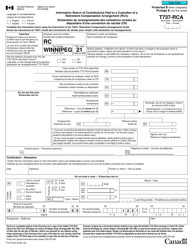

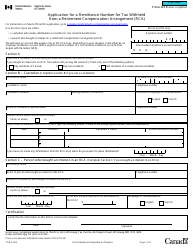

Form T4A-RCA SUM Information Return of Distributions From a Retirement Compensation Arrangement (Rca) - Canada (English / French)

Form T4A-RCA is used by Canadian individuals or entities who have made distributions from a Retirement Compensation Arrangement (RCA). This form summarizes the information about the distributions made from the RCA and is filed with the Canada Revenue Agency (CRA). It is used for reporting purposes and to ensure compliance with tax regulations related to retirement compensation arrangements.

The Form T4A-RCA SUM Information Return of Distributions From a Retirement Compensation Arrangement (RCA) is filed by the payer of the distributions in Canada.

FAQ

Q: What is a T4A-RCA form?

A: The T4A-RCA form is used to report distributions from a Retirement Compensation Arrangement (RCA) in Canada.

Q: What does the acronym RCA stand for?

A: RCA stands for Retirement Compensation Arrangement.

Q: Who needs to file a T4A-RCA form?

A: Any entity that has made distributions from an RCA needs to file a T4A-RCA form.

Q: What information is reported on the T4A-RCA form?

A: The T4A-RCA form reports information about the distributions made from an RCA, including the recipient's name, address, and the amount of the distribution.

Q: Is the T4A-RCA form available in both English and French?

A: Yes, the T4A-RCA form is available in both English and French.

Q: When is the deadline for filing the T4A-RCA form?

A: The deadline for filing the T4A-RCA form is the last day of February in the year following the year in which the distributions were made.

Q: Are there any penalties for late filing of the T4A-RCA form?

A: Yes, there are penalties for late filing of the T4A-RCA form. It is important to file the form on time to avoid these penalties.

Q: Do I need to submit copies of the T4A-RCA forms to recipients?

A: Yes, you need to distribute copies of the T4A-RCA form to the recipients of the distributions.