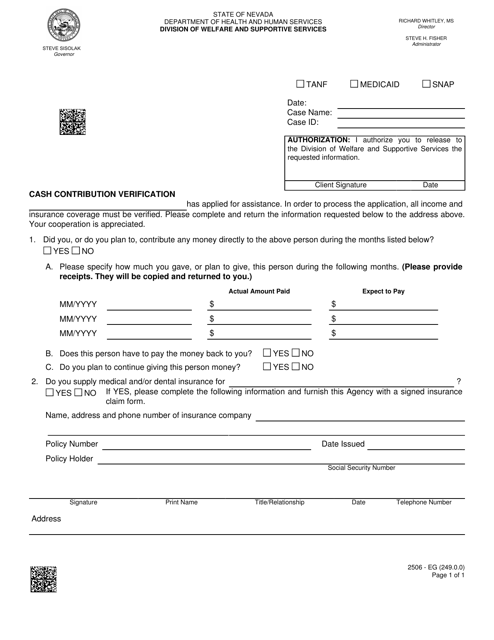

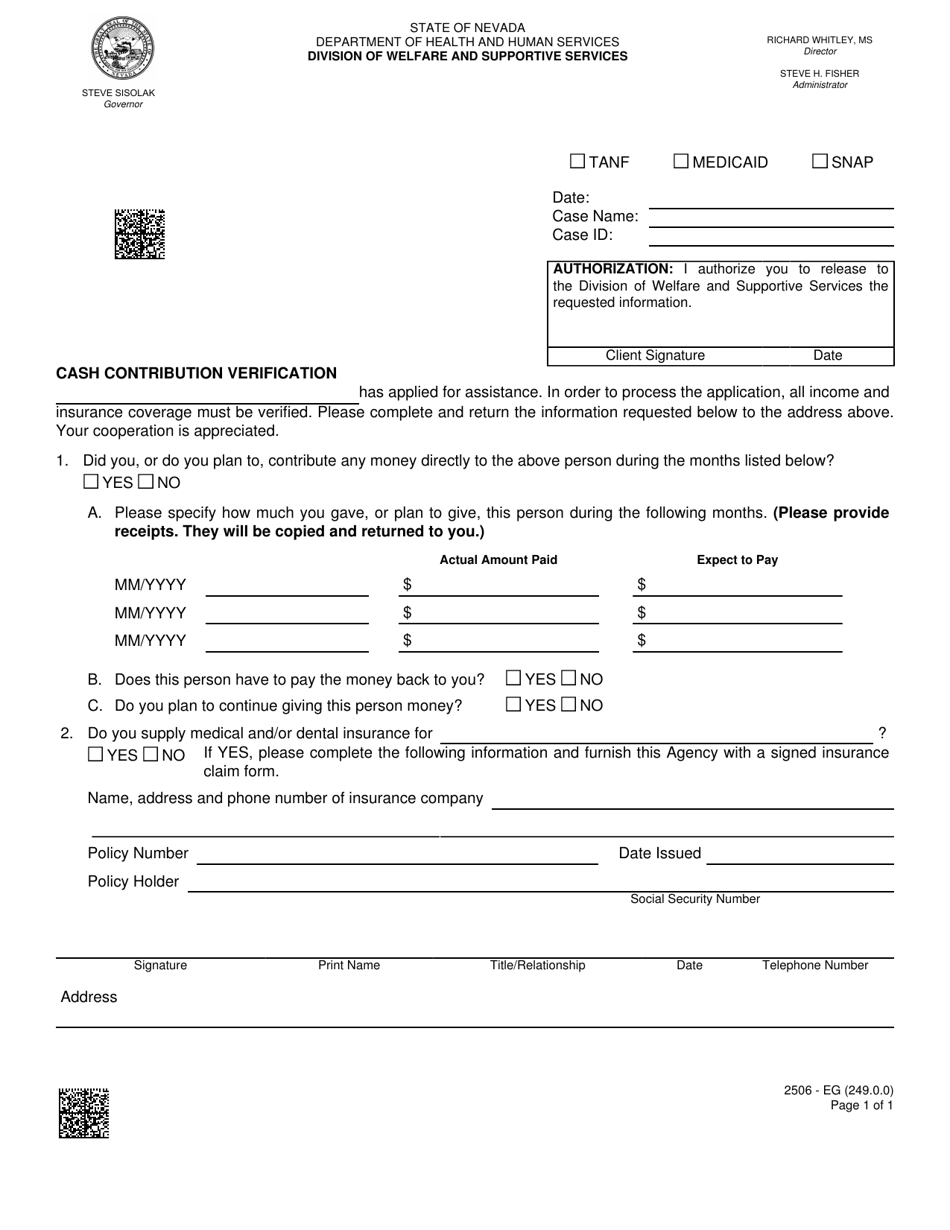

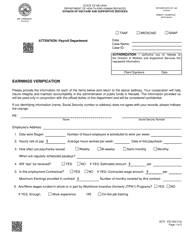

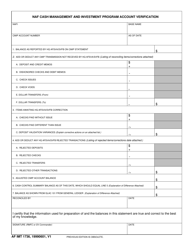

Form 2056-EG Cash Contribution Verification - Nevada

What Is Form 2056-EG?

This is a legal form that was released by the Nevada Department of Health and Human Services - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2056-EG Cash Contribution Verification?

A: Form 2056-EG is a document used to verify cash contributions made in Nevada.

Q: Who needs to complete Form 2056-EG Cash Contribution Verification?

A: Individuals and businesses who have made cash contributions in Nevada may need to complete this form.

Q: What is the purpose of Form 2056-EG Cash Contribution Verification?

A: The purpose of this form is to provide documentation and verification of cash contributions made in Nevada.

Q: Are there any specific requirements for completing Form 2056-EG Cash Contribution Verification?

A: Yes, there are specific requirements mentioned in the form instructions. It is important to read and follow these instructions carefully.

Q: When is Form 2056-EG Cash Contribution Verification due?

A: The due date for this form may vary. It is important to check the form instructions or contact the Nevada Department of Taxation for the specific deadline.

Q: Are there any fees associated with submitting Form 2056-EG Cash Contribution Verification?

A: No, there are no fees mentioned for submitting this form.

Q: What should I do with Form 2056-EG Cash Contribution Verification once completed?

A: You should keep a copy of the completed form for your records and submit it according to the instructions provided by the Nevada Department of Taxation.

Form Details:

- The latest edition provided by the Nevada Department of Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2056-EG by clicking the link below or browse more documents and templates provided by the Nevada Department of Health and Human Services.