This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

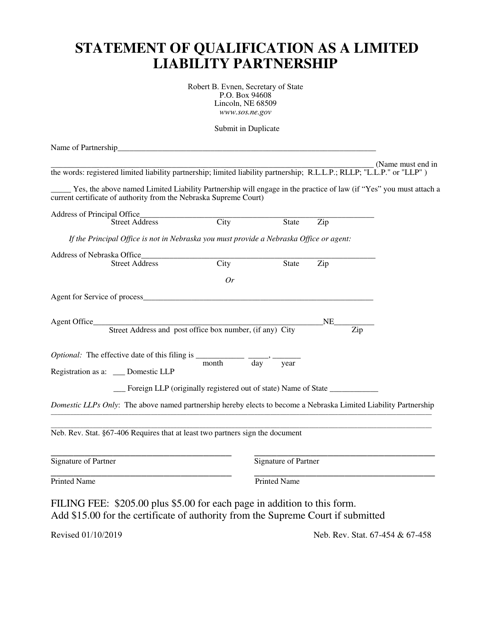

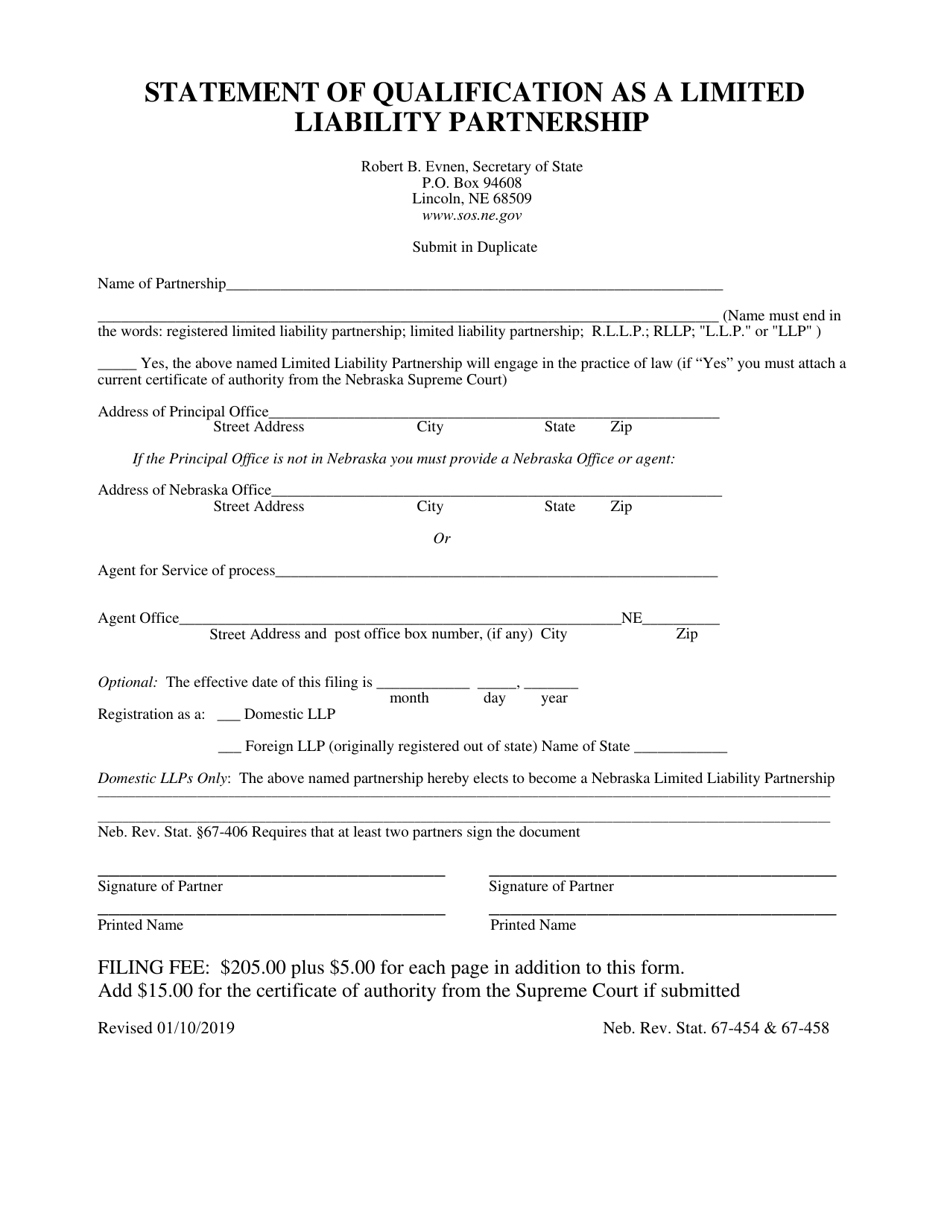

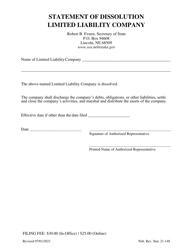

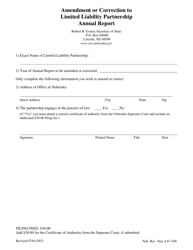

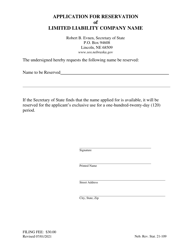

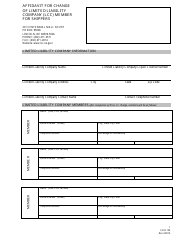

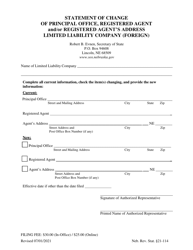

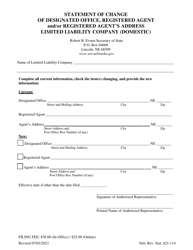

Statement of Qualification as a Limited Liability Partnership - Nebraska

Statement of Qualification as a Limited Liability Partnership is a legal document that was released by the Nebraska Secretary of State - a government authority operating within Nebraska.

FAQ

Q: What is a Limited Liability Partnership (LLP)?

A: A Limited Liability Partnership (LLP) is a business structure that combines elements of a partnership and a corporation. It provides limited liability protection to its partners.

Q: What are the benefits of forming a Limited Liability Partnership (LLP)?

A: The benefits of forming an LLP include limited liability protection for partners, flexibility in management and tax advantages.

Q: How do I form a Limited Liability Partnership (LLP) in Nebraska?

A: To form an LLP in Nebraska, you need to file a Statement of Qualification with the Nebraska Secretary of State and pay the required filing fee.

Q: What information is required to file a Statement of Qualification for an LLP?

A: The information required to file a Statement of Qualification for an LLP includes the name and address of the LLP, the name and address of the registered agent, and the names and addresses of the partners.

Q: What are the ongoing requirements for an LLP in Nebraska?

A: The ongoing requirements for an LLP in Nebraska include maintaining a registered agent, filing an annual report, and paying the required fees.

Q: Are partners in an LLP personally liable for the debts and liabilities of the partnership?

A: No, partners in an LLP are generally not personally liable for the debts and liabilities of the partnership, but they may be held personally liable for their own wrongful acts or misconduct.

Q: Can an LLP be converted to a different business structure?

A: Yes, an LLP can be converted to a different business structure such as a corporation or a limited liability company, depending on the state laws and the specific requirements.

Q: Can an LLP operate in multiple states?

A: Yes, an LLP can operate in multiple states, but it needs to qualify as a foreign LLP in each state where it wants to conduct business.

Q: What is the difference between an LLP and a general partnership?

A: The main difference between an LLP and a general partnership is that partners in an LLP have limited liability protection, while partners in a general partnership have unlimited personal liability for the debts and obligations of the partnership.

Q: Is an LLP the right business structure for me?

A: The decision to form an LLP depends on various factors such as the nature of your business, your liability concerns, and tax considerations. It is advised to consult with a legal or financial professional to determine the most suitable business structure for your specific needs.

Form Details:

- Released on January 10, 2019;

- The latest edition currently provided by the Nebraska Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Secretary of State.