This version of the form is not currently in use and is provided for reference only. Download this version of

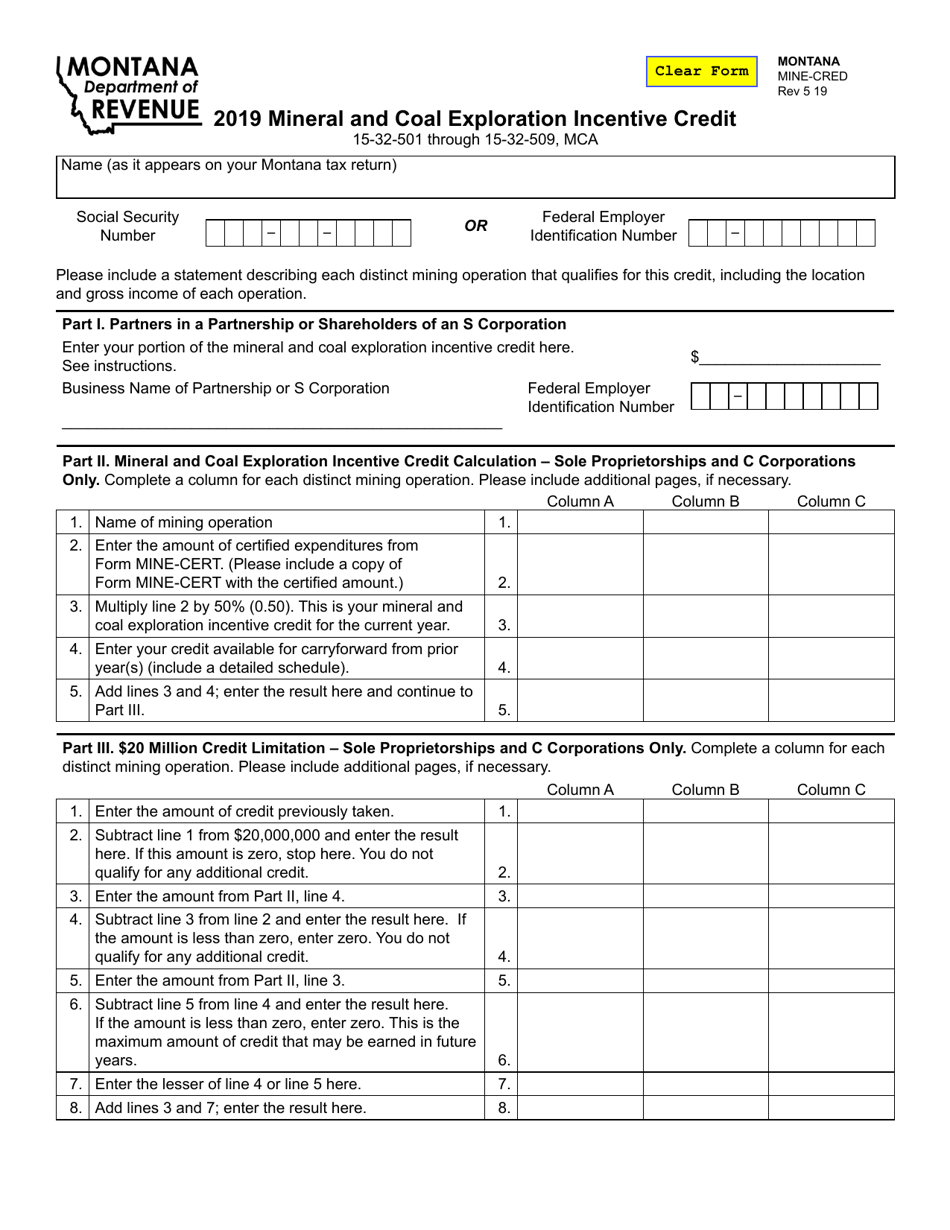

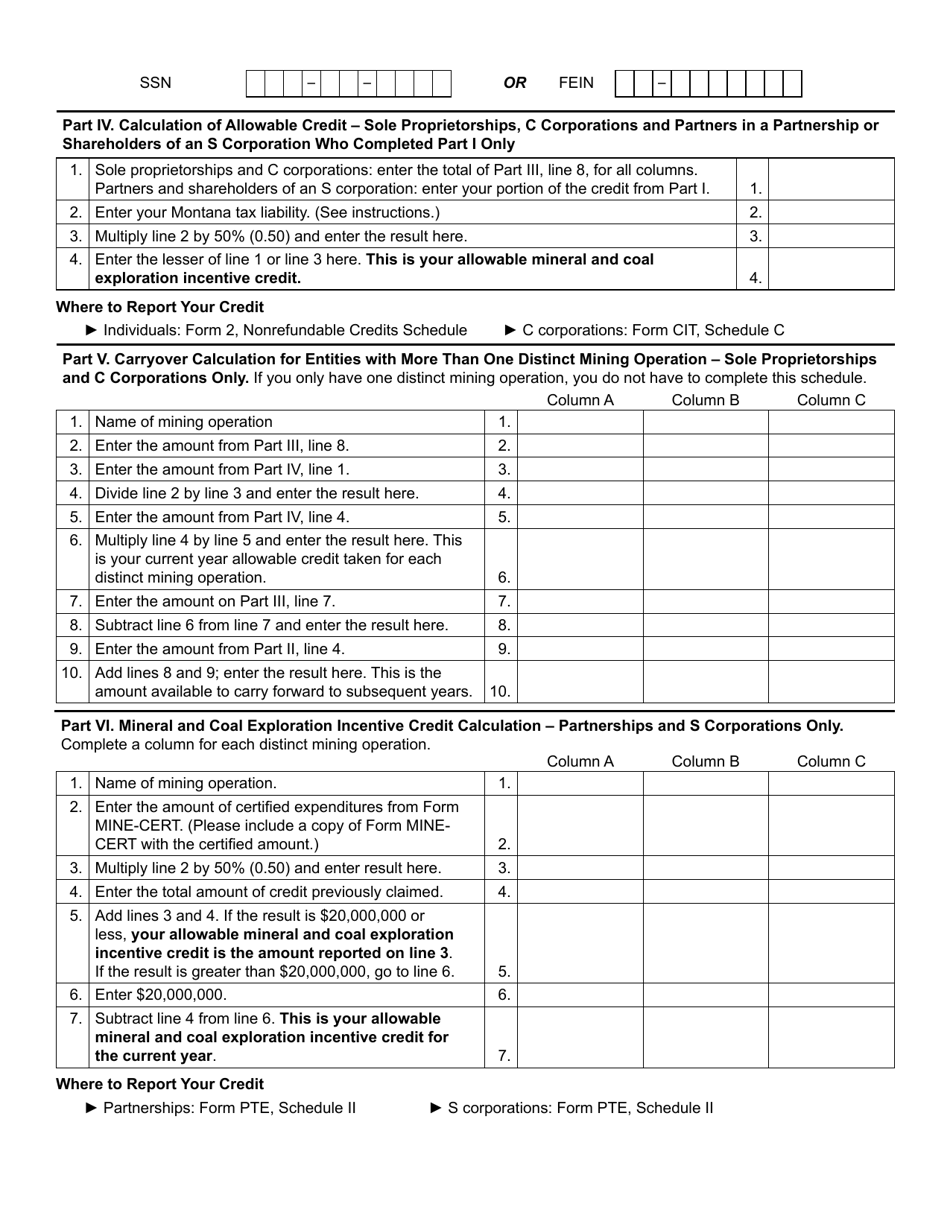

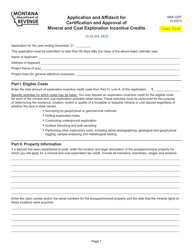

Form MINE-CRED

for the current year.

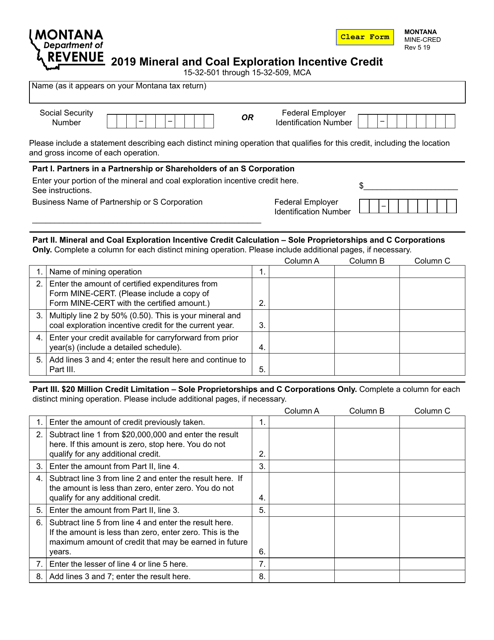

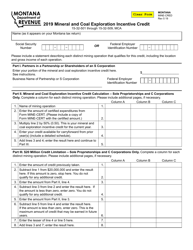

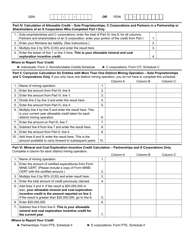

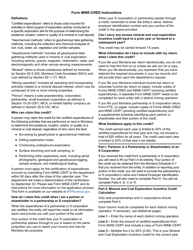

Form MINE-CRED Mineral and Coal Exploration Incentive Credit - Montana

What Is Form MINE-CRED?

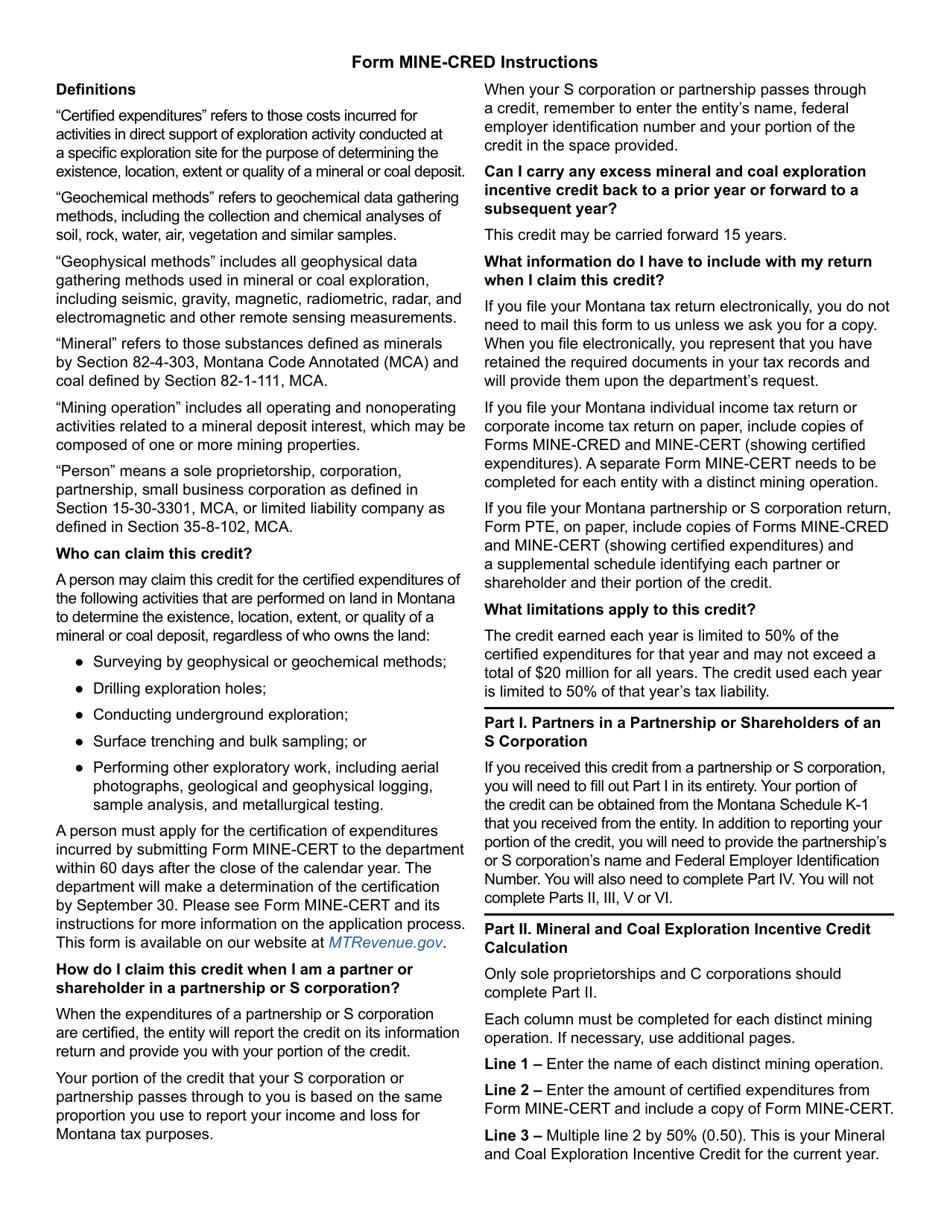

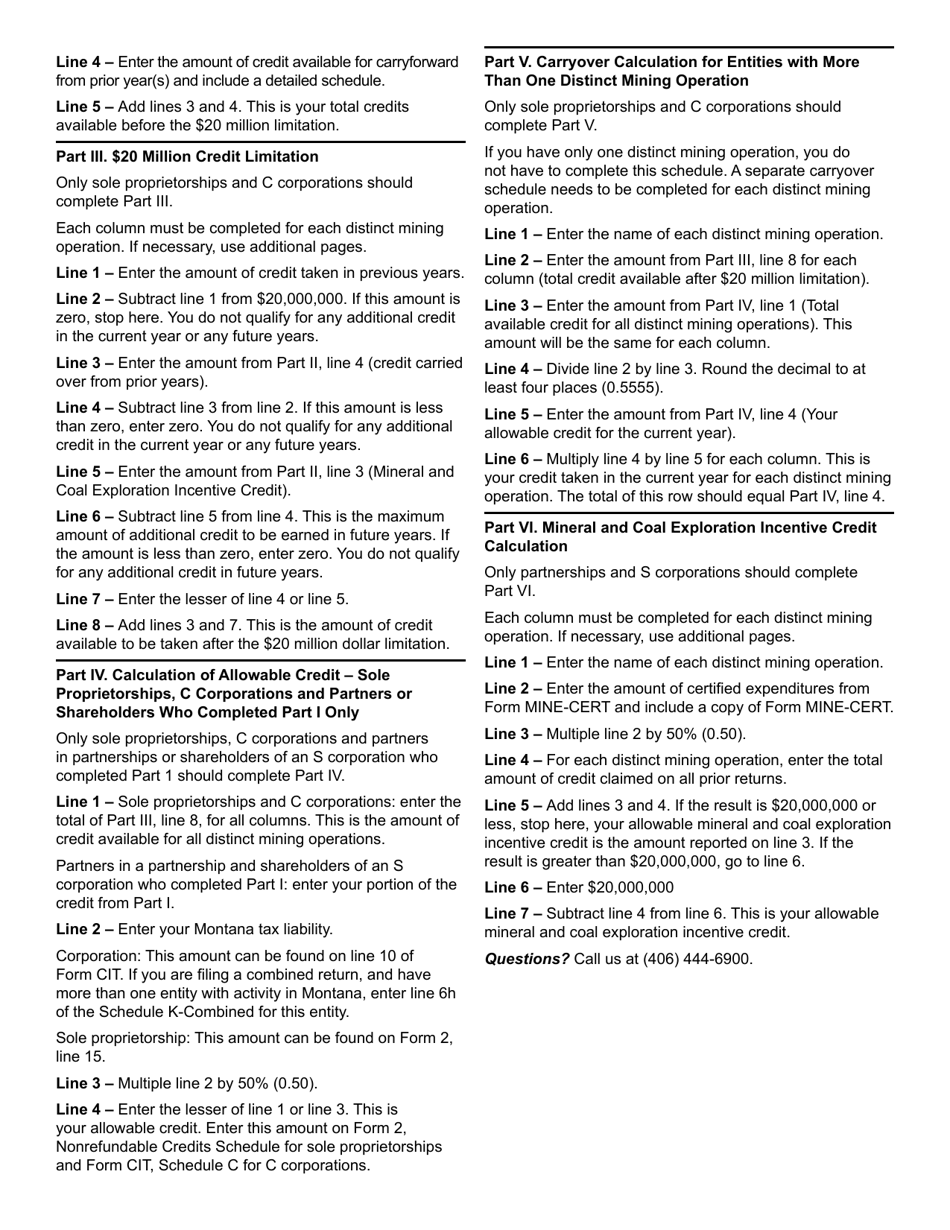

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MINE-CRED?

A: MINE-CRED stands for Mineral and Coal Exploration Incentive Credit.

Q: What is the purpose of MINE-CRED?

A: The purpose of MINE-CRED is to provide a tax credit incentive for mineral and coal exploration activities in Montana.

Q: Who is eligible for MINE-CRED?

A: Individuals and businesses engaged in mineral or coal exploration activities in Montana are eligible for MINE-CRED.

Q: How do I apply for MINE-CRED?

A: To apply for MINE-CRED, you must complete and submit Form MINE-CRED to the Montana Department of Revenue.

Q: What expenses are eligible for MINE-CRED?

A: Expenses related to conducting mineral or coal exploration activities, such as drilling and analysis costs, are eligible for MINE-CRED.

Q: What is the amount of the tax credit?

A: The amount of the tax credit is 100% of the eligible expenses, up to a maximum of $5,000 for individuals and $10,000 for businesses.

Q: Is there a deadline to apply for MINE-CRED?

A: Yes, the deadline to apply for MINE-CRED is June 30th of the year following the tax year in which the expenses were incurred.

Q: When will I receive the tax credit?

A: The tax credit will be applied against your Montana income tax liability for the tax year in which the expenses were incurred.

Q: Can the tax credit be carried forward or back?

A: No, the tax credit cannot be carried forward or back. It must be used in the tax year in which the expenses were incurred.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MINE-CRED by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.