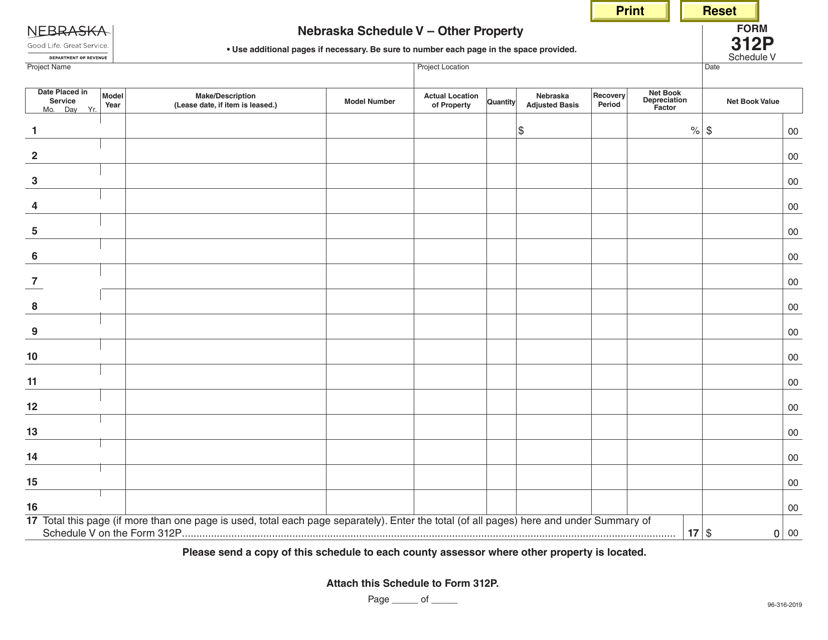

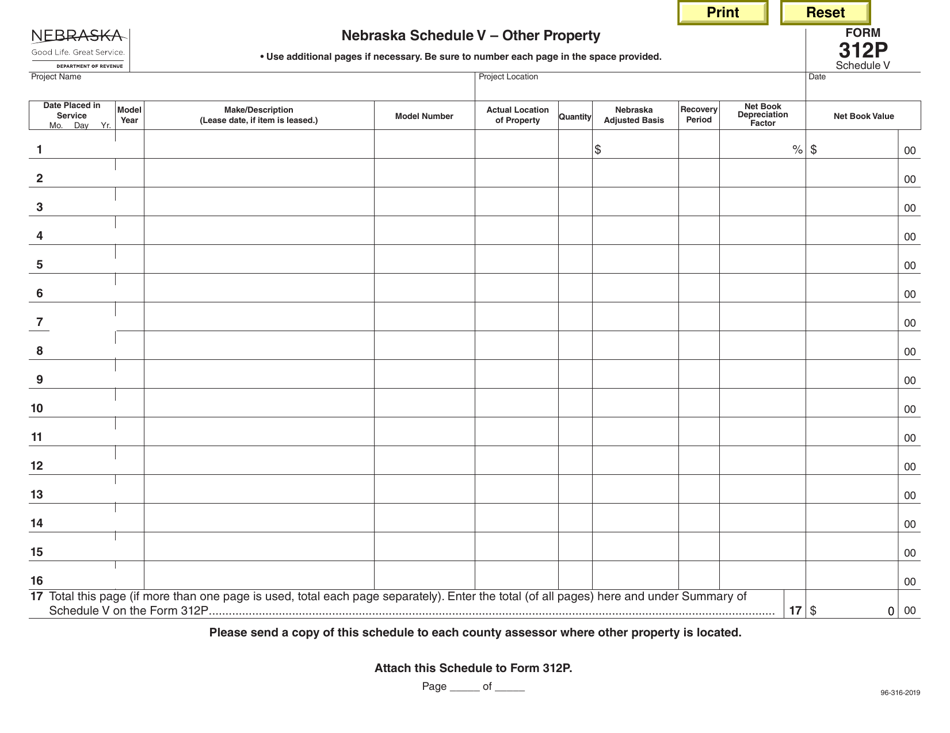

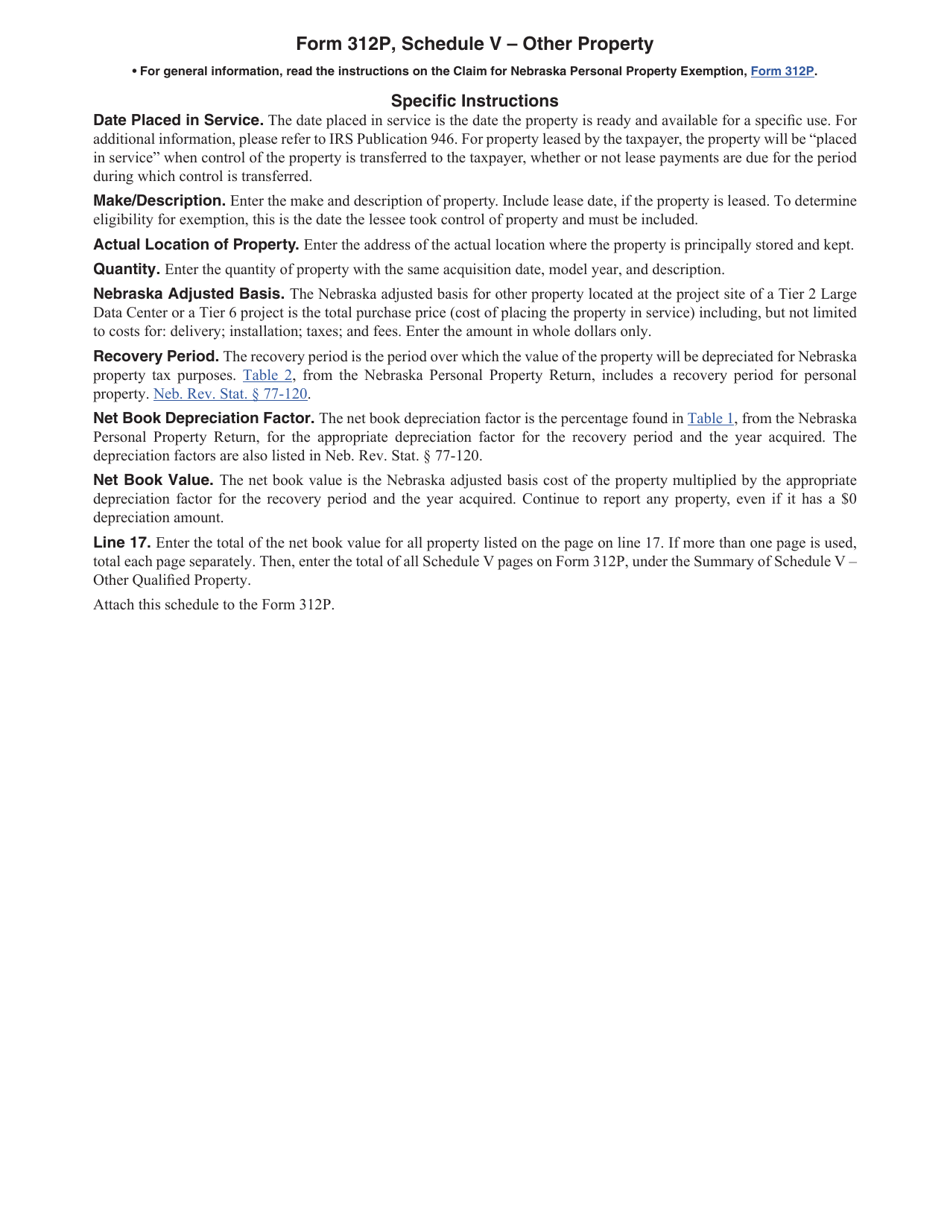

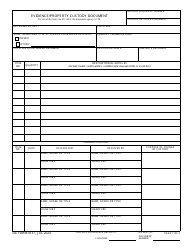

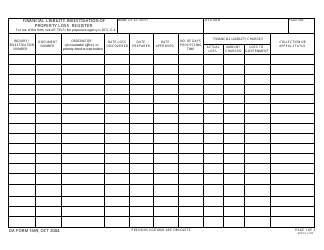

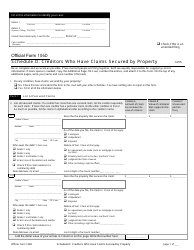

Form 312P Schedule V Other Property - Nebraska

What Is Form 312P Schedule V?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 312P, Nebraska Advantage Act Claim for Nebraska Personal Property Exemption. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 312P Schedule V?

A: Form 312P Schedule V is a tax form used by residents of Nebraska to report other property owned outside of their primary residence.

Q: Who needs to file Form 312P Schedule V?

A: Residents of Nebraska who own other property located outside of their primary residence need to file Form 312P Schedule V.

Q: What is considered 'other property'?

A: Other property refers to real estate, such as vacation homes or rental properties, that is owned by a Nebraska resident but is located outside of their primary residence.

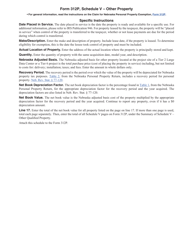

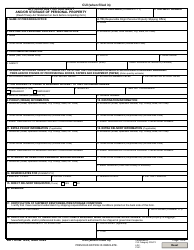

Q: What information is required on Form 312P Schedule V?

A: Form 312P Schedule V requires the description and address of the other property, as well as the percentage of ownership and the fair market value.

Q: When is the deadline to file Form 312P Schedule V?

A: The deadline to file Form 312P Schedule V is typically April 15th, but it may vary depending on the specific tax year. It is recommended to check with the Nebraska Department of Revenue for the exact deadline.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 312P Schedule V by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.