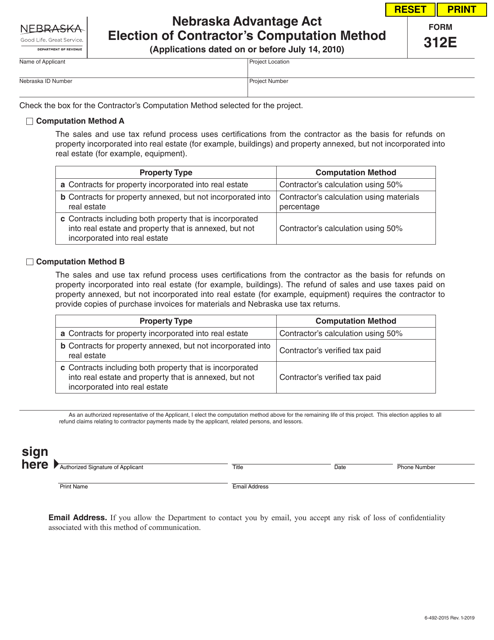

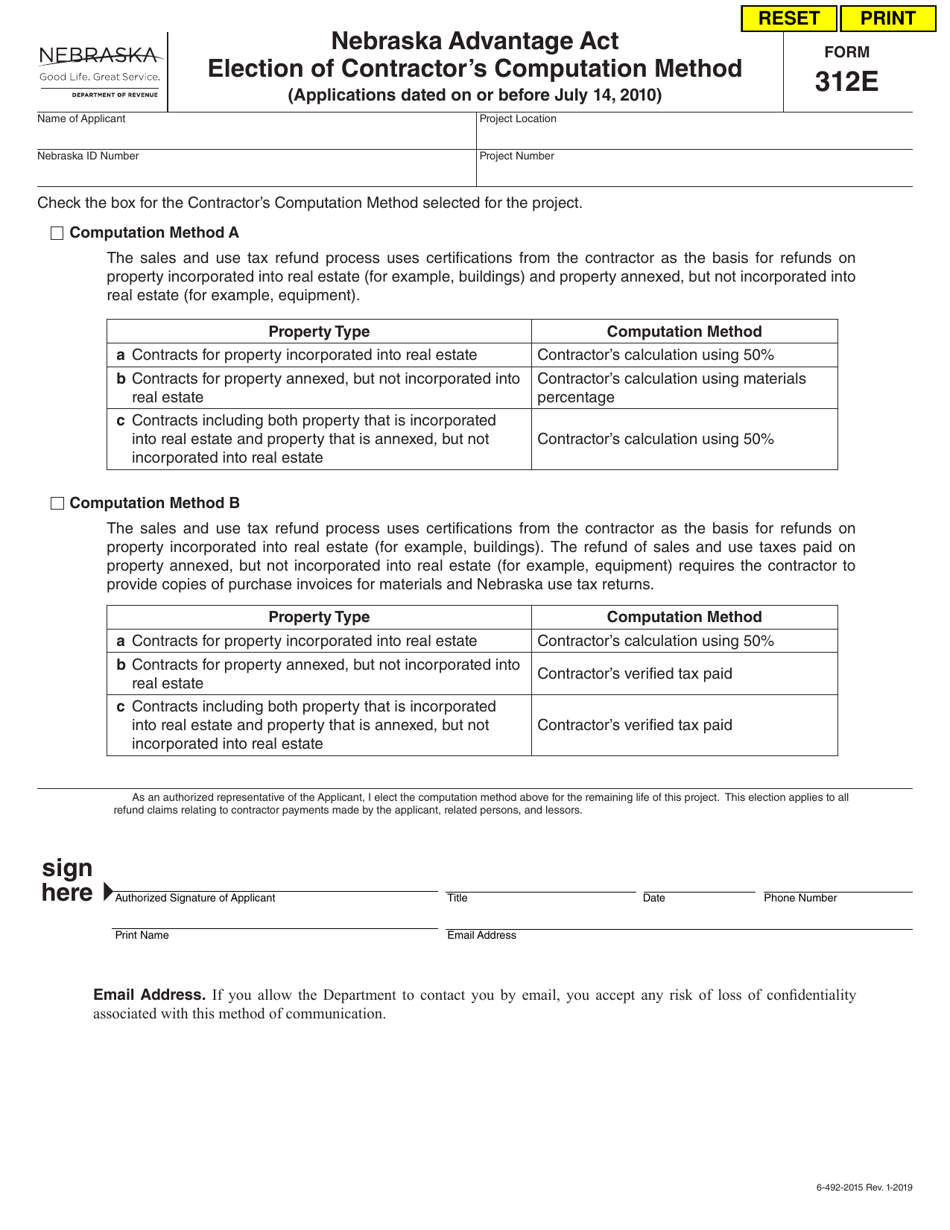

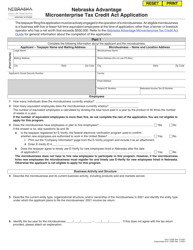

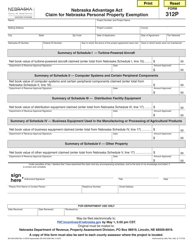

Form 312E Nebraska Advantage Act Election of Contractor's Computation Method - Nebraska

What Is Form 312E?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 312E?

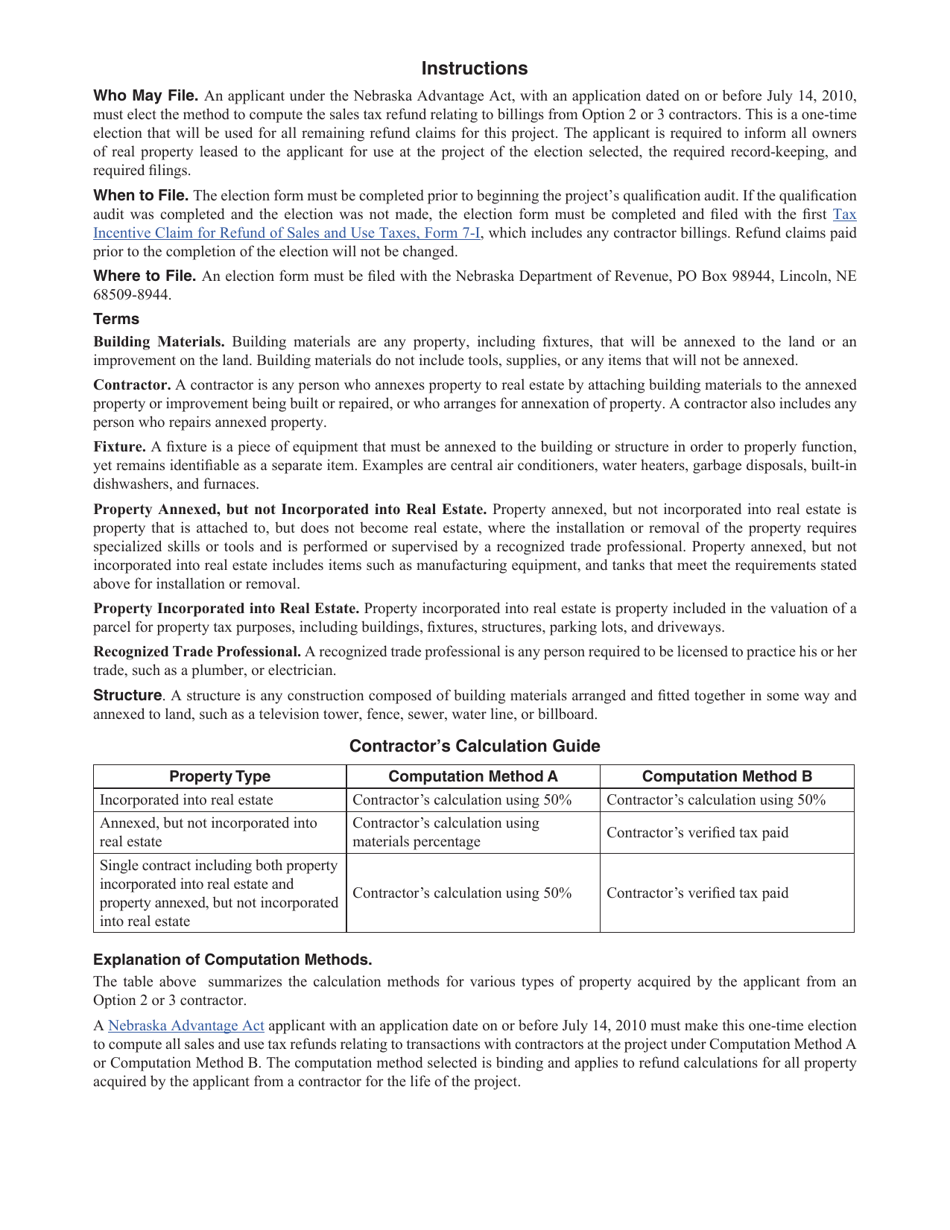

A: Form 312E is a document related to the Nebraska Advantage Act election for choosing a contractor's computation method.

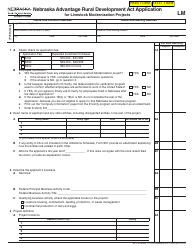

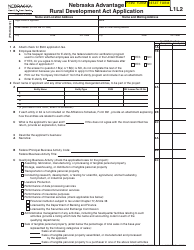

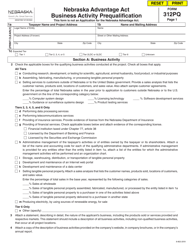

Q: What is the Nebraska Advantage Act?

A: The Nebraska Advantage Act is a law that provides tax incentives to businesses in Nebraska.

Q: What does the Form 312E Nebraska Advantage Act Election of Contractor's Computation Method deal with?

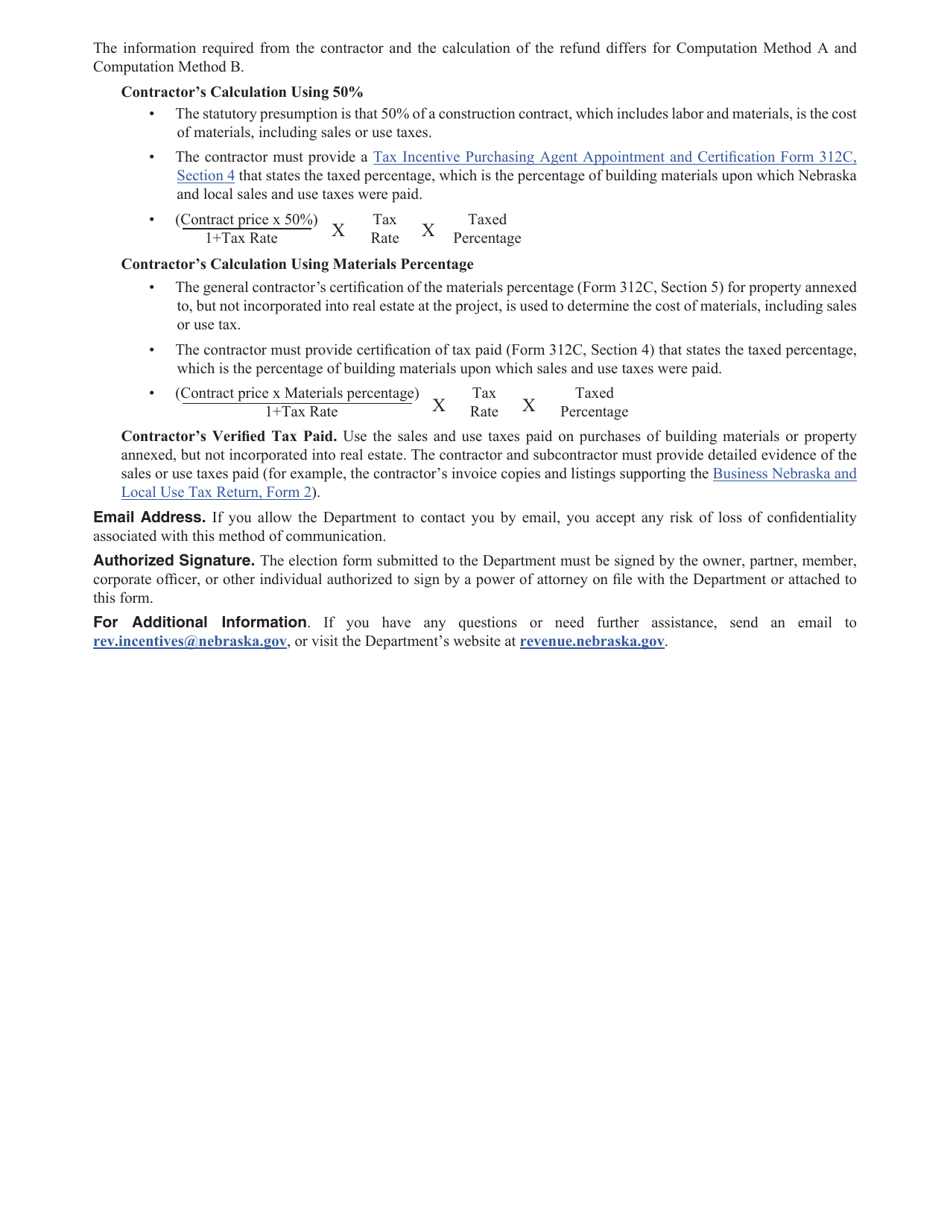

A: The form deals with the selection of a computation method for contractors under the Nebraska Advantage Act.

Q: Why is the computation method important for contractors?

A: The computation method determines how a contractor's tax liability is calculated under the Nebraska Advantage Act.

Q: Who is required to fill out Form 312E?

A: Contractors who are electing to use a specific computation method under the Nebraska Advantage Act are required to fill out this form.

Q: Are there any deadlines for submitting Form 312E?

A: Yes, contractors must submit the form before the start of a project or within 30 days of submitting a digital signature certification.

Q: What happens after submitting Form 312E?

A: After submitting the form, the contractor's chosen computation method will be used to calculate their tax liability under the Nebraska Advantage Act.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 312E by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.