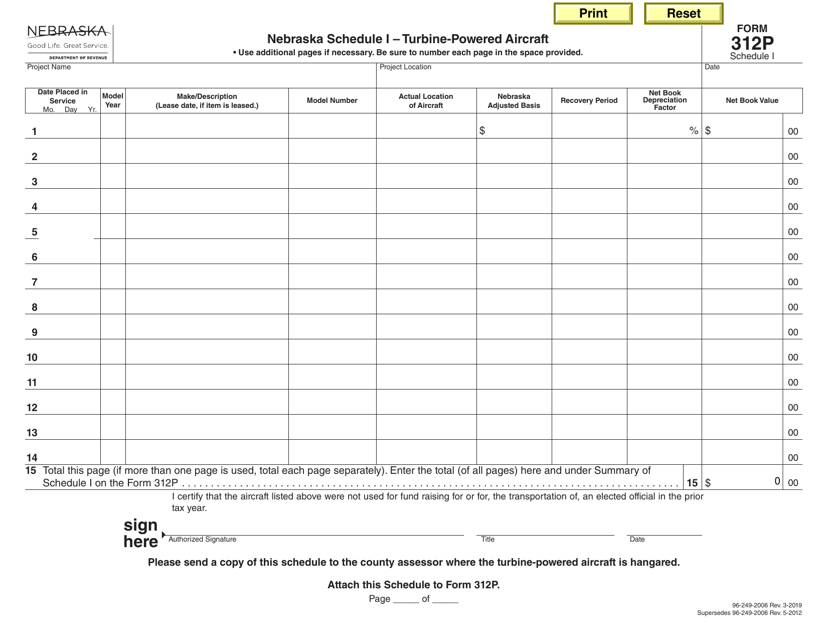

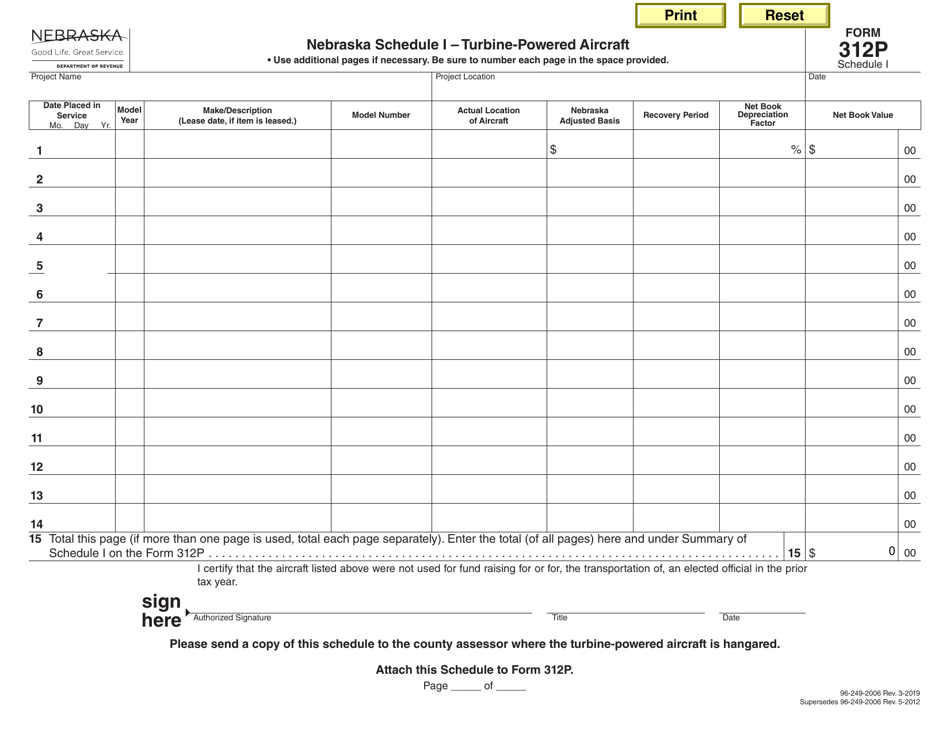

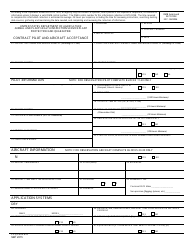

Form 312P Schedule I Turbine-Powered Aircraft - Nebraska

What Is Form 312P Schedule I?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 312P, Nebraska Advantage Act Claim for Nebraska Personal Property Exemption. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 312P?

A: Form 312P is a schedule for reporting turbine-powered aircraft activities in Nebraska.

Q: What is a turbine-powered aircraft?

A: A turbine-powered aircraft is an aircraft that is propelled by a turbine engine.

Q: Who needs to file Form 312P?

A: Owners or operators of turbine-powered aircraft operating in Nebraska need to file Form 312P.

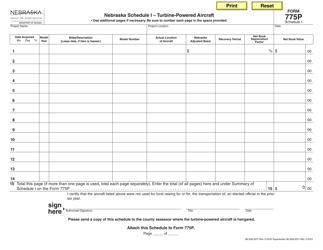

Q: What information is required on Form 312P?

A: Form 312P requires information about the aircraft, flight hours, and fuel usage.

Q: When is Form 312P due?

A: Form 312P is due by March 1st of each year.

Q: Are there any penalties for not filing Form 312P?

A: Failure to file Form 312P may result in penalties and fines.

Q: Is Form 312P specific to Nebraska?

A: Yes, Form 312P is specific to reporting turbine-powered aircraft activities in Nebraska.

Q: What is the purpose of Form 312P?

A: The purpose of Form 312P is to collect data on turbine-powered aircraft activities for regulatory and planning purposes.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 312P Schedule I by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.