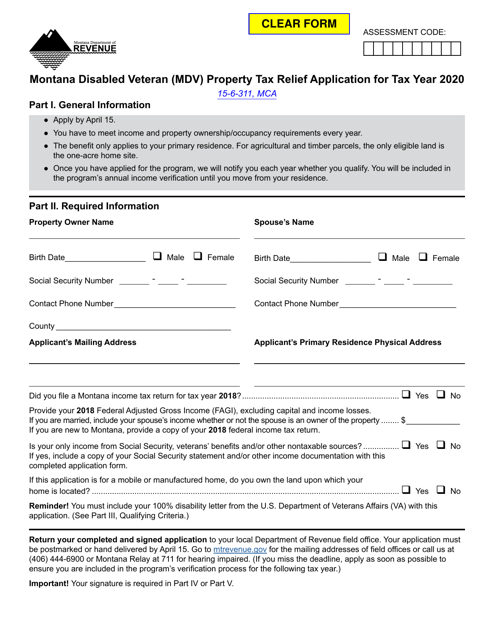

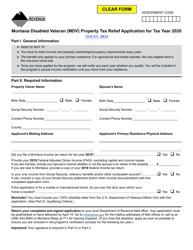

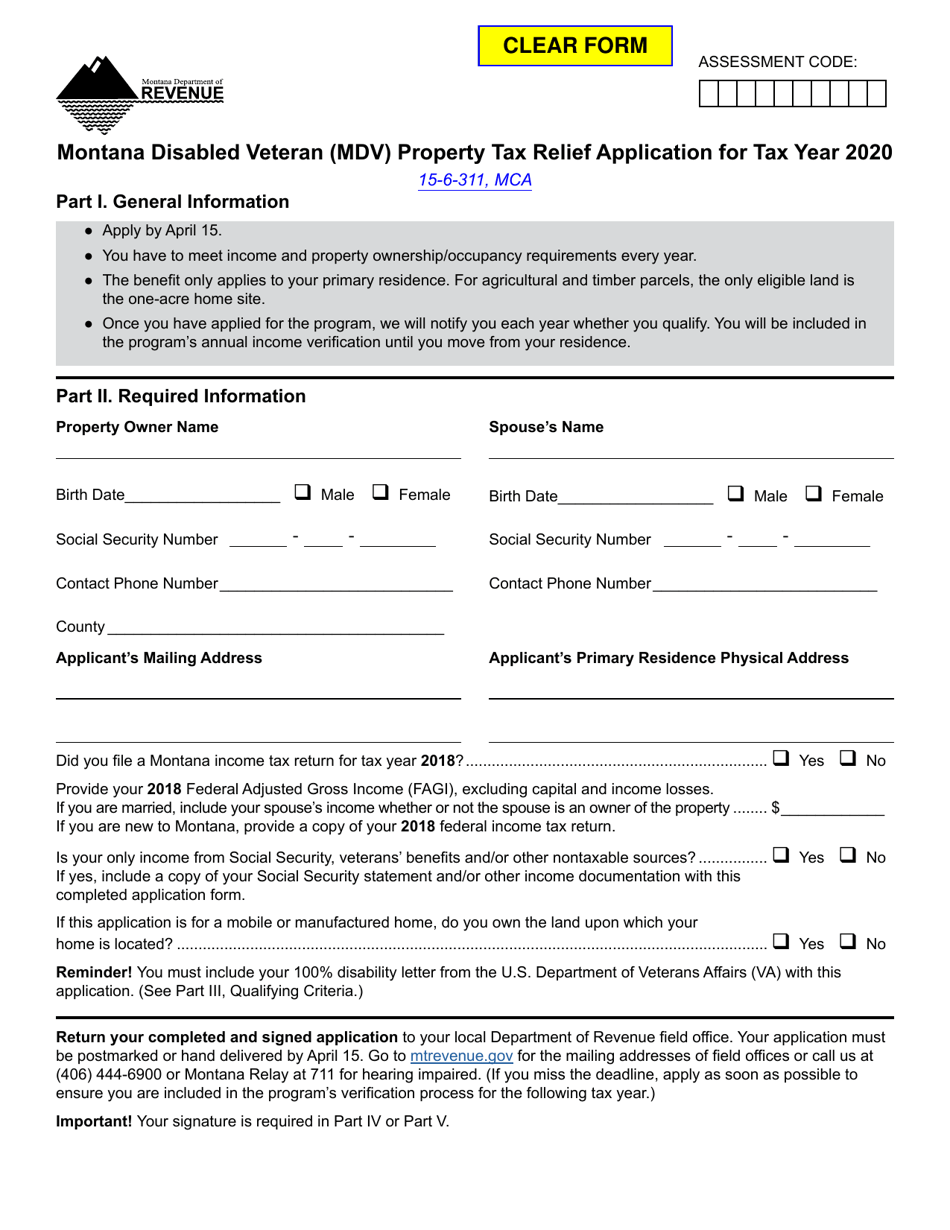

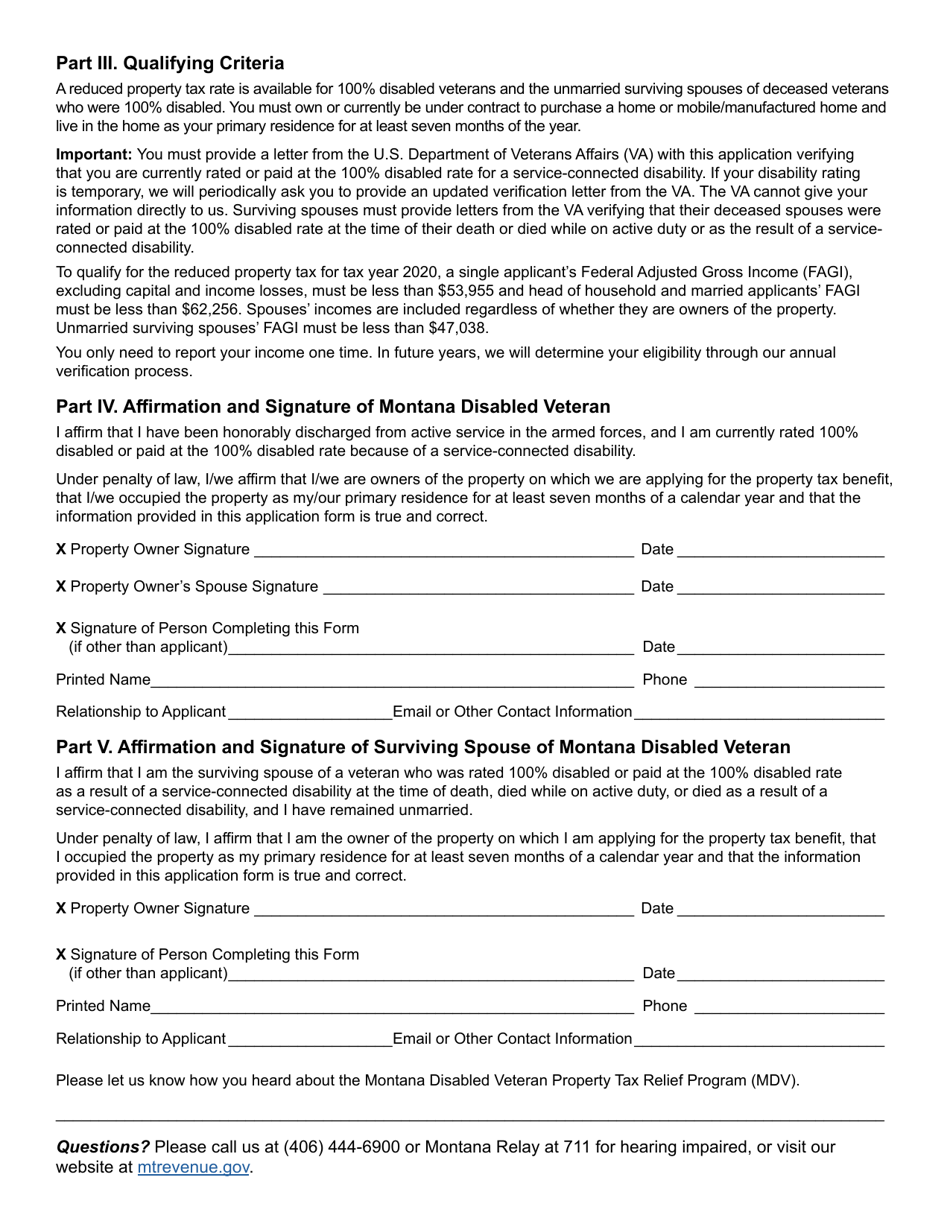

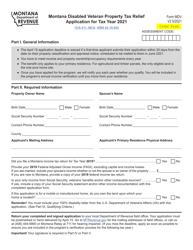

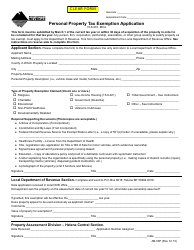

Montana Disabled Veteran (Mdv) Property Tax Relief Application - Montana

Montana Property Tax Relief Application is a legal document that was released by the Montana Department of Revenue - a government authority operating within Montana.

FAQ

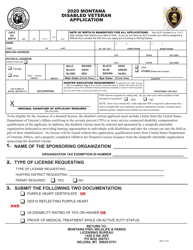

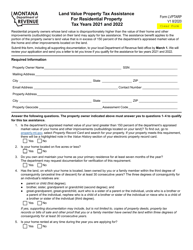

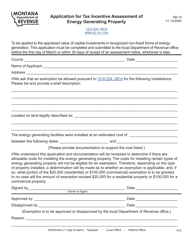

Q: What is the Montana Disabled Veteran (MDV) Property Tax Relief Application?

A: The Montana Disabled Veteran (MDV) Property Tax Relief Application is a program that provides property tax relief for disabled veterans in Montana.

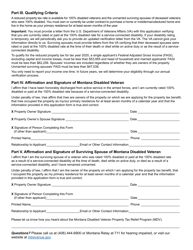

Q: Who is eligible for the MDV Property Tax Relief?

A: Eligibility for the MDV Property Tax Relief is limited to disabled veterans who meet certain criteria, including having a service-connected disability.

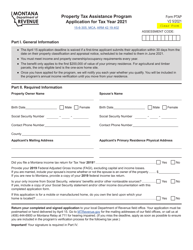

Q: How do I apply for the MDV Property Tax Relief?

A: To apply for the MDV Property Tax Relief, you need to complete and submit the Montana Disabled Veteran (MDV) Property Tax Relief Application to your local county tax assessor's office.

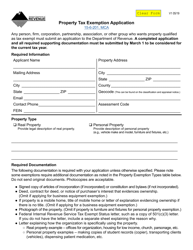

Q: What documents do I need to provide when applying for the MDV Property Tax Relief?

A: When applying for the MDV Property Tax Relief, you may need to provide documentation such as proof of disability, proof of military service, and proof of residency.

Q: How much property tax relief does the MDV program provide?

A: The amount of property tax relief provided by the MDV program varies depending on the veteran's disability rating and the value of their property.

Q: Is there an application deadline for the MDV Property Tax Relief?

A: Yes, there is an application deadline for the MDV Property Tax Relief. The deadline is typically April 15th of each year, but it may vary by county.

Q: Can I receive MDV Property Tax Relief if I already receive other property tax exemptions?

A: Yes, you can still receive MDV Property Tax Relief even if you already receive other property tax exemptions, such as the residential property tax exemption.

Q: What if I have additional questions about the MDV Property Tax Relief?

A: If you have additional questions about the MDV Property Tax Relief, you can contact your local county tax assessor's office or the Montana Department of Revenue for more information.

Form Details:

- The latest edition currently provided by the Montana Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.