This version of the form is not currently in use and is provided for reference only. Download this version of

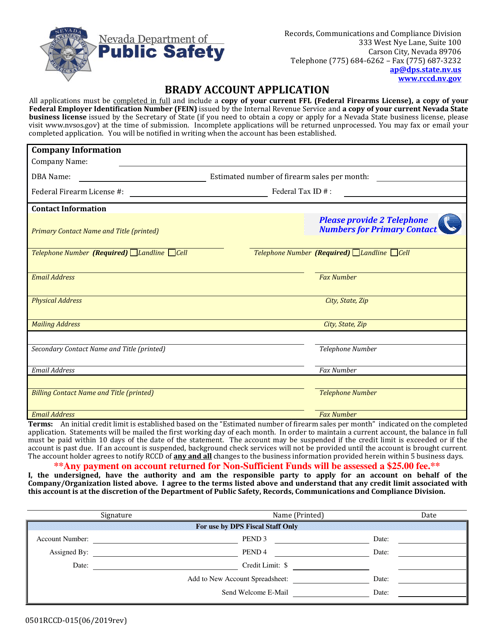

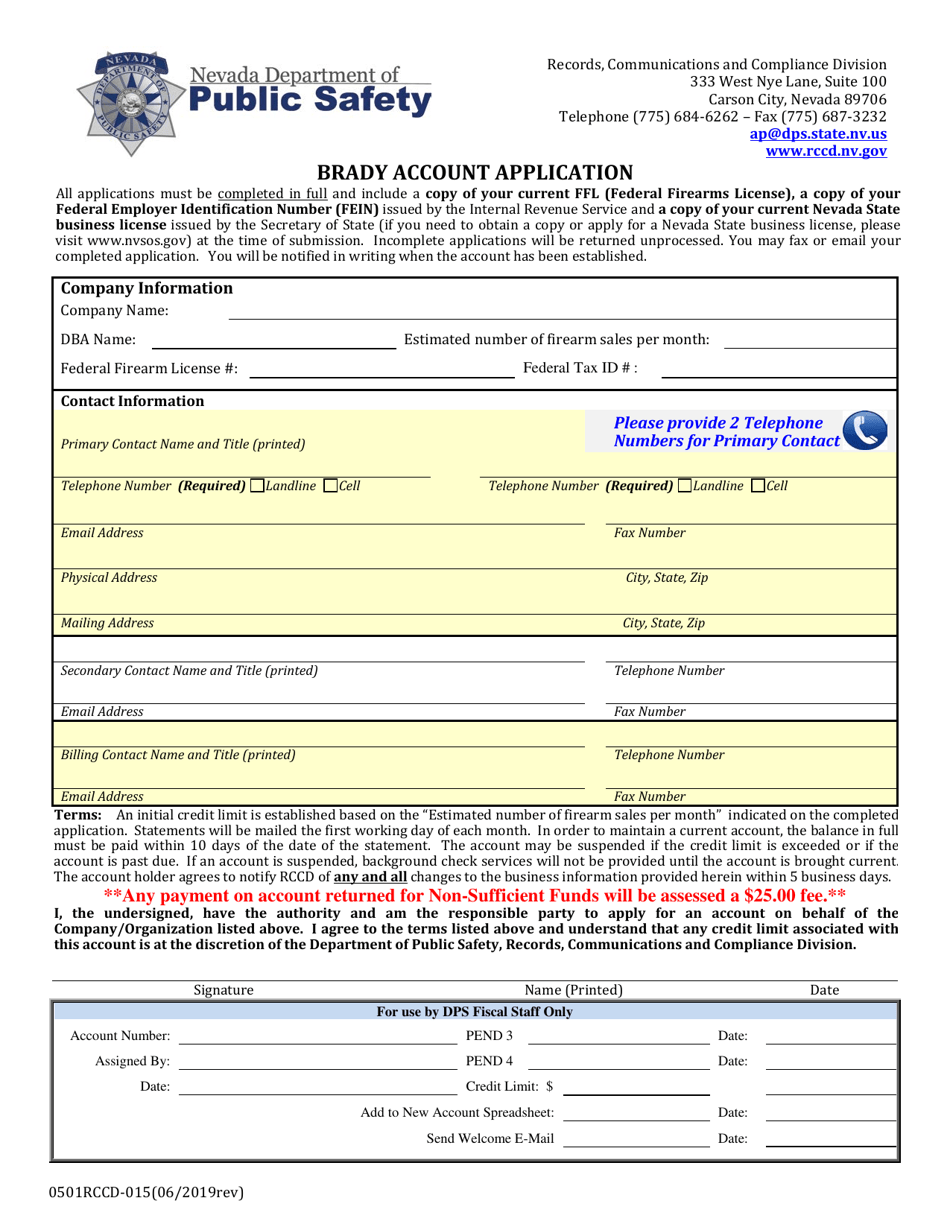

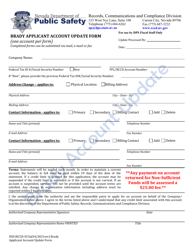

Form 0501RCCD-015

for the current year.

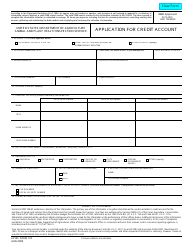

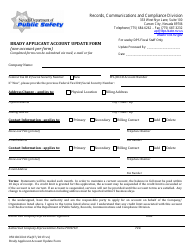

Form 0501RCCD-015 Brady Account Application - Nevada

What Is Form 0501RCCD-015?

This is a legal form that was released by the Nevada Department of Public Safety - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

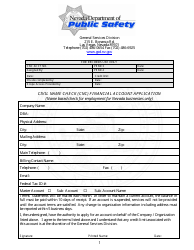

Q: What is Form 0501RCCD-015?

A: Form 0501RCCD-015 is the Brady Account Application specifically for the state of Nevada.

Q: Who needs to fill out Form 0501RCCD-015?

A: Individuals or entities who wish to open a Brady Account in Nevada need to fill out this form.

Q: What is a Brady Account?

A: A Brady Account is a specialized account used by certain entities to pay state sales and use taxes in advance.

Q: Why would someone need a Brady Account?

A: Having a Brady Account allows businesses to streamline the process of paying state sales and use taxes in Nevada.

Q: Are there any fees associated with opening a Brady Account?

A: There may be fees associated with opening and maintaining a Brady Account. You should refer to the instructions of Form 0501RCCD-015 or contact the Nevada Department of Taxation for more information.

Q: Are there any eligibility requirements for opening a Brady Account?

A: Yes, there are eligibility requirements for opening a Brady Account. These requirements may vary by state. You should refer to the instructions of Form 0501RCCD-015 or contact the Nevada Department of Taxation for more information.

Q: Can I use Form 0501RCCD-015 for any state other than Nevada?

A: No, Form 0501RCCD-015 is specifically for the state of Nevada. If you need to open a Brady Account in a different state, you will need to obtain the appropriate form for that state.

Q: How long does it take to process Form 0501RCCD-015?

A: The processing time for Form 0501RCCD-015 will vary. You should contact the Nevada Department of Taxation for information on current processing times.

Q: Can I make changes to my Brady Account after it has been opened?

A: Yes, you can make changes to your Brady Account. However, you should contact the Nevada Department of Taxation to determine the process and requirements for making changes.

Q: What happens if I no longer need my Brady Account?

A: If you no longer need your Brady Account, you should contact the Nevada Department of Taxation to determine the process for closing the account.

Q: Are there any penalties for non-compliance with Brady Account requirements?

A: There may be penalties for non-compliance with Brady Account requirements. You should refer to the instructions of Form 0501RCCD-015 or contact the Nevada Department of Taxation for more information.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Nevada Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 0501RCCD-015 by clicking the link below or browse more documents and templates provided by the Nevada Department of Public Safety.