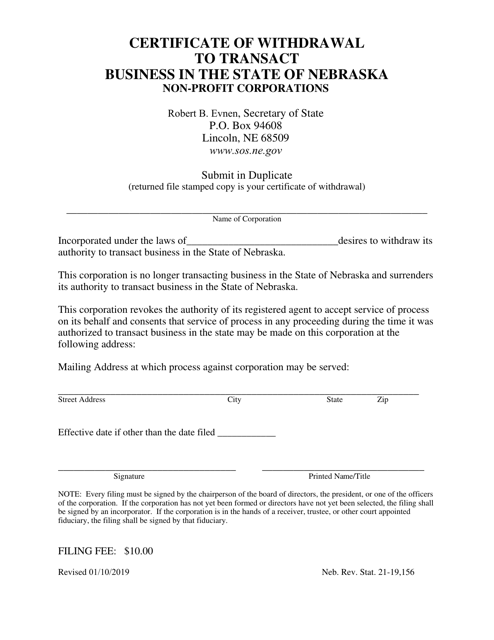

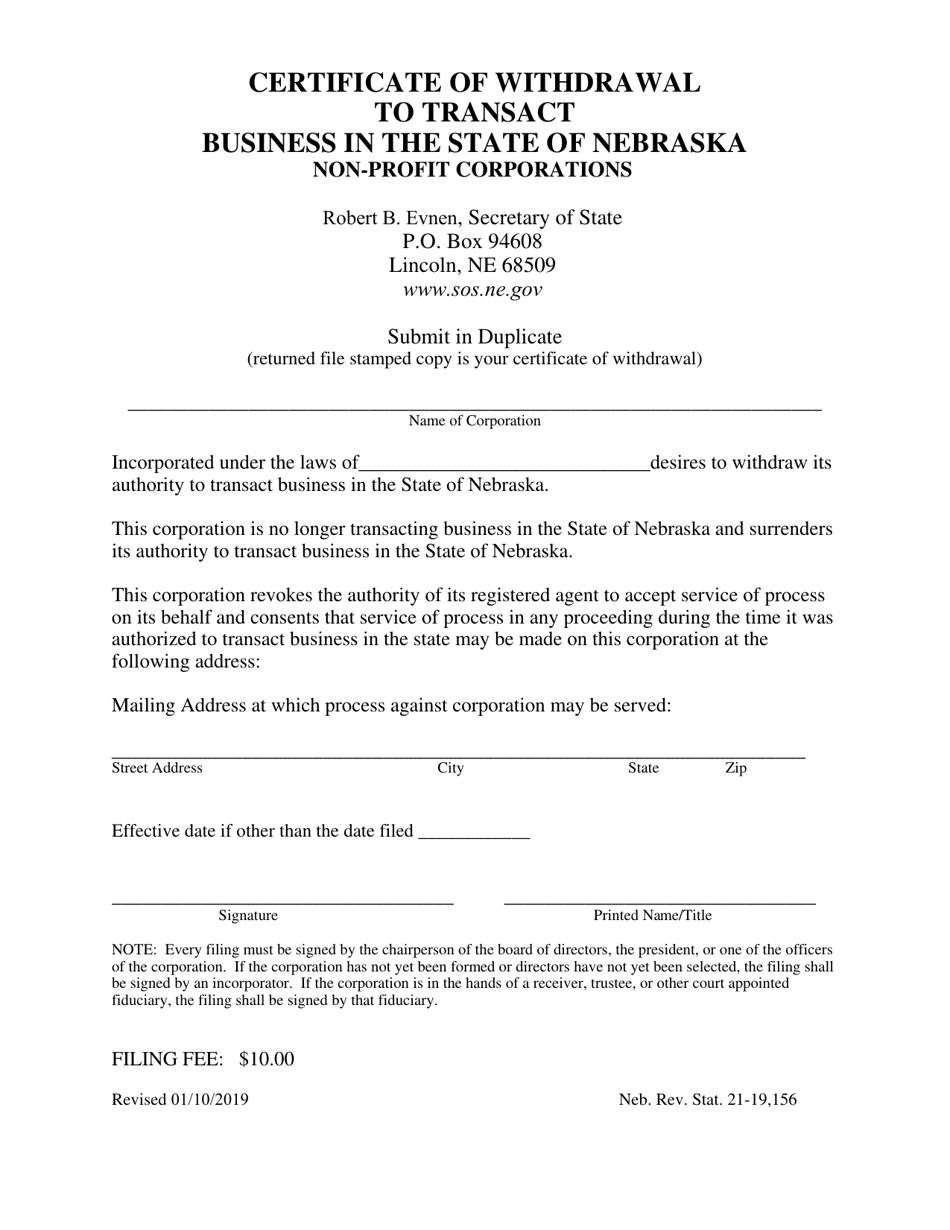

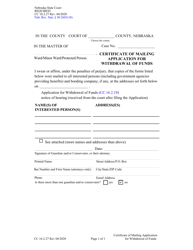

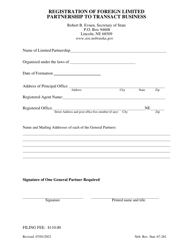

Certificate of Withdrawal to Transact Business in the State of Nebraska (Non-profit Corporations) - Nebraska

Certificate of Withdrawal to Transact Business in the State of Nebraska (Non-profit Corporations) is a legal document that was released by the Nebraska Secretary of State - a government authority operating within Nebraska.

FAQ

Q: What is a Certificate of Withdrawal to Transact Business?

A: It is a document that allows a non-profit corporation to cease its business operations in Nebraska.

Q: Who can apply for a Certificate of Withdrawal to Transact Business in Nebraska?

A: A non-profit corporation that wants to cease its business operations in Nebraska can apply for it.

Q: Does a non-profit corporation need to file a Certificate of Withdrawal to Transact Business in Nebraska?

A: Yes, if the corporation wants to cease its business operations in Nebraska.

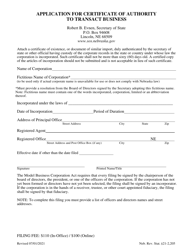

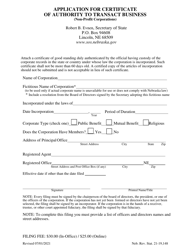

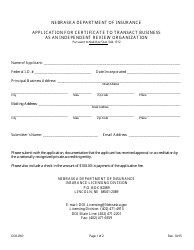

Q: What are the requirements to file a Certificate of Withdrawal to Transact Business in Nebraska?

A: The non-profit corporation must be in good standing with the Nebraska Secretary of State and must submit the required forms and fees.

Q: How can a non-profit corporation file a Certificate of Withdrawal to Transact Business in Nebraska?

A: The corporation needs to complete the necessary forms, including the Certificate of Withdrawal, and submit them along with the required fees to the Nebraska Secretary of State.

Q: Is it possible to expedite the processing of a Certificate of Withdrawal to Transact Business in Nebraska?

A: Yes, it is possible to expedite the processing of the Certificate of Withdrawal by paying an additional fee.

Q: How long does it take to process a Certificate of Withdrawal to Transact Business in Nebraska?

A: The processing time can vary, but it generally takes a few business days to complete.

Q: What happens after a Certificate of Withdrawal to Transact Business is approved in Nebraska?

A: Once approved, the non-profit corporation will no longer be authorized to transact business in Nebraska.

Q: Is there a deadline for filing a Certificate of Withdrawal to Transact Business in Nebraska?

A: There is no specific deadline, but it is recommended to file the Certificate of Withdrawal as soon as the decision to cease business operations in Nebraska is made.

Form Details:

- Released on January 10, 2019;

- The latest edition currently provided by the Nebraska Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Secretary of State.