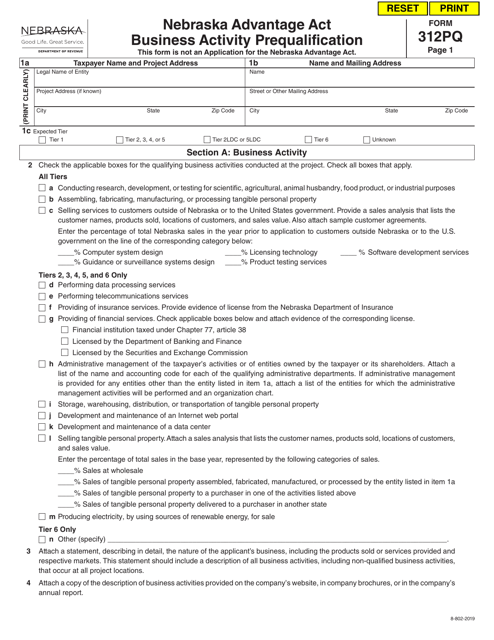

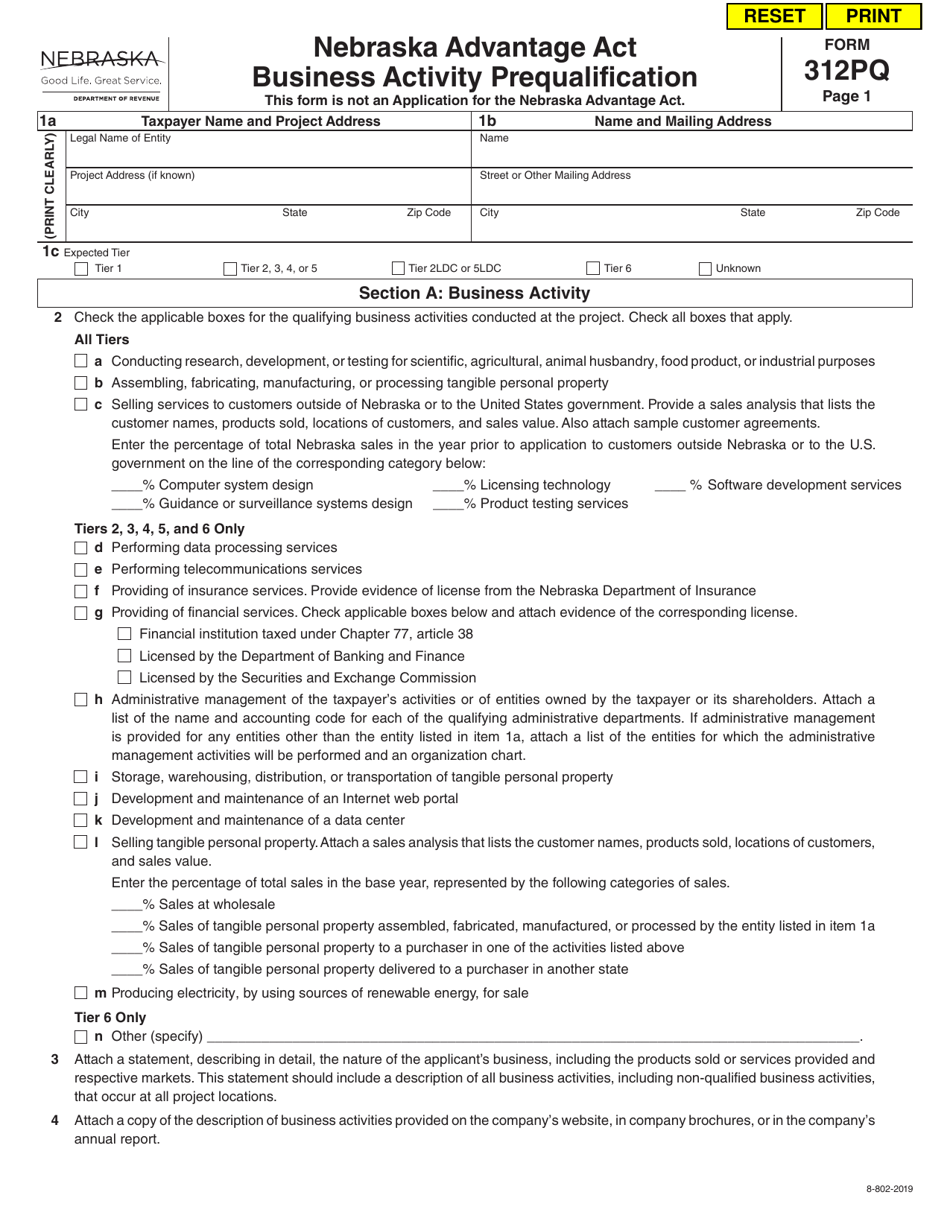

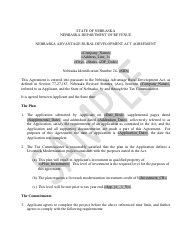

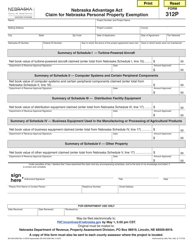

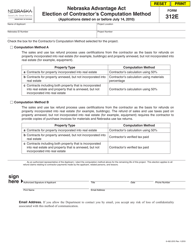

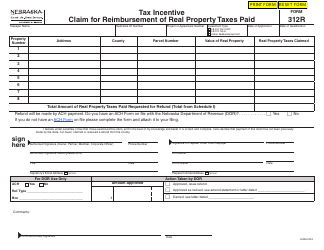

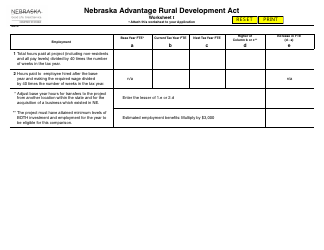

Form 312PQ Nebraska Advantage Act Business Activity Prequalification - Nebraska

What Is Form 312PQ?

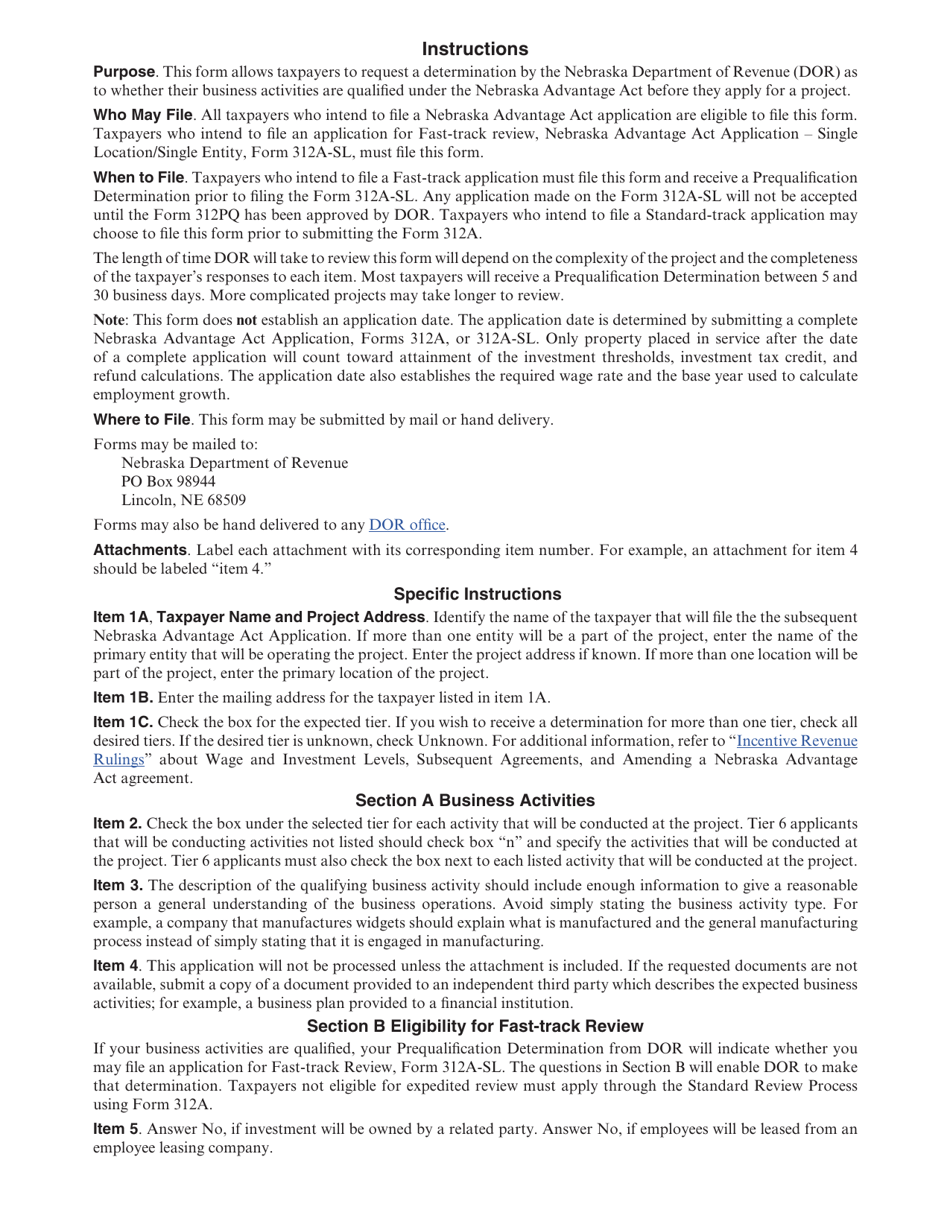

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

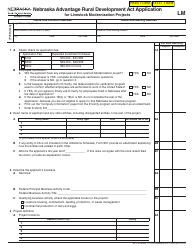

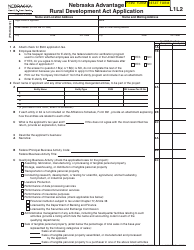

Q: What is the Nebraska Advantage Act?

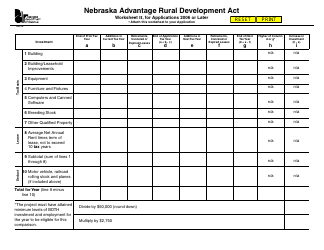

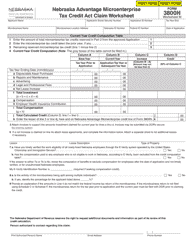

A: The Nebraska Advantage Act is a business incentive program designed to promote economic growth in Nebraska.

Q: Who is eligible for the Nebraska Advantage Act?

A: Most businesses that are engaged in qualifying activities in Nebraska are eligible for the Nebraska Advantage Act.

Q: What are qualifying activities under the Nebraska Advantage Act?

A: Qualifying activities include manufacturing, research and development, warehousing and distribution, data centers, and more.

Q: What benefits does the Nebraska Advantage Act provide?

A: The Nebraska Advantage Act offers various benefits such as tax incentives, sales tax exemptions, job training grants, and other assistance programs.

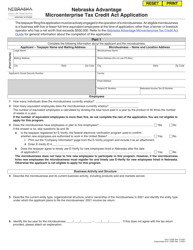

Q: How do I apply for the Nebraska Advantage Act?

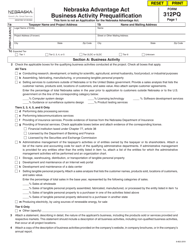

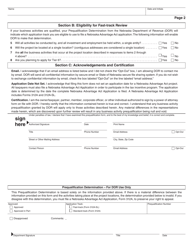

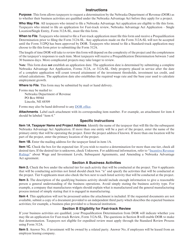

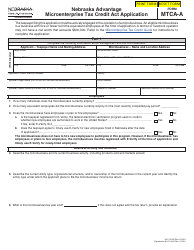

A: To apply for the Nebraska Advantage Act, businesses must complete Form 312PQ and submit it to the Nebraska Department of Revenue.

Q: What is Form 312PQ?

A: Form 312PQ is the Nebraska Advantage Act Business Activity Prequalification form that businesses need to fill out to apply for the program.

Q: What is the deadline to submit Form 312PQ?

A: There is no specific deadline to submit Form 312PQ, but it is recommended to submit it as early as possible to take advantage of the program benefits.

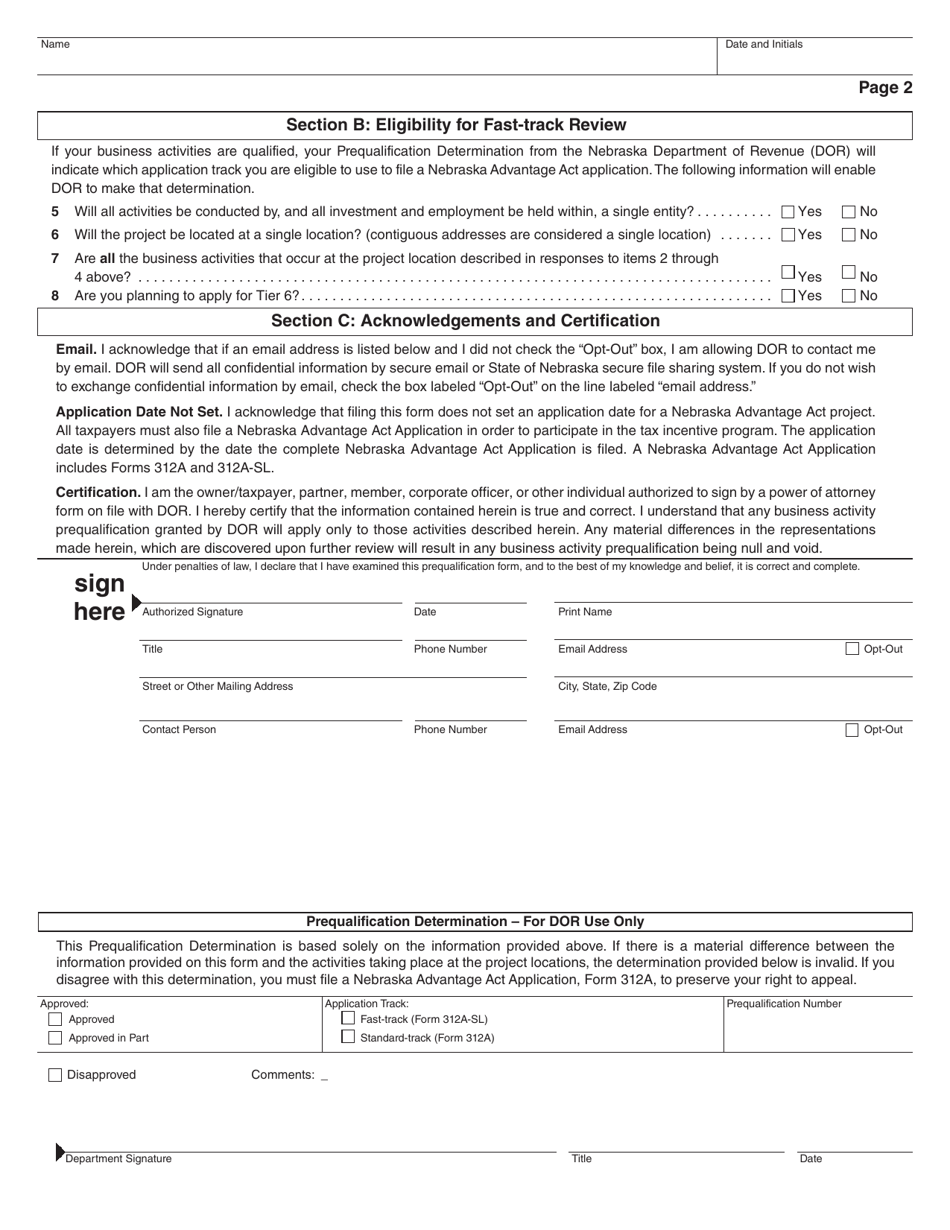

Q: What happens after I submit Form 312PQ?

A: After submitting Form 312PQ, the Nebraska Department of Revenue will review the application and determine if the business qualifies for the Nebraska Advantage Act.

Q: Is there a fee to apply for the Nebraska Advantage Act?

A: No, there is no fee to apply for the Nebraska Advantage Act.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 312PQ by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.