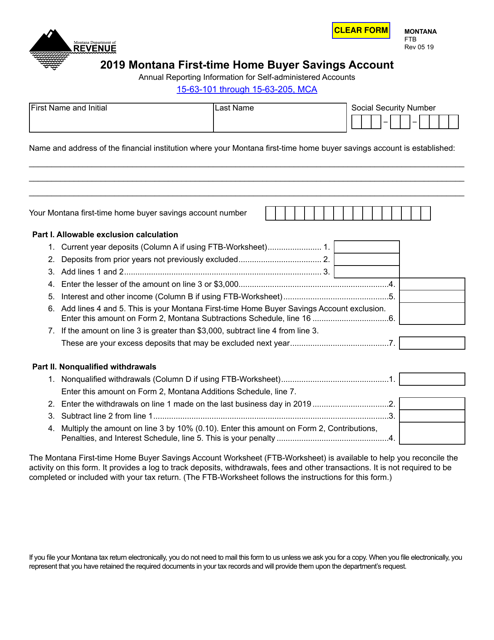

Form FTB Montana First-Time Home Buyer Savings Account - Montana

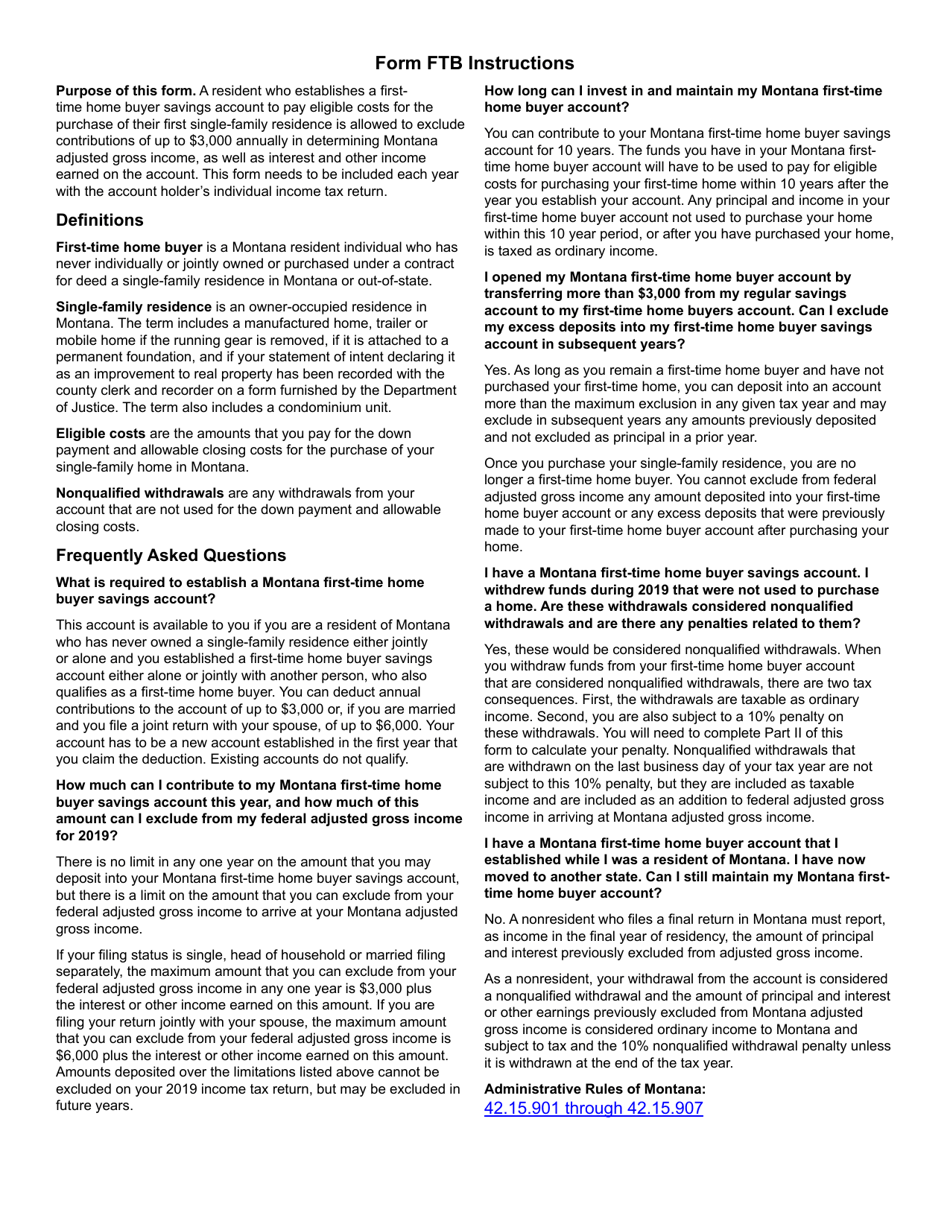

What Is Form FTB?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form FTB Montana?

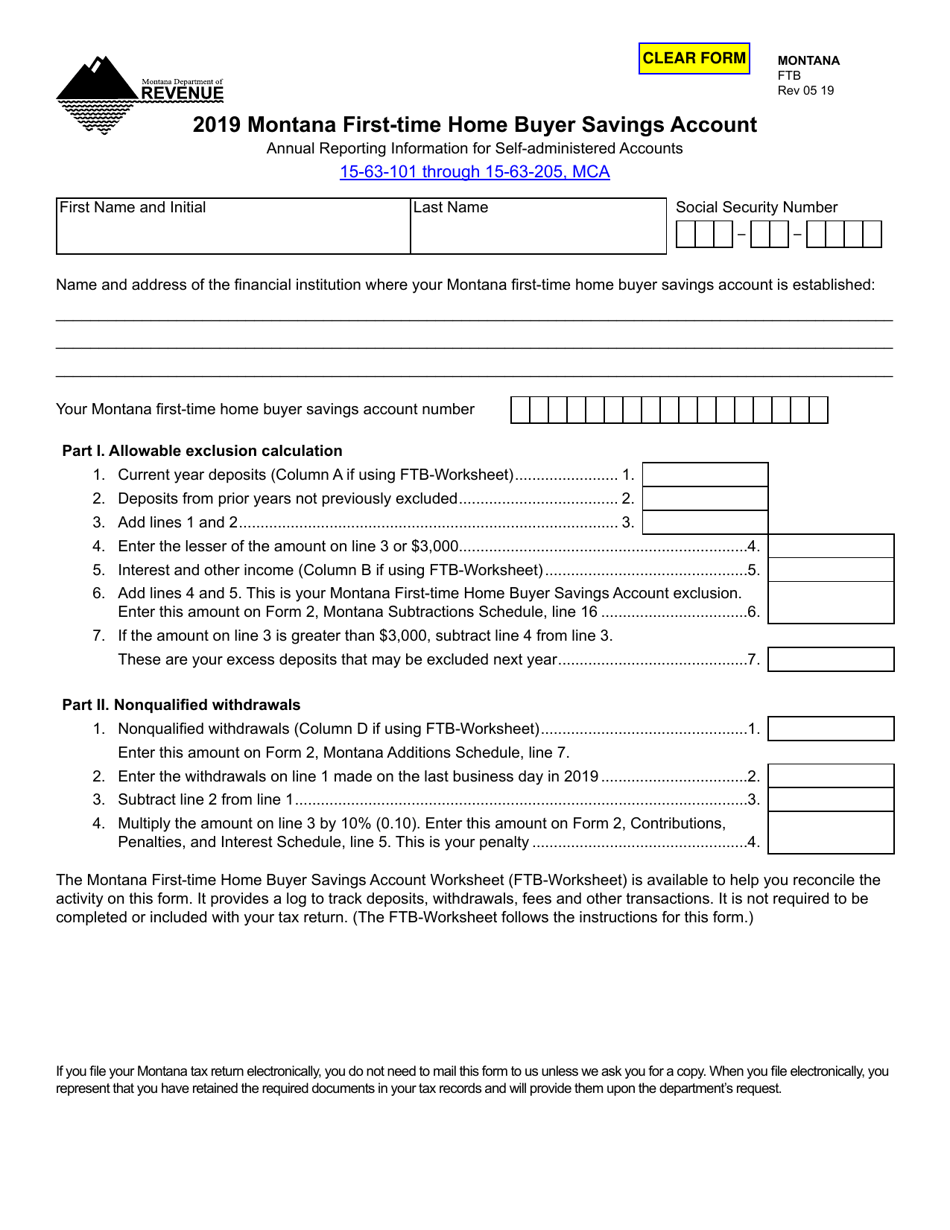

A: The Form FTB Montana is a document used to report a First-Time Home Buyer Savings Account in Montana.

Q: What is a First-Time Home Buyer Savings Account?

A: A First-Time Home Buyer Savings Account is a special savings account in which individuals can deposit money to save for the purchase of their first home.

Q: Who is eligible to open a First-Time Home Buyer Savings Account in Montana?

A: Any Montana resident who has never owned a home before is eligible to open a First-Time Home Buyer Savings Account.

Q: What are the benefits of opening a First-Time Home Buyer Savings Account?

A: The main benefit is that contributions to the account are deductible from Montana state income tax, and any earnings on the account are exempt from state income tax as well.

Q: What can the funds in a First-Time Home Buyer Savings Account be used for?

A: The funds can be used to pay for eligible expenses related to the purchase of a first home, such as down payment, closing costs, and prepaid interest.

Q: Are there any contribution limits for a First-Time Home Buyer Savings Account?

A: Yes, the maximum annual contribution limit is $3,000 for single filers and $6,000 for joint filers.

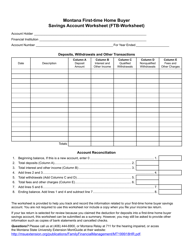

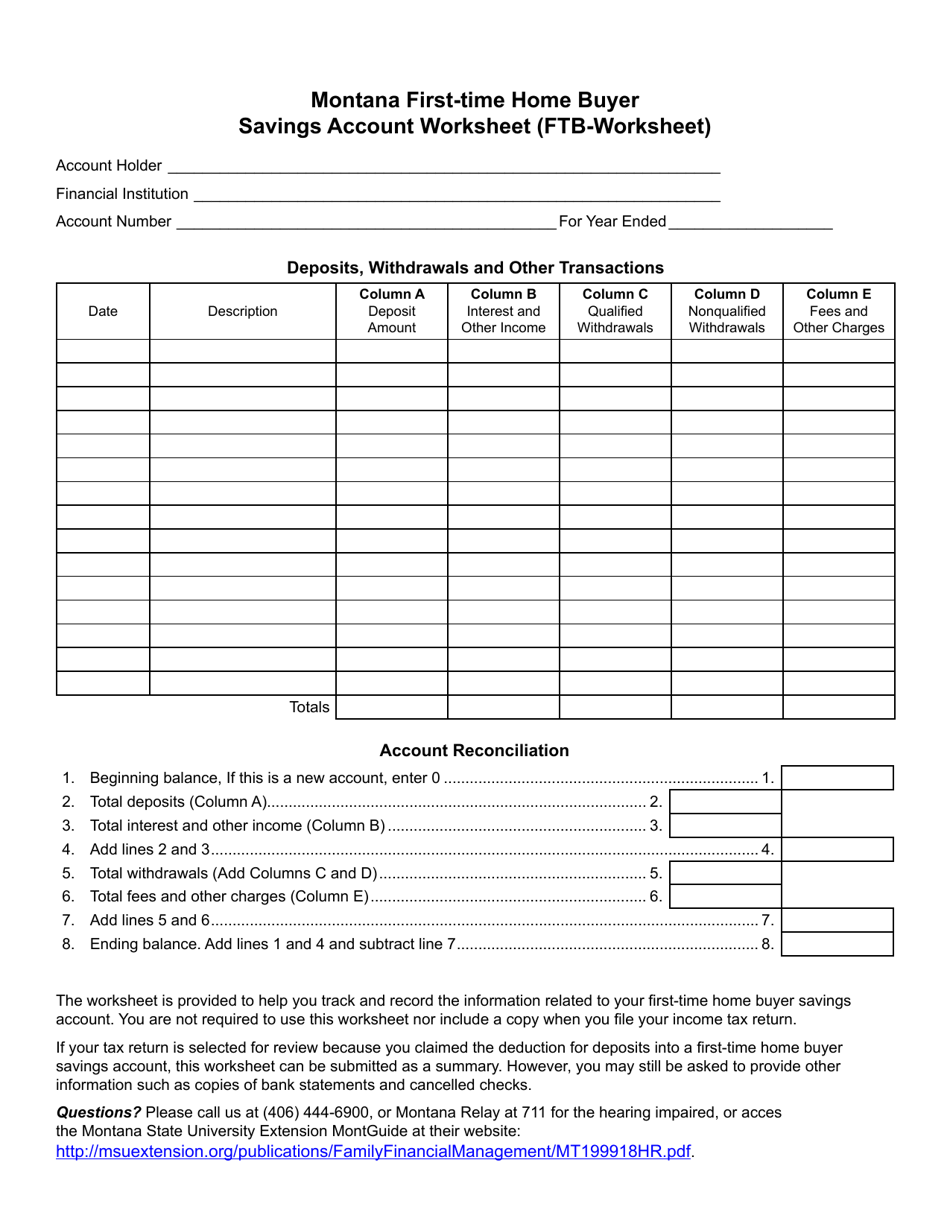

Q: Do I need to attach any supporting documents with the Form FTB Montana?

A: No, you do not need to attach any supporting documents with the form. However, you should keep records of your contributions and withdrawals in case of an audit.

Q: When is the deadline for filing the Form FTB Montana?

A: The form must be filed by April 15 of the year following the tax year for which the contributions were made.

Q: Can I rollover funds from another state's First-Time Home Buyer Savings Account into a Montana account?

A: No, Montana does not allow rollovers from other states' First-Time Home Buyer Savings Accounts.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.