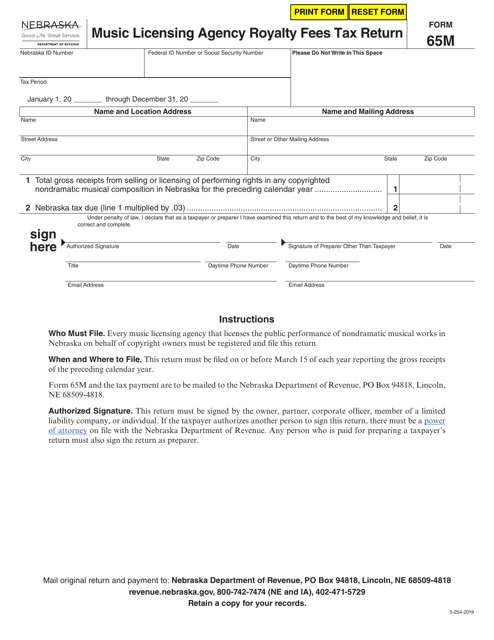

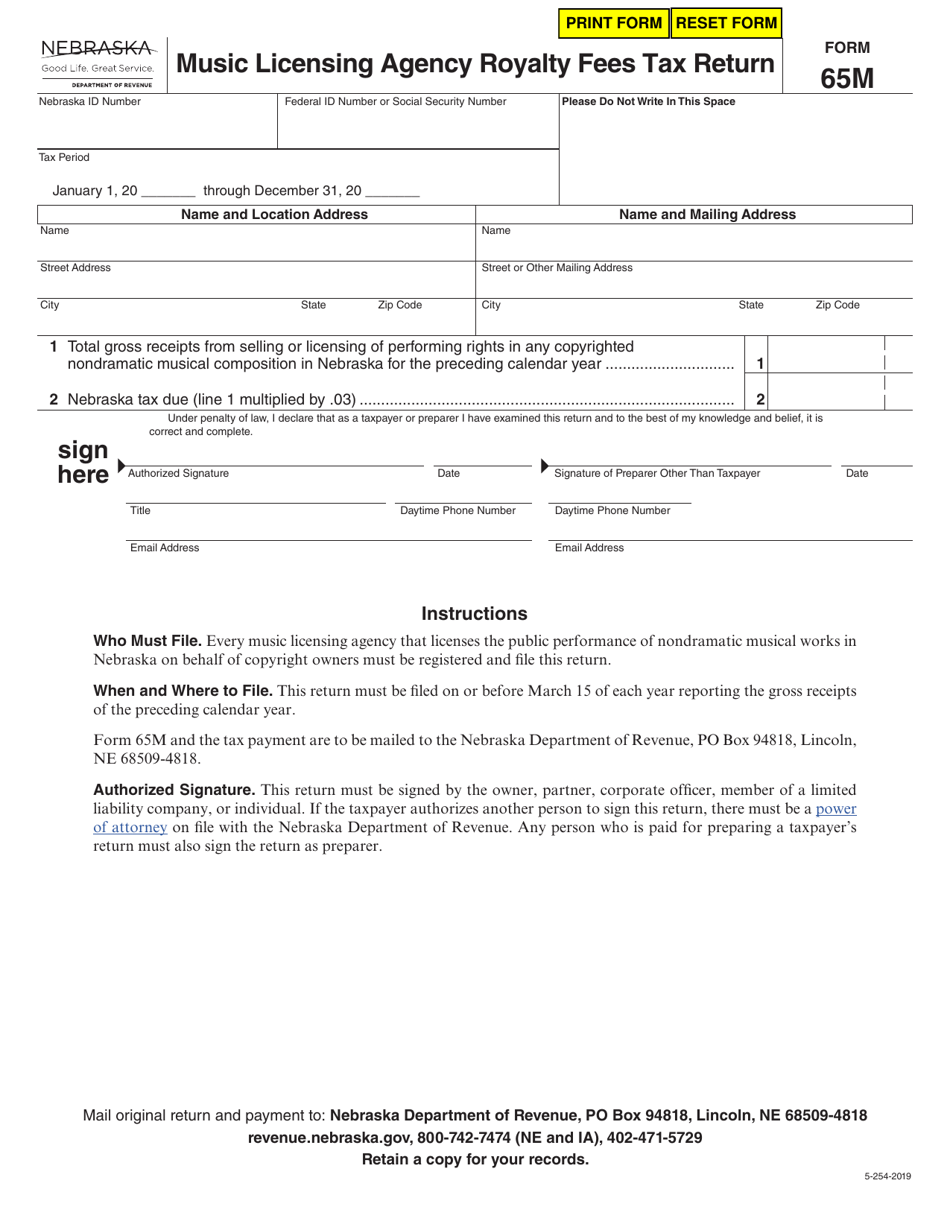

Form 65M Music Licensing Agency Royalty Fees Tax Return - Nebraska

What Is Form 65M?

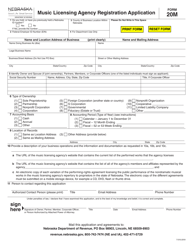

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 65M?

A: Form 65M is a tax return used for reporting music licensing agency royalty fees in Nebraska.

Q: Who needs to file Form 65M?

A: Individuals or businesses who earn income from music licensing agency royalty fees in Nebraska need to file Form 65M.

Q: What are music licensing agency royalty fees?

A: Music licensing agency royalty fees are payments made to music licensing agencies for the use of copyrighted music.

Q: When is Form 65M due?

A: Form 65M is due on the 15th day of the fourth month following the end of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing or underpayment of tax. It is important to file and pay on time to avoid these penalties.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 65M by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.