This version of the form is not currently in use and is provided for reference only. Download this version of

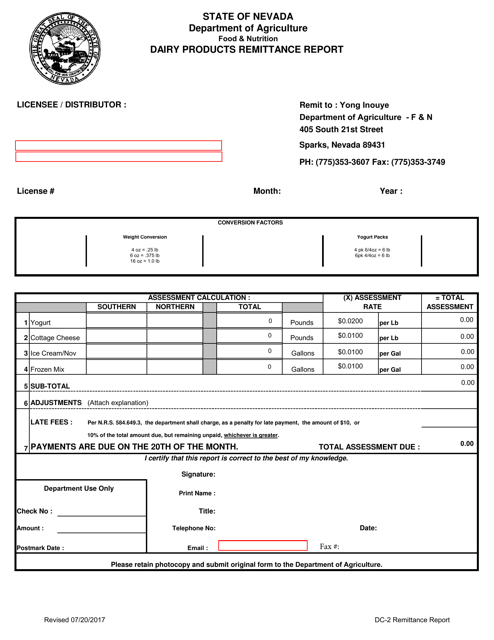

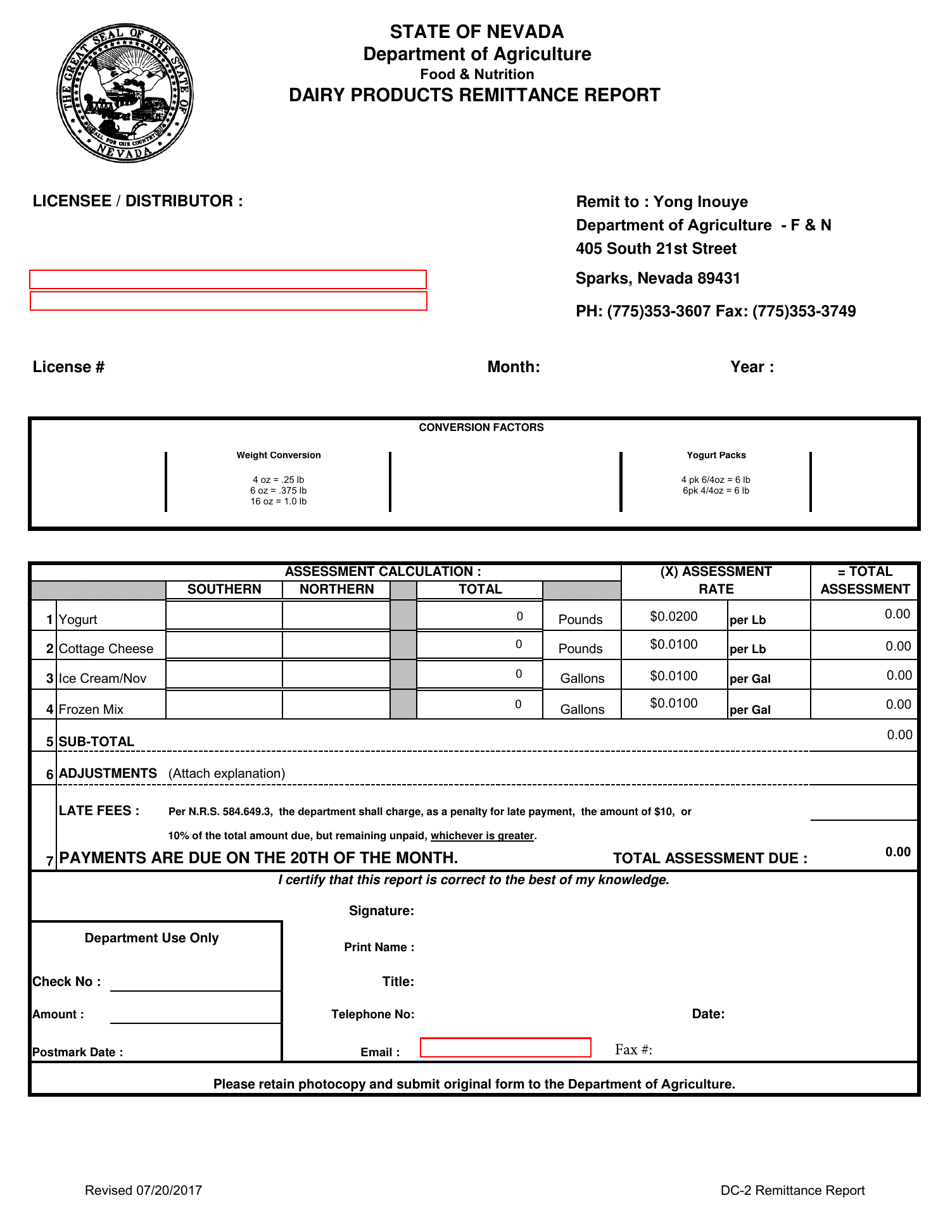

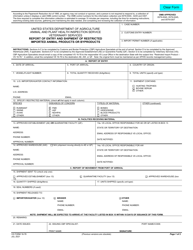

Form DC-2

for the current year.

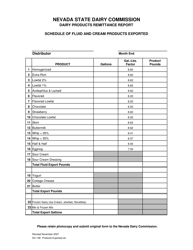

Form DC-2 Dairy Products Remittance Report - Nevada

What Is Form DC-2?

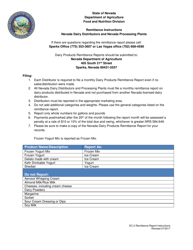

This is a legal form that was released by the Nevada Department of Agriculture - a government authority operating within Nevada. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DC-2?

A: Form DC-2 is the Dairy Products Remittance Report for the state of Nevada.

Q: What is the purpose of Form DC-2?

A: The purpose of Form DC-2 is to report and remit sales and use taxes on dairy products sold in Nevada.

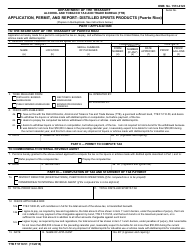

Q: Who needs to file Form DC-2?

A: Any person or business that sells dairy products in Nevada needs to file Form DC-2.

Q: When is the due date for filing Form DC-2?

A: Form DC-2 is due on or before the last day of the month following the end of the reporting period.

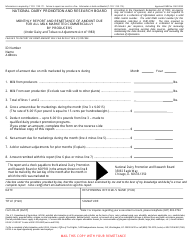

Q: Are there any penalties for late filing of Form DC-2?

A: Yes, there are penalties for late filing of Form DC-2, including potential interest charges and possible license revocation.

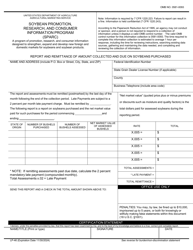

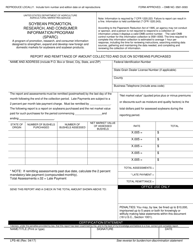

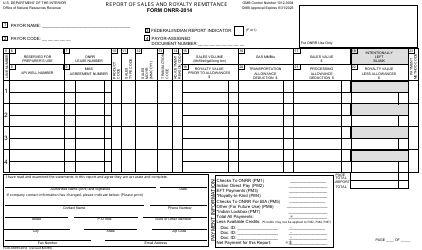

Q: What information is required on Form DC-2?

A: Form DC-2 requires information such as the taxpayer's name, address, and tax identification number, as well as details of the dairy products sold and the corresponding sales and use tax amounts.

Q: Can I file Form DC-2 electronically?

A: Yes, you can file Form DC-2 electronically through the Nevada Taxpayer Access Point (TAP) system.

Q: Do I need to keep records of my sales for Form DC-2?

A: Yes, you are required to keep records of your sales of dairy products for a period of at least four years from the filing date of Form DC-2.

Q: Who can I contact for more information about Form DC-2?

A: For more information about Form DC-2, you can contact the Nevada Department of Taxation.

Form Details:

- Released on July 20, 2017;

- The latest edition provided by the Nevada Department of Agriculture;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DC-2 by clicking the link below or browse more documents and templates provided by the Nevada Department of Agriculture.