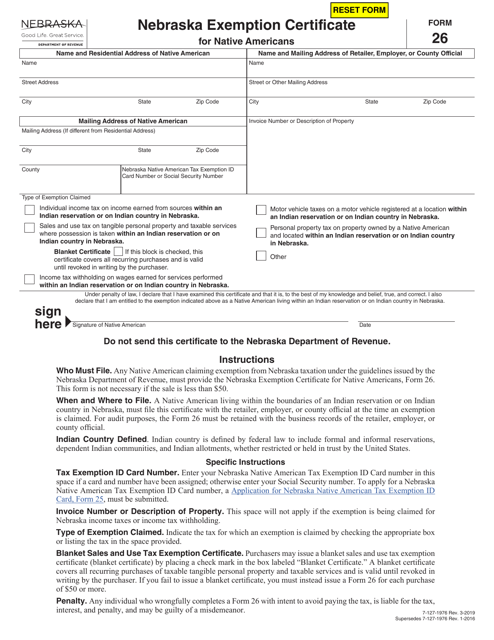

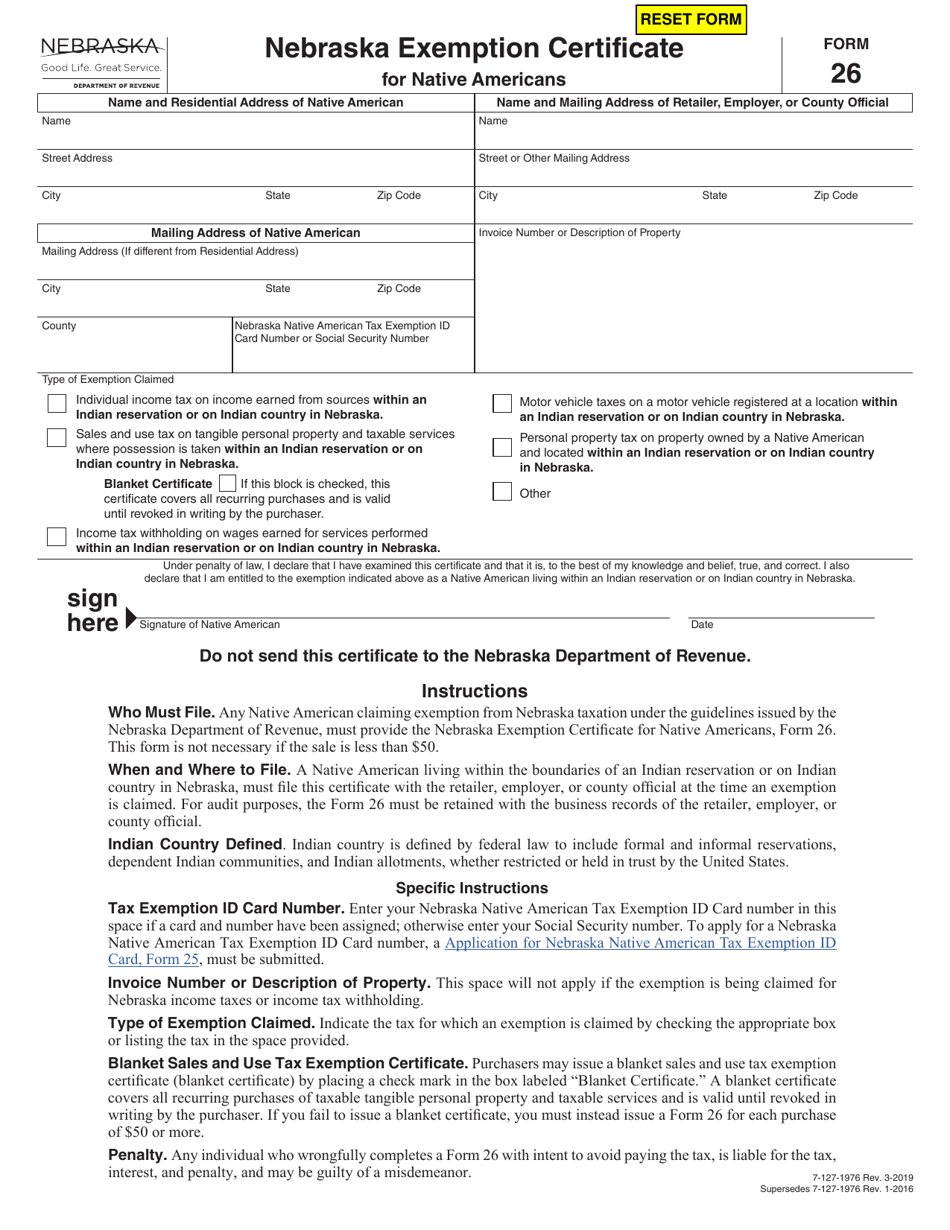

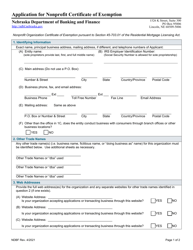

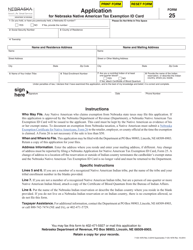

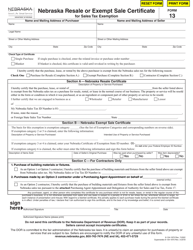

Form 26 Nebraska Exemption Certificate for Native Americans - Nebraska

What Is Form 26?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 26 Nebraska Exemption Certificate?

A: Form 26 Nebraska Exemption Certificate is a document used by Native Americans in Nebraska to claim exemption from sales and use tax.

Q: Who can use Form 26 Nebraska Exemption Certificate?

A: Native Americans who are enrolled members of federally recognized tribes and live on reservations in Nebraska can use Form 26 to claim tax exemption.

Q: What is the purpose of Form 26 Nebraska Exemption Certificate?

A: The purpose of Form 26 is to provide Native Americans with a way to claim exemption from sales and use tax on purchases made on reservations in Nebraska.

Q: Is Form 26 Nebraska Exemption Certificate valid only in Nebraska?

A: Yes, Form 26 is specific to Nebraska and can only be used to claim exemption from sales and use tax on reservations within the state.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 26 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.