This version of the form is not currently in use and is provided for reference only. Download this version of

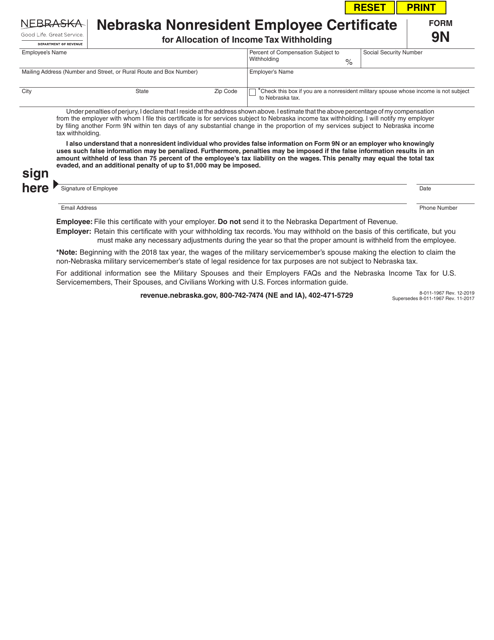

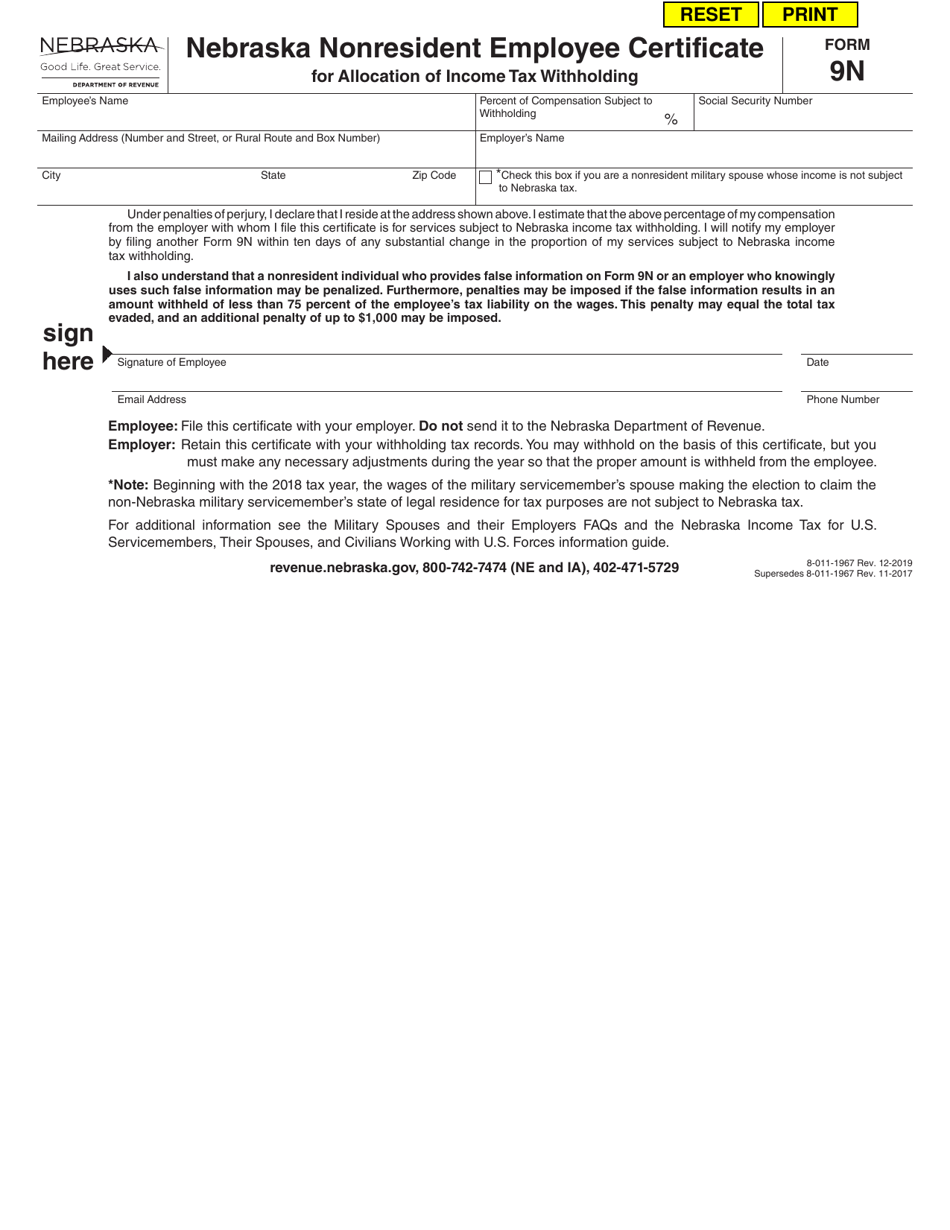

Form 9N

for the current year.

Form 9N Nebraska Nonresident Employee Certificate for Allocation of Income Tax Withholding - Nebraska

What Is Form 9N?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 9N?

A: Form 9N is the Nebraska Nonresident Employee Certificate for Allocation of Income Tax Withholding.

Q: Who fills out Form 9N?

A: Nonresident employees who work in Nebraska, but do not live in the state, fill out Form 9N.

Q: Why do nonresident employees need to fill out Form 9N?

A: Form 9N is used to determine the amount of income tax to be withheld from the employee's wages by their employer.

Q: How does Form 9N affect income tax withholding?

A: Form 9N provides information to the employer about the employee's residency and helps determine the appropriate amount of income tax to be withheld.

Q: When should Form 9N be filled out?

A: Form 9N should be completed by nonresident employees when they start working in Nebraska.

Q: Are there any other requirements for nonresident employees in Nebraska?

A: Nonresident employees may also be required to file a Nebraska income tax return if they meet certain criteria.

Q: Is Form 9N only for nonresidents working in Nebraska?

A: Yes, Form 9N is specifically for nonresident employees who work in Nebraska but do not live in the state.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 9N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.