This version of the form is not currently in use and is provided for reference only. Download this version of

Form PT-AGR

for the current year.

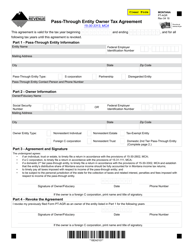

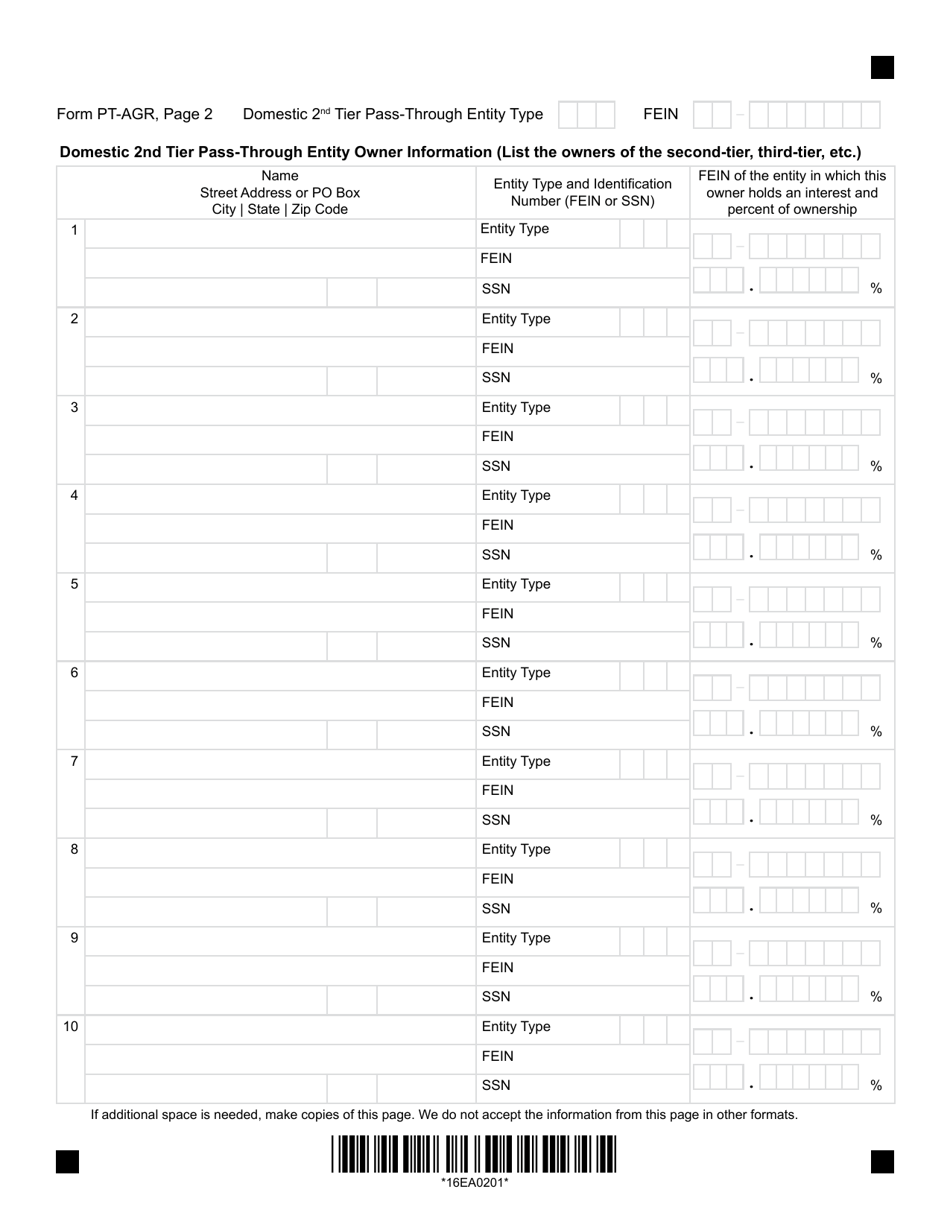

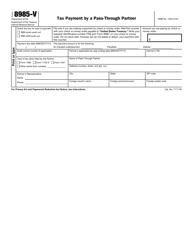

Form PT-AGR Pass-Through Entity Owner Tax Agreement - Montana

What Is Form PT-AGR?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-AGR?

A: Form PT-AGR is the Pass-Through Entity Owner Tax Agreement.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that doesn't pay income tax itself, but instead, passes through its income, losses, deductions, and credits to its owners.

Q: Who needs to file Form PT-AGR in Montana?

A: Pass-through entities that have at least one owner who is an individual or a trust, and who wants to elect to pay tax at the entity level.

Q: What is the purpose of filing Form PT-AGR?

A: The purpose of filing Form PT-AGR is to elect to pay tax at the entity level, instead of the owners paying tax on their distributive share of the entity's income.

Q: What are the requirements to make the election on Form PT-AGR?

A: To make the election on Form PT-AGR, all owners of the pass-through entity must consent.

Q: When is the deadline to file Form PT-AGR?

A: Form PT-AGR must be filed by the due date of the pass-through entity's tax return, which is generally the 15th day of the third month following the end of the tax year.

Q: Are there any penalties for not filing Form PT-AGR?

A: Yes, failure to file Form PT-AGR or pay the tax due may result in penalties and interest being assessed.

Q: Can I amend my election on Form PT-AGR?

A: Once the election is made on Form PT-AGR, it cannot be amended or revoked without consent from the Montana Department of Revenue.

Q: Who should I contact for more information about Form PT-AGR?

A: For more information about Form PT-AGR, you should contact the Montana Department of Revenue.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-AGR by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.