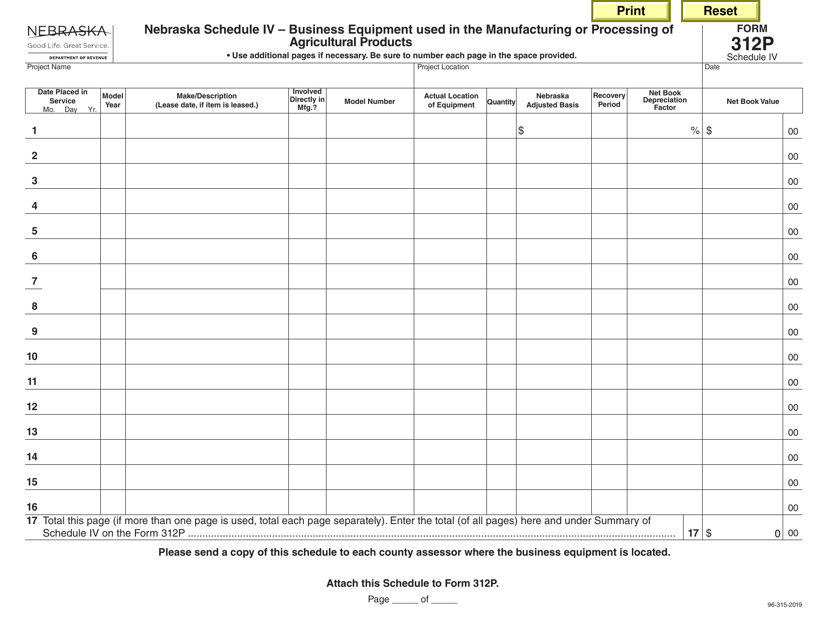

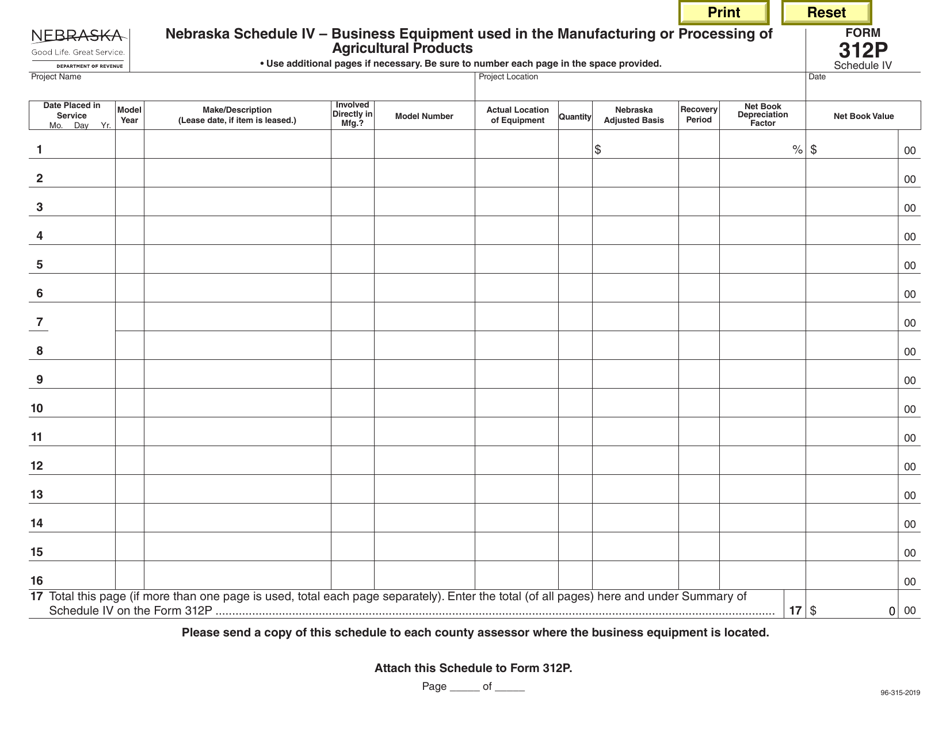

Form 312P Schedule IV Business Equipment Used in the Manufacturing or Processing of Agricultural Products - Nebraska

What Is Form 312P Schedule IV?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 312P, Nebraska Advantage Act Claim for Nebraska Personal Property Exemption. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 312P Schedule IV?

A: Form 312P Schedule IV is a form used in Nebraska for reporting business equipment used in the manufacturing or processing of agricultural products.

Q: What is the purpose of Form 312P Schedule IV?

A: The purpose of Form 312P Schedule IV is to report the use of business equipment in the manufacturing or processing of agricultural products.

Q: Who needs to file Form 312P Schedule IV?

A: Anyone who operates a business that uses equipment in the manufacturing or processing of agricultural products in Nebraska needs to file Form 312P Schedule IV.

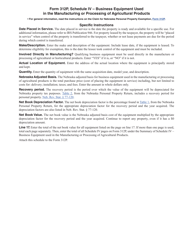

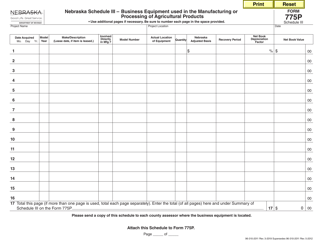

Q: What information is required on Form 312P Schedule IV?

A: Form 312P Schedule IV requires information such as the description of the equipment, its purchase date and cost, and the amount of time it was used in agricultural processing or manufacturing.

Q: When is the deadline for filing Form 312P Schedule IV?

A: The deadline for filing Form 312P Schedule IV is April 1st of each year.

Q: Are there any fees associated with filing Form 312P Schedule IV?

A: No, there are no fees associated with filing Form 312P Schedule IV.

Q: What should I do if I no longer use certain equipment listed on Form 312P Schedule IV?

A: If you no longer use certain equipment listed on Form 312P Schedule IV, you should update the form and provide the necessary information about the equipment you no longer use.

Q: What are the consequences of not filing Form 312P Schedule IV?

A: Failure to file Form 312P Schedule IV may result in penalties and fines imposed by the Nebraska Department of Revenue.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 312P Schedule IV by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.