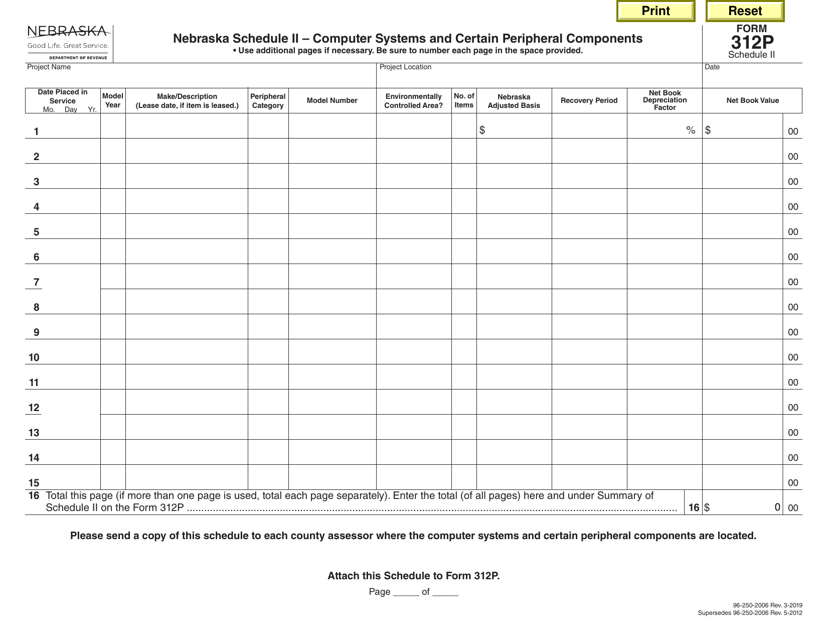

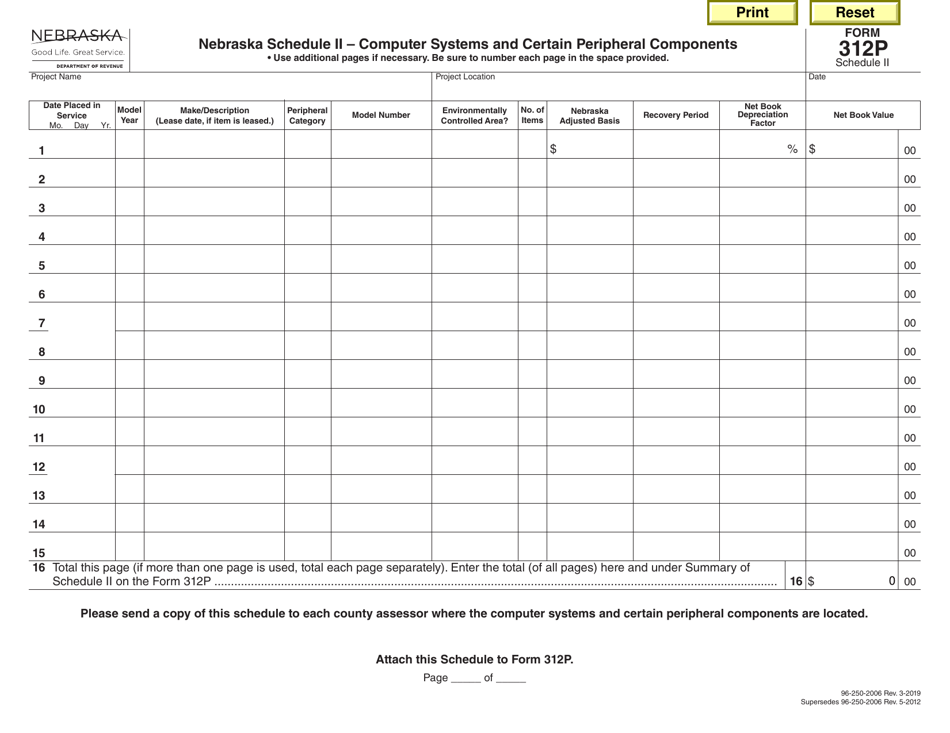

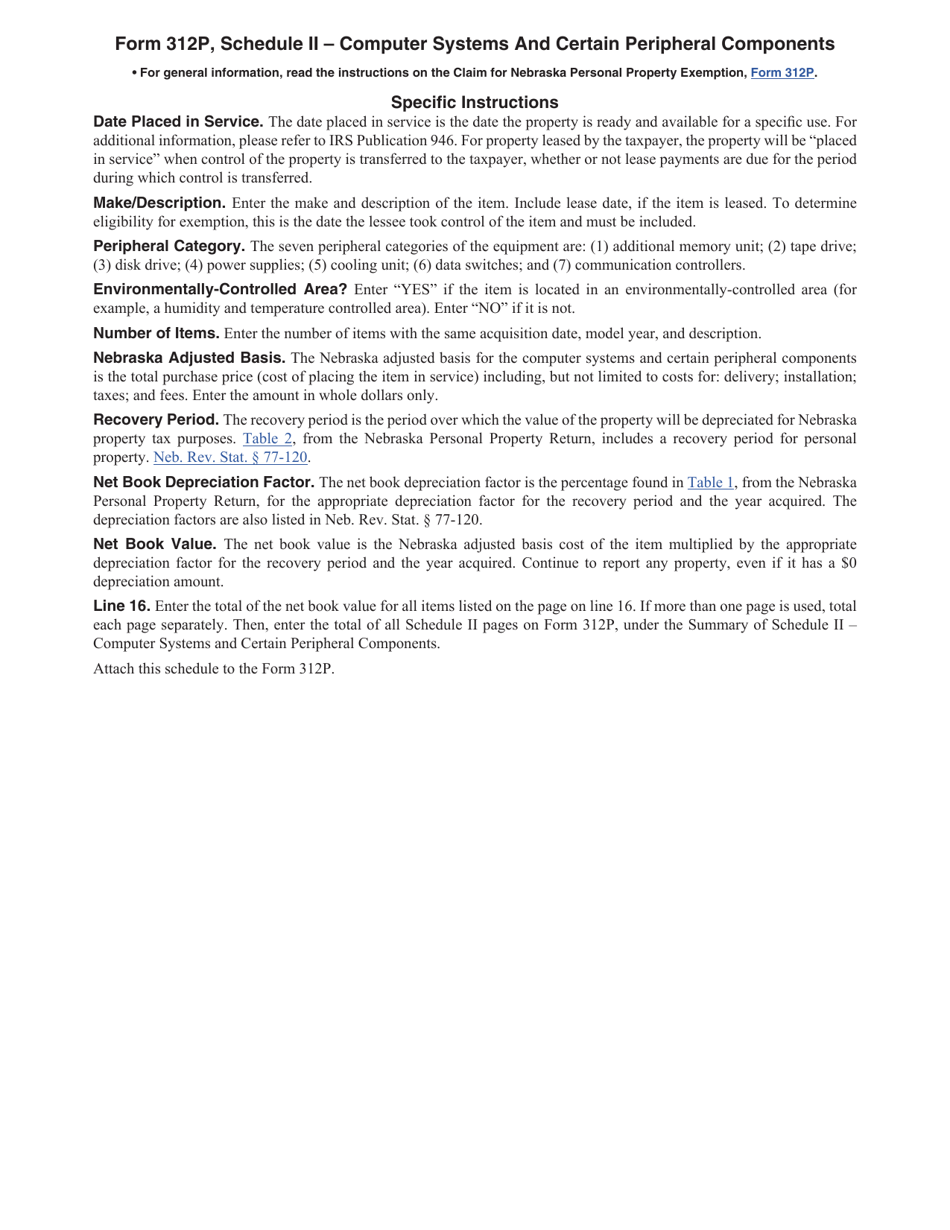

Form 312P Schedule II Computer Systems and Certain Peripheral Components - Nebraska

What Is Form 312P Schedule II?

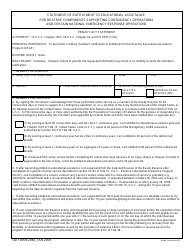

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 312P, Nebraska Advantage Act Claim for Nebraska Personal Property Exemption. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 312P Schedule II?

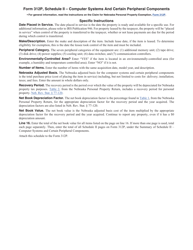

A: Form 312P Schedule II is a document that is used in Nebraska to report computer systems and certain peripheral components.

Q: Who needs to file Form 312P Schedule II?

A: Any individual or business in Nebraska that owns or leases computer systems and certain peripheral components may need to file Form 312P Schedule II.

Q: What are computer systems and certain peripheral components?

A: Computer systems are electronic devices that are capable of receiving, processing, and storing data. Certain peripheral components are devices that are used in conjunction with computer systems, such as printers, scanners, and monitors.

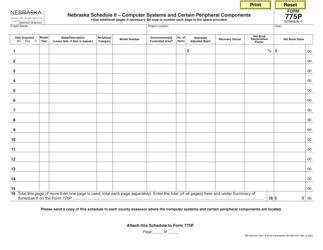

Q: What information is required on Form 312P Schedule II?

A: Form 312P Schedule II requires the taxpayer to provide details about the computer systems and certain peripheral components, such as the description, quantity, and cost of each item.

Q: When is Form 312P Schedule II due?

A: Form 312P Schedule II is due on or before February 1st of each year.

Q: What happens if I don't file Form 312P Schedule II?

A: Failure to file Form 312P Schedule II may result in penalties and interest on the unpaid tax.

Q: Can I file Form 312P Schedule II electronically?

A: Yes, Nebraska allows taxpayers to file Form 312P Schedule II electronically.

Q: Are there any exemptions to filing Form 312P Schedule II?

A: Yes, certain exemptions may apply for computer systems and certain peripheral components that meet specific criteria. It is recommended to consult with the Nebraska Department of Revenue for more information.

Q: What should I do if I no longer own or lease the computer systems and certain peripheral components?

A: If you no longer own or lease the reported computer systems and certain peripheral components, you should update your filing accordingly and provide any necessary documentation to the Nebraska Department of Revenue.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 312P Schedule II by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.