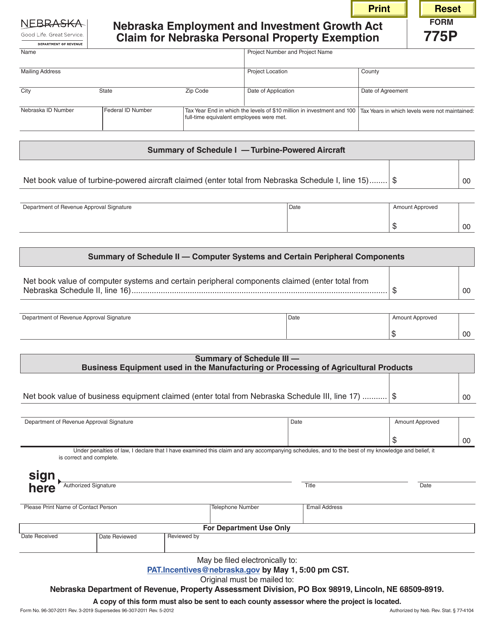

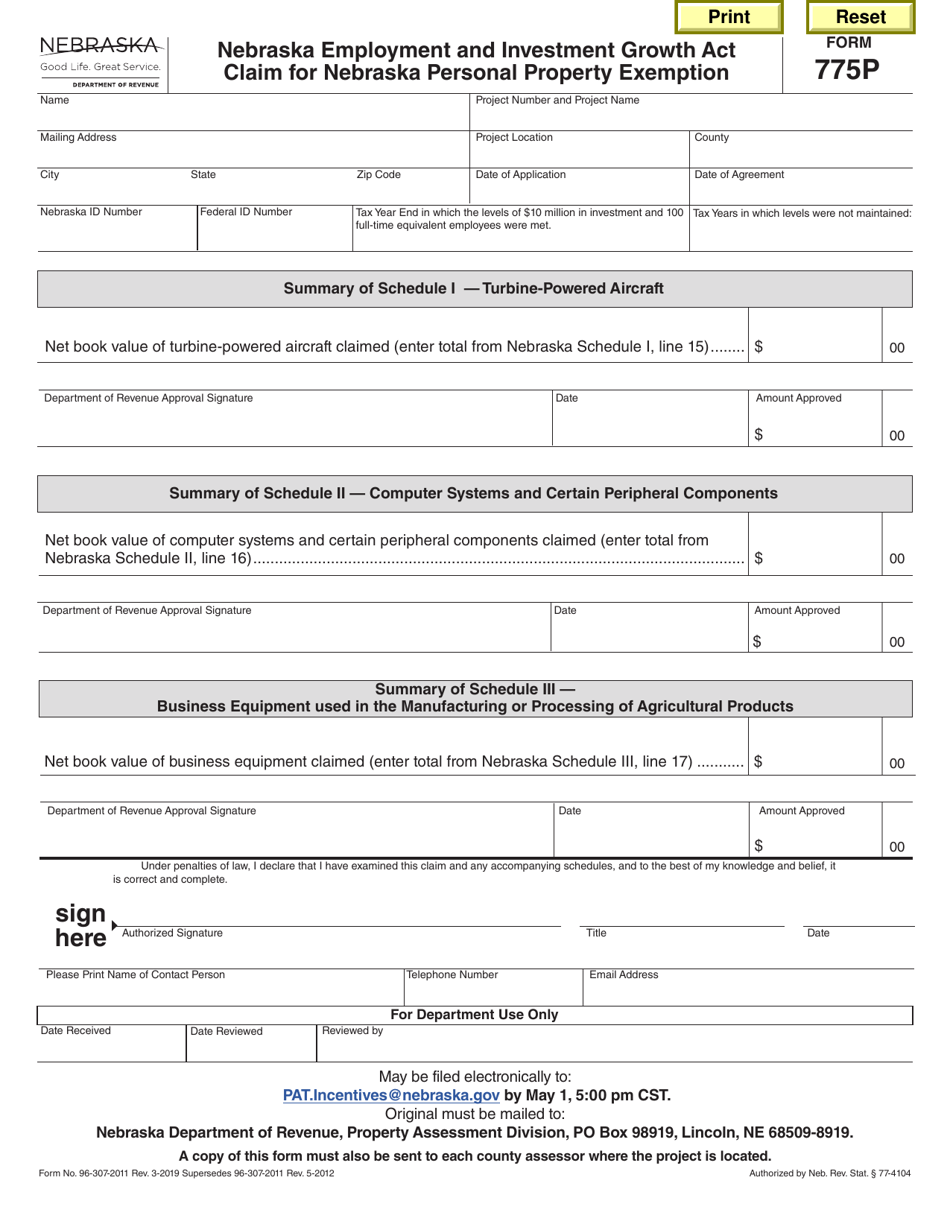

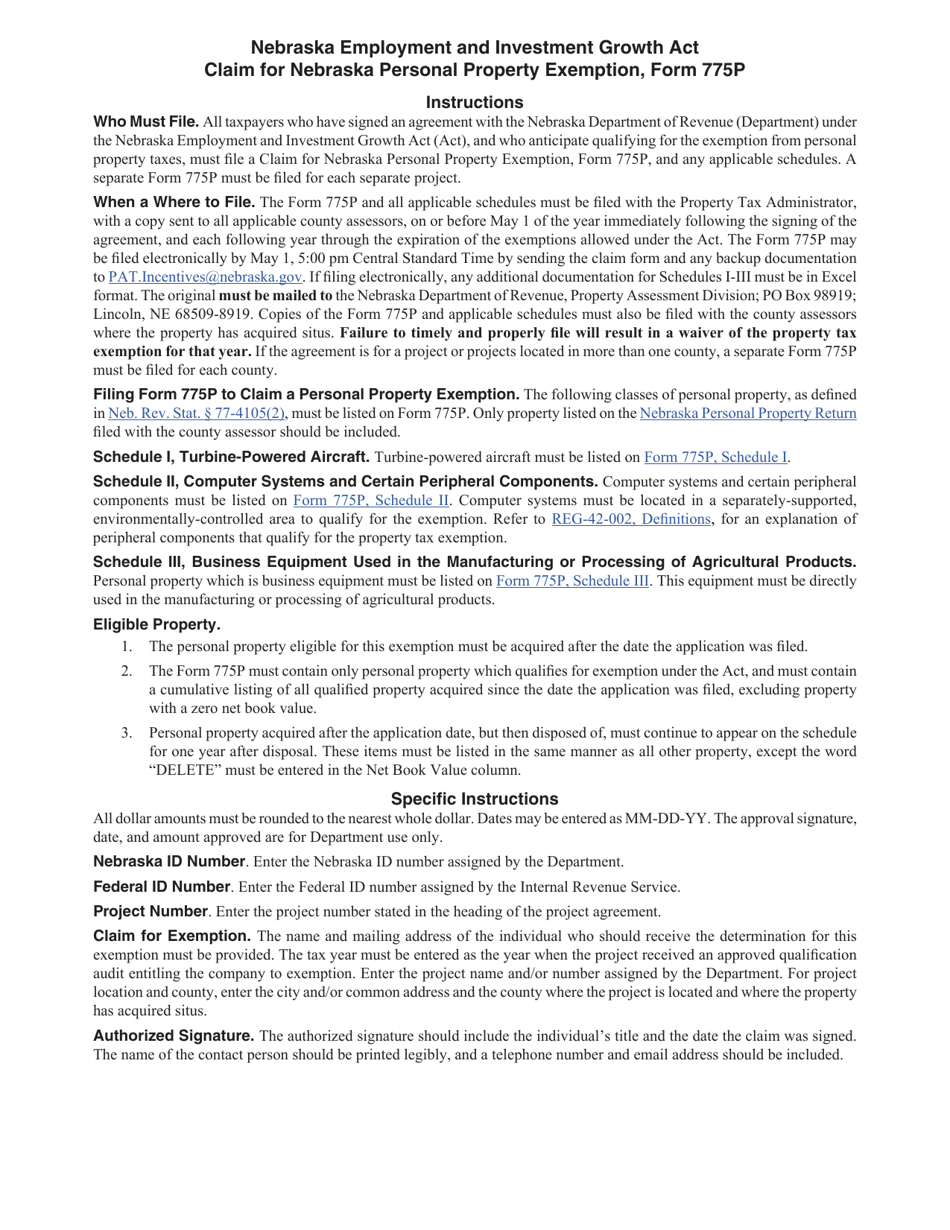

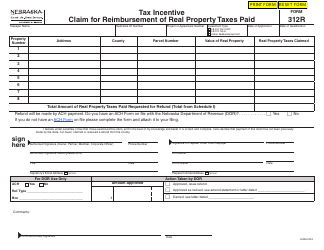

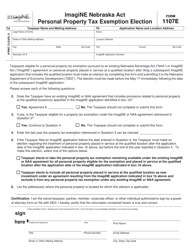

Form 775P Claim for Nebraska Personal Property Exemption - Nebraska

What Is Form 775P?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 775P?

A: Form 775P is the Claim for Nebraska Personal Property Exemption for residents of Nebraska.

Q: What is the purpose of Form 775P?

A: The purpose of Form 775P is to claim an exemption for personal property in Nebraska.

Q: Who can use Form 775P?

A: Form 775P can be used by residents of Nebraska who want to claim an exemption for their personal property.

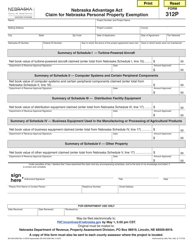

Q: What is personal property?

A: Personal property includes things like household goods, furniture, appliances, and other possessions that are not considered real estate.

Q: Which personal property can be exempted with Form 775P?

A: With Form 775P, you can claim an exemption for up to $2,500 worth of personal property.

Q: Is there a deadline for filing Form 775P?

A: Yes, Form 775P must be filed by June 30 of each year.

Q: Is there a fee for filing Form 775P?

A: No, there is no fee for filing Form 775P.

Q: What if I don't file Form 775P?

A: If you don't file Form 775P, you may not be able to claim an exemption for your personal property and may be subject to penalties.

Q: Is Form 775P only for Nebraska residents?

A: Yes, Form 775P is specifically for residents of Nebraska.

Q: Can I claim an exemption for personal property in multiple states?

A: No, Form 775P is only for claiming an exemption for personal property in Nebraska.

Q: Can I use Form 775P for business property?

A: No, Form 775P is only for claiming an exemption for personal property and does not apply to business property.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 775P by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.