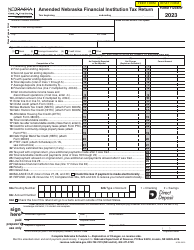

This version of the form is not currently in use and is provided for reference only. Download this version of

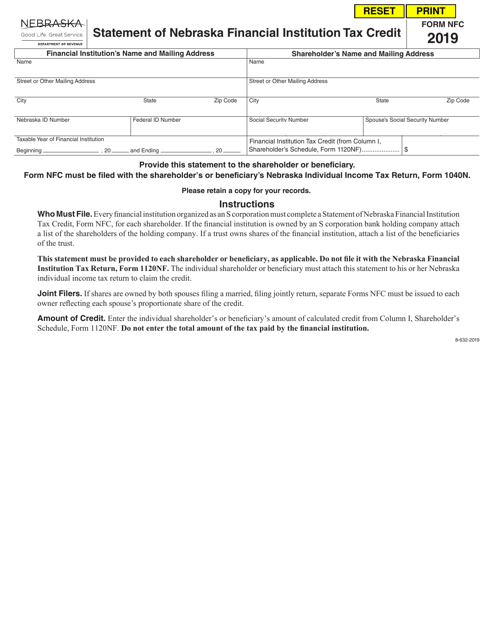

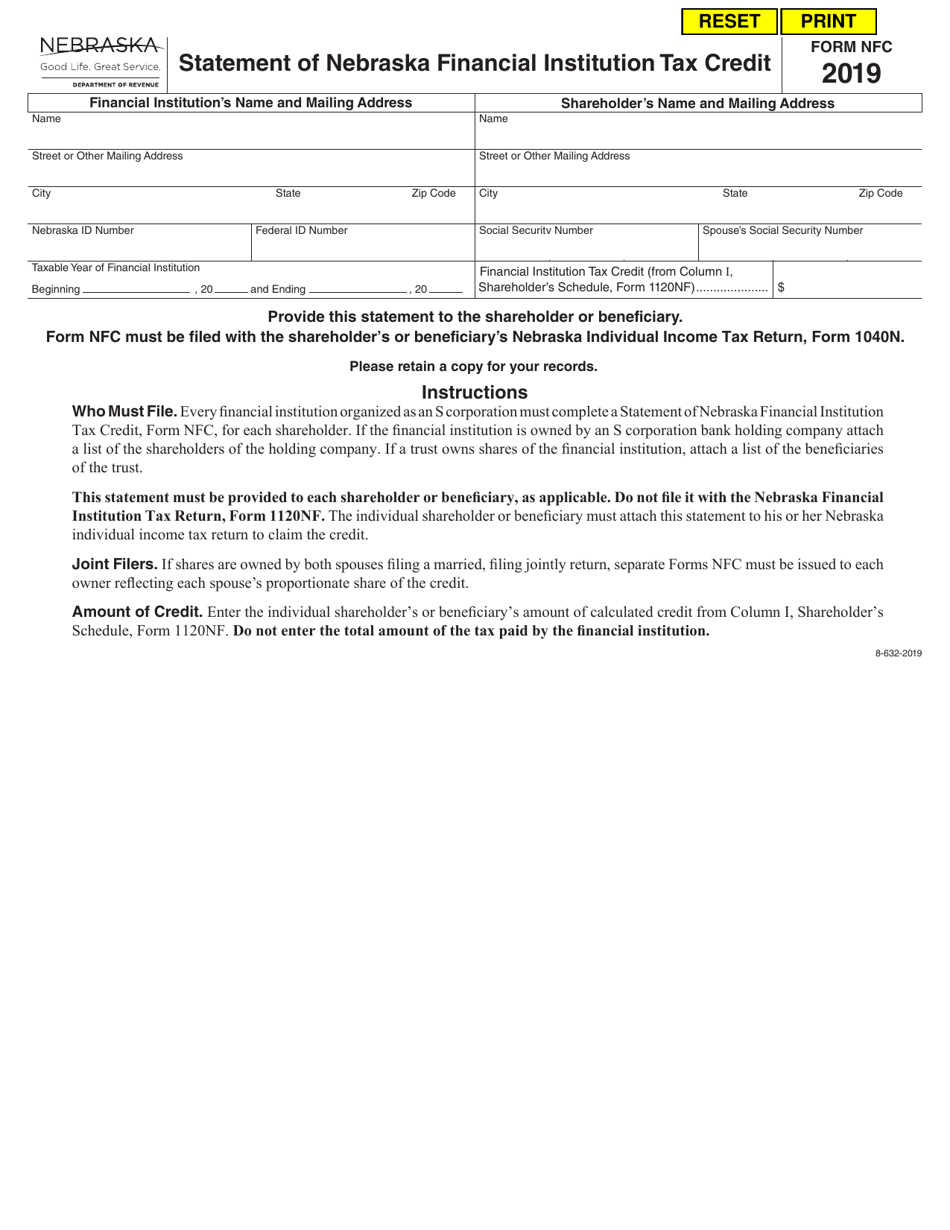

Form NFC

for the current year.

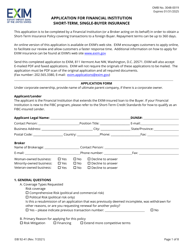

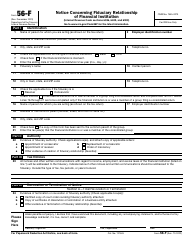

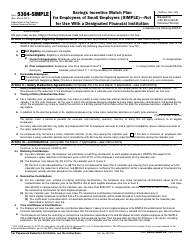

Form NFC Statement of Nebraska Financial Institution Tax Credit - Nebraska

What Is Form NFC?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NFC Statement?

A: The NFC Statement refers to the Nebraska Financial Institution Tax Credit.

Q: What is Nebraska Financial Institution Tax Credit?

A: The Nebraska Financial Institution Tax Credit is a tax credit available to financial institutions in Nebraska.

Q: How can I form the NFC Statement?

A: To form the NFC Statement, you will need to follow the guidelines provided by the Nebraska Department of Revenue.

Q: Who is eligible for the Nebraska Financial Institution Tax Credit?

A: Financial institutions operating in Nebraska are eligible for the Nebraska Financial Institution Tax Credit.

Q: What is the purpose of the Nebraska Financial Institution Tax Credit?

A: The purpose of the Nebraska Financial Institution Tax Credit is to incentivize financial institutions to invest and support economic development in Nebraska.

Q: Do I need to file the NFC Statement?

A: Yes, financial institutions in Nebraska are required to file the NFC Statement.

Q: Is the NFC Statement specific to Nebraska?

A: Yes, the NFC Statement is specific to Nebraska's tax credit program for financial institutions.

Q: Can individuals claim the Nebraska Financial Institution Tax Credit?

A: No, the Nebraska Financial Institution Tax Credit is only available to financial institutions.

Q: What are the benefits of the Nebraska Financial Institution Tax Credit?

A: The benefits of the Nebraska Financial Institution Tax Credit include reduced tax liability and support for economic development in Nebraska.

Q: When is the deadline for filing the NFC Statement?

A: The deadline for filing the NFC Statement is typically specified by the Nebraska Department of Revenue.

Q: Are there any penalties for late filing of the NFC Statement?

A: Penalties may apply for late filing of the NFC Statement, so it is important to submit it on time.

Q: What information is required for the NFC Statement?

A: The specific information required for the NFC Statement may vary, but it generally includes financial details and documentation related to the tax credit.

Q: Can I claim the Nebraska Financial Institution Tax Credit for past years?

A: It is best to consult the Nebraska Department of Revenue for information on whether past year claims are allowed.

Q: Can I amend the NFC Statement after filing?

A: You may be able to amend the NFC Statement after filing, but it is recommended to consult the Nebraska Department of Revenue for the correct procedure.

Q: Can I carry forward unused Nebraska Financial Institution Tax Credit?

A: Carrying forward unused Nebraska Financial Institution Tax Credit may be allowed, subject to the rules and limitations set by the Nebraska Department of Revenue.

Q: What happens if my NFC Statement is audited?

A: If your NFC Statement is audited, you may be required to provide additional documentation and explanations to support your claim.

Q: Can I get professional help for filing the NFC Statement?

A: Yes, you can seek professional assistance from tax advisors or accountants to help you with filing the NFC Statement.

Q: Is the Nebraska Financial Institution Tax Credit refundable?

A: The Nebraska Financial Institution Tax Credit is generally non-refundable, but it may be used to offset tax liability.

Q: Can I use the Nebraska Financial Institution Tax Credit to reduce my federal taxes?

A: No, the Nebraska Financial Institution Tax Credit can only be used to reduce Nebraska state tax liability.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NFC by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.