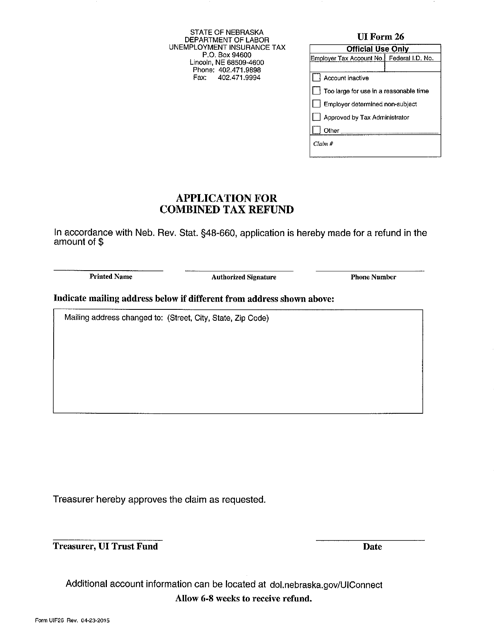

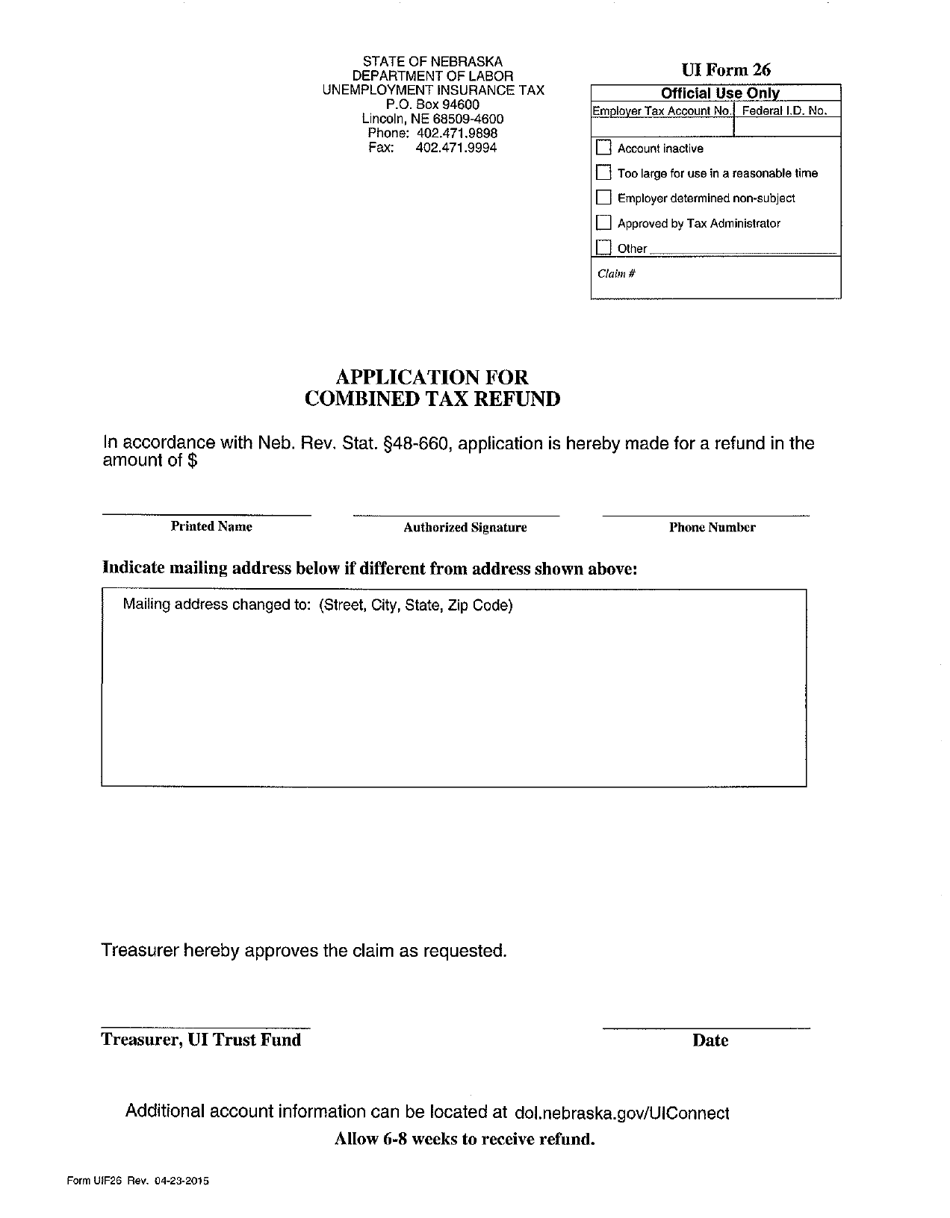

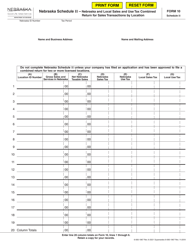

UI Form 26 Application for Combined Tax Refund - Nebraska

What Is UI Form 26?

This is a legal form that was released by the Nebraska Department of Labor - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is UI Form 26?

A: UI Form 26 is the Application for Combined Tax Refund specifically for Nebraska residents.

Q: Who can use UI Form 26?

A: Nebraska residents who are eligible for a tax refund can use UI Form 26.

Q: What is the purpose of UI Form 26?

A: The purpose of UI Form 26 is to apply for a combined tax refund in Nebraska.

Q: What information is required on UI Form 26?

A: UI Form 26 requires personal information, including name, address, social security number, and income details.

Q: Is there a deadline for submitting UI Form 26?

A: Yes, UI Form 26 must be submitted by the tax filing deadline specified by the Nebraska Department of Revenue.

Q: What should I do if I have additional questions about UI Form 26?

A: If you have additional questions about UI Form 26, you should contact the Nebraska Department of Revenue directly.

Form Details:

- Released on April 23, 2015;

- The latest edition provided by the Nebraska Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of UI Form 26 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Labor.