This version of the form is not currently in use and is provided for reference only. Download this version of

Form LVPTARP

for the current year.

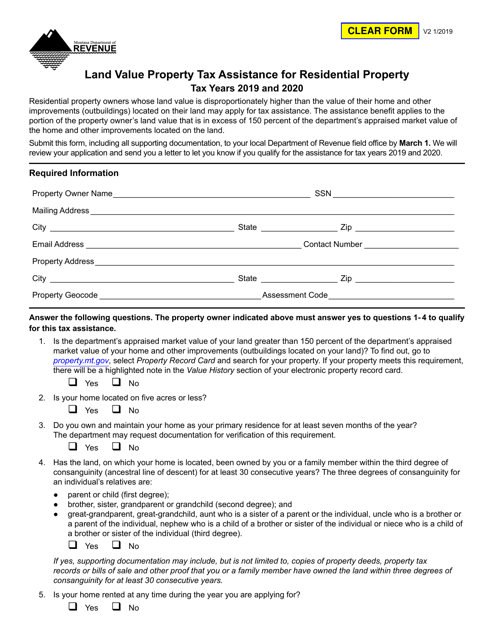

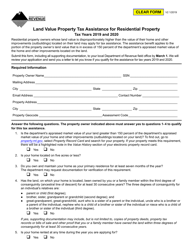

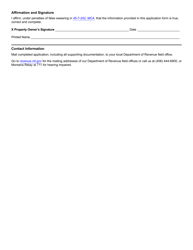

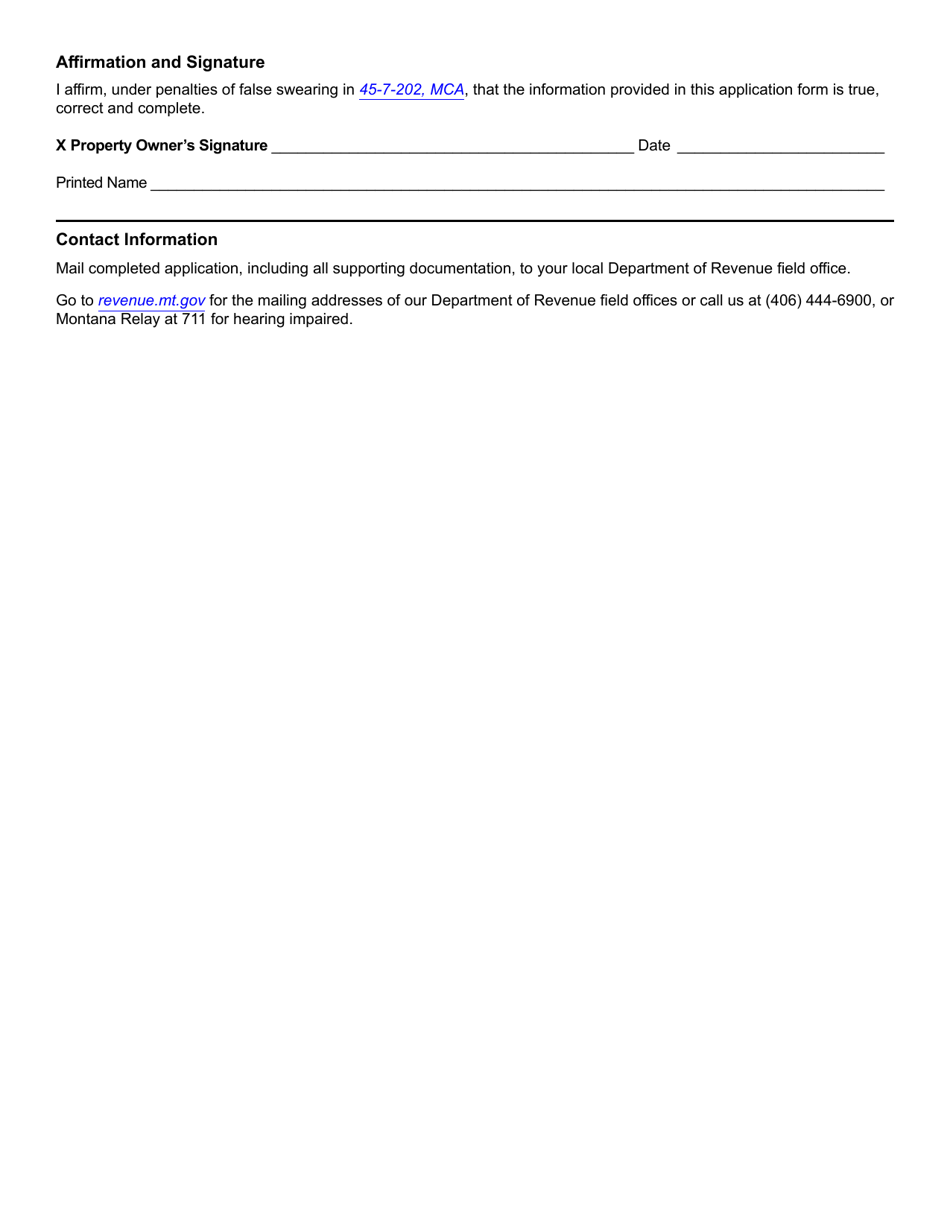

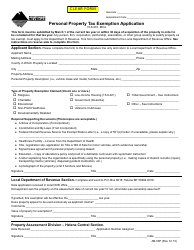

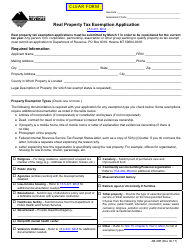

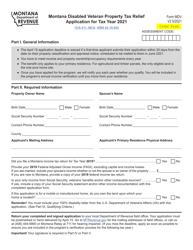

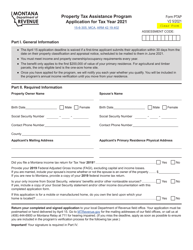

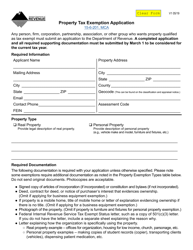

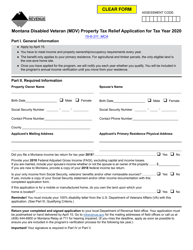

Form LVPTARP Land Value Property Tax Assistance for Residential Property - Montana

What Is Form LVPTARP?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LVPTARP?

A: LVPTARP stands for Land Value Property Tax Assistance for Residential Property.

Q: What is the purpose of LVPTARP?

A: The purpose of LVPTARP is to provide assistance with property taxes for residential properties in Montana.

Q: Who is eligible for LVPTARP?

A: Eligibility for LVPTARP is determined based on income and property value criteria.

Q: How can I apply for LVPTARP?

A: You can apply for LVPTARP by contacting your local Montana Department of Revenue office.

Q: Can I receive LVPTARP assistance if I rent a property?

A: No, LVPTARP is only available for residential property owners.

Q: What kind of assistance does LVPTARP provide?

A: LVPTARP provides partial property tax relief for eligible residential property owners.

Q: Are all residential properties eligible for LVPTARP?

A: No, only properties that meet the income and property value criteria are eligible for LVPTARP.

Q: What documents do I need to apply for LVPTARP?

A: You will need to provide proof of income, property value, and ownership when applying for LVPTARP.

Q: Is there a deadline to apply for LVPTARP?

A: Yes, the deadline to apply for LVPTARP is typically April 15th of each year.

Q: How often do I need to reapply for LVPTARP?

A: You need to reapply for LVPTARP annually to continue receiving assistance.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LVPTARP by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.