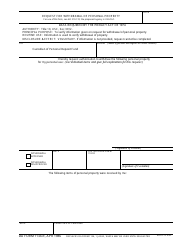

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

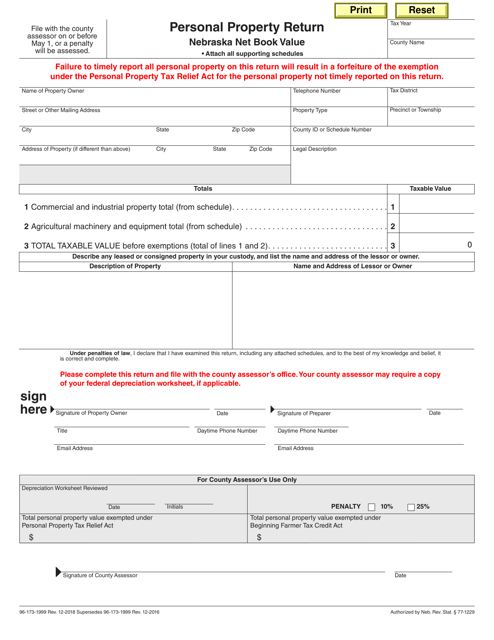

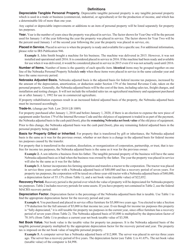

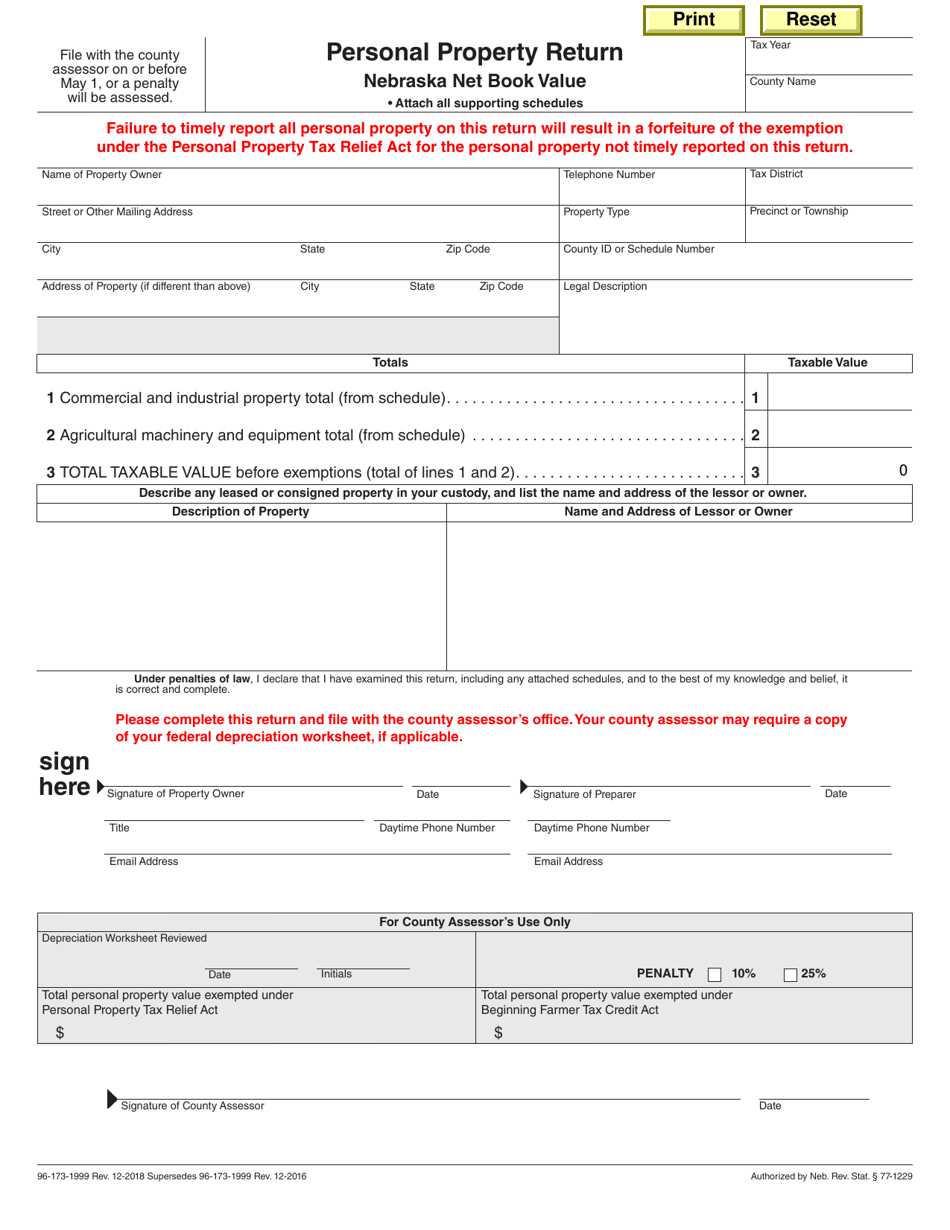

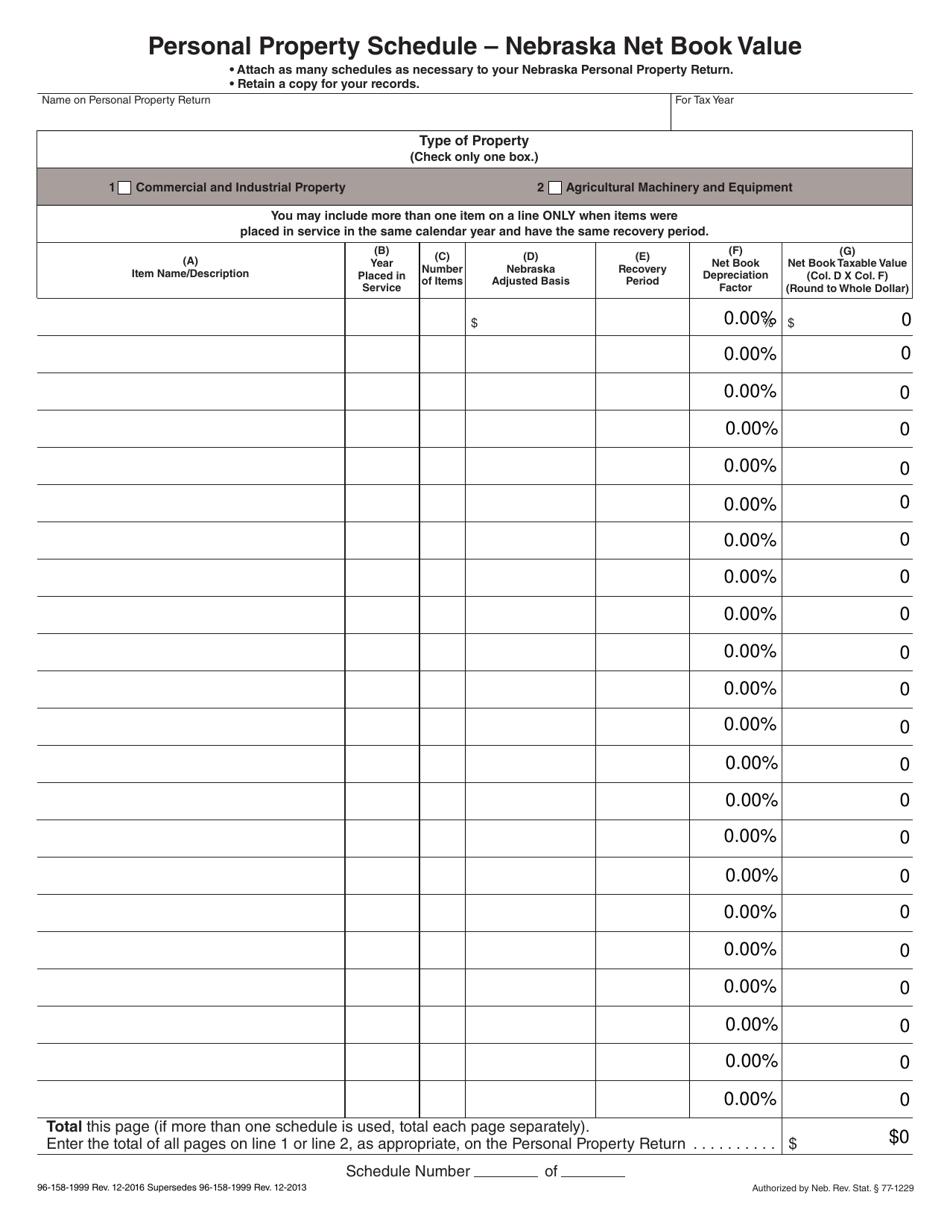

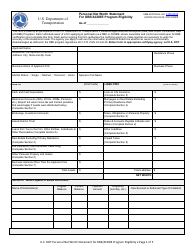

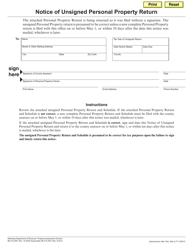

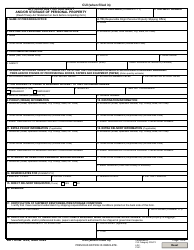

Personal Property Return - Nebraska Net Book Value - Nebraska

Personal Property Return - Nebraska Net Book Value is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

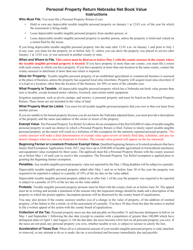

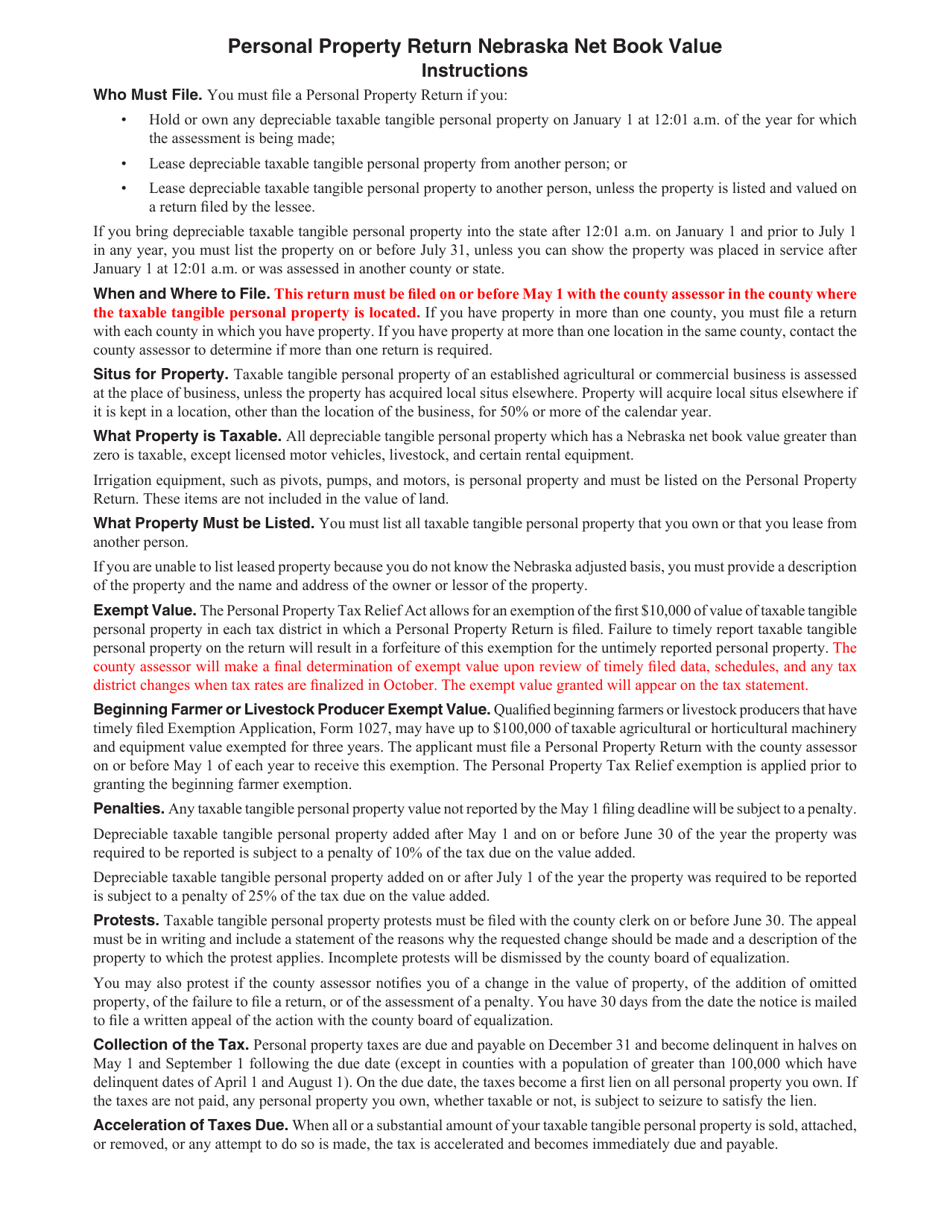

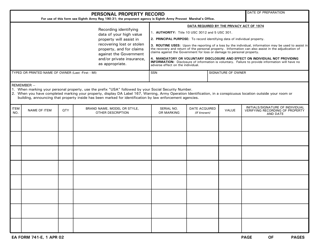

Q: What is a Personal Property Return?

A: A Personal Property Return is a form that individuals or businesses in Nebraska use to report their tangible personal property.

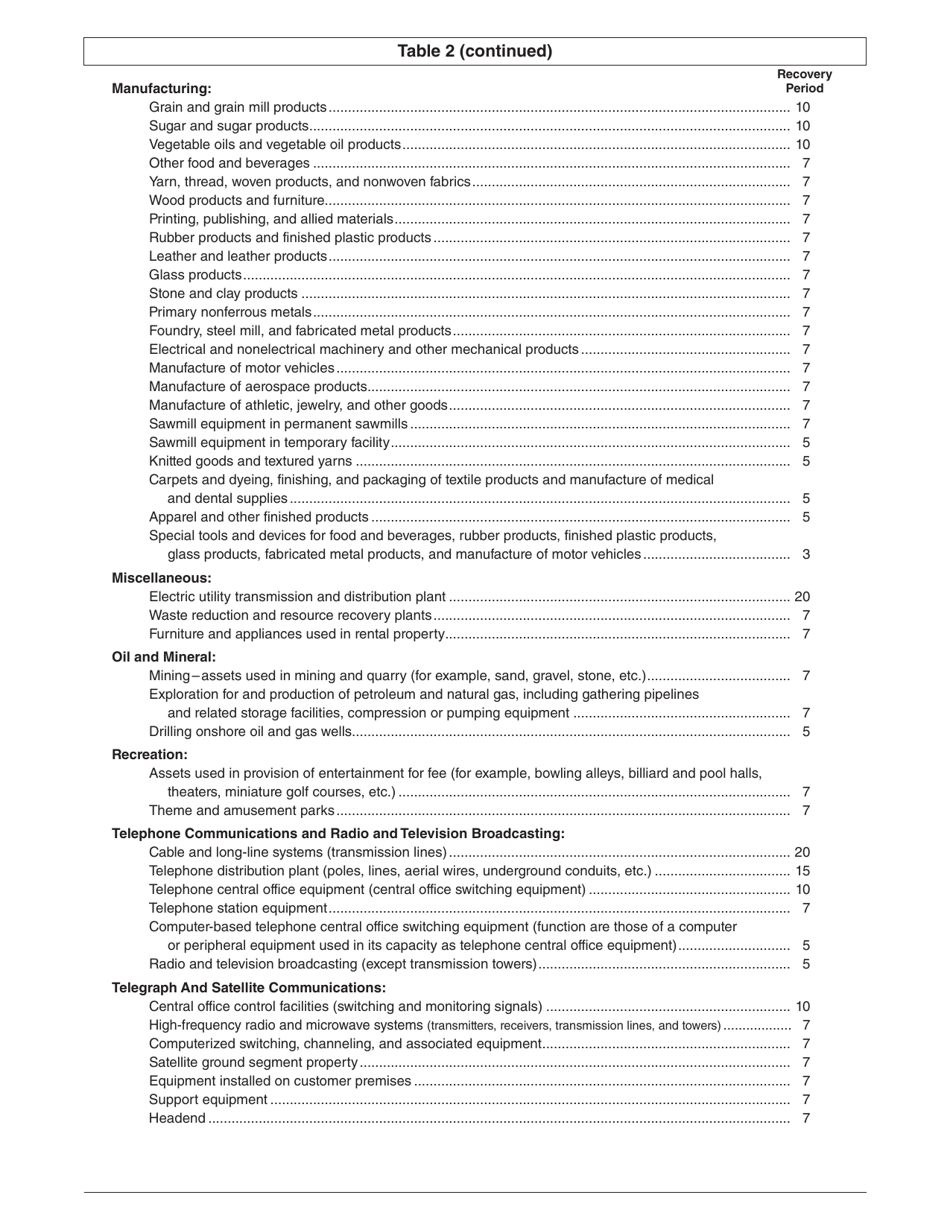

Q: What is considered tangible personal property?

A: Tangible personal property includes items such as furniture, equipment, machinery, and vehicles that are used for business purposes.

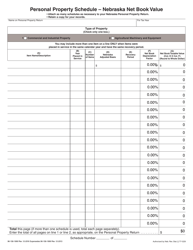

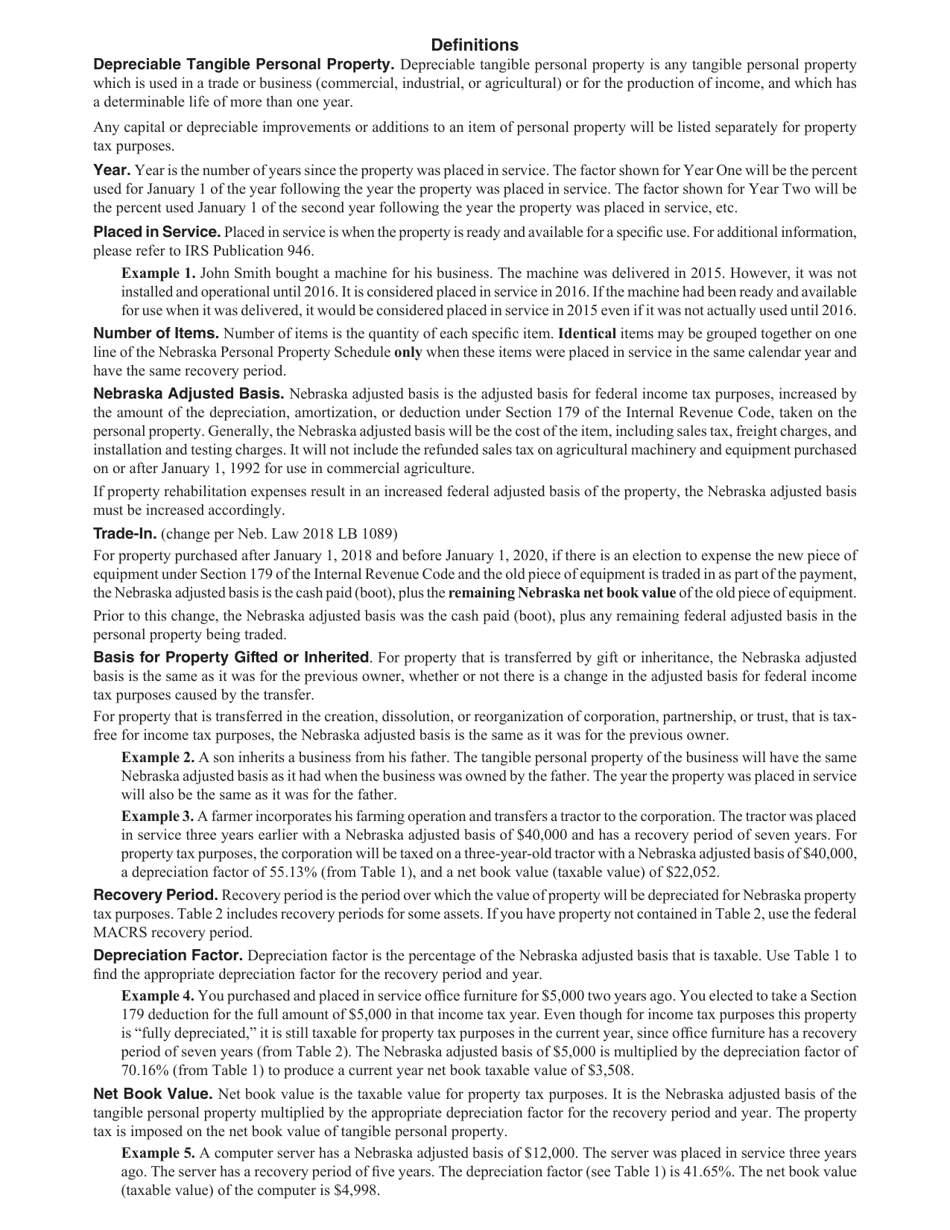

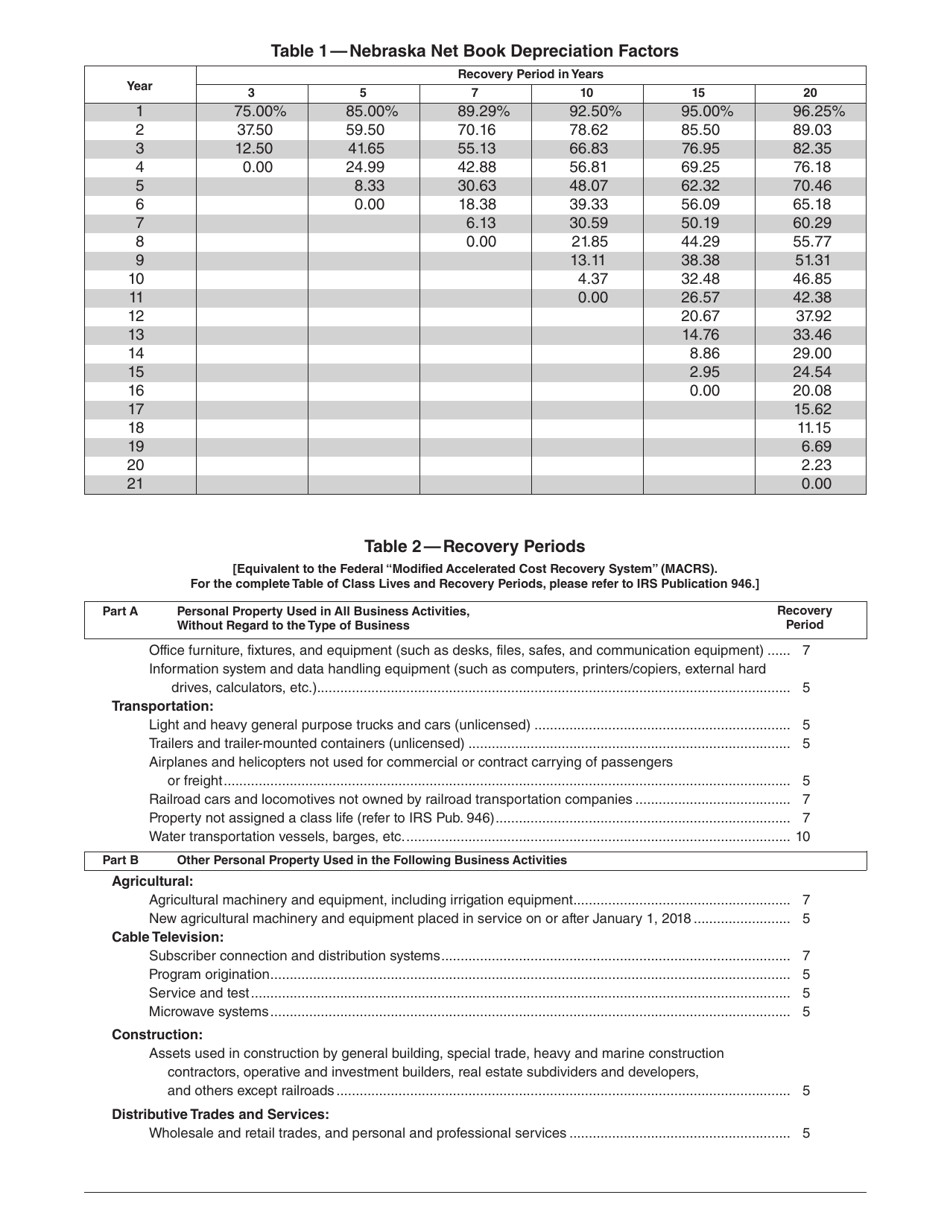

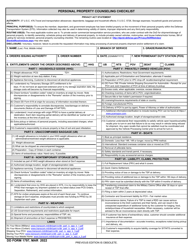

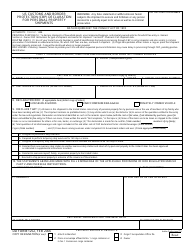

Q: What is the Net Book Value?

A: Net book value refers to the value of an asset as recorded on the books of the owner, after accounting for depreciation or amortization.

Q: What is the purpose of the Net Book Value?

A: The purpose of reporting the net book value on a Personal Property Return is to determine the assessed value of the property for tax purposes.

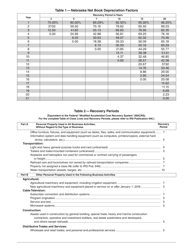

Q: How is the Net Book Value calculated?

A: The net book value is calculated by subtracting accumulated depreciation or amortization from the original cost or value of the asset.

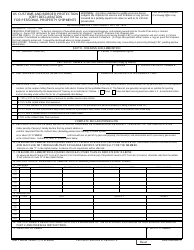

Q: Why is it important to report the Net Book Value accurately?

A: Reporting the net book value accurately helps ensure that the property is assessed fairly and that the owner pays the appropriate amount of taxes.

Form Details:

- Released on December 1, 2018;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.